Understanding Inflation and Its Profound Impact on the Forex Market

2024-12-27 10:53:22

When I was a kid, I used to love watch the TV, and from one cartoon to another, the propaganda always came in saying something on those lines “the inflation rose X% from last month to this month, prices on the supermarket have increased by Y%” but I didn’t had a clue on what this was, and now everything makes sense!

Do you know what is inflation? How can such a small word with only nine letters have a significant impact on our day-to-day life as well a massive impact on the financial markets? Especially on the forex market!

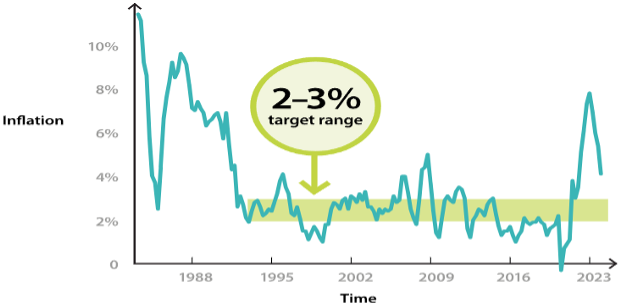

This may sound very new to you, so let’s start with the basics; inflation, on a simple term is the cost of a good or service that erodes as the years go by, if not the most important one if the most important fundamentals into the economy, where all the central banks pay pivotal attention and they even have targets! Every Central Bank has an inflation target that they must keep with, the target makes sure that the economy will be on the right path not to hot and not to cold. Every country has a different target, for example in Australia we have the target between 2-3% (you can read more on the official RBA website HERE).

RBA Inflation Target

USA for example have different target at 2% only and not a variable inflation targets between 2-3% like Australia (you can read more about the USA inflation target here).

Inflation is used as an indicator that reflects changes in buying power and economic stability. This phenomenon influences not only domestic economies but also the global financial markets, including the forex market. Its role in shaping monetary policy, influencing currency valuations, and driving strategies makes it an indispensable subject of study for expert traders or even for those who are starting.

Origins and Dynamics of Inflation

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, eroding the purchasing power of money. While moderate inflation is associated with economic growth, excessive inflation or hyperinflation can destabilise economies, because with a higher inflation we will have higher rates therefore the products will be extensive as well if you plan to buy a house on a hyperinflation scenario you would be paying the inflation price + the rates from central bank + the rates from what your bank may give you! This will lead to an erosion of consumer confidence.

The opposite can happen as well as disinflation scenario where what I just said is completely the opposite, the inflation will so low that the central bank will lower the rates in hopes that the population will spend money into the economy making it hotter and to grow quicker. This will lead to diminished savings as the rates will be lower people like me, and you will not leave the money on the saving account, right? As it will not be paying as before on a higher rates scenario. We spend this money into a gift for ourselves or even something cool for the day-to-day life. But this is not all flowers as can weaken the currency as well make the economy very weak, and if not well controlled by the central bank it can get the country economy into a depression.

Historical Perspectives

The concept of inflation has been central to economic thought since the advent of monetary systems. It traces its roots to the introduction of fiat money, where currency value is not tied to a physical commodity like gold or silver. The establishment of the Bank of England in 1694 marked a pivotal moment in regulating money supply and addressing inflationary pressures. Throughout history, events such as the Great Depression of the 1930s, the stagflation of the 1970s, and the global monetary crisis of 2008 and the most recent COVID-19 2021 have highlighted the profound influence of inflation on global economies and financial stability.

An interesting question is had you ever thought about what the first few currencies was we had at society, to all the way where we are now?

Before the invention of currency, societies relied on the barter system, where goods and services were exchanged directly. For example, you have a pig, and I have a cow, you want a cow, and I want a pig, both of us are willing to exchange our goods to each other, therefore we make a barter! You get my cow, and I get your pig. However, this system was inefficient due to the "double coincidence of wants" — the need for both parties to want what the other offered.

To overcome this limitation, early civilisations developed standardised mediums of exchange. These first forms of currency were not coins or paper like we have sophisticate machine printing it all day today but rather they have used commodity money, items with intrinsic value.

- Shells: Cowrie shells were used in Africa, Asia, and Oceania for centuries as currency due to their durability and aesthetic value.

- Precious Metals: Gold, silver, and copper became widely used due to their durability, divisibility, and inherent value. These metals were often traded by weight before being minted into coins.

Interesting enough, we can look at the chart below how the value of gold has been so incredible, as it serves as well for a protection against the inflation! The gold price has rose close to 4000%! (in USD).

Gold prices since inception at the stock market

The First Coined Currency

The first officially minted coins appeared around 600 BCE in the ancient kingdom of Lydia, in what is now modern-day Turkey. These coins, known as Lydian staters, were made of a naturally occurring alloy of gold and silver called electrum. Their introduction marked a revolutionary moment in the history of money, as they provided a standardised and portable form of wealth.

The use of coins spread rapidly across the Mediterranean and beyond, facilitated by empires like the Greeks and Romans. Coins were eventually complemented by paper money, first issued in China during the Tang Dynasty (7th century) and later formalised during the Song Dynasty in the 11th century.

What can cause inflation?

In January, this year 2024 I was heading to my favourite bakery to get my favourite bread that I found in December 2023, arriving there I found that the bread that I loved is now costing a bit more than it did last month. Why does this happen? There are many reasons inflation can creep into our day to day lives—over seven, in fact—but let us focus on the three most common and relatable causes:

Picture this: it is the holiday season, and everyone is rushing to buy the hottest new iPhone 16 pro max 1 TB. The shelves empty faster than the Apple can restock. As more clients come in to get the brand-new iPhone and apple staffs cannot handle it to make over 100,000 iPhones per hour, the natural effect will be prices shoot up. This is demand-pull inflation, and it often shows up in booming economies where people have more money to spend, but the supply chain struggles to keep up.

Now, imagine that bread again. What if the price of wheat skyrockets due to a poor harvest as December was a very raining season, or fuel costs rise because of the geopolitical uncertainties around the eastern, making transportation more expensive? These higher production costs get passed down to us, the final consumer, in the form of pricier bread. This is cost-push inflation—it happens when raw materials or wages become more expensive, and businesses must charge more to cover their costs, and then they include the inflation that they got charged into the price of our end final product so, yes, we are paying “double inflation”.

Finally, there is a more psychological aspect: inflation expectations. Suppose you hear that prices are likely to rise next month. What do you do? You might rush to the supermarket to buy items now before they become more expensive. But this increased spending fuels demand, which can ironically push prices up even faster. It is a self-fulfilling prophecy that keeps inflation spiralling upward.

Inflation is not just numbers on a chart it is something we feel in our everyday lives, from the grocery store to the gas pump. By understanding these causes, we can start to see the patterns and make better decisions about how we navigate rising costs.

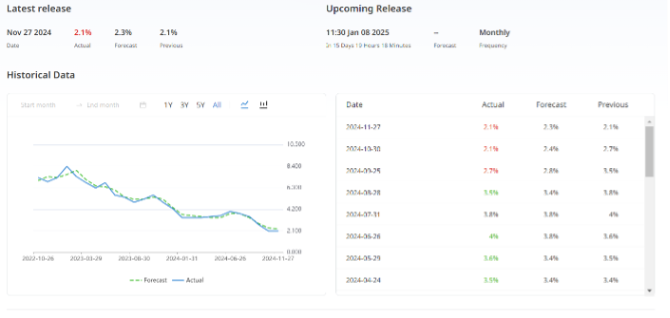

You can check out the inflation prices at Finlogix on our Economic Calendar, you can even check the last releases and when is the next release due.

Australia Last Release of Inflation

What are the tools we can use to measure the inflation?

It’s very important to know how to measure the inflation, but let me be clear with you, there is no 100% prediction ratio for measuring the inflation, but we can always assume that is a close call from what we can possibly imagine, you first need to know some basics about it.

- Consumer Price Index (CPI)

- Headline CPI: Captures all items, providing an overarching view of inflation trends.

- Core CPI: Excludes volatile categories such as food and energy to offer a clearer perspective on sustained inflationary trends.

- Producer Price Index (PPI)

- Big Mac Index

- If the actual exchange rate is higher, the currency is overvalued.

- If the actual exchange rate is lower, the currency is undervalued.

- Inflation Expectations Surveys

- Economic Data Releases

The CPI is the most widely recognised measure of inflation. It tracks changes in the price level of a fixed basket of consumer goods and services over time. The index is often presented as:

The reason why is divided by two releases is simple, on the Headline inflation we have the added of the most volatility items such as the food and the electricity prices, this is something that the central bank can directly control or reduce the inflation on, but is very important to understanding how the headline inflation is, what the central bank really pays attention is the CORE CPI, this is where we have the exclusion of food and energies prices to make it more reliable for the central bank, as all the items on this basket they can control by the rates.

The CPI release can be found on the Finlogix economic calendar, as mentioned before, and is important to keep track of, so I suggest you create an account with Finlogix and check the economic calendar on a daily basis.

A higher inflation makes a currency stronger, as the Central Bank will have to control the inflation by raising the rates (this is only one of the many other ways a central bank can adopt to control the inflation) as the inflation grows and the central bank make the rates tighter, the trader around the world will be sicking more return for their portfolio and therefore they will be trading on higher rates countries making the currency stronger because the demand for that currency will be higher.

A low than expected release can occasioned the opposite, making the traders getting out of the country and looking for better opportunities.

Unlike the CPI, which focuses on consumer prices, the PPI measures changes in prices at the producer level. It offers early insights into potential inflationary pressures as increased production costs are often passed on to consumers. Remember when we have talked about the cost-push-inflation where you get charged double inflation, the PPI will show us on a monthly, quarterly, and early basis if the inflation for the producers is higher or lower.

What? Big Mac when we talking about such an important topic? YES! Big Mac!

I was exactly like you, and I heard about the big mac index, shocked, what is this?

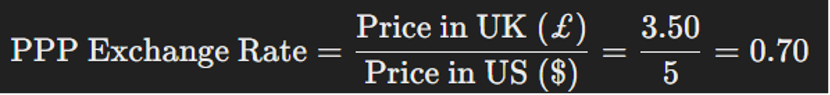

The Big Mac Index is an informal measure of currency valuation created by The Economist in 1986. It uses the price of a Big Mac, a globally standardised product offered by McDonald's as a benchmark to assess the relative purchasing power of different currencies. It offers a simplified way to evaluate whether a currency is undervalued or overvalued compared to another currency, based on the principle of Purchasing Power Parity (PPP).

PPP is an economic theory saying that in an ideal world, identical goods should cost the same in every country when their prices are expressed in a common currency. For example, if a Big Mac costs $5 in the United States and £3.50 in the UK, the PPP exchange rate would be:

If the actual exchange rate differs significantly from this PPP rate, the currency is considered misaligned:

Before you ask me, yes, they have a website that shows all the live valued currencies or undervalued ones, and you can find it right HERE.

Central banks often gauge public and market expectations through surveys. These insights are pivotal in shaping monetary policies, as expectations influence consumer behaviour and wage negotiations, which in turn impact inflation.

Regular statistical updates from government agencies, detailing monthly, quarterly, and annual inflation metrics, play a critical role in economic analysis. Platforms like Forex Factory’s economic calendar enable traders to track these releases, expecting market movements.

Inflation Rates Across Economic Contexts

Developed Economies

Developed economies such as the US, UK, and Eurozone nations often show low and stable inflation rates, with central banks targeting around 2%. This predictability fosters long-term effects and economic stability. Central banks like the Federal Reserve and the European Central Bank employ inflation targeting frameworks to manage economic growth while maintaining price stability.

Emerging Markets

In contrast, appearing economies, including Brazil, India, and South Africa, often experience higher inflation volatility. Factors such as commodity dependency, political instability, and structural inefficiencies contribute to these fluctuations. For instance, Brazil’s inflation rates have historically mirrored the volatility of its exchange rates and fiscal imbalances.

Sub-Emergent Economies

Sub-emergent economies may face extreme inflation scenarios such as hyperinflation or chronic deflation. Zimbabwe’s hyperinflation episode during the late 2000s underscores the devastating consequences of mismanaged monetary policies and governance.

Inflation’s Influence on the Forex Market

Interest Rate Differentials

Inflation significantly affects currency values through interest rate policies. Central banks often raise interest rates to combat high inflation, attracting foreign capital and strengthening the currency. Conversely, low inflation may lead to accommodative monetary policies, weakening the currency. The US dollar (USD), for example, often appreciates when the Federal Reserve signals rate hikes in response to rising inflation.

Purchasing Power Parity (PPP)

PPP theory asserts that exchange rates should adjust to equalise the price of identical goods between countries. Inflation differentials play a crucial role in this adjustment. Tools like the Big Mac Index offer a practical demonstration of PPP in action, highlighting how inflation impacts currency valuation.

Market Volatility

Inflation data releases are among the most significant drivers of forex market volatility. Unexpected inflation figures can lead to rapid shifts in exchange rates as market participants adjust their expectations for future monetary policy actions.

Ok, now, how to trade the inflation reports?

Trading the CPI is easy when done on the right way, it can be incredibly rewarding if approached with a solid strategy. Here is how I trade these releases keeping it straightforward yet precise.

But before diving into how to trade the CPI, you will need to understand how I score the major pairs in forex. I have developed a system that provides a framework for figuring out the relative strength or weakness of each currency. You can watch the video by clicking play on the video below:

Now that you understand how to measure the weakness or strength of the currency you have my holy grail. This fundamental principle drives my approach that is to trade the strong currency against the weaker currency. Let me walk you through an example to illustrate:

- Imagine the scoring system assigns EUR a -2 and USD a +1.

- The Eurozone's CPI release is scheduled in 15 minutes, and the market expects a specific value (the consensus).

- If the CPI comes in lower than expected and there are no adjustments to the previous release, it signals even more weakness in the euro, because investors will be looking to place their money into other countries remember that we’ve covered that just a few minutes ago?

With this scenario, my trade would be to short EUR/USD. But why?

- The euro, already weak based on our scoring analysis, is further weakened by the disappointing CPI release.

- The USD, comparatively stronger, makes it the ideal counterpart for this trade.

One last thing that you should understand is that this is a scalp nature trade and should be traded only on high impact news events, I like to trade these events for a maximum of 5 to 10 minutes with the trade open.

By combining a scoring system with a clear understanding of inflation data, you can trade CPI reports while minimising unnecessary risks.

Here is an example of a real trade.

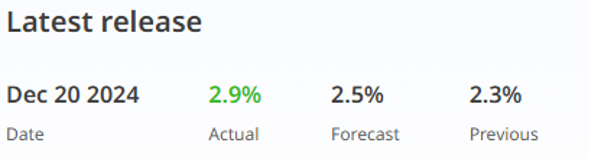

The Japan inflation was due on 20/12/2024 the expectation for the inflation was at 2.5%, Japanese yen was trading with a score of +1 and USD was trading at -1 scoring the release came as follow for the Japan CPI.

Japan CPI

With a higher-than-expected release for the Japan CPI, we could use the strength of the JPY (at that moment) to long it against a weaker currency like the USD. Remembering that a weaker currency on the base (Base/Quote) and strong on the quote makes the chart go down, as the opposite makes the chart goes up.

Here is the trade to short USDJPY:

Conclusion: Inflation’s Central Role in Forex Trading

Inflation remains a cornerstone of economic analysis, intricately linked to monetary policy, currency valuation, and market behaviour. By understanding its causes, measurement tools, and implications for the forex market, traders can develop strategies to navigate inflation-driven dynamics. Whether through interest rate speculation, strategic currency pair selection, or the use of custom indicators, forex participants can harness inflation insights to make informed trading decisions.

This in-depth exploration underscores the pervasive influence of inflation on global markets, equipping traders, and economists with the ability to translate economic theory into actionable strategies. As inflation continues to shape the financial landscape, mastering its intricacies will remain indispensable in the forex market.

At ACY Securities, we empower traders by providing:

Education Tailored to You: Catering to traders of all levels, we offer a diverse range of educational resources.

Informed Trading: We ensure you are not trading in the dark. Our expert insights and analysis support your trading decisions, helping you navigate the markets more confidently.

Ready to Dive In? Open your account with us today and begin a journey of growth and learning. Embrace the opportunity to grow, learn, and excel in the dynamic trading landscape with ACY Securities.

Explore ACY Securities' expert-led webinars to help traders navigate the world of the forex market. Learn more about Shares, ETFs, Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

延伸阅读