How to Leverage Gold Hedging Strategies - Expert Insights from ACY Securities

2023-12-21 10:24:39

Safe haven assets play a crucial role in safeguarding capital against financial downturns. These are assets that either maintain or significantly increase in value during periods of financial uncertainty or market volatility. Among these, gold stands out as a particularly promising safe haven asset in the financial market, largely retaining its value amidst global uncertainties.

Market downturns can vary in duration, sometimes being brief but often lasting longer, causing substantial declines in asset values. In such scenarios, safe havens like gold become indispensable, preserving or even increasing their value regardless of external economic shocks or uncertainties. As market volatility heightens the demand for gold, its value correspondingly rises. Gold's ease of purchase and sale, along with its long-standing role as a medium of exchange, further cements its status as a preferred safe haven asset.

At ACY Securities, we recognise the timeless value of gold in a trader's portfolio, especially during unpredictable market conditions. Its enduring appeal and resilience make it a strategic choice for those looking to mitigate risk and navigate through financial uncertainties with confidence.

The Role of Gold in Market Uncertainties

Throughout history, gold has served as a reliable hedge against various global crises, including economic downturns, periods of high inflation, and geopolitical tensions. Its enduring qualities of durability and scarcity have made it a trusted medium for preserving wealth across centuries. Unlike paper currencies, which can depreciate due to overprinting, gold consistently retains its demand and value.

Market participants have long relied on gold during times of economic distress, a trend that continues today. This reliance was evident in recent geopolitical conflicts such as the Ukraine-Russia and Israel-Gaza tensions, where gold's stability offered a safe haven amidst market turbulence. Its universal recognition adds to its appeal as a secure asset.

The COVID-19 pandemic further underscored gold's role as a financial bastion. During this period, demand for gold surged, culminating in a record-breaking price of $2,072 per troy ounce in August 2020. This milestone highlighted gold's resilience as an asset, especially during unprecedented global challenges.

Gold's unique financial strength positions it as a cornerstone for traders seeking a dependable store of value in uncertain times. Its historical performance and universal appeal continue to make it an attractive option for safeguarding capital against the unpredictable nature of global markets.

Inflation and Gold as a Hedge

Inflation, characterised by the declining purchasing power of currencies, often leads traders to seek refuge in assets like gold. Historically, during periods of high inflation, the value of currencies like the U.S. Dollar tends to diminish as the cost of goods and services rises. In contrast, gold often maintains or increases its value, making it a popular hedge against inflation.

A notable example of this dynamic is observed in the 1970s. According to NASDAQ data, this period experienced soaring inflation rates, peaking at around 14% by the year's end. Concurrently, gold prices witnessed a remarkable surge. The price of gold escalated from a mere $35 per ounce to an impressive $850 per ounce.

This significant increase not only highlights gold's role as a safe haven during turbulent economic times but also underscores its inverse relationship with inflation. As inflation erodes the value of paper currencies, gold often emerges as a resilient store of value, offering a buffer for traders against the adverse effects of rising prices.

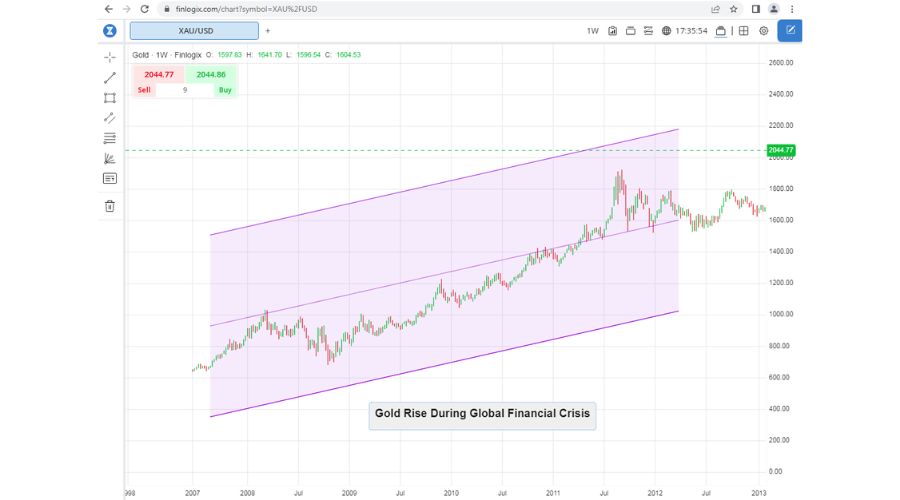

Gold's Role During the Global Financial Crisis

The Global Financial Crisis of 2008-2009 serves as a significant example of gold's status as a safe haven during economic turmoil. As the crisis unfolded, Market participants increasingly turned to gold, driving up its demand and, consequently, its value.

Data from the US Bureau of Labor Statistics reveals a telling trend: the Producer Price Index (PPI) for gold soared by 101.1% between 2008 and 2012. This surge in gold prices underscored its role as an effective hedge against inflation during the Great Recession. The crisis prompted the US Federal Reserve to inject substantial amounts of money into the economy, leading to a notable depreciation in the value of the US Dollar.

Faced with the dollar's weakening, market participants gravitated towards gold, seeking its stability and reliability. This shift in behaviour further fuelled the demand for gold, reinforcing its reputation as a resilient asset in times of financial distress.

Gold's Response to Geopolitical Tensions

Geopolitical tensions often lead to market uncertainty, prompting traders to seek reliable safe havens, with gold being a prime choice. Historically, gold prices have risen during periods of geopolitical conflict, reflecting its status as a stable venture.

For instance, during the Ukraine-Russia conflict, gold prices experienced significant increases. Similarly, during periods of heightened tension in the Middle East, such as the Israel-Hamas conflict, gold's value has tended to surge. Despite high global interest rates, which typically would depress gold prices, factors like robust consumer demand in China and increased purchases by central banks have contributed to its price escalation.

The Israel-Hamas conflict in October exemplified this trend. As tensions escalated, gold began to exhibit bullish behaviour, reinforcing trader confidence in its value as a safe haven. This sentiment is echoed by experts in the field, who suggest that gold could offer substantial benefits in the event of regional conflicts escalating further, potentially impacting oil supply and further driving demand for gold.

During the initial 20 days of heightened tensions in the Israel-Hamas conflict, gold prices saw gains of around +10%, a clear indicator of its appeal during times of geopolitical instability.

Diversification and Risk Management with Gold

Gold is a popular choice for market participants looking to diversify their portfolios, especially during times of economic uncertainty, financial crises, or global conflicts. Its ability to mitigate risk and maintain value when other assets may be faltering makes it an attractive option for portfolio diversification.

For instance, a weakening U.S. dollar often signals an opportune moment to incorporate gold into a financial holding. Similarly, during periods of stock market instability, gold can serve as a stabilising asset, helping traders navigate market volatility. Therefore, adding gold to a diversified portfolio is a strategic move for risk mitigation.

Alternatives to Gold for Hedging

Cryptocurrencies: Digital assets like Bitcoin are increasingly viewed as modern alternatives to gold. They share similar characteristics, such as a finite supply, which in Bitcoin's case is capped at 21 million coins. This scarcity, coupled with immunity to inflation, positions cryptocurrencies as potential hedges against economic instability. Additionally, like gold, Bitcoin operates independently of centralised regulatory systems, adding to its appeal as a decentralised store of value.

Other Precious Metals: Silver and platinum are other viable options for hedging. While they can be more volatile, these metals also offer the potential for high returns and can act as safeguards against global uncertainties, much like gold.

Conclusion

Gold has long stood as a steadfast safe haven asset amidst global uncertainties. Its consistent performance in retaining or increasing value during economic crises, inflationary periods, geopolitical tensions, and financial downturns cements its status as a preferred choice for traders seeking to hedge their holdings. Historical events like the Global Financial Crisis and ongoing geopolitical conflicts underscore gold's resilience and reliability. Incorporating gold into a diversified portfolio is a widely recognised strategy for risk management, offering stability and a safeguard against market volatility.

While gold remains a traditional hedge, modern alternatives such as cryptocurrencies (like Bitcoin) and other precious metals (such as silver and platinum) present additional avenues for market participants exploring comprehensive hedging strategies.

At ACY Securities, we empower your trading journey with a wealth of resources:

- Education: Enhance your trading acumen with our extensive educational resources, designed to cater to traders of all skill levels.

- Expert Insights: Trade with confidence and precision, backed by expert insights and analysis. With us, your trading decisions are not just informed but astute.

- Start Your Journey: Are you ready to dive into the world of forex trading? Open your account with us today and take the leap to bolster your trading prowess.

Explore ACY Securities' expert-led webinars to help traders navigate the world of CFDs and the forex market. Learn more about Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know