How to Master Social and Copy Trading with ACY Securities

2024-01-18 09:12:21

Embarking on the trading journey can be a complex endeavour, particularly for newcomers to the financial markets. At ACY Securities, we simplify this process through the innovative concepts of social and copy trading. These approaches offer a streamlined and interactive way to engage in trading by mirroring the strategies of seasoned traders.

Social trading, in particular, fosters a community-driven environment where insights and experiences are shared, making it an excellent starting point for beginners or those with limited time to analyse markets.

Copy trading further enhances this experience by allowing you to directly replicate the trades of experienced traders.

This guide is designed to introduce you to both social and copy trading, providing a pathway to grow your trading skills and knowledge within a supportive community at ACY Securities.

Tracing the Roots of Copy Trading: From Early Forums to Modern Platforms

Social trading has evolved significantly from its early days of online forums and chat rooms. Before the internet, traders shared advice in small groups, but the digital era expanded these interactions globally. The 1990s saw the rise of personal trading websites and digitally distributed newsletters, paving the way for modern social trading platforms.

These platforms, unlike their predecessors, offer structured environments for traders to engage and learn from each other. This evolution highlights the transformative impact of technology in trading, making it more accessible and community-oriented.

At ACY Securities, we embrace this evolution, fostering learning and collaboration among traders, aligning with our commitment to an inclusive and educational trading environment.

Explaining the Concept and Origins of Social Trading

Social trading, a concept rooted in collaborative market intelligence, has evolved significantly with the advent of the internet. Before the digital era, trading advice and strategies were often shared within small, localised groups. However, the rise of the internet marked a pivotal change, introducing early chat rooms and online forums. These digital spaces became the new hubs for real-time market discussions and idea exchanges among traders worldwide.

By the early 1990s, the expansion of the internet allowed individual traders and dealers to create their own websites, connecting with a global audience. This era also saw the emergence of digitally distributed newsletters, further facilitating the sharing of trading insights and strategies across borders.

The foundation of social trading was further solidified as businesses recognised the potential of the internet for financial markets. They began offering services that allowed traders to mirror or replicate the trades of experienced market participants. This development was a significant step towards what we now recognise as social trading platforms.

These platforms, which emerged in the late 2000s and early 2010s, provided a structured environment where traders could not only share their insights but also directly copy the trades of others. This marked a shift from informal online discussions to a more organised system of trading based on collective intelligence. Social trading platforms made it possible for individuals, regardless of their location or level of experience, to participate in financial markets by leveraging the knowledge and strategies of seasoned traders.

How Social Trading is Revolutionising Online Trading

Social trading, a relatively new phenomenon, is reshaping the landscape of traditional financial systems. This trend allows individuals to interact and assist each other, blending online trading platforms with the power of social media. Here's how social trading is making waves:

- Enhanced Collaboration: Social trading fosters an environment where traders can exchange ideas, strategies, and insights. This collaborative approach is powered by group intellect, encouraging diverse perspectives and innovative strategies.

- Democratising Finance: By leveling the playing field, social trading makes financial markets more accessible. It harnesses community knowledge, enabling traders to refine their strategies in the digital age.

Examples of Social Trading Platforms and Communities:

- WhatsApp and Telegram Groups: Traders share insights and strategies in real-time.

- TikTok and YouTube: Platforms where traders post educational content and market analysis.

- Discord Channels: Communities for in-depth discussions and strategy sharing.

Beginner's Guide to Social Trading:

- Choose a Reliable Platform: Opt for platforms that are reputable and offer necessary functionalities. Ensure they are regulated and recognised.

- Research Traders to Follow: Spend time analysing their market choices, strategies, and risk profiles.

- Allocate Capital Wisely: Distribute your portfolio among traders based on their risk levels and performance.

Key Tools in Social Trading Platforms:

- Copy Trading: Automatically replicate the trades of experienced speculators.

- Risk Management Tools: Set personalised parameters to minimise potential losses.

- Social Feeds and Forums: Engage in vibrant communities for shared learning and strategy exchange.

- Research and Analysis Tools: Access real-time market data and educational resources for informed trading.

- Mobile Apps: Stay connected and trade on the go with user-friendly applications.

In conclusion, social trading is not just a trend; it's a transformative force in online trading. By understanding and leveraging the tools and communities available, traders can navigate the markets more effectively and make informed decisions. With platforms like ACY Securities, you're not just trading; you're becoming part of a global community of informed traders.

Integrating Copy Trading within the Social Trading Ecosystem

Copy trading, as an integral part of social trading, empowers beginners to navigate the trading landscape effectively. It enables them to mirror the strategies of expert traders, thus facilitating a smoother and more informed entry into the world of trading.

What is Copy Trading?

Copy trading is essentially the process of replicating the trading strategies of experienced traders on a trading platform. It's particularly suitable for beginners who are yet to grasp the fundamentals of trading and the factors influencing the market.

Getting Started with Copy Trading at ACY Securities

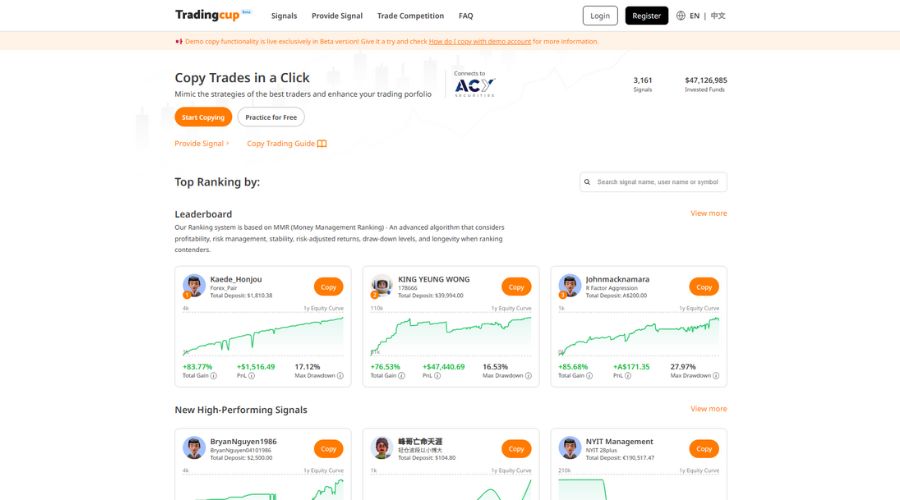

To begin copy trading, sign up on a reliable platform like ACY Securities, known for its user-friendly interface and strong features. Connect your account to a copy trading service like Tradingcup. Deposit the amount you wish to allocate, and then embark on selecting traders to emulate. Research their market strategies, tactics, and risk profiles to make informed decisions.

Discover the future of Forex trading in our latest video, showcasing a cutting-edge copy trading solution launching in 2024. Learn how trading automation can enhance your strategy, the importance of a diversified portfolio of uncorrelated automated trading systems, and effective ways to create a portfolio of top traders to copy. We also delve into essential strategies tailored to your portfolio size. This video is a must-watch for anyone looking to elevate their trading game with the latest innovations in copy trading.

Click play on the video below.

Advantages of Copy Trading

- Ideal for New Traders: Copy trading offers a straightforward path to start earning by following proficient traders.

- Low Risk: It reduces the likelihood of losses, especially for traders with limited experience.

- Time-Efficient: It allows for earning without the need for extensive market research or strategy development.

Challenges in Copy Trading

- Limited Discretion: Traders cannot make independent decisions, as they are replicating another trader's moves.

- Technology Dependence: Reliance on digital platforms means being subject to technological risks.

- Variable Trade Pricing: Market conditions can lead to differences in trade execution prices.

Selecting the Best Trader to Copy

- Observe Total Returns: Look for traders with a high return rate, indicating their market proficiency.

- Assess Return Volatility: Higher volatility can mean higher risk.

- Review Short-Term Returns: Consider the trader's recent performance to gauge current effectiveness.

Copy Trading with ACY Securities

ACY Securities offers a diverse and user-friendly copy-trading platform. It provides real-time data, and a transparent system, making it an ideal choice for both beginners and experienced traders. Our platform is designed to cater to both novice and seasoned traders, and we take pride in providing an efficient and transparent trading experience.

Here are some of the things that set our service apart:

Exceptional Support System

- We offer comprehensive support, available 24/5 through email and chat, ensuring that all your queries and concerns are promptly addressed.

Universal Mobile Compatibility

- Our platform is designed for accessibility from any device, allowing you to engage in copy trading seamlessly, whether you're at home or on the move.

Cutting-Edge Technology

- Our copy trading is powered by robust proprietary technology, ensuring a reliable and smooth trading experience.

Fully Hosted Service

- We ensure that your account is always connected, providing a hassle-free trading environment.

Multi-Platform Capability

- Our platform supports copy trading from any MT4/MT5 Signals, offering flexibility and a wide range of trading options.

How It Works with ACY Securities

- Quick Account Connection: Connect your trading account in under 60 seconds by simply entering your login credentials.

- Signal Selection and Setup: Choose the signals you wish to copy and effortlessly set them up according to your trading preferences.

- Start Copying: With just a click on the copy button, you're all set to begin your copy trading journey.

To summarise, copy trading platforms are designed to offer a transparent and efficient trading experience, enhanced by the integration of real-time data and high leverage options.

These platforms serve as more than just tools; they are gateways to broadening trading horizons for individuals at all levels of experience. By facilitating the replication of strategies from seasoned traders, they provide a unique opportunity for learning and growth in the dynamic world of trading.

Breakthrough Stories in Social Trading: Learning from the Experts

Social trading has revolutionised the online trading landscape, with prominent figures like Jim Cramer and Robert Kiyosaki leading the way. Their stories offer valuable insights into the power of community involvement and strategic financial approaches.

Robert Kiyosaki: A Financial Education Pioneer

- Best known for his book "Rich Dad Poor Dad," Kiyosaki has significantly influenced financial education.

- His teachings often emphasise entrepreneurship and question traditional employment and saving methods.

- Kiyosaki's impact lies in encouraging people to rethink their approach to money, investments, and work, thereby making more informed and proactive financial decisions.

- His advice on trading gold, silver, and Bitcoin has been particularly influential, with his gold price predictions often coming to fruition.

Jim Cramer: A Controversial Financial Analyst

- Host of CNBC's "Mad Money," Cramer is known for his bold and sometimes contentious investment advice.

- He has gained a reputation for making incorrect stock market predictions, leading to the nickname "Inverse Cramer."

- An example of Cramer's misjudgement includes his 2008 advice on Bear Stearns stocks, which plummeted from $60 to $3 per share within days.

Challenges and Considerations in Social Trading

Navigating the social trading world requires a sophisticated approach, with risk management being a key challenge.

Risk Management in Social Trading

- Effective social traders are those who identify and mitigate risks.

- Diversifying the portfolio and researching various sectors and professions are crucial steps.

- Trading inherently involves risks, and not everyone is cut out for the uncertainties of the market.

The Value of Independent Research

- Despite the benefits of communal insights, individual research remains vital.

- Effective traders can sift through collective information and noise, understanding the importance of independent market analysis.

Balancing Trend-Following with Personal Decision-Making

- Traders strive to follow trends while maintaining their own judgment.

- Utilising various analytical tools like VRIO or SWOT helps in evaluating the pros and cons of each decision.

- Flexibility and adaptability are essential in responding to new information or changing circumstances.

- Regularly reviewing and adjusting decisions based on evolving trends is key.

In conclusion, social trading presents a complex yet rewarding financial landscape. Mastery in this field requires balancing communal insights with independent research and strategic decision-making.

The Future of Social Trading: Emerging Trends and Technological Impact

The rise of social trading has been a direct response to the global demand for futures, stocks, and foreign exchange. Looking ahead, the social trading market is anticipated to experience significant growth between 2023 and 2030. This growth trajectory is expected to surpass the rates observed in 2022, driven by the strategic adoption of new practices by major players in the market.

Technological Advancements and Their Influence

The landscape of social trading is poised for a transformative shift with the advent of cutting-edge technologies. Developments in artificial intelligence and the Internet of Things are opening up nearly limitless possibilities. The progress in quantum computing and autonomous vehicles is also garnering attention, indicating a shift towards a more technologically advanced trading environment.

- Advanced analytics tools are increasingly utilised by traders for deeper data analysis, enhancing the ability to make informed decisions.

- Predictive modelling, combined with real-time data processing, is expected to improve market movement forecasts.

- The integration of Virtual Reality (VR) and Augmented Reality (AR) technologies will revolutionise social trading platforms, offering immersive and interactive tools for market research and analysis.

Conclusion: The Growing Significance of Social Trading

Social trading platforms are not just about trading; they offer a unique opportunity for networking, learning, and discussion among diverse traders. This approach allows beginners to start trading with real-time experience, gradually learning from seasoned traders. It's particularly beneficial for traders prone to emotional decision-making, as it allows them to emulate more stable trading positions.

- The trend in social trading is towards leveraging technology to enhance financial strategies and overall trading experiences.

- Social trading platforms are emerging as a reliable and user-friendly means for capital generation, especially for novice traders.

- The simplicity and accessibility of social trading have led to its growing popularity across various markets and trading styles.

- Platforms are recognising the potential of social trading as a valuable addition to their service offerings, catering to a broader range of traders.

In summary, the future of social trading looks bright, with technological advancements playing a pivotal role in shaping its evolution. As the sector grows, it continues to offer accessible and innovative solutions for traders of all levels, making it an increasingly important part of the financial trading landscape. At ACY Securities, we empower your trading journey with a wealth of resources:

- Education: Enhance your trading acumen with our extensive educational resources, designed to cater to traders of all skill levels.

- Expert Insights: Trade with confidence and precision, backed by expert insights and analysis. With us, your trading decisions are not just informed but astute.

- Start Your Journey: Are you ready to dive into the world of forex trading? Open your account with us today and begin a journey of growth and learning. Embrace the opportunity to grow, learn, and excel in the dynamic trading landscape with ACY Securities.

Explore ACY Securities' expert-led webinars to help traders navigate the world of CFDs and the forex market. Learn more about Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

FAQs

1. What is Social Trading?

Social trading is a method where traders share insights and strategies within a community, allowing beginners to learn from experienced traders.

2. How does Copy Trading differ from Social Trading?

Copy trading is a subset of social trading where traders directly replicate the strategies of experienced traders.

3. What are the benefits of Social Trading?

Social trading offers community-driven learning, access to expert strategies, and a more democratic approach to financial markets.

4. Can beginners benefit from Social Trading?

Yes, beginners can greatly benefit from social trading by learning from and copying the trades of seasoned traders.

5. What should I consider when engaging in Social Trading?

It's important to manage risks, conduct independent research, and balance following trends with personal decision-making.

Try These Next