How to Master Automated Forex Trading

2024-06-14 16:23:05

What is Automated Forex Trading? Automated forex trading involves using software to execute trades in the foreign exchange market without human intervention. This software, often referred to as automated forex trading software, forex trading robots, or forex trading bots, leverages advanced algorithms to analyse market conditions and execute trades based on predefined strategies.

For example, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular platforms that support automated trading. These platforms allow traders to implement algorithmic trading strategies through Expert Advisors (EAs) that can automatically open and close trades based on specified criteria.

Automated trading systems offer numerous benefits, including the ability to trade 24/7, eliminate emotional trading decisions, and ensure consistent execution of trading strategies.

Definition of Automated Forex Trading

Automated Forex trading is a type of trading where all trading decisions fall under the independent control of a machine. This trading method utilises automated forex trading software to execute trades without human intervention, relying on pre-programmed algorithms to analyse market conditions and make trading decisions.

An auto trading system achieves its goals by avoiding ambiguity and strictly defining the rules for entry, exit, and the market’s direction. This precision eliminates the emotional and psychological biases that often affect manual trading, ensuring consistent and disciplined trade execution.

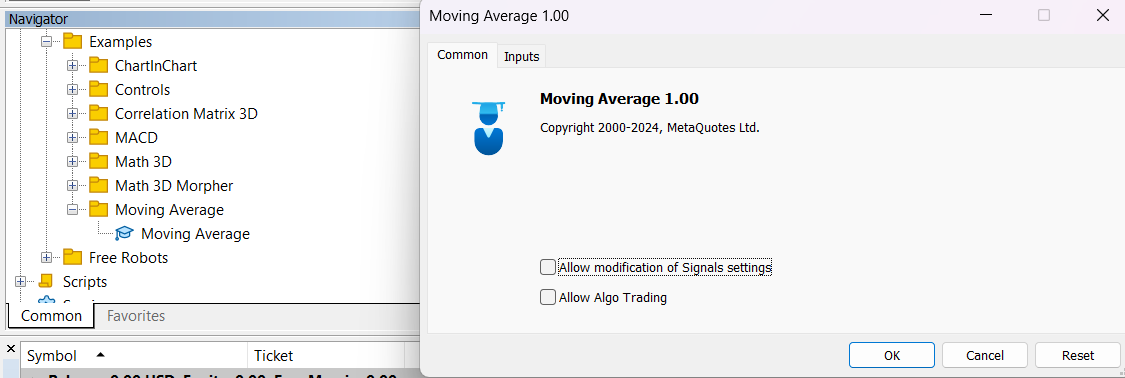

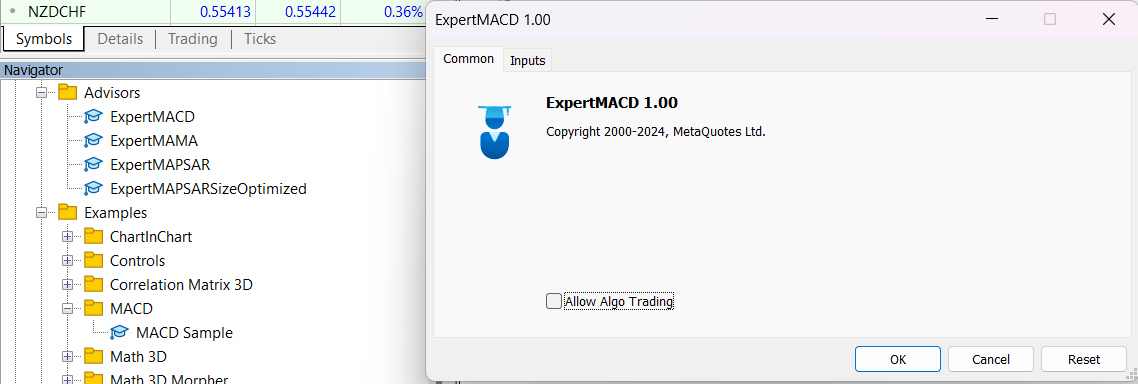

Adding an Expert Advisor to your MetaTrader chart is straightforward:

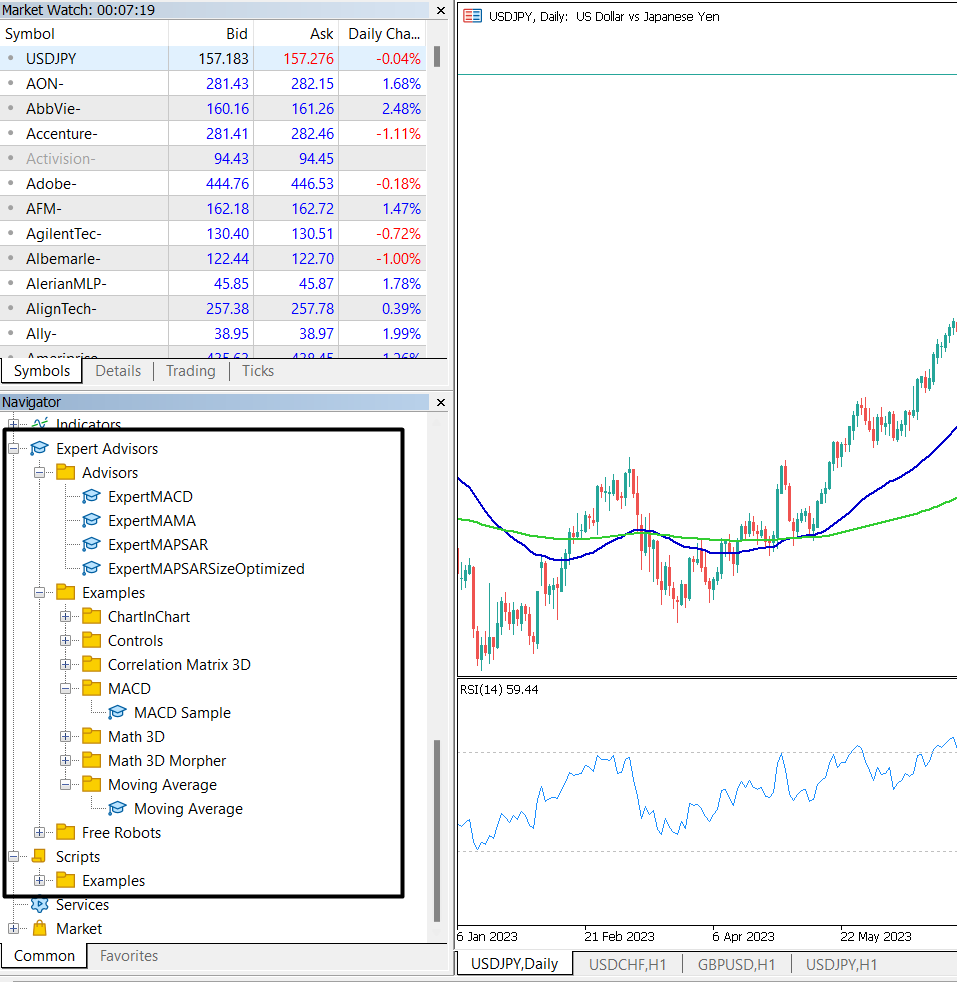

1. Select the Chart: Choose the chart where you want to add an EA.

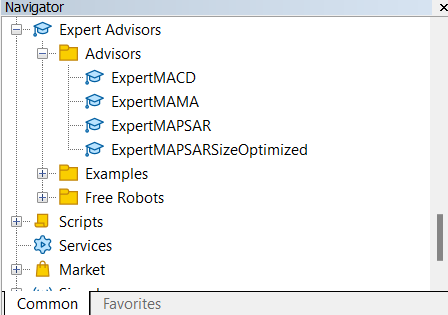

2. Open the Navigation Panel: Click on the "Navigation" panel.

3. Expand the Menus: Expand the "Expert Advisors" menu, followed by the "Advisors" menu.

4. Apply the EA: Select your preferred EA and drag it onto the chart, or double-click to apply it.

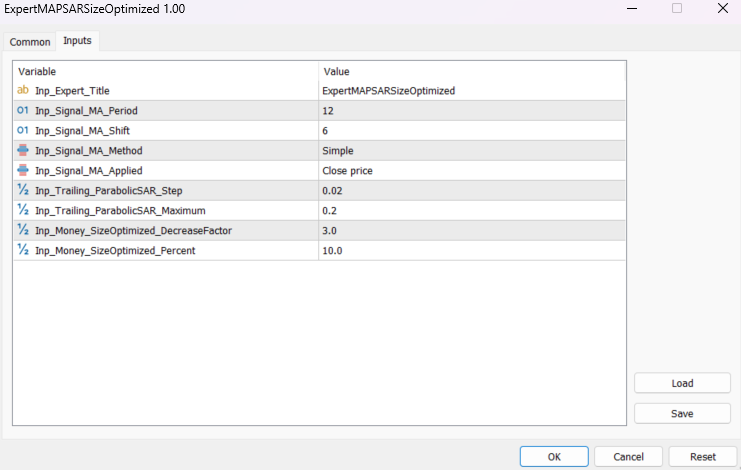

5. Set Parameters: Enter the desired parameters in the popup window.

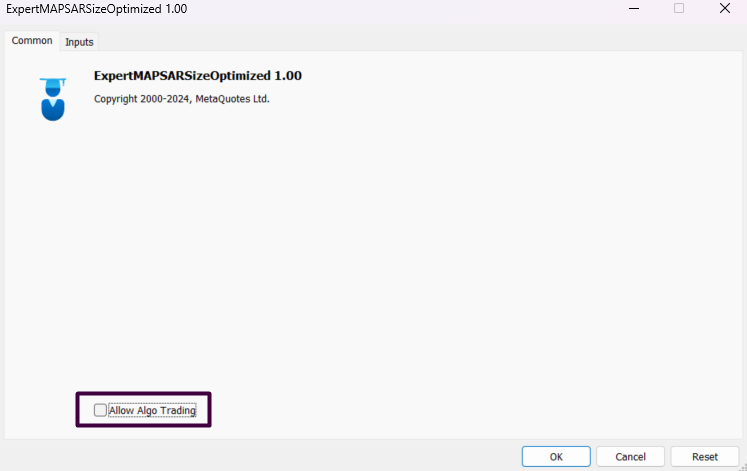

6. Enable Automated Trading: In the "Common" tab, check the "Allow Automated (Algo) Trading" option.

Example: MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for supporting automated trading strategies. For instance, a trader can create an Expert Advisor (EA) on MT4 that follows a specific algorithm to trade EUR/USD.

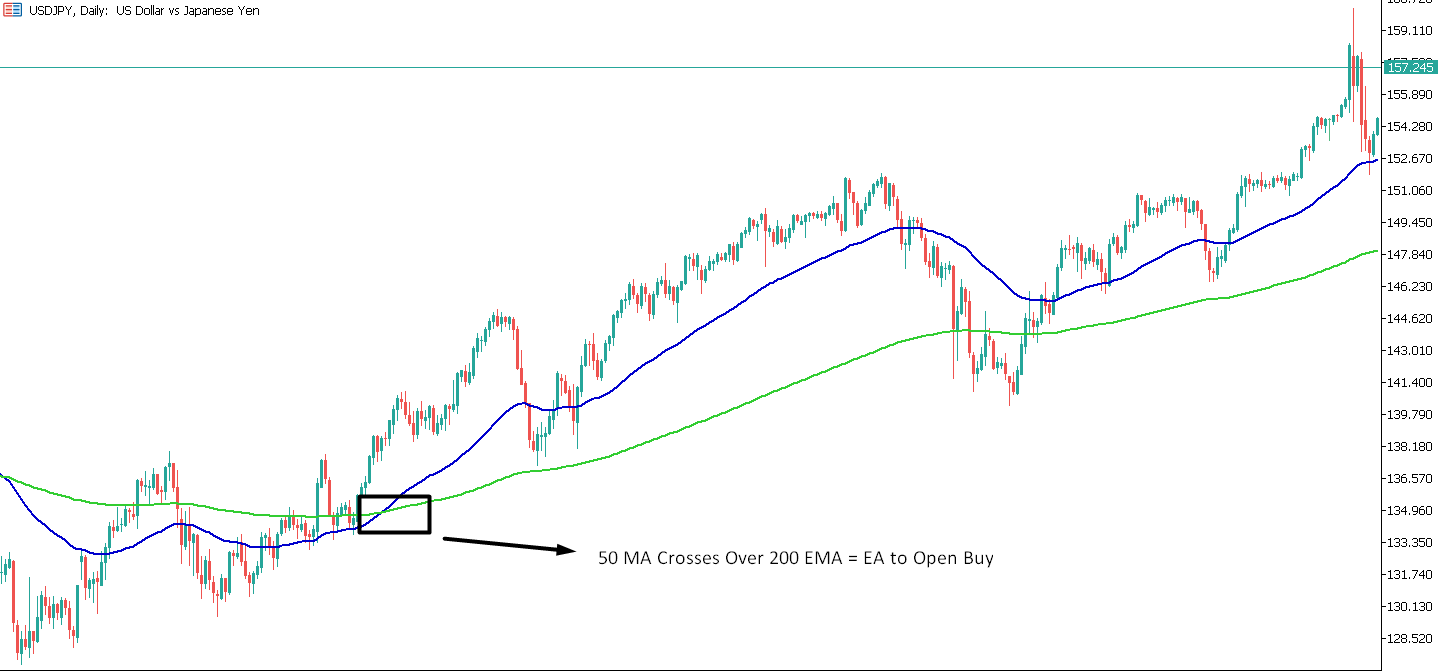

This EA might be programmed to enter a buy position when the 50-day moving average crosses above the 200-day moving average and to close the trade when a certain target is reached or a stop-loss limit is triggered.

Similarly, on MT5, a trader might use an EA to trade GBP/JPY, where the system automatically executes trades based on technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

These automated trading systems ensure trades are executed precisely as planned, even when the trader is not actively monitoring the market, thereby maximising trading opportunities and minimising potential losses.

How Does Automated Forex Trading Work?

Automated forex trading leverages sophisticated software that analyses market data and makes buy or sell decisions based on pre-programmed trading strategies. This software, known as automated forex trading software-or-forex trading robots, operates independently to execute trades, ensuring consistent application of trading strategies without human intervention.

Analysis of Market Data

Automated trading software scans the forex market for data, analysing technical indicators and identifying price patterns to find potential trading opportunities.

For example, the software might use moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) to make trading decisions.

The automated forex trading software is programmed to recognise specific market conditions that match predefined criteria set by the trader.

Algorithmic Trading Decisions

The core functionality of automated trading systems lies in their ability to make algorithmic trading decisions. These decisions can be based on technical analysis, such as chart patterns and technical indicators, or on economic news and events.

For instance, an automated trading system might be programmed to buy EUR/USD if a certain economic report meets specific criteria or to sell GBP/JPY if a technical indicator signals an overbought condition.

Execution of Trades

Once the software identifies a trade that aligns with its programmed criteria, it executes the buy or sell order automatically. This process ensures that trades are made promptly, without the delays associated with manual trading.

For example, using MetaTrader 4 (MT4) or MetaTrader 5 (MT5), traders can set their forex trading bots to execute trades when the 50-day moving average crosses above the 200-day moving average for a currency pair like USD/JPY.

Customisable Trading Strategies

Traders can customise their automated trading strategies to fit their specific trading goals. This includes setting parameters for entry and exit points, risk management, and trade sizes. By using these advanced trading tools, retail traders can maximise their returns and minimise risks.

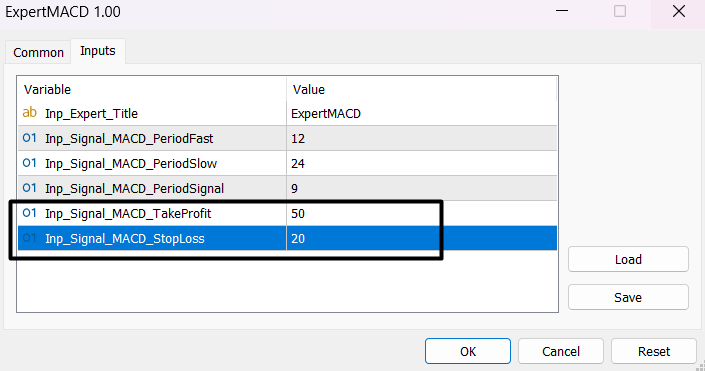

For example, an automated trading strategy might involve setting a stop-loss order at 20 pips below the entry price and exit order at 50 pips above the entry price for trades involving currency pairs like EUR/USD or GBP/USD.

Continuous Monitoring and Adaptation

Automated forex trading platforms continuously monitor market conditions and adapt to changes in real time. This ability to react quickly to market fluctuations helps traders capitalise on trades and avoid potential losses.

For instance, during the New York trading session, an automated trading system can execute trades based on high-impact economic news releases, ensuring that trading decisions are made promptly and accurately.

By understanding how automated forex trading works, traders can effectively use these powerful tools to enhance their trading performance and achieve their financial goals in the highly dynamic forex market.

Benefits and Risks of Using Automated Forex Trading

Benefits of Automated Forex Trading

- 24/7 Trading: Automated forex trading software allows traders to operate continuously, taking advantage of trading opportunities across different time zones. Unlike manual trading, automated systems can execute trades even when the trader is asleep or unavailable.

- Elimination of Emotional Trading Decisions: One of the significant advantages of using automated trading systems is the removal of emotional influences. Emotions such as fear and greed can cloud judgment and lead to poor trading decisions. Automated trading ensures that trades are executed based on predefined criteria, maintaining consistency and discipline.

- Efficiency and Speed: Automated trading platforms can process vast amounts of market data and execute trades with incredible speed. This efficiency is crucial in the fast-paced forex market, where timing can significantly impact return potential.

- Backtesting Capabilities: Traders can backtest their strategies using historical data to evaluate their effectiveness before deploying them in real-time trading. This feature helps in refining trading strategies and increasing their effectiveness.

- Consistent Strategy Implementation: Automated trading ensures that trading strategies are implemented consistently without deviations. This consistency helps in maintaining the integrity of the trading plan and achieving long-term trading goals.

Risks of Automated Forex Trading

- Insufficient Risk Management: One of the primary risks of auto trading is the failure to incorporate detailed risk management conditions into the system. Without proper risk management, automated trading can lead to significant losses, especially during volatile market conditions.

- Over-Optimisation: Over-optimising a trading strategy for historical data can result in a system that performs well in backtests but fails in live trading. This risk occurs when the strategy is too finely tuned to past data and does not adapt well to changing market conditions.

- Technical Failures: Automated trading relies heavily on technology, including software and hardware. Any technical failures, such as connectivity issues, software glitches, or power outages, can disrupt trading and lead to potential losses.

- Market Conditions Changes: Automated systems are based on historical data and predefined rules. However, market conditions can change rapidly, rendering the programmed strategies less effective. Traders need to regularly update and adapt their systems to current market conditions.

- Dependency on the Initial Setup: The effectiveness of automated trading systems largely depends on the initial setup and parameters defined by the trader. If these parameters are not well thought out, the system may not perform as expected, leading to suboptimal trading outcomes.

Welcome to the World of Experts, Scripts, and Robot Trading

ACY Securities offers a comprehensive suite of scripts and indicators to enhance your automated forex trading experience on the MT4 platform. New clients can open a demo or live account to access these tools while existing clients can re-download MT4 from the ACY.Cloud Download Center.

Note that certain indicators are exclusive to live account holders.

- MT4 Script: Close All

- Description: Closes all open positions and deletes all pending orders in one go.

- Delete All Objects Script

- Description: Deletes all objects and drawings on your chart with ease.

- Trading Statistics

- Description: Displays all critical trading statistics in one window, including open P&L, spreads, and product information.

- Trailing Stop & Long Short Indicator

- Description: Applies trailing stop loss and indicates whether the market is bullish or bearish.

- Calculate Your Lots

- Description: Calculates position sizes to determine risk in advance.

- Keltner Channel Indicator

- Description: Identifies important trends and volatility breakouts using Keltner Channel and ATR calculations.

- Trend Ribbon

- Description: Quickly identifies market trends to help plan entries and exits.

- Donchian Channel

- Description: Utilises a channel breakout trading system to identify highs and lows over N periods.

- Advanced Pivot Points

- Description: Automatically calculates seven critical levels based on the previous day's high/low close.

- Time Zone Indicator

- Description: Indicates the current trading time zone to understand volatility characteristics.

- Advanced Bollinger Breakout

- Description: Enhances entry timing with improved Bollinger Bands and trading stop line.

- Multi-Timeframe RSI

- Description: Integrates RSI values from daily, 4-hour, and hourly charts for market direction assessment.

- Cross Timeframe MA

- Description: Places the moving average of a higher-level time frame on a lower time frame to follow the trend.

- Auto Trendline

- Description: Identifies current market trends to assist in planning future trades.

How to Choose the Best Auto Trading Software

Define Your Needs

When selecting automated forex trading software, it's crucial to identify your specific trading requirements. The best algorithmic trading software should be capable of generating reports, setting stop orders, managing trailing stops, and executing trades efficiently. Consider your trading goals and needs:

- Do you need advanced reporting and alert generation?

- Are stop and trailing stop orders essential for your strategy?

- Do you require high-frequency trading capabilities?

Determine these factors to find software that aligns with your trading style and objectives.

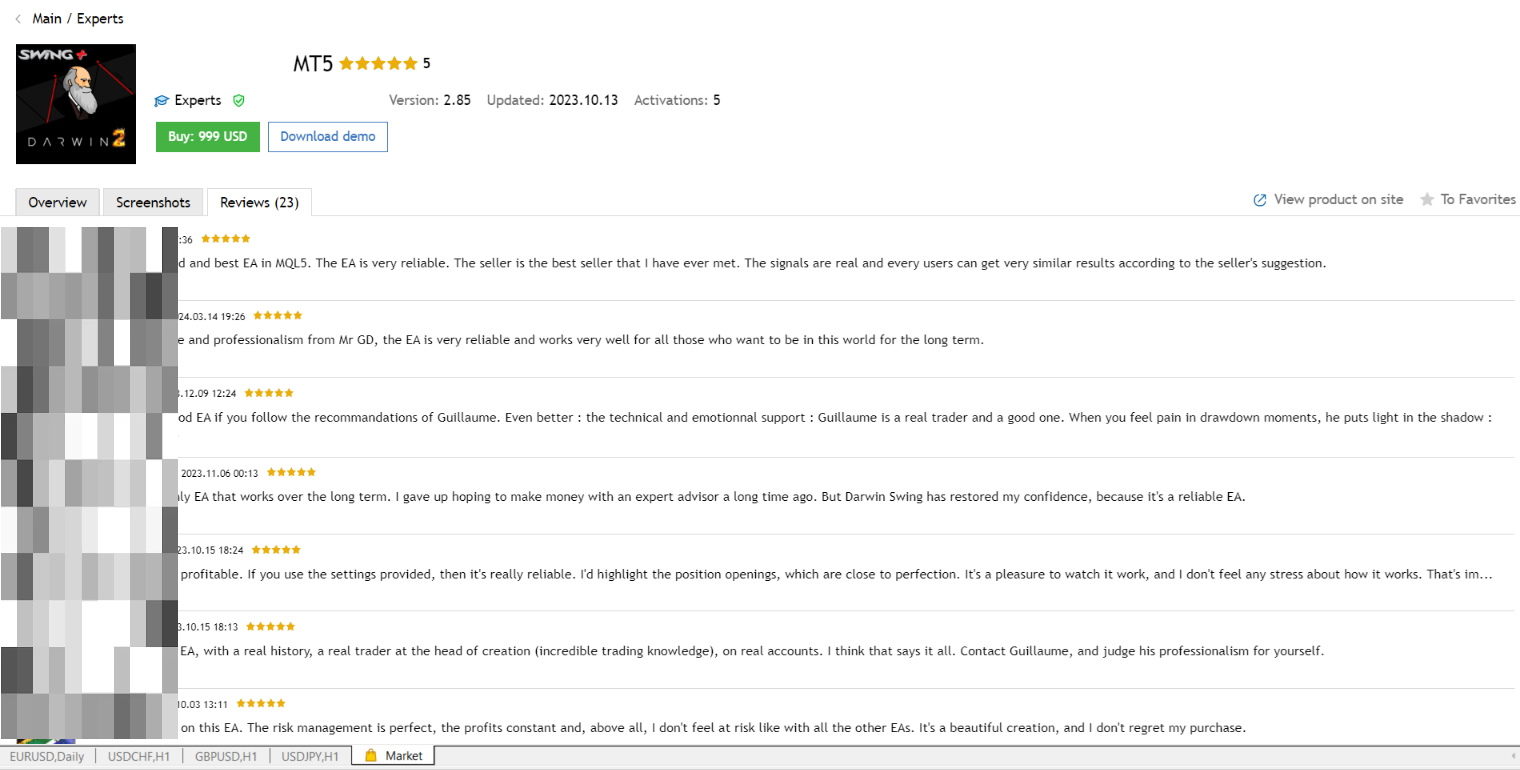

Read Reviews and Compare Features

Research is vital when choosing automated forex trading software. Read reviews and compare the features of different options:

- Look for user feedback on performance, ease of use, and reliability.

- Verify if the software supports real-time market monitoring and remote access.

- Ensure the availability of Virtual Private Server (VPS) hosting for enhanced security and performance.

- Check if the software provides authenticated trading history results to validate its effectiveness.

Comparing these features helps you select a platform that meets your requirements and offers reliable performance.

Consider Costs and Fees

Understand the costs and fees associated with each automated forex trading software option. Transparent and competitive pricing is essential:

- Determine if there is a one-time purchase fee or ongoing subscription costs.

- Check for additional fees, such as trading commissions or maintenance charges.

- Compare the cost with the features and benefits offered to ensure value for money.

Avoid sacrificing quality for a lower price, as effective trading software is a crucial consideration.

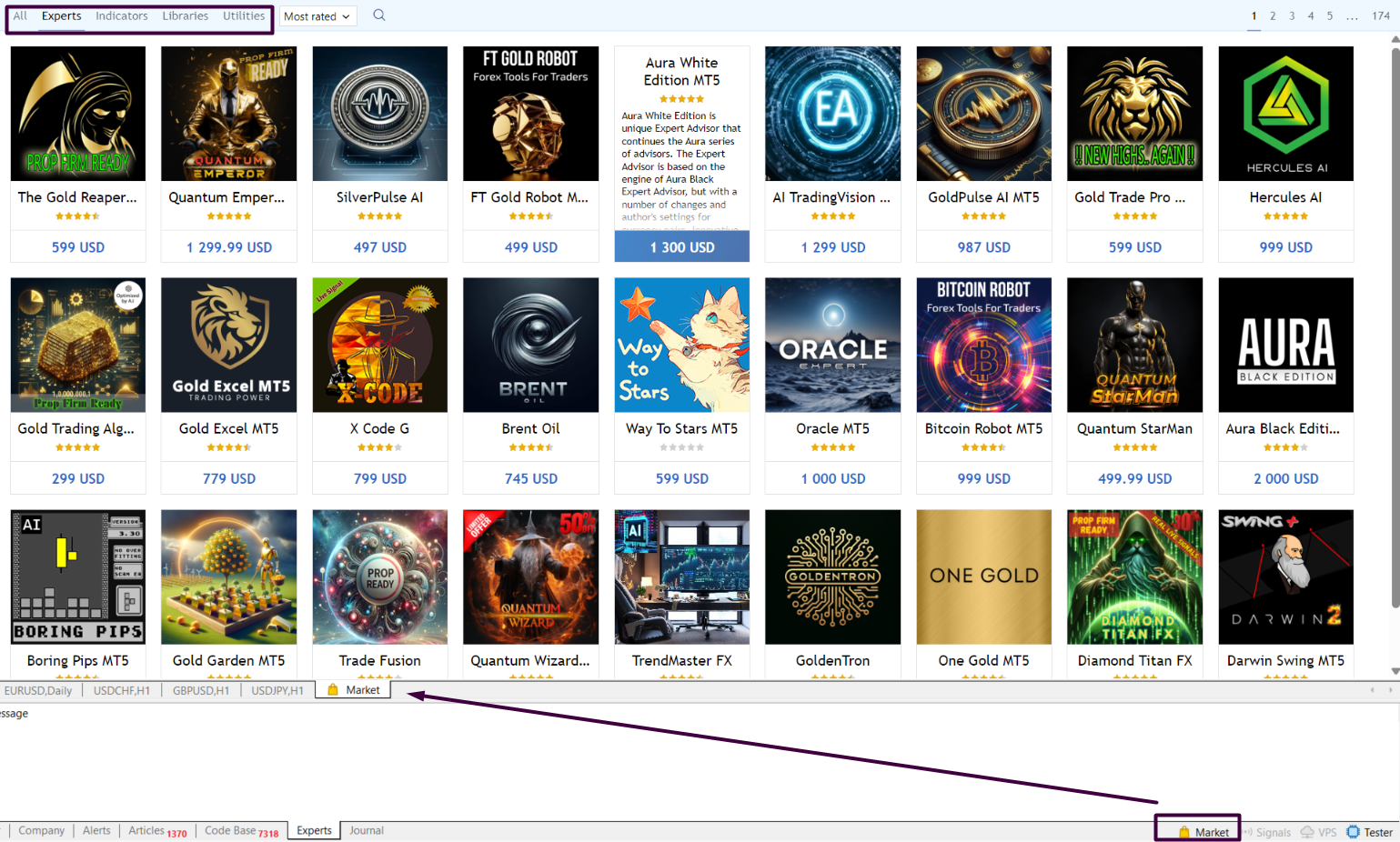

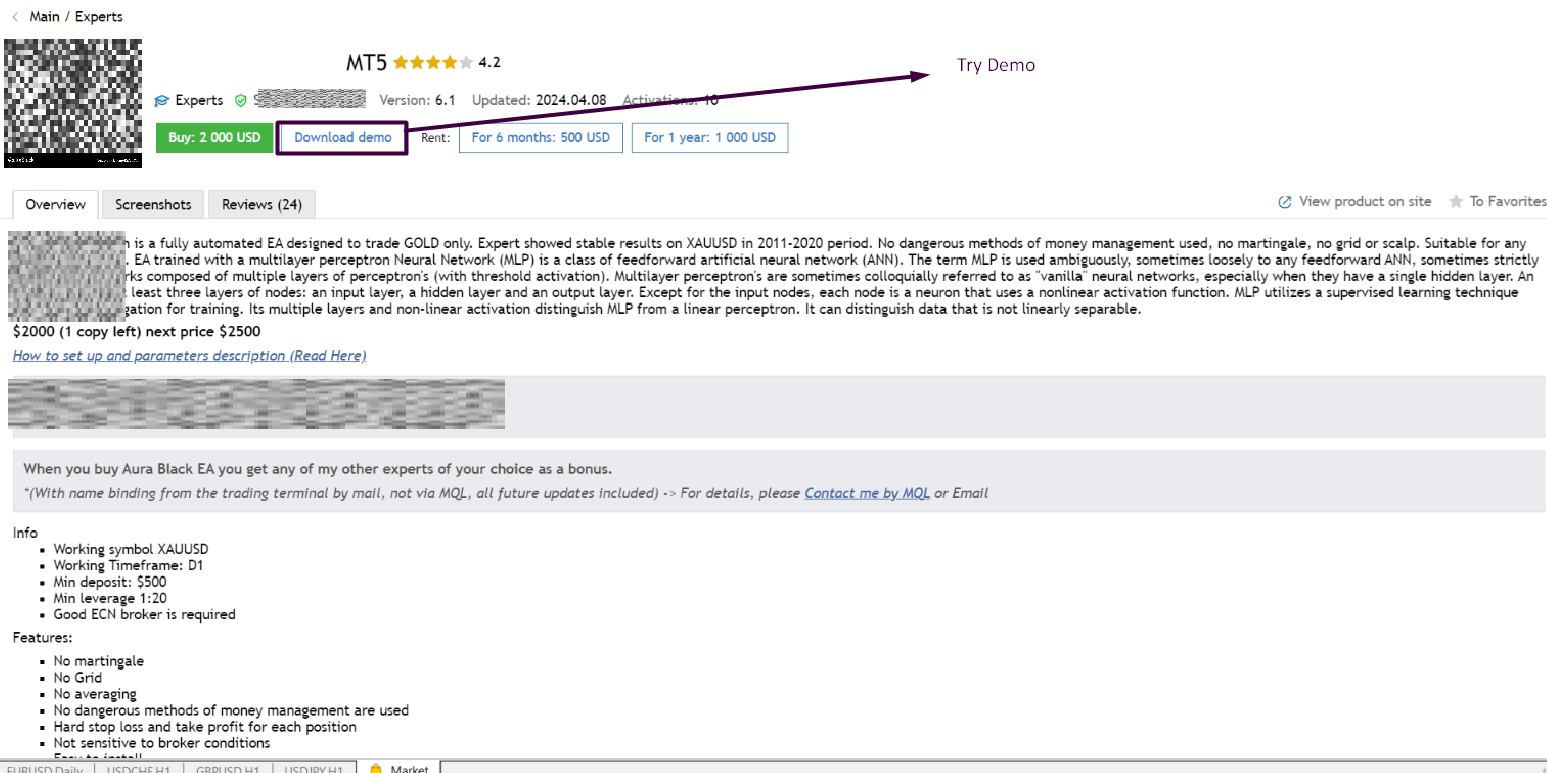

Try Before You Buy

Before committing to an automated forex trading software, test it using a demo trading account:

- Many platforms, including those supported by ACY Securities, offer free trials or demo accounts.

- Use this opportunity to evaluate the software’s functionality, ease of use, and compatibility with your trading strategy.

- Run tutorials and check the quality of customer support to ensure comprehensive assistance.

Testing the software helps you ensure it meets your needs and performs as expected, reducing the risk of making an unsuitable purchase.

Final Thoughts on Automated Forex Trading

Automated forex trading enhances trading efficiency and consistency by using sophisticated algorithms and predefined strategies to execute trades automatically. This approach minimises emotional decisions and maximises potential returns. Whether you are a novice or an experienced trader, understanding the benefits and risks of automated trading is crucial for proficiency in the forex market.

Can Retail Traders Use Automated Trading?

Yes, retail traders can use automated trading strategies through popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms support Expert Advisors (EAs) and other automated trading tools, allowing traders to implement and execute their strategies without constant supervision.

How Much Does it Cost to Start Automated Trading?

Starting automated trading can be cost-free, especially when using a demo trading account.

Many brokers will also offer an automated trading platform for free when you open an account with them, including ACY Securities. We offer free access to automated trading platforms like MT4 and MT5 when you open an account. This provides a risk-free environment to test and refine your strategies without any initial financial commitment.

Curious about how AI is revolutionizing the world of automated trading? Watch more here:

At ACY Securities, we empower traders by providing:

- Education Tailored to You: Catering to traders of all levels, we offer a diverse range of educational resources.

- Informed Trading: We ensure you're not trading in the dark. Our expert insights and analysis support your trading decisions, helping you navigate the markets more confidently.

- Ready to Dive In? Open your account with us today and begin a journey of growth and learning. Embrace the opportunity to grow, learn, and excel in the dynamic trading landscape with ACY Securities.

Explore ACY Securities' expert-led webinars to help traders navigate the world of the forex market. Learn more about Shares, ETFs, Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

Try These Next