Futures CFDs Trading Strategies for Beginners

2023-10-20 11:47:42

The futures market is an ever-buzzing hub, akin to a city that never sleeps, with activities spanning almost 24 hours during weekdays. But what keeps this market so active? Journey with us to demystify the complexities of futures trading and gain invaluable insights to manoeuvre this intricate market.

Futures CFDs at ACY Securities: An Overview

Discover the intricacies and opportunities of futures CFDs with ACY Securities - your gateway to comprehensive trading insights.

- Technological Mastery: Harnessing the power of cutting-edge technological advancements, ACY Securities provides traders with access to CFDs (contracts for difference) and futures CFDs via platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Traditional vs. OTC Trading: While traditional futures contracts operate on designated futures exchanges, such as the Chicago Mercantile Exchange (CME), futures CFDs offered by ACY Securities are traded as over-the-counter (OTC) derivatives.

- Speculation without Ownership: Engaging in CFD trading allows traders to speculate on the price fluctuations of the associated futures contract without any direct ownership or vested interest in the asset.

- Trading Hours: It is essential to note that futures CFDs can be traded only during the operational hours of the specific exchange where the underlying asset is listed.

- Expiration Awareness: When delving into futures CFDs trading, it is crucial to be mindful of expiration dates, mirroring the nature of the original futures contracts.

In essence, futures CFDs are derivatives layered upon another derivative, offering a unique avenue for trading.

Advantages of Trading Futures

The futures market, accessible from brokers like ACY Securities, presents a myriad of advantages that make it a cornerstone in the global financial arena.

Here's a consolidated look at the perks it brings to the table:

- Hedge Against Market Volatility: The futures market offers a robust mechanism to shield forex traders from unpredictable currency price oscillations. For instance, businesses that deal with international transactions can leverage futures contracts to lock in exchange rates. This ensures they aren't adversely affected by sudden currency rate fluctuations, providing a stable environment for their financial planning and operations.

- Take a Position: It's not just about safety. If traders can accurately anticipate where prices are headed, the futures market offers a lucrative playground for realising gains from these positions.

- Diverse Opportunities: Traders and speculators have a lucrative playground in the futures market to realise returns from predicting where prices are heading.

In essence, the futures market is not merely a protective tool; it is a hub of opportunities where traders can test their market acumen, manage risks, and diversify their portfolios. Dive deeper with us, unravel the subtleties of futures trading, and harness the insights to thrive in this bustling market.

Navigating Futures Trading Hours with ACY Securities

When diving into the diverse world of futures trading, it is essential to be aware of varying trading hours across different markets. Different futures assets have distinct opening and closing timings, and some even incorporate mid-day breaks that differ for each asset.

Gold Futures Timing:

- Trading from Sunday to Friday: 5:00 pm – 4:15 pm CT.

- Includes a 45-minute break at 4:15 pm on the CME Globex exchange.

Bitcoin Futures Timing:

- Span from 5:00 p.m. to 4:00 p.m. CT, Sunday to Friday on the CME Globex exchange.

Checking Specifications and Trading Hours for a Futures Contract on MT4

1. Launch MT4: Start your MetaTrader 4 platform.

2. Market Watch Window: Ensure the 'Market Watch' window is visible on the left side of your screen. If it is not, you can open it by clicking on View in the menu bar and selecting Market Watch or pressing Ctrl+M.

3. Locate the Future Contract: Scroll through the 'Market Watch' list to find the futures contract you are interested in.

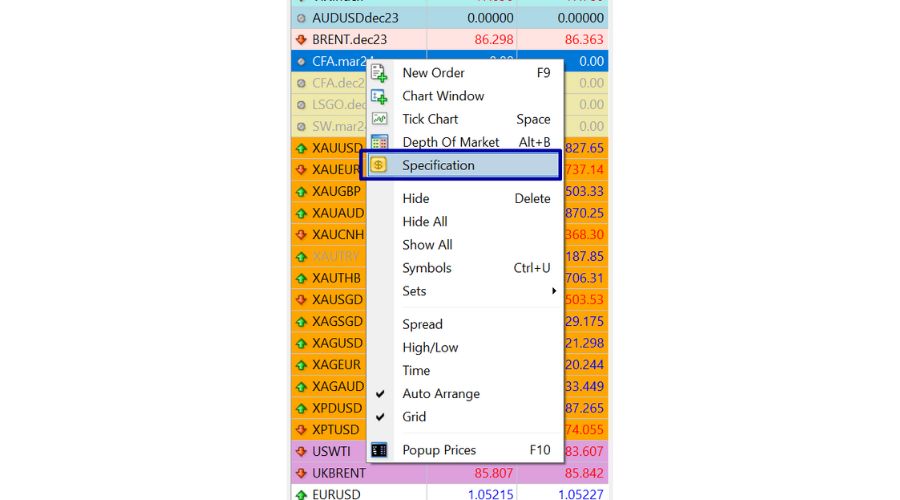

4. Right-Click on the Contract: Once you have found the futures contract, right-click on its name.

5. Select 'Specification': From the drop-down menu that appears, choose the 'Specification' option.

6. Review Details: A new window will pop up, displaying various details about the futures contract. This includes:

- Trading Hours: This section provides information about when the market opens and closes.

- Contract Size: The standard size of the contract.

- Tick Value: The smallest price change possible and its monetary value.

- Margin Requirements: The amount needed to open a position.

- Expiration Date: The date when the futures contract will expire.

And many other specifications related to the contract.

7. Close the Window: After reviewing the necessary details, close the 'Specification' window.

8. Plan Your Trade: With the knowledge of trading hours and other specifications, you can plan your trading strategy more effectively.

Trading Futures CFDs with ACY Securities

How does one approach futures CFD trading at ACY Securities? The answer often varies among traders.

While some of ACY' Securities’ clientele lean towards fundamental analysis, others are inclined to rely on technical methods. The seasoned traders with ACY Securities, however, typically employ a blend of both.

Technical analysis centres on analysing price action. Regardless of the asset class being traded, an adept technical analyst at ACY Securities scrutinises price trajectories. As an illustration, they assess prevailing trends to predict forthcoming movements.

ACY Securities’ trading platform equips traders with technical tools such as price tracing, support and resistance level annotation, identification of supply and demand zones, and trendline plotting. Additionally, it provides widely utilised technical indicators like simple moving averages and the relative strength index.

At ACY Securities, fundamental analysis is also embraced to assess financial, economic, and geopolitical factors to determine market direction.

Discover the Best CFD Trading Strategies for Beginners

ACY Securities aims to simplify this for you, presenting three pivotal strategies tailored for CFD trading.

Trend-Following with ACY Securities

A popular strategy among CFD traders is trend following, which involves analysing market trends and identifying momentum in a specific direction. Once a trend is identified, traders initiate positions that align with this trend.

To effectively utilise trend-following, ACY Securities recommends utilising technical analysis tools such as moving averages, trend lines, and chart configurations. These assist traders in identifying key support and resistance levels where price reversals or breakouts may occur.

Patience and restraint are key when using the trend-following approach, as impulsive decisions can lead to losses. Wait for clear signals before launching a position and avoid acting on emotions or hearsay.

Range Trading at ACY Securities

Range trading is a popular strategy among CFD traders, which involves identifying crucial support and resistance levels where price fluctuations typically occur. By pinpointing these zones, traders can initiate long positions near support levels and short positions at resistance levels.

To make the most of this strategy, ACY Securities recommends using technical indicators such as Bollinger Bands or Relative Strength Index (RSI). These tools help traders identify when assets are overextended within a specific range.

Range trading is ideal for times of market consolidation or low volatility. However, traders must remain vigilant of any news or other catalysts that could push prices beyond the established range.

News-Centric Trading with ACY Securities

For those inclined towards global events, news trading emerges as a viable strategy. By keeping abreast of economic news bulletins and gauging market responses, this approach capitalises on the significant price motions instigated by such events.

Key events like interest rate announcements, GDP (Gross Domestic Product) data, or employment figures can precipitate considerable market shifts. With ACY Securities, traders are equipped to make informed decisions by understanding the implications of these events on various assets. However, a word of caution: the volatile nature of markets during significant news events necessitates a comprehensive risk management blueprint. ACY Securities emphasises the importance of measured risk-taking and discourages excessive leverage.

Maximise Your Trading Potential with Demonstrated Technical Analysis Strategies for Futures and CFDs

The world of trading presents a vast array of strategies and techniques, each tailored to fit varying trading temperaments and objectives.

A Glimpse into the Premier Trading Strategies:

- Day Trading: Focusing on quick, intraday trades to capitalise on small price fluctuations.

- Swing Trading: Aiming to capture gains in a stock (or any financial instrument) over a span of a few days to several weeks.

- Fibonacci Trading: Uses mathematical ratios derived from the Fibonacci sequence. This technique is ideal for traders who focus on significant price retracements and extensions in the market.

- Positional Trading: Maintaining positions over a more extended period, from weeks to months, based on expected long-term movements.

- Algorithmic Trading: Leveraging algorithms to make trading decisions in real-time.

- Seasonal Trading: Aligning trades with predictable patterns observed during specific times or seasons.

Delve deeper with us as we unravel the intricacies of each strategy, offering you a roadmap to navigate the dynamic terrain of futures and CFDs trading.

1. Day Trading Strategies with ACY Securities

Day trading involves buying and selling securities within a single trading day. At ACY Securities, day traders rarely hold positions overnight. Charts used in day trading typically show four-hour, one-hour, thirty-minute, and fifteen-minute timeframes. While day trading can bring gains, it requires significant training and can be risky for inexperienced traders.

Crafting Your Day Trading Strategy with ACY Securities

As challenging as day trading might seem, with ACY Securities, you can harness effective day trading methodologies and refine your strategy over time. Whether you are looking at stocks or forex, several key elements form the backbone of a day trading strategy:

- Choosing Your Market: While many have a penchant for stocks, day trading can be effectively executed across any prominent market. As quick trades for minimal price variations are the hallmark of day traders, markets offering minimal spreads and low commissions are pivotal.

- Selecting Your Timeframe: Various day trading timeframes are at your disposal. Choose one that aligns with your schedule and offers familiarity with market movements.

- Your Trading Tools: ACY Securities offers a plethora of trading indicators. Focus on a select few to truly understand their mechanics.

- Risk Management: Deciding how much you are willing to risk per trade is paramount. Ensure you are not overexposing yourself, especially given that a series of losses can occur at any stage in your trading journey.

A Glimpse into a Day Trading Example

A day trading strategy chart is crucial for documenting the price movements of a currency pair over two days. Moving averages are invaluable for day traders to differentiate between varying market scenarios and establish specific trading criteria.

- Criteria 1: If the price is above the moving average, prioritise long or buy trades.

Criteria 2: If the price is below the moving average, lean towards short or sell trades.

These rules can provide traders with a clearer decision-making framework. Yet, this is just a foundation. Traders must also define entry and exit conditions, manage risks, and maintain an overarching portfolio risk strategy.

As we move forward, we will delve deeper into detailed trading strategies for different assets. But first, let us shift our focus to our next trading strategy at ACY Securities - swing trading.

2. Swing Trading Strategies at ACY Securities

Swing trading involves buying and selling securities with the intent to hold them for several days or weeks. ACY Securities’ swing traders often use daily charts, aligning trades with the market's overall trend. While some base their decisions purely on technical chart analysis, many incorporate fundamental insights or multiple timeframes for a comprehensive view.

Swing Trading Strategy Example

Swing trading at ACY Securities often involves trading indicators like the Stochastic Oscillator, MACD (Moving Average Convergence Divergence), or the Relative Strength Index (RSI) to hint at price direction.

A typical swing trading chart at ACY Securities has:

- Daily Chart Bars/Candles: Each represents a full trading day.

- Trend Filter: Often a fifty-period moving average.

- Oversold & Overbought Indicator: Such as the Stochastic Oscillator.

Basic strategy rules might include:

- Criteria 1: If price is above the moving average, go long; if below, go short.

- Criteria 2: Long trades for Stochastic Oscillator below 20 (oversold) and short trades for above 80 (overbought).

Effective swing trading at ACY Securities is about combining these tools and rules, ensuring trades align with market trends and optimising entry timings. Proper preparation and understanding of indicators ensure trading profitability.

3. Fibonacci Trading Strategies at ACY Securities

Fibonacci trading at ACY Securities is a specialised technique grounded in mathematical ratios derived from the Fibonacci sequence. This method primarily serves traders who align their strategies with significant price retracements and extensions in the market.

Key Strategy Components at ACY Securities:

- Timeframes: Typically spans daily to monthly charts.

- Primary Tool: Fibonacci retracement and extension levels.

- Supplementary Indicator: Often, the MACD Oscillator is employed to gauge momentum.

Strategy Guidelines:

Criteria 1: Consider long positions when price retraces to a significant Fibonacci level and shows signs of resuming the previous trend; consider short positions when the opposite occurs.

Criteria 2: Use the MACD Oscillator to confirm momentum: bullish when above 0 and bearish when below 0.

Traders using Fibonacci strategies aim to capitalise on significant price levels and trends in the market, optimising potential outcomes. Position traders seek prolonged trending scenarios to optimise trading outcomes.

Insights from the US Dollar Index’s Daily Chart:

The oscillator indicator highlighted the overbought zone, signalling potential exhaustion of bulls near the $104.87 level. This presented an opportune moment to employ the Fibonacci indicator.

Here's what it revealed:

- The US dollar index declined, achieving the 38.2% Fibonacci retracement at $102.

- Further descent led to a 50% retracement at $101.23.

If equipped with a sound understanding of the Fibonacci trading system, traders had the opportunity to both:

- Capitalise on sell positions as the index declined.

- Buy as the index found support at these Fibonacci levels.

4. Understanding Positional Trading at ACY Securities

Positional trading, as advocated by ACY Securities, is a trading methodology where securities are acquired with an intent to retain them for extended periods - spanning several weeks to months.

While utilizing this approach, traders at ACY Securities integrate a blend of charts (daily, weekly, and monthly) and fundamental analysis. The essence of this strategy is more about active trading. The focus isn't the short-term market fluctuations but holding onto trades for a more extended timeframe.

At ACY Securities, the emphasis for positional traders is on the potential reward versus the risk associated with a trade. Given their approach to retaining trades for an extended duration, they often encounter a series of minimal loss-making trades before realizing significant gain from a particular trade. This tactic allows traders to commit a smaller portion of their capital to each trade, maximizing the number of trades and diversifying their holdings.

A Glimpse into ACY's Positional Trading Strategy:

Most positional trading strategies at ACY Securities encompass:

- Chart Timeframes: Predominantly daily charts, extending to weekly or monthly when necessary.

- Trend Identification: In our sample chart, we utilise a one hundred period moving average as our trend determinant, depicted as the orange undulating line.

- Momentum Indicator: Our chosen example integrates a MACD Oscillator to discern momentum shifts, situated at the chart's base.

Using the aforementioned components, a trader at ACY Securities can establish a set of strategic guidelines.

For instance:

Criteria 1: Opt for long (or buy) trades when the price trends above the moving average. Conversely, when prices dip below the moving average, focus on short (or sell) trades.

Criteria 2: Initiate a long trade only if the MACD Oscillator value surpasses 0, indicating bullish momentum. Conversely, opt for a short trade if the MACD Oscillator dips below 0, signalling bearish momentum.

In the provided chart, you'll notice that when both rules align – price sustaining above the hundred-point moving average and MACD Oscillator exceeding 0 – it denotes a robust trending phase. However, it's pivotal to ascertain the opportune trade execution moment. Despite adept execution, there's always the potential for momentum to reverse, leading to trade setbacks.

ACY Securities supports these prolonged trend scenarios, equipping traders to pinpoint and harness such market conditions.

5. Exploring Algorithmic Trading Strategies

Algorithmic trading is an advanced trading approach where computer programs are utilised to automate trade entries and exits. Traders, equipped with ACY Securities' platforms, design and encode specific rules and parameters that guide these automated systems.

Often referred to as algo trading, automated trading, black-box trading, or simply robo-trading, this method offers a precision-driven approach to the markets.

A predominant characteristic of most algorithmic strategies employed at ACY Securities is their propensity to leverage minute price fluctuations, executing trades at high frequencies.

Many ACY Securities traders combine the efficiency of algorithmic systems with their manual trading techniques:

- Market algorithms, or "investment algorithms," act as scanners, spotlighting potential trading opportunities.

- This data-driven approach allows traders to apply their proprietary insights effectively.

Directly from MT4/MT5 platforms, traders can purchase expert advisors. However:

- Due diligence is essential. It's vital to research and backtest these advisors.

- Ensure the results align with the seller's claims before making any venture.

6. Seasonal Trading

Defining Seasonality: Seasonal trading with ACY Securities capitalises on recurrent yearly trends. Many markets display predictable patterns due to factors like weather shifts, scheduled economic announcements, and corporate earnings reports.

Strategic Value: While not a definitive buy/sell system, seasonality gives ACY Securities traders a broader context to shape their trading strategies. The inherent patterns offer a statistical advantage in selecting trades.

Key Seasonal Trading Strategies at ACY Securities

- Sell in May Strategy: A time-honoured adage advises to "sell in May and go away." It alludes to the stock market's typical dip during summer months, between May and October. As per a 2013 Financial Analyst Journal study, from 1998 to 2012, stocks showed higher returns between November and April than between May and October. However, this doesn't imply that summers were categorically unfavourable.

- Santa Claus Rally: Another recognised seasonal strategy among traders is the "Santa Claus Rally." It observes the stock market's propensity to surge during the year's last five trading days and the subsequent two days of the new year.

Conclusion

The world of futures trading offers a labyrinth of opportunities, challenges, and intricacies. ACY Securities serves as a compass, navigating traders through the highs and lows of this vibrant market. With the backing of state-of-the-art technology, deep market insights, and a suite of tailored strategies, traders are not just equipped to traverse but also to excel in the landscape of the future.

Whether you are just starting or looking to enhance your trading techniques, ACY Securities stands ready to support your journey. Ready to unlock the full potential of futures trading? Get started with ACY Securities today or dive deeper into futures trading with our expert guides. Explore ACY Securities' educational content and expert-led webinars to help traders navigate the world of CFDs and the forex market. Learn more about Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

Try These Next