The Importance of the US Dollar in the Forex Market

2023-08-30 15:24:32

The wide-reaching domain of the forex market holds a prominent position as the main hub for trading currencies, where each day sees transactions surpassing an impressive $7.5 trillion. Unlike regular markets tied to physical locations, the forex market operates digitally, fuelled by a complex network of banks, companies, and individual traders from around the world. Playing a significant role in this global network, ACY Securities equips traders with advanced platforms, tools, and insights to navigate this intricate financial landscape effectively.

To make the forex market easier to understand, think of it like a big stage where currencies play the main roles, trying to get attention. For example, consider the EUR/USD pair – it is like the euro and the US dollar being in the spotlight together. With the tools from ACY Securities, traders keep a close eye on the markets and guess what will happen next, figuring out which currency will perform better. If they anticipate a strong performance from the euro, they might allocate funds with the expectation of gaining from its potential appreciation.

But what really makes these money stories happen? Well, it all boils down to the demand of a specific currency. When there is more demand, the currency becomes more valuable. If there is less demand, its value goes down. In this big theatre of finance, currencies are grouped in different themes: there are Major pairs like EUR/USD, where the US dollar is always in the picture; Minor pairs like EUR/GBP, which show important currencies without the dollar; and Exotic pairs like GBP/ZAR, where a strong currency teams up with one from a growing market.

The Crucial Role of Currency Rates in Forex Trading

Foundational Principle: Forex trading is fundamentally linked to fluctuations in currency values relative to each other. Central to this dynamic is the exchange rate, with an example being £1 corresponding to $1.24.

Fluidity of Rates:

- Exchange rates are not static; they sway under the influence of diverse economic variables.

- Traders harness their analytical skills to chart this shifting landscape, aiming for advantageous outcomes.

Influence of Monetary Policy:

- Championed by a nation's central bank, monetary policy encompasses directives on money supply and interest rates.

- Elevated interest rates can attract foreign investments due to higher returns, which makes the local currency stronger.

- Conversely, negative signals like rampant inflation can erode trader confidence, leading to a decline in currency value.

Additional Determinants:

- Political Stability: A stable political environment can enhance investor trust and currency strength.

- Economic Health: A robust economy attracts investments, benefiting the national currency.

- Speculation by Traders: Their actions, based on future predictions, play a role in current currency valuation.

In essence, multiple factors, ranging from central bank decisions to geopolitical stability, collectively influence the fluid valuations of currencies in the multifaceted arena of forex trading.

The Evolution of the US Dollar: A Historical Perspective

The US dollar, commonly known as the 'greenback', has a rich history deeply entwined with the story of America's economy and society. Prior to the dollar's inception, regions within the Americas predominantly utilized the Spanish dollar, crafted from silver. During the time of the American Revolution, though, the young United States started using its own version of paper money, calling it 'Continentals'.

These were initially pegged to the value of the Spanish dollar, though they unfortunately depreciated in value over subsequent years.

Establishment of the US Dollar: Foundations and The Civil War

Recognizing the need for monetary stability, the US government in 1785 initiated the formulation of what would become the US dollar, culminating in its formal establishment via the Coinage Act of 1792. A significant milestone occurred during the Civil War when green-tinted dollar bills were disseminated to fund the war, earning them the nickname 'greenback'.

The true unification of the nation's monetary system, however, was realized with the advent of The National Banking Act in 1863, which heralded the US dollar as the singular accepted currency.

Precious Metals and the Dollar: Gold and Silver Standards

Historically, the US dollar's value was underpinned by both gold and silver. This changed in 1900 with the Gold Standard Act, which enshrined gold as the exclusive standard.

Yet, as the clouds of the Great Depression loomed in the 1930s, and with World War II on the horizon, President Roosevelt curtailed the conversion of gold assets into paper money.

Bretton Woods and Global Dominance

A defining moment in global financial history occurred in 1944 with the signing of the Bretton Woods Agreement. This landmark accord not only dissolved the Gold Standard on an international scale but also positioned the US dollar as the paramount reserve currency.

Concurrently, pivotal financial institutions, namely the International Monetary Fund (IMF) and the World Bank, were birthed. In response, the US decided on a fixed gold conversion rate, instilling the dollar with a value equivalent to gold.

The Nixon Shock: Transition to Fiat Currency

However, the landscape shifted dramatically in 1971 when President Nixon unilaterally ceased converting dollars to gold, an event termed the 'Nixon Shock'. This pivotal decision transitioned the US dollar to a fiat currency, anchoring its value not to tangible assets but to the collective faith in the robustness and integrity of the US government.

Since that watershed moment, the US dollar has retained its position as the premier global reserve currency.

The US Dollar as a Key Reserve Currency

A currency held in significant volumes by governments and financial establishments as a component of their foreign exchange reserves. It serves as the primary currency in global commerce and finance. Observers keenly track its performance given its global importance.

Reasons for the US Dollar's Dominance:

- Economic Strength: The US boasts a robust and stable economy, which naturally boosts confidence in its currency.

- Financial Markets: The US has expansive financial markets that are essential to global financial operations.

- Trust: Institutions based in the US enjoy a high degree of global trust.

- Historical Agreements: The Bretton Woods Agreement was pivotal in tying major global currencies like the Japanese yen, British pound, and German mark to the US dollar.

The "Petrodollar" Influence:

- The term refers to the US dollar's role in oil trade.

- Oil, a globally critical commodity, is predominantly priced and transacted in US dollars.

- Nations engaged in oil commerce thus maintain significant dollar reserves.

- This widespread use in oil trade has further solidified the US dollar's international prominence.

The US Dollar as International Cash

The US dollar is a popular choice for international transactions because it is the world's reserve currency. People often save money in dollars, especially in places with high inflation or unstable local currencies.

Travelers also prefer using dollars in countries with vibrant tourism or unpredictable local money, as merchants are happy to accept them. It is like a universally accepted and reliable currency for people worldwide.

Interestingly, some countries have even adopted the US dollar as their official currency, a process called dollarisation.

Eleven countries, including Ecuador, El Salvador, and Zimbabwe, have made the dollar legal tender. Others peg their currency to the dollar at a fixed exchange rate, particularly oil-producing Arab nations like Saudi Arabia and Oman. This is because the dollar is strongly associated with international oil trade.

Role of the US Dollar in International Financial Transactions

The US dollar is widely accepted worldwide, making it a key part of cross-border transactions. It simplifies international trade by giving everyone a common currency to use. Important items like oil, gold, and grain are often bought and sold using dollars for convenience. It is like a language that everyone understands, making global trade easier.

Furthermore, the dollar is the primary currency held in foreign currency reserves by central banks, accounting for about 54% of global reserves, according to the International Monetary Fund. Holding dollars provides these institutions with liquidity and stability, ensuring the smooth functioning of the global financial system.

The dollar plays a vital role in the banking sector and global finance. Around 60% of international deposits and loans are in dollars, according to the Federal Reserve. Important institutions like the World Bank and IMF provide loans in dollars. It is also common to see foreign countries and companies issuing bonds in dollars. It is like the currency of choice for big financial players.

The Significance of the US Dollar in the Forex Market

The value of the US dollar in global finance and trade unequivocally marks its crucial position within the foreign exchange (forex) market. Taking centre stage, it encompasses 88% of all transactions, equivalent to $6.6 trillion of the daily $7.5 trillion trading volume.

The forex arena is characterized by its emphasis on major currency pairs, many of which prominently feature the US dollar. These pairs include key currencies like the euro, Japanese yen, British pound, Australian dollar, New Zealand dollar, Swiss franc, and Canadian dollar.

It is vital to mention that changes in the US's economic and monetary policies can have a strong impact on these pairs of currencies, affecting the entire forex market. Economic milestones, such as GDP (Gross Domestic Product) fluctuations or US interest rate decisions, can even ripple through to seemingly distant pairs, exemplified by GBP/JPY.

The Journey of the US Dollar in the Forex Market

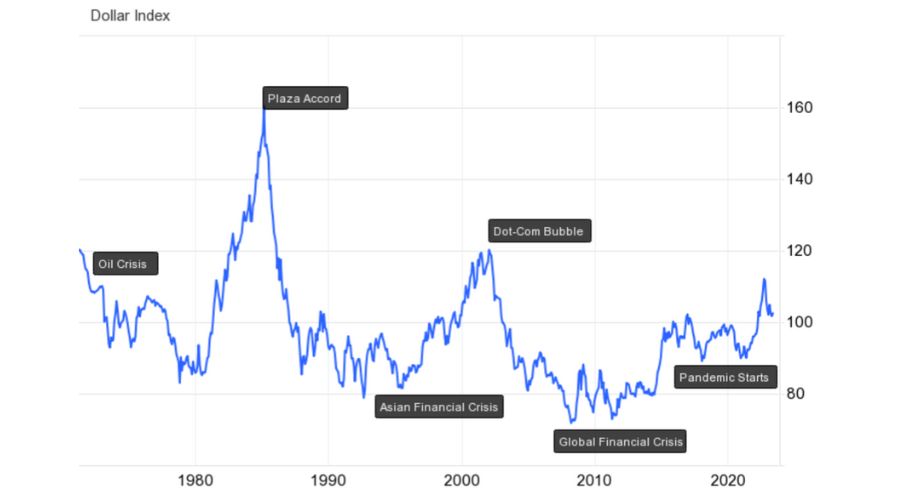

Over the years, the path of the US dollar in the forex world has been shaped by a variety of worldwide events. The provided DXY chart below gives us a look into this journey. The 1970s, marked by OPEC's oil embargo, brought about high inflation that made the dollar weaker. However, the 1980s marked its comeback, driven by Reagan's strong interest rate decisions.

In 1985, a group of powerful economies came together and made the Plaza Accord, aiming to deal with the strong position of the dollar, which led to economic difficulties. On the other hand, during the Asian Financial Crisis in the late 1990s, the dollar became strong as investors turned to it for safety.

The financial crisis in 2008 initially made the dollar lose its appeal. However, it quickly recovered, but then had to face the challenges brought by the COVID-19 pandemic more recently. The actions taken by the Federal Reserve to change interest rates also played a role in affecting its value.

Understanding the Connection Between International Lending and the US Dollar

The way international lending happens in US dollars creates a constant need for the currency. Countries that owe money find themselves linked to repaying in dollars, which makes the demand for it strong. However, when these loans are changed into other currencies, it can put a lot of dollars into the forex market, making it less powerful.

The Federal Reserve's plans for money have a big impact on this complex situation. When they lower interest rates, it can encourage borrowing, which makes people want more dollars. But if they raise rates, it might lessen this eagerness and make the dollar less attractive. These changes in rates between the US and other countries often guide the direction of currency pairs that involve the dollar.

Imagining a Future of Forex Without the Dominance of the Dollar

Throughout history, there have been times when people wondered if the dollar's importance might decrease, especially during crises. Nowadays, discussions are getting stronger about using the dollar less, with countries like China and Brazil leading the way.

If the dollar were to lose its dominance, it would cause significant turmoil in the forex market. The current sense of stability, based on trust and easy trading, is what holds the world economy together. If this changed, other currencies like the euro or the renminbi might try to become the new leaders, leading to a different economic time.

A potential positive side to this could be that it might become easier for countries to pay back international loans not in dollars, which could help emerging markets and make managing US debt smoother.

Conclusion

At ACY Securities, we offer valuable educational content and expert-led webinars to help traders navigate the world of CFDs and the forex market. Learn more about Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

Try These Next