Revealing What You Need to Know in Trading Fed Rate Decisions

2024-09-05 17:13:15

The Federal Reserve funds rate is a critical benchmark in the global financial landscape. It represents the interest rate at which commercial banks lend reserve balances to each other overnight. This rate is instrumental in ensuring that banks meet stringent reserve requirements set by the Federal Reserve Bank.

More importantly, it serves as a pivotal tool for the Federal Reserve to regulate the nation’s money supply, influencing economic growth, price stability, and overall market dynamics. As the foundation for various interest rates—including those on savings accounts, loans, and credit cards—any adjustment to the Federal Reserve’s rate reverberates across the financial markets, especially the forex markets.

Changes in interest rates affect currency values, leading to fluctuations in the forex markets, thereby emphasising the interconnectedness of monetary policy decisions and currency trading dynamics.

In this guide, we will delve deeper into how these rate decisions influence currency pairs, trading strategies, and the broader forex market.

Understanding the Federal Reserve's Role in Shaping Economic Policy

The United States Federal Reserve System, often referred to simply as “The Fed,” is the central banking authority of the United States. It plays a crucial role in maintaining economic stability by pursuing a dual mandate: promoting maximum employment and ensuring stable prices. Major central banks, including the Fed, significantly influence market reactions through their economic policies and announcements.

The Federal Open Market Committee (FOMC), the Fed’s primary policy-making body, comprises 12 officials and convenes eight times a year. During these meetings, the FOMC assesses the state of the U.S. economy and implements monetary policy decisions based on the prevailing economic outlook.

Anticipating the Fed Rate Decision

The Federal Funds Rate, set by the FOMC, is closely monitored by forex traders due to its significant impact on global currency markets. As of the most recent update, the effective Federal Funds Rate is approximately 5.33%, within the Federal Reserve’s target range of 5.25%-5.50%.

- Fed buys Treasury bonds: Injects liquidity into the banking system, lowers the Federal Funds Rate, making loans cheaper.

- Fed sells Treasury bonds: Reduces liquidity, raises the Federal Funds Rate, making loans more expensive.

The Fed uses open market operations to keep the effective rate within this target range by buying or selling U.S. Treasury bonds, which influences the money supply. When the Fed raises rates, the U.S. dollar typically strengthens, attracting foreign traders. Conversely, a rate cut can weaken the dollar.

Tools like the CME FedWatch Tool, which currently indicates a 49% chance of a rate cut at the next FOMC meeting, help traders anticipate these changes and adapt their strategies. By analysing interest rate expectations, traders can better understand market dynamics and adjust their forex trading strategies accordingly.

Why the Federal Funds Rate Matters to Forex Traders

For forex traders, the Federal Funds Rate is a critical indicator because interest rates matter significantly in influencing the value of the U.S. dollar against other currencies. Even a small change in this rate can cause significant fluctuations in currency pairs, creating both opportunities and risks for traders.

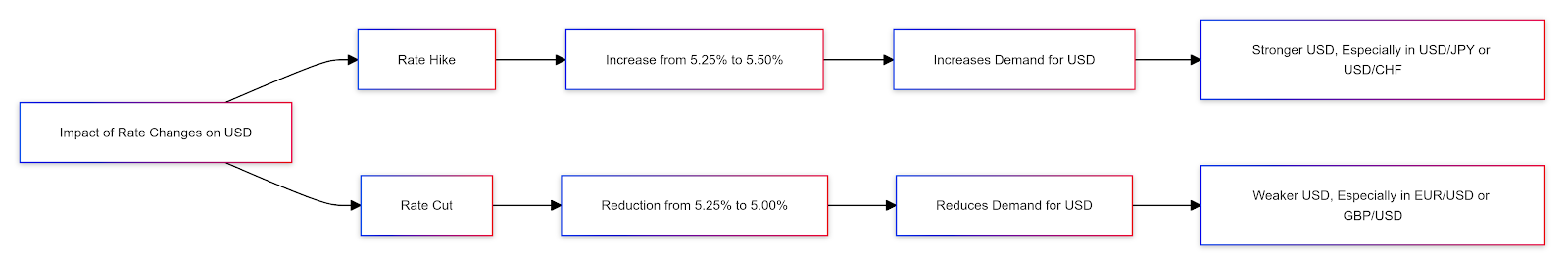

When the Federal Reserve increases the interest rate, it strengthens the U.S. dollar. For example, if the Fed raises the rate from 5.25% to 5.50%, the higher returns on U.S. assets attract foreign venture:

- Rate hike (e.g., 5.25% to 5.50%): Increases demand for the U.S. dollar, often leading to a stronger USD, especially in pairs like USD/JPY or USD/CHF.

Conversely, if the Fed cuts the interest rate, the U.S. dollar typically weakens. Lower rates, such as a reduction from 5.25% to 5.00%, make U.S. ventures less attractive, decreasing demand for the dollar:

- Rate cut (e.g., 5.25% to 5.00%): Reduces demand for the U.S. dollar, potentially weakening it in pairs like EUR/USD or GBP/USD.

Fed Rate Announcements: Key Insights for Forex Traders

The Federal Reserve’s rate announcements are among the most anticipated and impactful events for traders and traders worldwide.

Market sentiment plays a crucial role in shaping trader reactions to the Federal Reserve's rate announcements. Analysing market sentiment can provide insights into potential shifts in trader behaviour and help in making informed trading strategies in response to economic indicators and interest rate changes.

These decisions not only shape the U.S. economy but also have a ripple effect across the global financial landscape, causing immediate and significant movements in various markets.

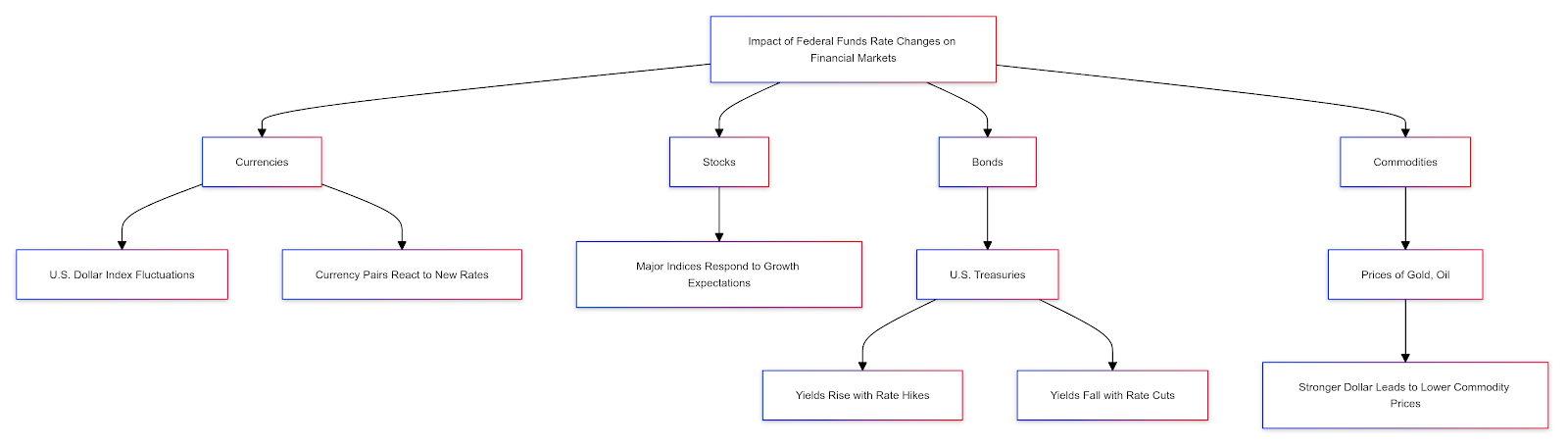

When the Fed announces a change in the Federal Funds Rate, the reaction in the financial markets is swift and widespread. This includes:

- Currencies: The U.S. Dollar Index, along with currency pairs like EUR/USD, often experiences sharp fluctuations as traders react to the new interest rate environment.

- Stocks: Major U.S. equity indices, such as the S&P 500 and Nasdaq, can rise or fall depending on how the rate decision influences economic growth expectations.

- Bonds: U.S. Treasuries are particularly sensitive to rate changes, with yields typically rising when the Fed hikes rates and falling when the Fed cuts them.

- Commodities: The prices of commodities like gold and oil can also be affected, as a stronger dollar usually leads to lower commodity prices and vice versa.

Among these, the forex market is particularly reactive. For instance, if the Fed raises rates, the U.S. dollar often appreciates, leading to a decline in pairs like EUR/USD or GBP/USD. Conversely, a rate cut typically results in a weaker dollar, providing opportunities for traders to gain from rising currency pairs.

For a deeper understanding of how the federal funds rate impacts forex trading, watch this video, where we break down its influence on the U.S. dollar and how you can adapt your trading strategies based on rate changes.

Understanding Interest Rates: A Pillar of Financial Markets

Interest rates represent the percentage charged on a principal amount that is lent, deposited, or borrowed over a specified period. The total interest accrued depends on several factors: the principal amount, the interest rate, the compounding frequency, and the duration of the loan or deposit. These rates are a cornerstone of financial markets, influencing everything from consumer spending to trading strategies.

Interest rate movements have a profound impact on both stock and bond markets, shaping market dynamics in various ways. For stock traders, higher interest rates lead to reduced consumer spending and lower business trades. This can negatively impact corporate earnings and, as a result, drive share prices down. Conversely, lower interest rates encourage consumer spending and business expansion, thereby boosting corporate gains and lifting stock valuations.

For bond traders, the implications of interest rate changes are different. When rates rise:

- New bonds are issued with higher returns.

- Existing bonds lose value because their lower interest rates are less attractive compared to new issues.

On the other side, when interest rates fall:

- New bonds offer lower yields.

- Existing bonds with higher rates increase in value, often trading at a premium.

Impact on Stocks: Navigating Interest Rate Fluctuations

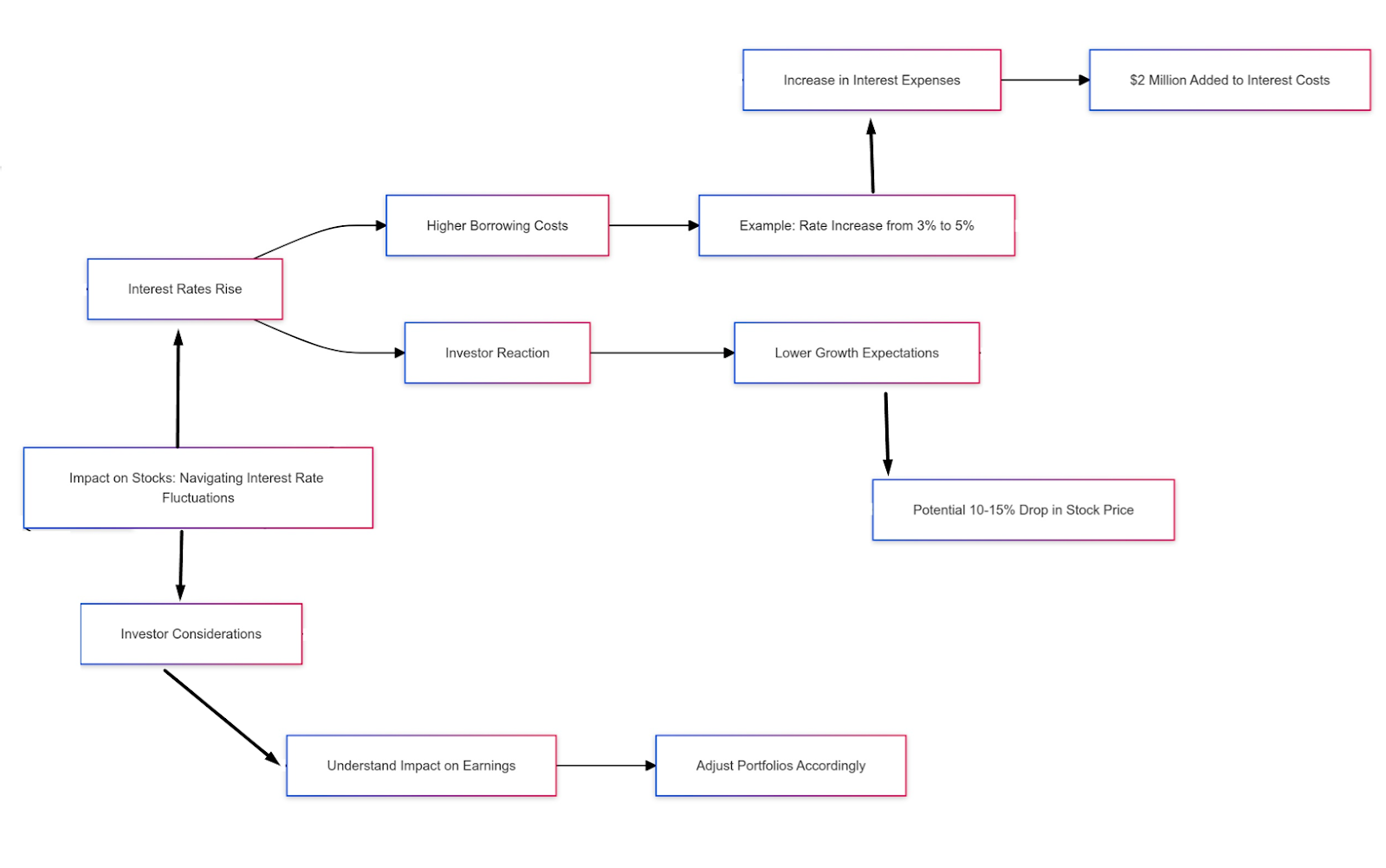

Interest rate changes significantly influence stock prices. When rates rise, borrowing becomes more expensive for companies, increasing their costs of raising capital through bonds. For example, if a company that currently borrows at 3% sees rates increase to 5%, its interest expenses would rise, reducing profitability.

Consider a technology firm that relies on debt to fund its R&D. If the interest rate jumps from 3% to 5%, the company might see its annual interest costs increase from $3 million to $5 million on a $100 million loan. This $2 million increase in expenses can lead trades to lower their growth expectations:

- Higher borrowing costs: Increase from 3% to 5%, adding $2 million in interest expenses.

- Trader reaction: Lower growth expectations, potentially leading to a 10-15% drop in stock price.

For traders, understanding how these fluctuations impact company earnings is key to making informed decisions and adjusting portfolios accordingly, while carefully managing the associated risks when interest rates are on the rise.

Impact on Bonds: The Inverse Relationship with Interest Rates

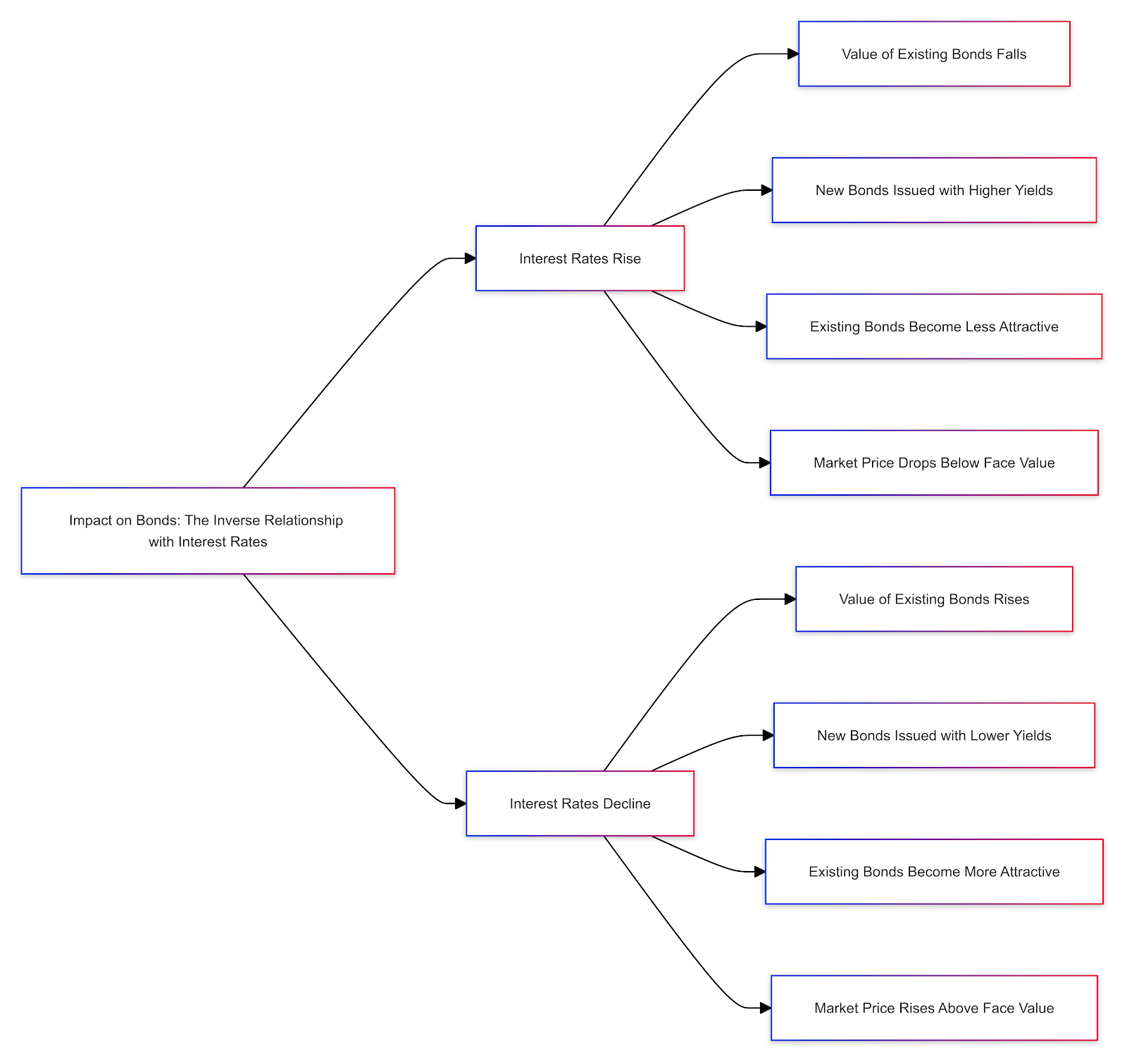

Interest rates and bond prices share an inverse relationship, which is fundamental for bond traders to understand. When interest rates rise, the value of existing bonds typically falls, and when interest rates decline, the value of existing bonds tends to rise.

To illustrate, imagine a bond with a $1,000 face value that offers a fixed 5% interest rate, yielding $50 annually. If current interest rates climb to 10%:

- New bonds are issued with a 10% yield, paying $100 annually.

- Existing bonds with a 5% yield become less attractive, causing their market price to drop below $1,000 to compensate for the lower interest payment.

Conversely, if interest rates fall to 1%:

- New bonds offer only $10 annually.

- Existing bonds with a 5% yield become highly desirable, driving their market price above $1,000 as traders seek better returns.

This inverse relationship is crucial for managing a bond portfolio, as shifts in interest rates can significantly affect the value of holdings.

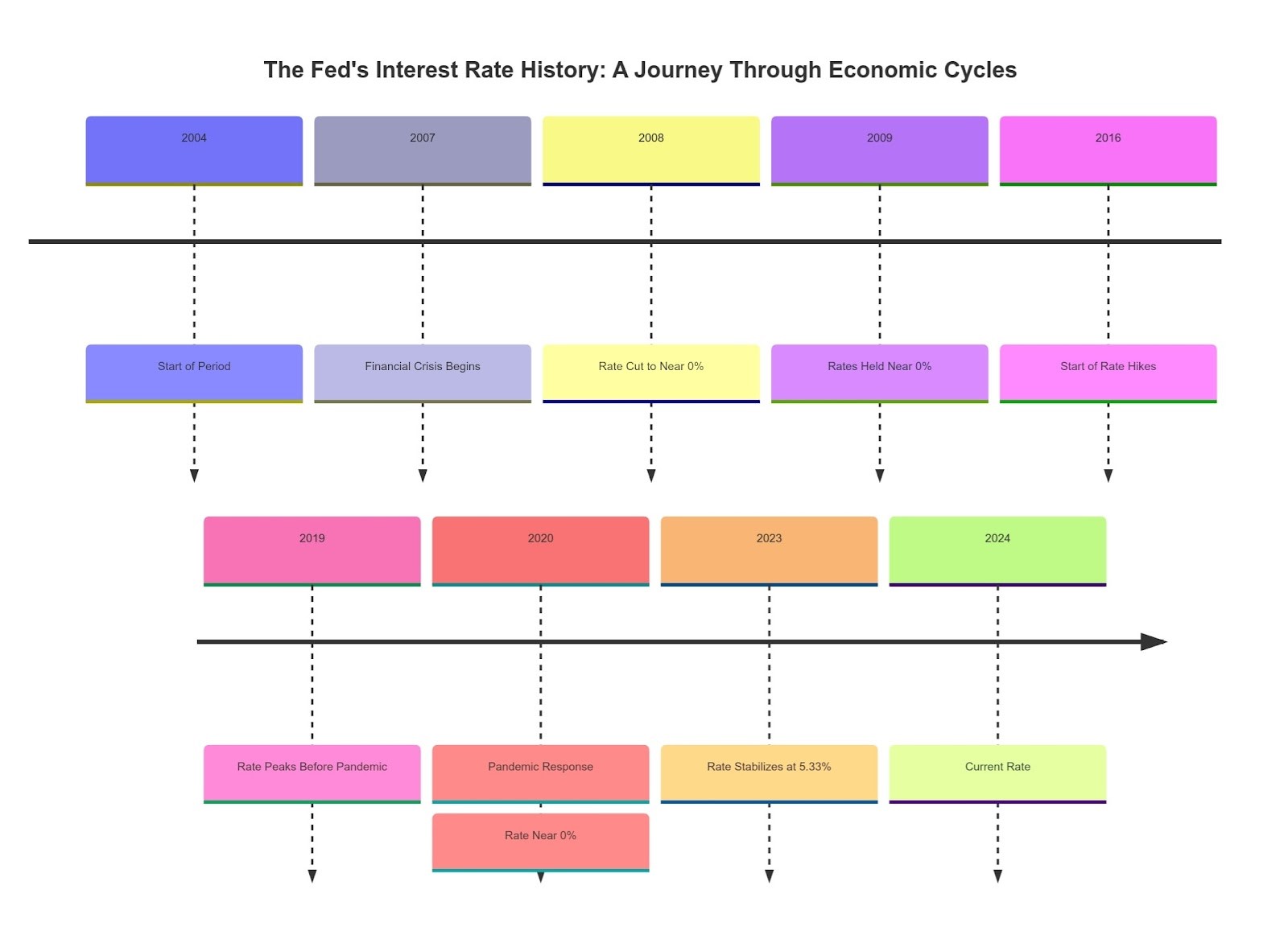

The Fed's Interest Rate History: A Journey Through Economic Cycles

The Effective Federal Funds Rate has been a pivotal tool in the U.S. Federal Reserve's efforts to manage economic stability, reflecting the broader economic cycles over decades. As of August 2024, the rate held steady at 5.33%, a stark contrast to its historical extremes—averaging 4.61% since 1954, with an all-time high of 22.36% in July 1981 and a record low of 0.04% in December 2011.

The period from 2004 to 2024 captures some of the most significant economic events that influenced Fed policy:

- 2007-2009 Financial Crisis: In the wake of the 2008 financial meltdown, the Fed slashed the federal funds rate from 5% to nearly 0%, a dramatic move to stimulate the economy during a severe downturn.

- 2016-2019 Rate Hikes: To counter rising inflation and support economic growth, the Fed incrementally raised rates multiple times, pushing the rate from near-zero levels back up, as reflected by the upward trend in the chart.

- 2020-2023 Pandemic Response: The COVID-19 pandemic triggered another aggressive policy shift. The Fed kept the rate near 0% to prevent a recession, but as the economy rebounded, the rate gradually increased, stabilising around 5.33% by late 2023.

This historical journey through the Fed's interest rate decisions highlights the central bank's role in navigating the U.S. economy through both crises and recoveries, using rate adjustments as a key lever to influence economic outcomes.

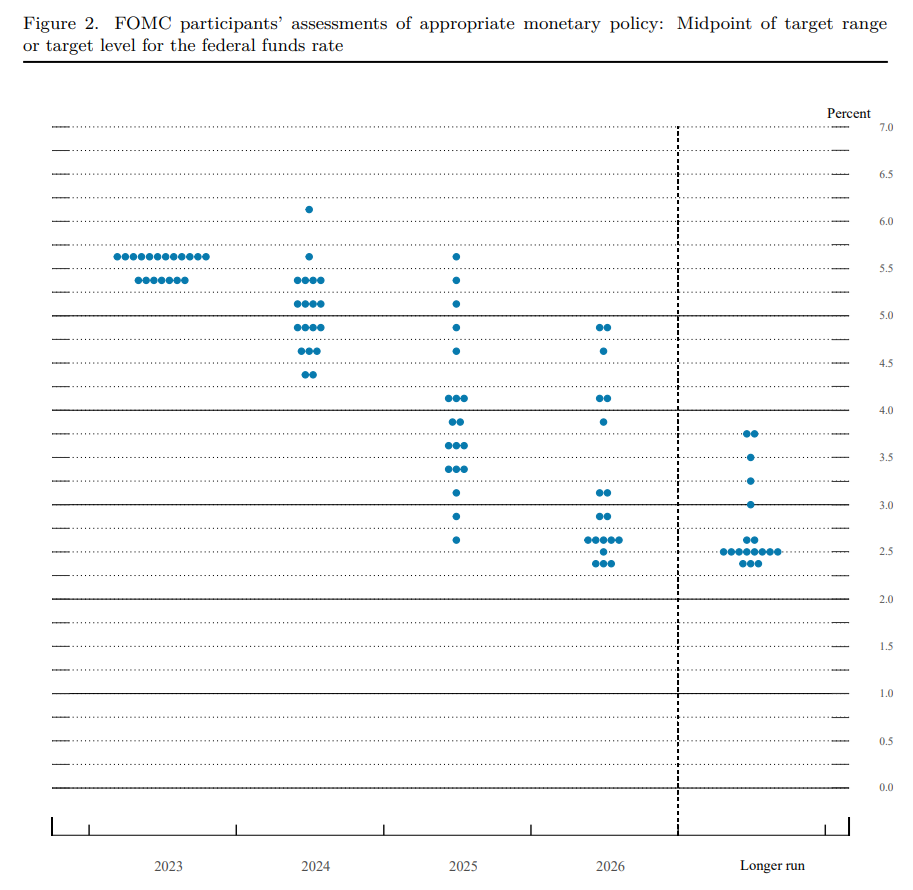

Dot Plot Interest Rates: Forecasting the Fed’s Moves

The Federal Reserve’s dot plot is a valuable tool for traders, offering insights into the future trajectory of interest rates as projected by members of the Federal Open Market Committee (FOMC).

Each dot on the chart represents an individual FOMC member’s forecast for the midpoint of the target range or level of the federal funds rate at the end of each year.

In the latest dot plot, we can observe several key trends:

- Current Year: The majority of FOMC members anticipate that interest rates will stay within the 5.25% to 5.50% range, reflecting a cautious stance in the short term.

- Next Year: For the upcoming year, projections show a significant spread, with some members expecting rates to drop to as low as 4%, while others predict they could remain close to 5.5%.

- Longer-Term Outlook: By 2026, most dots cluster around 2.5% to 3%, suggesting that the FOMC expects rates to gradually decrease as the economy stabilises over the long run.

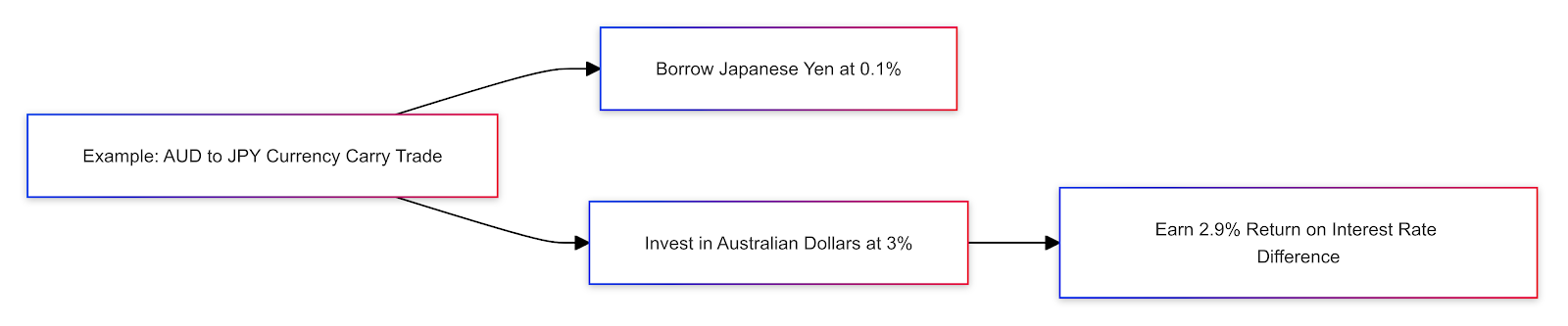

Currency Carry Trades: Leveraging Interest Rate Differentials

A currency carry trade involves borrowing a currency with a low interest rate to trade in one with a higher rate, aiming to gain from the interest rate difference.

For instance: Consider the AUD/JPY pair. The Australian dollar (AUD) usually has a higher interest rate than the Japanese yen (JPY). A trader might borrow yen at 0.1% and trade in Australian dollars at 3%, potentially earning a 2.9% return, depending on market conditions.

However, currency values can fluctuate, affecting returns. For instance, if the yen unexpectedly appreciates due to geopolitical tensions, the trader could incur losses despite the favourable interest rate differential. Understanding and managing these risks is crucial for efficient carry trades.

CME FedWatch Tool: Predicting Rate Changes

The CME FedWatch Tool is a helpful resource for forex traders, offering easy-to-understand predictions about potential changes in U.S. interest rates. It uses data from fed funds futures contracts to estimate the chances of the Federal Reserve raising or lowering rates, which can impact currency values.

Recent Data:

- Current Rate: 5.33%

- Predicted Scenarios:

- 49% chance of the rate dropping to 4.75%-5.0%.

- 51% chance of it staying at 5.0%-5.25%.

If a rate cut happens, the U.S. dollar might weaken. Traders could then consider buying other currencies like the euro or yen, which might strengthen against the dollar as a result. This tool helps traders make more informed decisions by providing a glimpse into market movements.

Forex Interest Rate Trading Strategy

When crafting a forex trading strategy around interest rates, it is vital to understand how rate decisions impact specific currency pairs. Here is how to approach it:

- Monitor Central Bank Meetings:

Stay informed about the interest rate decisions of central banks relevant to the currency pairs you trade. For instance, if you are trading GBP/USD, keep an eye on both the Federal Reserve and the Bank of England. Use an economic calendar to track important dates. - Combine Fundamental and Technical Analysis:

Interest rate decisions can disrupt technical patterns. If technical analysis suggests a bullish trend in the EUR/USD but the European Central Bank (ECB) might cut rates, reconsider your trade, or tighten stop-loss levels. - Multi-Time Frame Analysis:

Analyse charts across different time frames to gain insights into market trends. For example, use a daily chart for overall trends and a 4-hour chart for precise entry points. - Implement Effective Risk Management:

Interest rate changes can cause volatility. Tighter stop-loss orders can protect against sudden market reversals, especially if unexpected rate hikes or cuts occur.

Trading the Fed’s Policy Decision: Strategies to Consider

Navigating the uncertainty around the Federal Reserve’s policy decisions requires careful strategy. Here are three approaches to consider:

- Pre-Announcement Positioning:

Some traders position themselves before the Fed’s announcement based on market expectations. For instance, if a rate hike is anticipated, a trader might go long on the U.S. dollar against weaker currencies like EUR or JPY. However, this strategy can be risky, as unexpected announcements can lead to significant market volatility. - Post-Announcement Reaction:

Another approach is to wait for the market’s initial reaction post-announcement. If Fed Chair Jerome Powell’s comments suggest further rate hikes, and EUR/USD breaks through a resistance level, a trader might go long on the dollar, anticipating continued strength. - No-Trade Strategy:

At times, the wisest course of action might be to refrain from trading until the market stabilises. If the Fed’s announcement causes unpredictable swings, it might be wiser to wait until the market stabilises before making any trades, ensuring decisions are based on clear trends rather than erratic movements.

Conclusion: Mastering Forex Trading Amid Fed Rate Announcements

Trading during Fed rate decisions requires a blend of fundamental and technical analysis. By tracking key indicators like inflation and employment data, traders can anticipate potential market movements.

Effective risk management, such as using stop-loss orders, is crucial to navigate the volatility these announcements often bring.

At ACY Securities, we empower traders by providing:

- Education Tailored to You: Catering to traders of all levels, we offer a diverse range of educational resources.

- Informed Trading: We ensure you are not trading in the dark. Our expert insights and analysis support your trading decisions, helping you navigate the markets more confidently.

- Ready to Dive In? Open your account with us today and begin a journey of growth and learning. Embrace the opportunity to grow, learn, and excel in the dynamic trading landscape with ACY Securities.

Explore ACY Securities expert-led webinars to help traders navigate the world of the forex market. Learn more about Shares, ETFs, Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

FAQs

1. Why are Fed rate decisions important for forex traders? Fed rate decisions directly impact the U.S. dollar’s value, influencing currency pairs and creating trading opportunities.

2. How can I anticipate Fed rate changes? Monitor key economic indicators like inflation and employment data and use tools like the CME FedWatch Tool to gauge market expectations.

3. What is a good strategy during Fed announcements? A balanced approach using both fundamental and technical analysis, combined with effective risk management, helps navigate the volatility.

4. Should I trade before or after the Fed’s announcement? It depends on your risk tolerance. Pre-announcement trading is riskier but can be advantageous, while post-announcement allows for a reaction to clearer market signals.

5. How can I manage risk during volatile periods? Implement stop-loss orders, keep positions small, and stay updated with real-time news to protect your trades during high volatility.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know