The Importance of Liquidity in Forex: A Beginner's Guide

2023-07-27 16:58:47

Liquidity in the forex market is a critical aspect that defines the ease of buying or selling currencies without causing significant price fluctuations.

At ACY Securities, we understand the profound impact of liquidity on forex trading and its vital role in guiding traders' decision-making processes. When numerous buyers and sellers interact at various price levels, high liquidity prevails, ensuring seamless trade executions, competitive pricing, and minimal slippage.

Conversely, low liquidity scenarios can pose challenges, making trading harder and more expensive. For forex traders, robust liquidity is crucial as it empowers them to navigate the markets and secure the best trading opportunities confidently.

Understanding Forex Liquidity: A Key Factor in Market Dynamics

In the dynamic world of forex trading, liquidity refers to the ease with which traders can buy or sell a currency pair without significantly impacting its price. Picture it as a smoothly paved road allowing quick and seamless currency exchanges at desired prices. This characteristic holds immense significance for traders as it translates to reduced transaction costs, enabling them to save valuable resources.

High liquidity empowers traders with the freedom to enter and exit positions without causing substantial price swings, fostering a stable and predictable trading environment. The global financial market, the forex market, witnesses a staggering daily trading volume of approximately $7.5 trillion. This remarkable figure is fuelled by participants from diverse time zones, ensuring a constant influx of buyers and sellers.

Liquidity levels in currency pairs vary based on their popularity and activity. Major currencies like EUR/USD, GBP/JPY, and GBP/CHF dominate the most liquid pairs, making them easily tradable at any time.

The Significance of Liquidity in Forex Trading

Liquidity plays a crucial role for traders and the overall economy. Ample liquidity creates a win-win situation for buyers and sellers, enabling smooth trade execution, lower costs, and optimized trading strategies. High liquidity allows significant transactions without disrupting exchange rates for large institutions, fostering economic stability.

Price stability is another vital aspect facilitated by abundant liquidity. Predictable price movements promote a thriving economy by reducing uncertainty, while excessive volatility can deter investors and hinder economic growth. High liquidity ensures reliable market conditions, bolstering confidence in the financial landscape.

The significance of liquidity in the forex market cannot be overstated. It enhances trading efficiency, promotes price stability, and supports economic growth. At ACY Securities, we recognise liquidity's pivotal role and provide traders with the knowledge and resources to navigate the forex market effectively.

Participants Impacting Forex Liquidity

A diverse array of participants sustains the fluidity of the forex market, each contributing to its dynamic nature. At ACY Securities, we recognise these key players' significance and impact on forex liquidity. Let us delve deeper into their roles:

Central Banks

Central banks, such as the Federal Reserve (United States), European Central Bank (Eurozone), Bank of Japan (Japan), and Bank of England (United Kingdom), wield considerable influence over the forex market.

With the authority to set interest rates and intervene in currency markets as necessary, they play a pivotal role in shaping currency liquidity. Responsible for maintaining stability in their respective countries' currencies and overall economies, central banks' decisions resonate throughout the forex landscape.

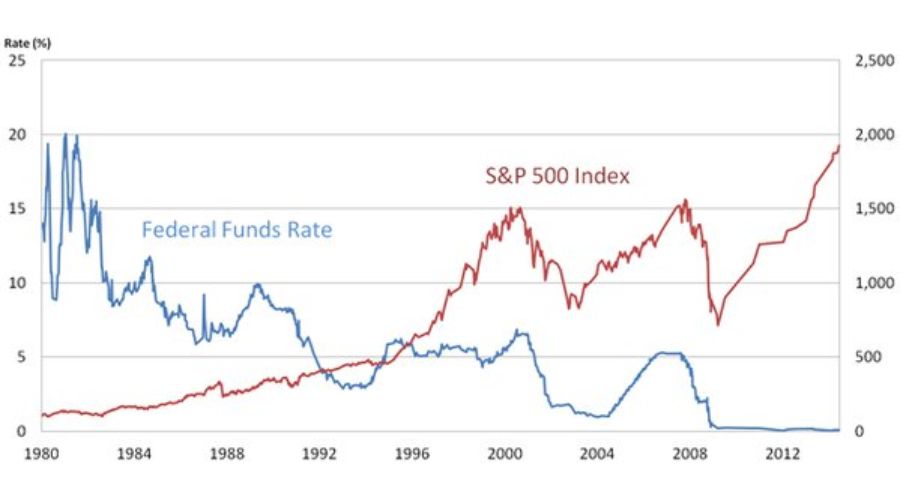

For example, the Federal Reserve's decisions on monetary policy, including changes in the federal funds rate, can have significant implications for the US dollar and impact global forex markets.

Consider a scenario: a drop in interest rates triggered a buying frenzy in the S&P 500 index. As rates decreased, the market experienced a temporary negative correction, offering smart investors an enticing buying opportunity.

Recognizing the short-term nature of the correction, shrewd investors entered the market to purchase discounted stocks. This strategic move positioned them for potential future gains when the market regained its upward momentum.

By capitalizing on the market's momentary downturn and buying at attractive prices, investors contributed to the overall buying activity in the S&P 500 index.

Similarly, the European Central Bank's decisions on interest rates and quantitative easing measures can influence the euro's value and affect trading strategies for traders worldwide.

Although their involvement might not be as overt as other market investors, their actions and statements hold substantial value for traders and investors, providing crucial insights into future market trends. As a result, traders closely monitor central bank announcements and press conferences to gauge potential shifts in currency liquidity and make informed trading decisions.

Commercial Banks

As vital participants, commercial banks actively engage in forex trading as part of their routine banking operations. They facilitate international transactions, assist clients in hedging against currency risks, and conduct proprietary trading activities. Their robust participation contributes essential liquidity to the forex market, ensuring efficient functioning.

For instance, when a multinational company in the United States wants to import goods from Japan, they must pay in Japanese yen. A commercial bank facilitates this transaction by converting US dollars into yen, ensuring smooth cross-border trade, and adding liquidity to the forex market.

Large Investors/Institutional Traders

Hedge funds, pension funds, mutual funds, and various financial institutions are instrumental in the forex market. These entities inject liquidity into the market through their large-volume trades by employing significant currency transactions as part of their investment strategies.

Global Companies

Operating on a global scale, multinational corporations interact with various currencies to conduct international business. They undertake hedging activities that involve substantial forex transactions to safeguard themselves from currency risks.

This engagement fosters liquidity, benefitting other participants and enriching the overall functionality of the forex market.

Individual Traders/Private Traders

Despite constituting only a fraction of the daily forex volume, individual retail traders play a role in the market's liquidity.

Their collective participation, though relatively modest, adds to the overall liquidity as they engage in currency trading and contribute to market activity.

How to Identify High Liquidity and Low Liquidity

The forex market experiences varying levels of liquidity, which can change over time. Traders should be mindful of these fluctuations as they can significantly influence market conditions and impact their trading strategies and execution.

- High Liquidity: In the forex market, high liquidity is characterized by a significant number of active buyers and sellers engaging in trading, leading to substantial trading volumes. This situation benefits traders by narrowing bid-ask spreads, resulting in reduced slippage and transaction expenses.

Additionally, abundant liquidity fosters price stability, with prices changing in smaller and more predictable increments. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY are renowned for their high liquidity, driven by their widespread acceptance and popularity among traders.

- Low Liquidity: During periods of low liquidity in the forex market, there are fewer active traders and lower trading volumes. Consequently, this leads to wider bid-ask spreads, resulting in higher transaction costs for traders. Price movements become more volatile and less predictable, increasing the likelihood of slippage and price gaps. Exotic currency pairs, representing smaller or emerging economies, typically exhibit lower liquidity. Traders need to exercise caution during such times, as executing trades smoothly becomes more challenging, and prices may fluctuate rapidly.

Forex Liquidity: Measuring Market Efficiency and Trade Execution

Estimating liquidity in the forex market can be challenging, given the absence of a central exchange. Traders rely on various indicators to gauge the relative liquidity of currency pairs, providing valuable insights into how easily they can buy or sell a currency without significantly affecting its price.

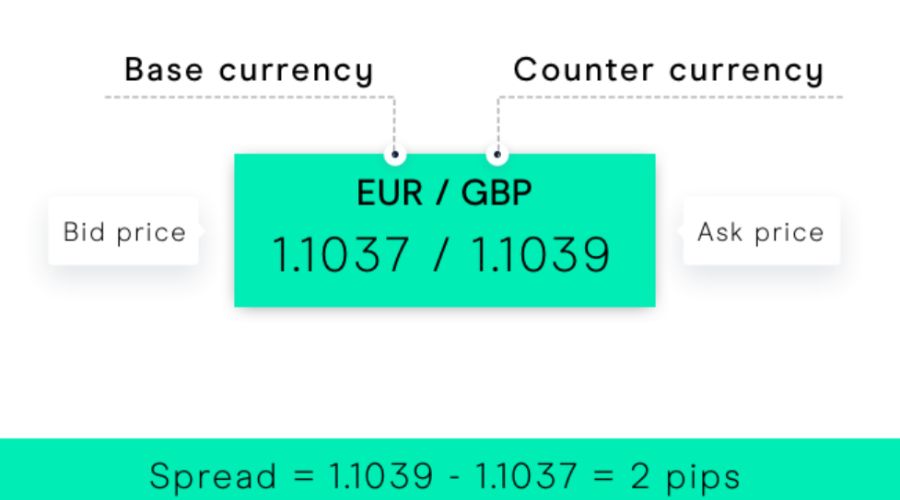

- Bid-Ask Spread: The bid-ask spread serves as a simple measure of liquidity. A narrow spread indicates high liquidity, making trading easier and more cost-effective. Conversely, a wider spread suggests lower liquidity, making trading more expensive and challenging. Traders closely monitor the spread to assess the market's liquidity conditions.

- Volume: High trading volumes signify high liquidity, whereas low volumes suggest lower liquidity in the forex market. Traders can assess liquidity by comparing a currency pair's current volume with its historical volume. A higher volume compared to the past indicates better liquidity, while a lower volume implies potentially reduced liquidity for that specific currency pair.

- Price Movement: Price movements are indicative of liquidity in the market. Liquid markets experience smoother price changes without sudden gaps or extreme spikes. Conversely, illiquid markets are more volatile, leading to frequent price gaps. Traders closely observe price behaviour to assess market liquidity and its potential impact on trading.

- Market Depth: The depth of the order book, available on certain trading platforms, provides valuable insights into market liquidity. A deep order book featuring numerous buy and sell orders at different price levels indicates high liquidity. Traders analyse the order book to gauge the availability of liquidity in the market and make well-informed trading decisions.

Factors That Influence Liquidity

Various factors can impact liquidity in the forex market, influencing trading volume and specific currency pairs' liquidity. It is crucial to recognise that even highly liquid currency markets like EUR/USD can experience periods of illiquidity due to these factors.

- Forex Market Hours: The forex market operates 24 hours a day, five days a week, with varying liquidity levels throughout these hours. The peak liquidity usually occurs during the overlap of major market sessions, particularly the London and New York sessions. These times see a higher number of active traders, leading to increased trading volumes and improved liquidity.

Conversely, during off-peak hours like the late US session or early Asian session, liquidity tends to be lower due to fewer participants trading. Traders should consider these liquidity patterns when selecting the optimal times to trade, as it can impact order execution and market conditions.

- Impact of Economic News and Events: Economic news and events hold significant sway over forex liquidity. Before and after important releases, such as employment reports, inflation data, or central bank announcements, liquidity tends to decrease as traders await the outcomes.

However, once the news is released, trading volume often surges, resulting in higher liquidity. Traders must remain vigilant during these moments and anticipate potential liquidity fluctuations.

Notably, bid-ask spreads may widen during news events, making it essential to employ appropriate risk management strategies to navigate the potentially volatile market conditions.

- Influence of Market Sentiment: Market sentiment plays a pivotal role in shaping liquidity. During uncertain or volatile periods, such as geopolitical crises or economic shocks, traders may adopt a cautious approach, leading to reduced liquidity and lower trading volumes.

On the other hand, in times of positive market sentiment, where traders feel confident and eager to participate, market activity and liquidity can increase. By comprehending and accounting for these factors, traders can make more informed decisions and adapt their strategies, accordingly, effectively navigating the dynamic landscape of forex liquidity.

Indicators of Low Liquidity in the Forex Market

In the forex market, it is vital to remain attentive to warning signs of illiquidity that may indicate potential risks and impact your trading decisions. Recognizing these indicators can help you navigate the market more effectively and protect your investments. Below are some noteworthy signs of illiquidity to be aware of:

Widening Spreads

A prominent sign of illiquidity is when the spread, the difference between a currency pair's buying and selling price, widens.

This often occurs towards the end of trading sessions or ahead of significant economic releases.

Such widening spreads can make trading more costly and challenging, reducing the efficiency of executing trades at desired prices.

At ACY Securities, the good thing is that spreads are very competitive and start from zero, ensuring that our clients can trade with optimal efficiency and without excessive costs.

Increased Slippage

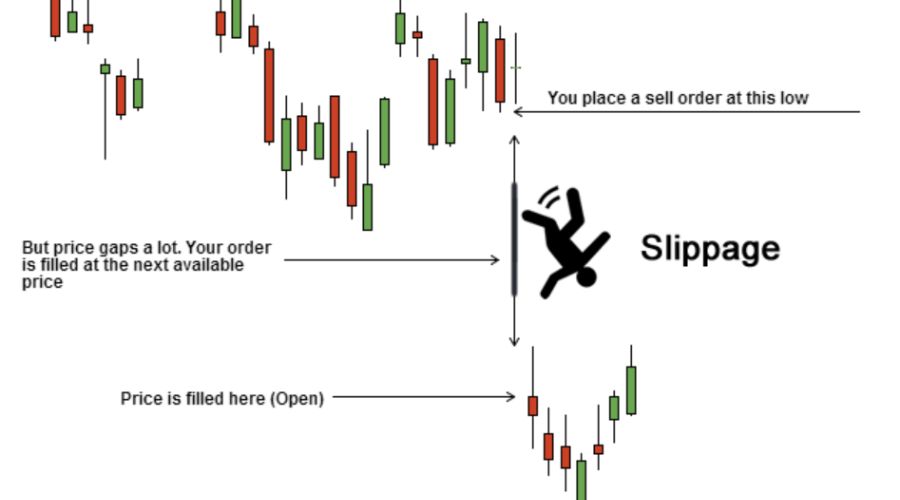

In illiquid markets, traders may encounter increased slippage, where trades are executed at prices different from their expected levels.

Consistently experiencing trades being filled at less favourable prices could indicate a lack of liquidity, making it challenging to enter or exit positions at desired levels.

Price Gaps

Illiquid markets are more prone to price gaps, where a currency pair's price jumps from one level to another without trading at intermediate prices. The absence of buyers or sellers at certain price levels can cause sharp price movements until an order can be filled. Price gaps may lead to unexpected losses and create challenges in managing risk.

Higher Volatility

Illiquid markets exhibit higher volatility, resulting in larger price swings even in response to relatively small trades. Observing erratic and substantial price movements without corresponding changes in fundamental factors may indicate a lack of liquidity.

Higher volatility increases the potential for significant price fluctuations, posing risks for traders and investors.

To learn more about managing volatility strategically in your trading endeavours, check out the webinar conducted by ACY experts. Understanding these indicators of illiquidity can help traders make informed decisions and navigate the forex market more effectively.

Forex Liquidity: Risks and Rewards

In the forex market, liquidity plays a pivotal role in shaping trading outcomes, presenting both risks and rewards for market participants. Understanding these dynamics is crucial for making informed decisions and optimizing trading strategies.

Rewards of High Liquidity:

- Tight Spreads: Liquid markets usually offer tighter spreads, minimizing the difference between buying and selling prices. This fosters cost-effectiveness and lowers transaction expenses for traders.

- Price Stability: Price movements tend to be more stable and predictable in liquid markets. Traders can analyse and interpret price action with greater confidence, enabling them to make well-informed trading choices.

- Easy Execution: High liquidity ensures that orders are more likely to be executed at desired prices. For traders dealing with large volumes, this means smoother order execution without significant slippage.

Risks of Low Liquidity:

- Increased Costs: Illiquid markets often experience wider spreads, resulting in higher transaction costs. This can make specific short-term trading strategies less feasible and impact potential profits.

- Volatility: Low liquidity levels can lead to increased market volatility. Larger price swings in response to even minor trades may expose traders to higher risks, necessitating cautious risk management practices.

- Slippage: In illiquid markets, there is a greater risk of encountering slippage, where orders are filled at less favourable prices than intended. This can reduce overall profitability and amplify losses as executing trades at desired prices becomes challenging.

Bottom Line

To navigate the forex market effectively, it is crucial for traders to remain vigilant and recognise warning signs of illiquidity. Widening spreads, increased slippage, price gaps, and higher volatility are notable indicators traders should be aware of while making trading decisions.

At ACY Securities, we provide valuable educational resources and expert-led webinars to empower traders with the knowledge and skills needed to navigate liquidity challenges successfully.

Join us to deepen your understanding of forex liquidity and enhance your trading strategies. Experience the benefits of trading in a liquid market with ACY Securities today.

Try These Next