How to Master MT4 & MT5 - Tips and Tricks for Traders

2023-08-14 11:48:44

MetaTrader 4, fondly known as MT4, is a renowned trading platform, the creation of MetaQuotes Software in 2005. Its reputation spans the globe, gaining favour with online traders, especially those within the foreign exchange market. MT4 is essentially a one-stop shop for a multitude of trading resources, facilitating online money trades with its intuitive and user-friendly interface.

This powerful platform offers a range of features and tools for traders, functioning as an insightful guide to the intricate world of online trading. With its flexible, customizable nature and practice-friendly demo accounts, MT4 is considered an efficient tool for novice and seasoned traders.

In this update, we will delve deeper into the world of MetaTrader and the usage of MT4 and MT5 for ACY Securities. We will discuss the notable features of these platforms and provide tips and tricks for getting the most out of your trading experience.

Why Choose MT4 or MT5?

MT4/MT5 platforms are user-friendly, customizable and provide various useful tools that make trading easier. MT4, being the older version, enjoys extensive popularity due to its simplicity and wide acceptance among brokers. It offers a robust trading system, technical analysis tools, advanced charting, and Expert Advisors (EAs) for automated trading, and allows backtesting of trading strategies.

MT5, on the other hand, incorporates all MT4 features and includes additional functionality such as depth of market, integrated economic calendar, and improved strategy tester for EAs. Despite these advanced features, some traders prefer to stick with MT4, primarily because many brokers support it.

Both platforms are available for various devices and operating systems, including Windows, Mac, iOS, Android, and even web-based versions for flexible accessibility. It is recommended to start with the web version for a broad understanding of the platform before transitioning to a desktop or mobile app.

Making the Most of MetaTrader: Six Essential Tips

1. Leverage the MetaTrader Market Scanner

The MetaTrader Market Scanner is a valuable trading aid. It intelligently searches for trading opportunities by analysing price changes, chart patterns, and significant financial news. Think of it as a helpful assistant, providing timely and accurate information to inform your trading decisions.

2. Design Custom Indicators

Custom indicators are bespoke trading tools that you can create to track specific price movements or other market variables. For instance, you could develop an indicator to signal when prices frequently retract to a certain point, informing you when to potentially make a move.

3. Harness Expert Advisors

Expert Advisors (EAs) are essentially automated trading systems. They can execute trades on your behalf, monitor your positions, and close them when necessary. Specify your trading rules, and your EA will follow them, making your trading more efficient and less complicated.

4. Implement Effective Risk Management

Risk management is a vital component of successful trading. The MetaTrader platform facilitates this by allowing you to set stop losses — safeguards that prevent you from losing more than a predetermined amount. Such risk management measures help protect your capital and circumnavigate difficult trading conditions.

5. Maintain Trading Discipline

A disciplined approach to trading often leads to more consistent outcomes. Remain composed, adhere to your pre-established trading plan, and avoid letting emotions cloud your judgment.

6. Adopt Realistic Expectations

While trading can be lucrative, it is essential to maintain realistic expectations. Remember, success often takes time, and losses are part of the journey. Think long-term and set achievable goals.

Navigating Charts: Key MT4/MT5 Tricks

Here are some user-friendly shortcuts and tricks that can make your experience with MetaTrader 4 (MT4) even more efficient and enjoyable:

- Time Saver: Instead of scrolling endlessly, roll your mouse wheel or use the Page Up/Down keys to move back and forth in time on your chart. This helps you quickly analyse past data.

- Latest Updates: Hit the "End" key to instantly snap to the most recent price bar on your chart. This is useful for staying up-to-date with the latest market movements.

- Step-by-Step Learning: Press "F12" to navigate through historical data one bar at a time. This is a great way to learn how the market behaves and develop trading strategies.

- Chart Adjustment: Click and hold the vertical price scale to move it up or down, allowing you to focus on specific price levels or targets.

- Zoom In and Out: Click and hold the horizontal time scale to move left or right, effectively zooming in or out on your chart to analyse different time frames.

- Quick Reset: Double-click on the chart to instantly revert to the original scale if you have adjusted the price or time scale.

- Direct Time Jump: Need to go to a specific point in time? Hit "Enter," then type the date in the format "DD.MM.YY," followed by "HH.MM" for the time. This precise navigation can be handy for pinpointing historical events.

These straightforward MT4 shortcuts can enhance your trading experience, allowing you to navigate through time and charts while making informed decisions efficiently.

Measure Distances

On MetaTrader 4, measuring distances on a trading chart is made easy using the "ruler" function. It is similar to measuring tape for trading. Simply click your mouse wheel or press Ctrl-F to access the measuring tool, then click and drag from one point to another.

The ruler provides you with three pieces of information: the number of bars between the points, the number of pips (which indicates price change) between them (such as 61 indicating 6.1 pips), and the current location of your cursor. This tool is helpful in quickly determining the distance in bars or pips, which can aid in understanding trends and determining when to stop or take profits.

Drawing Tools

In MetaTrader 4, drawing tools serve as specialized instruments for illustrating trends or ranges on your chart:

- Utilize graphical aids such as trendlines and consolidation rectangles to represent price action.

- To create parallel lines, select a trendline and hold Ctrl while clicking on it, simplifying the process of drawing channels.

- For duplicating a selected object, use Ctrl+left click. This method is efficient, sparing you the hassle of navigating through menus every time you wish to replicate an object, like a Fibonacci retracement.

- At times, the duplicate may overlay the original, but dragging it will reveal both.

- If you want to change something about a line or shape, just double-click it.

By using these helpful shortcuts, you can save time and improve your ability to identify trends and patterns on your chart. These tricks not only enhance visualization but also increase efficiency.

Producing a Trading Report

In the Terminal window, there is a tab called "Account History" that allows clients to easily access their past transactions. Users can either view their entire transaction history or filter it by selecting a specific time frame.

- Click "Account History," then "Select a Time Range."

- The Account History menu is accessible by right-clicking anywhere in the section. There will be a drop-down menu available.

- To save the information, select either "Save as Report" or "Save as Detailed Report."

- Then select "Save as" or "Print" from the context menu.

Profit Analysis Using Three Different Measures

The Terminal displays earnings and losses in the default deposit currency. For example, if you have an Australian dollar trading account and trade in Euros against Dollars (EURUSD), your profits and losses will be shown in Australian dollars. However, you can toggle to view your gains and losses in either Points or the Terms Currency.

- Open the "Terminal Window."

- Right-click anywhere within the Terminal Window to access a drop-down menu.

- Hover over "Profit" to reveal a secondary drop-down menu.

- From there, select to view your earnings in Points, the Terms Currency, or the Deposit Currency.

Display the Ask Line

It is important to display the ask line when using MT4 as it helps you quickly determine your entry point for long trades and the required price movement for short trades. Keep in mind that the spread may be wider than anticipated and you may only notice a jump of 5 to 10 pips above your target entry point when placing the trade.

- Click the chart's "F8" button, then choose "show ask price line" to display the asking price.

Turning off the Grid

When trying to make quick decisions, the grid view can be overwhelming as it crowds the page and makes it hard to see price activity clearly. To minimize distractions, you can either press the "CTRL" and "G" keys or right-click on the chart and select "Grid" from the context menu.

This will help to keep the screen free from unnecessary distractions, allowing for better focus and decision-making.

Add One Indicator to Another

The indicator compounding tool in MetaTrader 4 and MetaTrader 5 is a valuable addition for forex traders. It provides real-time data and allows users to combine the RSI (Relative Strength Index) with other custom or technical indicators in their chart window, supporting their trading strategy.

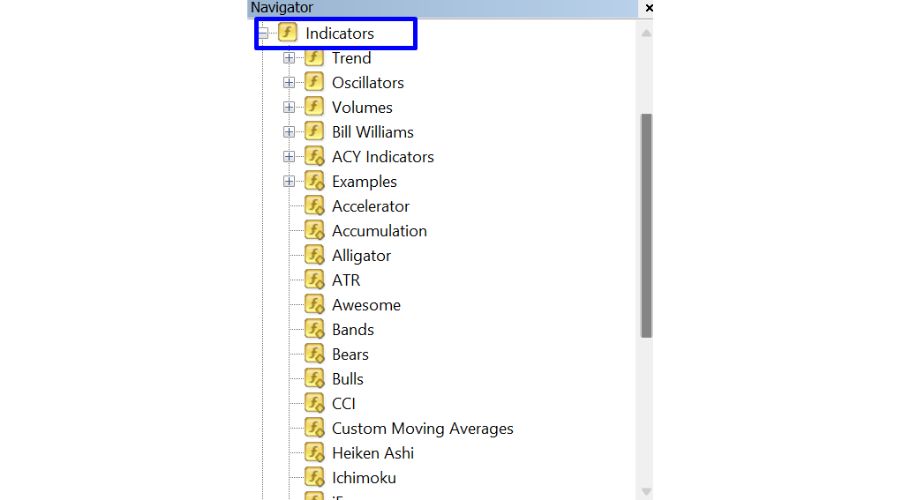

- To open the indicators menu, first press Ctrl+N to bring up the navigator window. Then, click on the plus sign.

- To add an indicator to a chart, simply click and drag the desired indicator into the chart window.

- To access the "Parameters" tab, click on the "Properties" window. To combine two indicators, select the "First Indicators data" option from the "Apply to" menu.

HotKeys

If you are analysing charts in MT4 and want to switch chart templates, you may lose all your progress. However, you can use hotkeys to keep your price charts open while changing the indicators you see. Instead of manually changing the chart template, you can assign a hotkey to the indicator you want to use.

To do this, right-click on the indicator in the navigation window and select "Hotkey" from the context menu.

Here is a list of easy-to-use hotkeys in MetaTrader 4:

Navigation and Scaling: Use arrow keys to scroll and adjust views. Numpad 5 restores the vertical scale. Page Up/Down scrolls a whole screen. Home and End take you to the start or recent point. "+" and "-" zoom in and out. Delete removes selected objects, Backspace deletes recent ones. Enter lets you enter specific times. Esc closes pop-ups.

Function Keys

- F1: Opens user guide

- F2: Accesses History Center

- F3: Views Global Variables

- F4: Opens MetaEditor

- F5: Launches Tester

- F6: Calls Tester for an expert

- F7: Changes expert settings

- F8: Edits chart setup

- F9: Initiates New Order

- F10: Displays Popup Prices

- F11: Toggles full screen

- F12: Scrolls bars to the left

- Shift+F12: Scrolls bars to the right

- Shift+F5: Switches profiles

Chart Display

- Alt+1: Shows OHLC bars

- Alt+2: Displays candlesticks

- Alt+3: Views as a line

- Alt+A: Copies test results

- Alt+W: Manages charts

- Alt+F4: Exits the application.

MT4/MT5 Control Shortcuts

Let us delve deeper into the realm of shortcuts that you can utilize while trading with MetaTrader 4 and MetaTrader 5 on the ACY Securities platform. These are the CTRL shortcuts you can employ to increase the speed and efficiency of your trading workflow:

- Ctrl+A: Adjusting Indicator Window Heights - Automatically adjust the height of all the indicator windows to the same height.

- Ctrl+B: Opening the Objects List - It quickly brings up the objects list, allowing you to manage various objects on your charts.

- Ctrl+C: Copying Data - Useful when you want to copy data such as values, text, or analysis from one place to another within the platform.

- Ctrl+D: Toggling the Data Window - With this command, you can quickly show or hide the data window that displays the details of different currency pairs and indices.

- Ctrl+E: Enabling/Disabling an Expert Advisor - This shortcut allows you to quickly enable or disable an expert advisor for automated trading.

- Ctrl+F: Switching to Crosshair Mode - It enables the crosshair mode, which allows you to pinpoint specific spots on your chart.

- Ctrl+G: Showing/Hiding Grids - This shortcut lets you toggle the grid lines on your chart, making it easier to view or hide gridlines based on your preference.

- Ctrl+H: Showing/Hiding OHLC Lines - This allows you to display or hide the OHLC (Open, High, Low, Close) lines on your charts.

- Ctrl+I: Opening the Indicators List - It brings up the list of indicators that you have added to the current chart, allowing you to edit or delete them easily.

- Ctrl+L: Displaying Volume Data - This shortcut lets you quickly display or hide the volume data on your charts.

- Ctrl+M: Opening the Market Watch Window - It opens the Market Watch window that shows the live quotes for selected financial instruments.

- Ctrl+N: Opening the Navigator - This command brings up the Navigator window that lists all your accounts, indicators, expert advisors, and scripts.

- Ctrl+O: Opening Setup - It opens the Options window where you can change various settings of your MetaTrader platform.

- Ctrl+P: Printing - This shortcut allows you to print the chart that you are currently viewing.

- Ctrl+R: Opening Tester - For MT5, it opens the Strategy Tester window for backtesting your Expert Advisors.

- Ctrl+S: Saving Prices - It saves the price data from the current chart.

- Ctrl+T: Opening Terminal - This command opens the Terminal where you can view trade information, account history, news, alerts, and others.

- Ctrl+W or Ctrl+F4: Closing the Active Chart - These commands close the chart that you are currently working on.

- Ctrl+Y: Showing/Hiding Date Separators - It lets you quickly show or hide the date separators on your chart.

- Ctrl+Z or Alt+Backspace: Undoing Object Deletions - These shortcuts undo the deletion of the most recently deleted object.

- Ctrl+F6: Switching Charts - This command allows you to switch between open charts.

- Ctrl+F9: Opening the Trade Terminal - It opens the Trade Terminal for keyboard trading.

Using these shortcuts can significantly enhance your efficiency, thereby allowing you to react to market changes in a timely manner. Remember, trading is not only about having the right strategy but also about the ability to implement it efficiently and effectively. These CTRL shortcuts will prove to be valuable assets as you navigate through your MetaTrader platform, allowing you to take full advantage of its extensive range of features.

Tips and Tricks for MT5

Since it is a newer edition, Metatrader 5 boasts a number of features over its predecessor. Users can benefit in a number of ways from the Platform MT5, including the streamlined deposit process, improved analysis tools, and sleek user interface.

When it comes to automated trading, MetaTrader 5 (MT5) is the platform to use. Learn how to get the most out of MT5 and your automatic trading with these helpful hints:

Technical Assistance with Expert Advisors (EAs)

Automate your trades using EAs to enter and exit the market at optimal times with minimal effort. While EAs come with pre-programmed strategies, they can be tailored to align with your specific objectives and risk comfort level. To avoid potential losses from ineffective strategies or ill-chosen parameters, always back test your EA before deploying it.

Robotic Trading with MetaTrader 5: MetaTrader 5 trading bots serves as valuable tools for automating trading actions. Create an EA that tailor trading parameters, such as time frame and currency pair, to the prevailing market conditions. Before launching your trading bot, utilize MT5's strategy tester on historical data to refine its performance.

Copy Trading: It allows investors to replicate the strategies of market professionals by tracking the signals they disseminate through email or social media. However, always conduct thorough research before entering any agreements with the service providers you are considering. Never blindly trust a signal provider; always validate their performance history first.

Risk Management in MetaTrader 5: Effective risk management is paramount in foreign exchange (Forex) trading. For traders using MetaTrader 5, consider the following strategies to mitigate potential losses:

- Stop-loss and Take-Profits: By setting defined exit points beforehand, you ensure that potential losses remain within your acceptable limits. Taking profits at predetermined thresholds also prevents engaging in overly large or high-risk trades.

- Utilizing Trailing Stops: Trailing stops, which adjust exit points while keeping risk ceilings intact, offer a versatile method for concluding trades.

- Position Size Calculation: In case the market swings unexpectedly against your predictions, ensure that your exposure to a single currency pair or asset type remains controlled. MT5's indicator settings facilitate quick and efficient position size determinations.

Managing Multiple Open Positions: For optimal risk management, monitor all active positions and establish individual exposure limits per currency pair or asset type.

Trading Calculators in MT5: Capitalize on MT5's integrated trading calculators to easily ascertain pip value, available margin, and potential profit or loss, thus eliminating manual calculations and saving time.

Staying Updated with Economic Calendars: Receive real-time market insights from credible sources like the International Monetary Fund (IMF), the Bank for International Settlements (BIS), and the Organization for Economic Cooperation and Development (OECD).

Alerts and Notifications: Take advantage of MT5's comprehensive alerts and notifications to remain abreast of your trades, regardless of your location or device. Vigilantly monitor for value triggers, as these could signify profitable opportunities, be it from price movement alerts or specific order value changes.

Viewing Commissions in MT5:

To see your commissions and swap fees in MetaTrader 5, follow these steps:

- Access the MT5 Toolbox using the Ctrl+T shortcut on your keyboard.

- Click the Trade button to view all your active trades.

- The Commissions for your open positions will be shown in the Exchange column.

Bottom Line

In conclusion, MetaTrader 4 and MetaTrader 5 offer an array of sophisticated tools and features that cater to both novice and experienced traders. With the seamless interface, customizable features, and a plethora of shortcuts at your disposal, it is clear why these platforms are the gold standard in the trading world.

As you continue your trading journey with ACY Securities, utilizing these insights and tips will not only streamline your experience but also equip you with the agility to navigate the dynamic world of online trading. Remember, it is the mastery of these tools, combined with discipline and strategy, that defines a successful trader.

Did this article provide you with valuable insights? ACY Securities offers many other free educational resources and expert-led webinars to empower clients on their trading journey.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know