Mastering Fundamental Analysis in Forex Trading

2023-11-08 11:15:36

Fundamental analysis (FA) serves as a compass for traders, guiding them towards advantageous endeavours by meticulously evaluating the inherent value of a security. This analytical approach aims to optimise returns through informed decisions on whether to buy, hold, or sell a security, based not on its current market price, but on its intrinsic value. When it comes to the dynamic landscape of the foreign exchange market, fundamental analysis broadens its lens to encompass the potential ramifications of economic, social, and political factors.

Traders vested in fundamental analysis, especially when engaged with ACY Securities, delve beyond mere figures; they strive to discern the true worth of a market, analysing if it's underpriced or overpriced based on the current offerings, thus paving a way for well-considered trading strategies.

Core Factors Influencing Forex Trading

Navigating the financial markets requires a keen understanding of the variables that sway currency values. Here are some pivotal factors, explored with practical examples, aiming to enrich the trading experience at ACY Securities:

1. Central Bank Announcements

Central banks are the linchpins of market volatility across various asset classes, primarily through the modulation of interest rates. Their actions reverberate through the realms of currencies, equities, and indices. For instance, when the Federal Reserve adjusts the federal funds rate, it's not just the U.S. dollar that reacts; stock indices like the S&P 500 and commodities like gold are also affected.

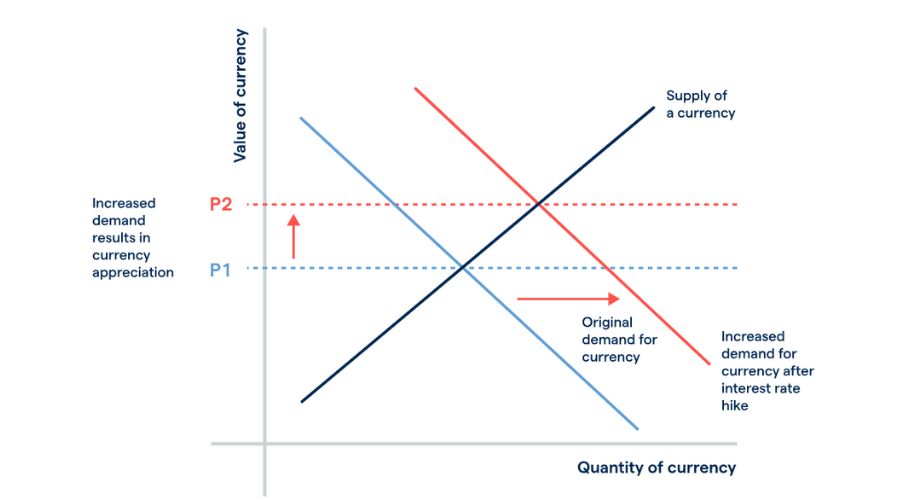

Likewise, a surprise interest rate hike by the Federal Reserve could lead to a rally in the USD, affecting currency pairs like EUR/USD, which traders on the ACY Securities platform could capitalise on.

At ACY Securities, traders can monitor and respond to central bank announcements through our news feed and market analysis. Additionally, any shifts in monetary policies, asset purchases, currency revaluations, or personnel changes are closely scrutinised by fundamental analysts, serving as bellwethers of possible central bank policy shifts.

2. Economic Indicators

Fundamental traders, particularly those engaged with ACY Securities, are perpetually on the hunt for signs of economic expansion or contraction as the broader economic ambience casts a wide net of influence over almost every asset. The regular dispatch of economic reports furnishes speculators with a lens to gauge the economic health of a particular country. The foreign exchange market (FX), akin to the stock market, is exceptionally sensitive to even minuscule deviations from expected economic data.

Detailed Analysis of Key Economic Indicators

Key economic indicators such as the unemployment rate and housing statistics are vital cogs in understanding these economic dynamics.

For example, a lower than expected unemployment rate in the US could strengthen the USD, offering trading opportunities for ACY Securities’ clientele.

#1: Gross Domestic Product (GDP)

The Gross Domestic Product (GDP) serves as a yardstick measuring the market value of all final goods and services crafted within a nation over a stipulated timeframe. Given its tag as a lagging indicator, traders usually have their eyes glued to the advance report and preliminary report disseminated in the months preceding the final GDP statistics. A significant disparity between these reports can breed considerable uncertainty.

The GDP mirrors internal growth, akin to the gross profit margin for a publicly traded corporation. Moreover, the unemployment rate and housing statistics are some of the economic factors intertwined with GDP dynamics.

For instance, a soaring GDP figure in the Eurozone could potentially bolster the EUR, which traders on the ACY Securities platform could leverage to enhance their trading strategies.

Utilising the cutting-edge trading infrastructure provided by ACY Securities, traders can navigate the tumultuous waves of the Forex market by keeping a close tab on these and other pertinent factors, thereby making informed trading decisions that could enhance their earnings potential.

#2: Consumer Price Index (CPI)/ Inflation and ACY Securities

The CPI tracks prices of 200+ products and, with export data, shows a country's export profitability. Traders should watch exports, as they affect currency strength. Strong exports often mean a bullish stance for the country's currency.

Central banks, in general, strive to tether inflation rates around the 2.0% mark, employing the Consumer Price Index (CPI) as their yardstick. However, the Federal Reserve, the monetary authority in the USA, veers from this norm by harnessing the Personal Consumption Expenditure (PCE) index instead of the CPI. Therefore, if you're trading the U.S. Dollar via ACY Securities and aim to forecast the prospective interest rate terrain, the PCE index should be your go-to metric.

Nonetheless, an augury of a surging CPI usually heralds bullish news for the currency in question. For instance, should the forecast for the UK's CPI hover around 2.5% for a quarter while Australia's CPI remains stagnant at 1.5%, this disparity could potentially cast a bullish glow on the GBP/AUD pair.

#3: Additional Economic Indicators

Apart from CPI, there exists a gamut of other pivotal indicators that fundamental analysis traders, especially those leveraging the tools and insights provided by ACY Securities, should closely monitor. These include:

- Producer Price Index (PPI): This index measures the average changes in selling prices received by domestic producers for their output. It's a critical indicator of cost inflation and can significantly impact forex markets.

- Purchasing Managers' Index (PMI): The PMI is a robust early indicator of economic activity. A PMI above 50 signals economic expansion, while a figure below 50 indicates contraction. Traders on ACY Securities can harness PMI data to gauge the economic health of a country and its potential impact on currency pairs.

- Durable Goods Report (DGR): The DGR reflects new orders placed with domestic manufacturers for delivery of hard goods. It's a strong indicator of manufacturing sector trends and provides insights into the health of the broader economy.

- Employment Cost Index (ECI): The ECI tracks changes in the cost of labour and is a key indicator of inflationary pressures. It can provide traders with insights into potential central bank monetary policy shifts.

These indicators, when interpreted in tandem, can offer a holistic view of the economic landscape, aiding traders on the ACY Securities platform in making well-informed trading decisions. By understanding the interplay of these economic indicators, traders can better anticipate market movements, aligning their trading strategies to capitalise on emerging opportunities in the forex market.

#4: Interest Rate, Policy Decisions & Movement of Interest Rates

Policy decisions from central banks play a crucial role in determining the trends of currencies as well as stock markets. When interest rates in one country are higher than those in another, capital tends to flow to the country offering the higher rate because shareholders see a greater returns from their capital. Consequently, the value of a currency may increase in response to the heightened demand.

Conversely, companies are inclined to take out loans to fund growth when interest rates are competitive. However, excessive borrowing can lead to inflation, which can diminish the value of a currency. Central banks often lower interest rates to support economic growth (GDP) and raise them to prevent inflation (CPI).

After assessing the market direction, traders must take the following steps:

- Be Prompt: When a major event occurs, traders race to act by buying (or selling) before the rest of the market. A significant payoff is possible with diligent planning and swift execution.

- Watch for Trend Reversals: The market may react strongly to traders' expectations immediately after data is released, but the trend often reverts to its original direction shortly thereafter.

Now let’s have a look at some of the top central banks around the globe.

The Federal Reserve (United States)

The Federal Reserve, serving as the central bank of the United States, wields substantial influence over global currency markets through its policy decisions.

Types of Announcements by the Federal Reserve:

- Interest Rate Decisions: The Federal Reserve sets the federal funds rate, which serves as a benchmark for interest rates in the United States. Changes in the federal funds rate can significantly impact currency pairs. An increase in interest rates generally strengthens the U.S. dollar (USD), whereas a decrease can lead to its weakening.

- Monetary Policy Statements: Alongside interest rate decisions, the Fed releases statements that shed light on its perspective on the economy, inflation, and future monetary policy actions. These statements are scrutinised by traders for indications of the Fed's future plans, influencing currency pair movements.

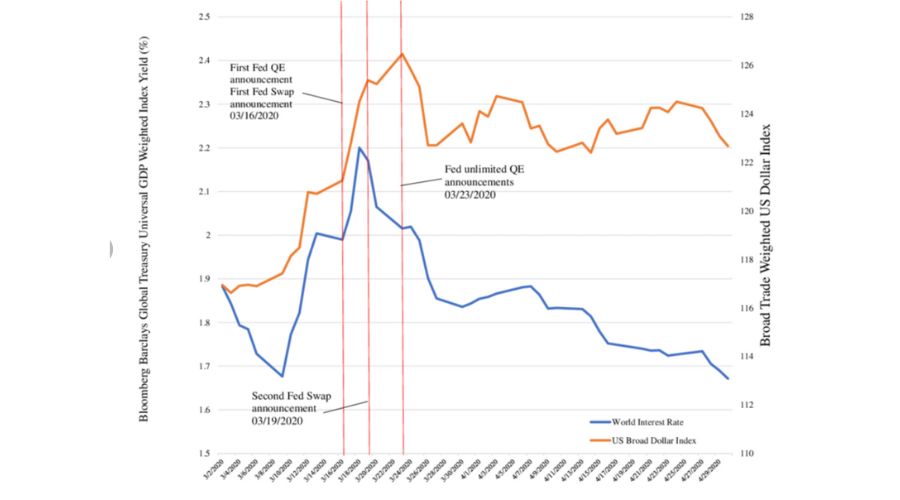

- Quantitative Easing (QE) Announcements: QE is a monetary policy tool used to increase the money supply, lower interest rates, and encourage lending during financial crises. Decisions to implement or adjust QE programme can significantly impact currency pairs. As of July 16, 2023, the Federal Reserve's balance sheet had grown to approximately 8.24 trillion U.S. dollars.

- Unconventional Policy Measures: In times of economic distress or financial crises, the Federal Reserve might resort to unconventional measures, such as asset purchases or emergency lending programmes, which can profoundly affect currency markets.

- Main Street Lending Programme (MSLP) - 3/23/20 to 12/31/20

- Term Asset-Backed Securities Loan Facility (TALF) - 3/23/20 to 12/31/20

- Primary and Secondary Market Corporate Credit Facilities (PMCCF, SMCCF) - 3/23/20 to 12/31/20

- Municipal Liquidity Facility (MLF) - 4/9/20 to 12/31/20

- Primary Dealer Credit Facility (PDCF) - 3/17/20, extended through 3/31/21

- Commercial Paper Funding Facility (CPFF) - 3/17/20, extended through 3/31/21

- Money Market Mutual Fund Liquidity Facility (MMLF) - 3/18/20, extended through 3/31/21

- Paycheck Protection Programme Liquidity Facility (PPPLF) - 4/6/20, extended through 3/31/21

For more detailed information, you can refer to the article on the St. Louis Fed's website.

- Labor Market Reports: The Fed closely monitors employment data, including non-farm payrolls and the unemployment rate. These reports can influence the Fed's policy decisions and, consequently, currency pairs.

Other Central Banks Around the World

While the Federal Reserve is a pivotal player, other central banks around the world also play crucial roles in shaping currency markets. Here are the top central banks to monitor:

- European Central Bank (ECB): Governing monetary policy for the Eurozone, the ECB's interest rate decisions and policy statements can have a substantial impact on the Euro (EUR) and its currency pairs.

- Bank of England (BoE): The central bank of the United Kingdom sets interest rates and monetary policy for the British Pound (GBP). Its actions and pronouncements can significantly sway GBP currency pairs.

- Bank of Japan (BoJ): As Japan's central bank, the BoJ's monetary policy, including interest rates and quantitative easing programmes, can influence the Japanese Yen (JPY) and associated currency pairs.

- People's Bank of China (PBoC): As China's central bank, the PBoC's monetary policy decisions and currency interventions can affect the Chinese Yuan (CNY) and have wider implications for global markets, given China's significant role in the global economy.

- Reserve Bank of Australia (RBA): The RBA's interest rate decisions and monetary policy statements can impact the Australian Dollar (AUD) and its currency pairs.

Each of these central banks can influence currency values through their policy decisions, interest rate adjustments, and other monetary tools.

#5: Unemployment Rate & Non-Farm Payrolls (NFP)

The Non-Farm Payroll (NFP) report stands as a pivotal economic indicator for the United States, encapsulating the total count of salaried workers, excluding those in farms, federal government employment, private households, and nonprofit entities. Its release often triggers significant fluctuations in the foreign exchange (forex) market, owing to its immense influence on economic perspectives.

Consequently, a vast array of analysts, traders, funds, and speculators ardently await the NFP data, speculating on its potential impact on currency values. Traditionally unveiled on the first Friday of every month, the report details the monthly variations in the number of salaried U.S. workers spanning most sectors.

A surge in these numbers might signal economic growth, albeit with underlying concerns of inflation, while a decline often points to broader economic challenges.

Value Assessment using Fundamental Analysis

The concept of value in financial markets refers to the intrinsic or true worth of a financial asset, such as a stock, bond, or currency, as opposed to its market price. Value based on performance is different from market value, which is the price at which an item can be sold to willing buyers.

To find the value of a currency pair in forex using fundamental analysis, you can follow these steps:

- Economic Indicators: Start by examining key economic indicators and data from the countries whose currencies make up the pair. This includes GDP growth, inflation rates, interest rates, employment figures, and trade balances. These indicators give you insight into the economic health of the countries involved.

- Political and Economic Stability: Assess each country's overall political and economic stability. Stable countries often have stronger currencies because they are seen as safer holdings.

- Trade and Current Account Balances: Examine each country's trade and current account balances. A country with a trade surplus (exports > imports) and a current account surplus is often associated with a stronger currency.

- Market Sentiment: Pay attention to market sentiment and news. Events like political developments, natural disasters, and geopolitical tensions can influence currency markets in the short term.

- Comparative Analysis: Compare the economic conditions and data between the two countries in the currency pair. Identify which currency appears to be stronger based on these factors.

- Technical Analysis: Combine fundamental analysis with technical analysis to get a comprehensive view. Technical analysis involves analysing price charts and patterns to identify potential entry and exit points.

Integrating Fundamental and Technical Analysis

Many traders utilise technical analysis, examining price charts, trends, and technical indicators, alongside fundamental analysis, which concentrates on economic and political factors, to inform their trading decisions. Integrating technical and fundamental analysis can create a comprehensive trading strategy.

Here are three main techniques to blend technical analysis with fundamental analysis for deeper insights:

- Combining Fundamental Analysis with Range Bound Trading

- Merging Fundamental Analysis with Breakout Trading

- Fundamental Analysis Combined with Oscillators

Combining Fundamental Analysis with Range Bound Trading

Range bound trading, often known as "channel trading", is a strategy where a trader identifies and takes advantage of price channels within which an asset, such as a currency or stock, tends to oscillate. These channels can be horizontal (showing no significant trend) or tilted. The basic idea is to buy at the lower end of the range and sell at the upper end.

Fundamental analysis, on the other hand, involves evaluating an asset's intrinsic value by examining related economic, financial, and other qualitative and quantitative factors.

The image provided showcases the U.S. Dollar Index (DXY) chart, a measure of the value of the U.S. dollar relative to a basket of foreign currencies. The chart highlights a range (channel) where the Dollar Index had been trading before experiencing a breakout.

Key observations from the image:

- Defined Range: Before the breakout, the Dollar Index was oscillating between a defined upper and lower limit, establishing a range.

- Breakout Point: Around mid-June, the Dollar Index broke out of this range, surging upward.

- Fundamental Catalyst: On the right side of the image, a table provides a historical record of the Federal Reserve's interest rate decisions. Just as the Dollar Index breaks out of its range, we see that the Federal Reserve hiked interest rates from 1.00% to 4.00% from June to Nov, 2023.

This rate hike by the Fed serves as a fundamental catalyst. Higher interest rates can attract foreign capital looking for the best return on their portfolios, which can increase demand for that country's currency. In this case, the U.S. dollar appreciated after the rate hike.

Conclusion: The Dollar Index's breakout from its range-bound trading pattern, coinciding with the Fed's interest rate hike, is a prime example of how fundamental analysis can be combined with technical strategies. By keeping an eye on major economic indicators and central bank decisions, traders can better anticipate potential breakouts from established ranges and adjust their strategies accordingly.

Merging Fundamental Analysis with Breakout Trading:

The trading chart depicts the intricate interplay of the EUR/USD currency pair, underscoring the harmony of fundamental analysis and breakout trading.

1. Upward Channel Formation:

The upward channel, marked by two parallel purple lines, has been formed between a price range of approximately 1.06500 at the base and roughly 1.11000 at its peak. This structure shows the EUR/USD pair oscillating within these bounds for a significant period.

2. Fed Rate Hike and Upward Channel Breakout:

When the Federal Reserve increased its interest rates from 5.00% to 5.25%, the EUR/USD pair exhibited a pronounced breakout from the channel. As seen on the chart, the price plummeted, breaking below the 1.08000 mark, indicating the potential strengthening of the US Dollar against the Euro.

3. Sharp Bearish Trend:

Post breakout, a stark bearish trend is evident, with the currency pair descending sharply. The most significant drop after the breakout positions the EUR/USD slightly above the 1.05998 price point. This downward trajectory suggests a strong selling momentum in the market.

4. Fundamental Triggers:

Annotations at the bottom display pivotal events: the Federal Funds Rate, a FOMC Statement, and a FOMC Press Conference. These fundamental triggers can sway currency prices, and their alignment with specific price points can provide traders with insights into potential market reactions.

Conclusion: Understanding price movements in correlation with fundamental events grants traders a layered perspective. By blending price points, technical analysis, and fundamental events, traders can potentially forecast currency behaviours with greater accuracy, paving the way for informed trading decisions.

Fundamental Analysis Combined with Oscillators

From October 7 to October 27, 2023, the gold market saw a notable shift in its trajectory, influenced by both fundamental and technical elements.

1. Geopolitical Tensions - The Driving Force:

Beginning October 7, 2023, the 2023 Israel-Hamas conflict erupted, serving as a significant geopolitical catalyst. With tensions escalating, venturers gravitated towards safe-haven assets, and gold, with its historical reputation, became a prime choice. The rising uncertainty in the global geopolitical arena amplified gold's allure.

2. Price Movements:

On October 7, gold opened at approximately $1860.00. Driven by the increasing geopolitical disturbances, it surged, reaching a peak just above $2010.00 by October 27. This sharp ascent within a span of 20 days reflects gold's capability to act as a hedge during tumultuous times.

3. Percentage Appreciation:

Over this 20-day period, gold experienced an impressive appreciation of about 8.1%. This spike in price underscores gold's protective nature during times of geopolitical volatility.

4. RSI Indicator & Market Dynamics:

Below the primary chart, the Relative Strength Index (RSI) showcases the momentum of the market. Around the onset of the conflict, the 'oversold' status of RSI, dipping beneath 30, possibly instigated further buying momentum for gold, echoing its importance during unstable periods.

Conclusion: The evolution of gold prices from October 7 to October 27, 2023, integrated with the fundamental backdrop of the Israel-Hamas conflict and technical indicators like the RSI, delivers a comprehensive perspective of the market's behaviour. Such intertwined analysis is pivotal for discerning potential market reactions and assists traders in navigating turbulent markets.

Summing Up

Fundamental analysis, serving as a navigational tool for forex traders, underscores the importance of understanding economic, social, and political factors that influence market dynamics. With ACY Securities' comprehensive platform, traders are empowered with real-time data, market insights, and innovative tools to make well-informed decisions.

From central bank announcements and key economic indicators to policy decisions and their global implications, ACY Securities provides a strong foundation for traders to harness the power of fundamental analysis, maximising their returns in the forex market.

With ACY Securities:

- Education Tailored to You: Catering to traders of all levels, we offer a diverse range of educational resources.

- Stay Informed: With us, you’re not just trading, you're making informed decisions backed by expert insights.

- Ready to Dive In? Take the leap and access a myriad of tools and insights to bolster your trading prowess. Open Your Account Now.

Explore ACY Securities' expert-led webinars to help traders navigate the world of CFDs and the forex market. Learn more about Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

Try These Next