The Impact of GDP Reports on Forex Market Movements

2025-01-02 09:39:04

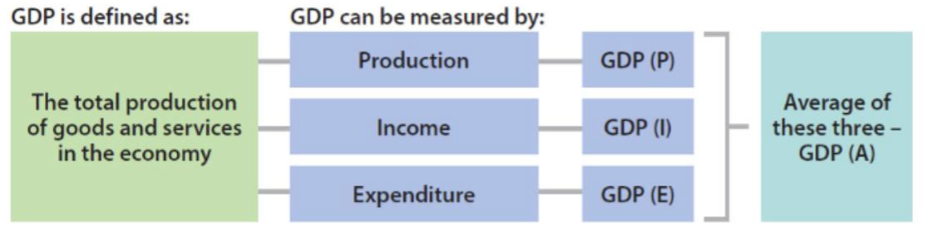

The Gross Domestic Product (GDP) is one of the most important and widely used economic indicators for measuring a country's economic performance. It reflects the total value of all final goods and services produced within a nation over a specific period, usually a quarter or a year. This article explores in depth how GDP reports influence forex market movements, how GDP affects forex trading, and its impact on economic growth trends. Examples and practical insights will help traders and audiences better understand these dynamics.

How GDP is Calculated

GDP can be measured in three main ways:

- Production Approach: This approach sums up the value added at each stage of production across the economy. It involves subtracting the cost of inputs used in the production of goods and services from their final value. For instance, if a car manufacturer sells a car for $30,000 and the cost of raw materials and components is $20,000, the value added is $10,000, which contributes to the GDP.

- Expenditure Approach: This approach sums up the value added at each stage of production across the economy. It involves subtracting the cost of inputs used in the production of goods and services from their final value. For instance, if a car manufacturer sells a car for $30,000 and the cost of raw materials and components is $20,000, the value added is $10,000, which contributes to the GDP.

- Consumption (C): Household expenditures on goods and services, such as buying groceries, clothing, or paying for utilities.

- Trading (T): Spending on capital goods, like a company purchasing machinery or building a new factory.

- Government Spending (G): Public sector expenditures, such as building roads or funding public healthcare.

- Net Exports (X - M): : The difference between exports (X) and imports (M). For example, if a country exports $500 million worth of goods but imports $300 million, its net exports add $200 million to the GDP.

- Income Approach: This metric calculates GDP as the total income earned in the economy, including wages, corporate gains, and taxes minus subsidies. Imagine a bakery that earns $200,000 annually, paying $50,000 in wages and $20,000 in taxes; this contribution is reflected in the income approach.

The basic formula is GDP = C + T + G + (X - M).

Each method theoretically results in the same value, offering different perspectives on economic activity.

How GDP is Calculated

Types of GDP

- Nominal GDP: Measured at current market prices, reflecting changes in prices and production. For example, if the nominal GDP of a country is $5 trillion and inflation is 3%, part of this growth may be due to price increases rather than increased production.

- Real GDP: Adjusted for inflation, providing a clearer view of economic growth over time. If the GDP grows by 4% but inflation accounts for 2%, the real GDP growth is 2%.

- GDP per capita: GDP divided by the population, offering a measure of average wealth levels. For instance, if a country has a GDP of $1 trillion and a population of 50 million, its GDP per capita is $20,000.

GDP Reports and the Forex Market

GDP reports play a critical role in shaping forex market trends and influencing trading strategies. Here is how:

- Impact on Exchange Rates

- Trader Confidence: A growing GDP typically signals a healthy economy, increasing demand for the country’s currency. For example, when the U.S. reported strong GDP growth in 2021, the dollar appreciated against major currencies, demonstrating how GDP forex analysis can guide decisions.

- Monetary Policy Expectations: Central banks use GDP growth as a key indicator when setting interest rates. Higher-than-expected GDP can lead to rate hikes, attracting foreign interests and boosting the local currency. For instance, in 2022, better-than-expected GDP data from Australia led to increased expectations of rate hikes by the Reserve Bank of Australia, strengthening the Australian dollar.

- Trade Balances and Economic Growth

- Volatility and Trading Opportunities

GDP impacts trade balances and international commerce. For example, China’s strong GDP growth over the past two decades has led to increased imports of raw materials, affecting global commodity currencies like the Australian and Canadian dollars. Conversely, slowing GDP growth in a major economy like the Eurozone often results in weaker demand for goods and services, impacting its currency value.

GDP announcements often trigger significant forex market volatility. For instance, when the U.S. GDP report for Q2 2022 came in below expectations, the dollar experienced sharp fluctuations. Traders who anticipated this result and positioned themselves accordingly benefited from these movements. Understanding how GDP reports influence forex markets is crucial for creating effective trading strategies.

Using GDP Data for Forex Trading Decisions

GDP reports provide critical insights for forex traders:

- Analysing Economic Growth: Strong GDP growth often correlates with .Conversely, a decline in GDP might indicate economic weakness, leading to bearish market movements. For example, a contraction in Japan’s GDP often results in Yen depreciation due to reduced trader confidence.

- Forecasting Trends: Forex trading economic data, such as GDP forecasts, helps traders anticipate market reactions. For instance, if analysts predict a GDP growth rate of 3%, but the actual figure is 4%, this positive surprise can lead to a surge in the currency value.

- Implementing Strategies: Experienced traders use GDP data to develop specific strategies for GDP announcements. By understanding the relationship between GDP growth and forex impact, they can identify financial viability opportunities. For example, a trader may set buy orders for the British pound if they anticipate strong GDP data from the UK.

Challenges and Limitations of GDP in Forex Analysis

While GDP is a vital indicator, it has limitations:

- Delayed Data Releases: GDP reports are published quarterly, making them less timely compared to other economic indicators. For instance, employment data often provides a more immediate snapshot of economic conditions.

- Broader Economic Context: GDP does not capture all aspects of economic health, such as income distribution or environmental factors. For example, a country’s GDP might grow due to increased industrial production, but this growth could come at the cost of environmental degradation.

- Global Interdependencies: The impact of GDP on forex markets is often influenced by global economic conditions and interconnected economies. For instance, a decline in U.S. GDP might weaken the dollar but strengthen the Yen, as traders seek safe-haven currencies.

Conclusion

GDP is one of the most comprehensive indicators for understanding a country’s economic performance and its role in the forex market. By analysing GDP reports, forex traders can make informed decisions and develop strategies tailored to economic trends. Whether using GDP data for forex trading or understanding its broader implications, mastering this economic measure is essential for navigating the complexities of forex market movements. Practical examples, such as anticipating GDP announcements and understanding their impact on currencies can help traders refine their strategies and achieve better outcomes.

At ACY Securities, we empower traders by providing:

- Education Tailored to You: Catering to traders of all levels, we offer a diverse range of educational resources.

- Informed Trading: We ensure you are not trading in the dark. Our expert insights and analysis support your trading decisions, helping you navigate the markets more confidently.

- Ready to Dive In? Open your account with us today and begin a journey of growth and learning. Embrace the opportunity to grow, learn, and excel in the dynamic trading landscape with ACY Securities.

Explore ACY Securities' expert-led webinars to help traders navigate the world of the forex market. Learn more about Shares, ETFs, Indices, Gold, Oil and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

Try These Next