Navigating the US Dollar Index: Tips and Strategies for Traders

2023-09-28 11:06:24

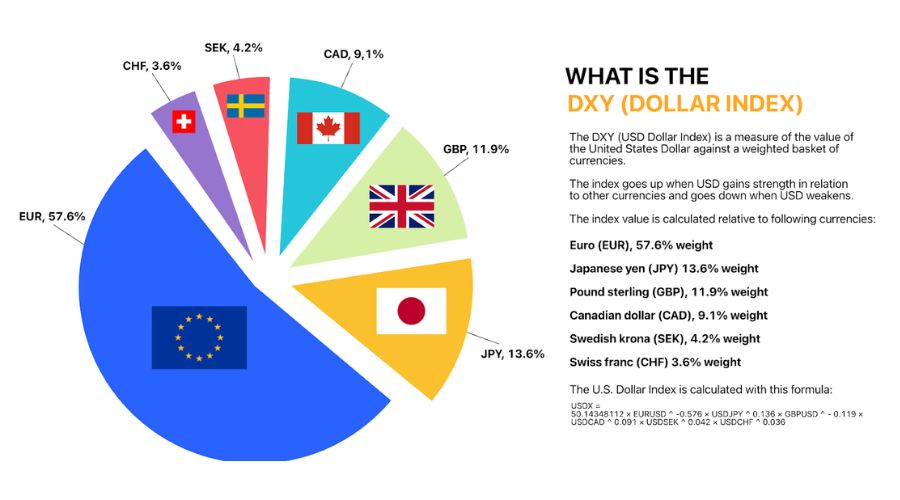

The US Dollar Index (DXY) is a pivotal measure that gauges the strength of the US Dollar relative to a basket of major foreign currencies. This basket comprises the Canadian Dollar, Euro, British Pound Sterling, Swedish Krona, Swiss Franc, and Japanese Yen. First introduced by the Federal Reserve in 1973, each currency in the DXY is assigned a specific weight. Among them, the Euro stands out with the highest weightage, reflecting its significant role in global trade.

For traders at ACY Securities, it is essential to comprehend the nuances of the DXY. This index acts as a bellwether in the financial markets, offering insights into the strength and resilience of the US economy. A higher DXY value signals a robust economic position and underscores the relative strength of the US economy.

Conversely, a lower DXY often points to prevailing economic challenges, suggesting that central bank decisions might be influenced by these underlying issues.

What is the US Dollar Index?

The US Dollar Index provides a yardstick to gauge the performance of the USD against a basket of six major global currencies. These currencies are allocated specific weights:

- Euro (EUR) at 57.6%

- Japanese Yen (JPY) at 13.6%

- British Pound Sterling (GBP) at 11.9%

- Canadian Dollar (CAD) at 9.1%

- Swedish Krona (SEK) at 4.2%

- Swiss Franc (CHF) at 3.6%

These weights are derived from the trading volumes associated with each currency, reflecting the dynamic nature of global trading activity. Once the weights are determined, the exchange rates of these currencies in relation to the USD are taken into account.

How is the US Dollar Index Calculated?

The DXY is derived through a systematic calculation that incorporates exchange rates and their associated weights. At its core, the DXY employs a geometric mean methodology, and it is important to note that the weights attributed to each currency can shift periodically.

The specific formula used to calculate the DXY is:

DXY = 50.14348112 × EURUSD^-0.576 × USDJPY^0.136 × GBPUSD^-0.119 × USDCAD^0.091 × USDSEK^0.042 × USDCHF^0.036

Historical Background

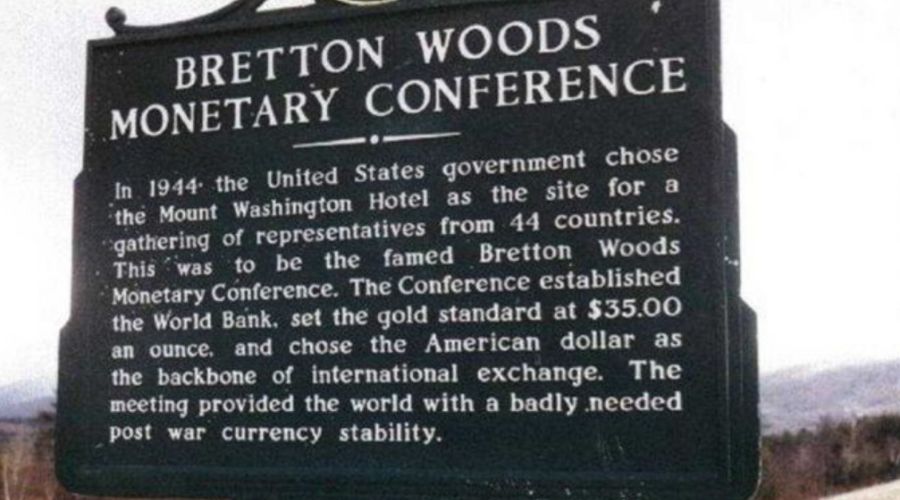

The roots of the modern monetary system can be traced back to the Bretton Woods Agreement of 1944. This accord pegged various currencies to the US Dollar, which in turn could be converted to gold at a fixed exchange rate of $35 per ounce. This arrangement laid the groundwork for the US Dollar's role as the world's primary reserve currency.

However, in 1971, this convertibility of the USD to gold was halted, an event widely known as the Nixon Shock. In response to these seismic shifts in global finance, the US Dollar Index (DXY) was established by the Federal Reserve in 1973.

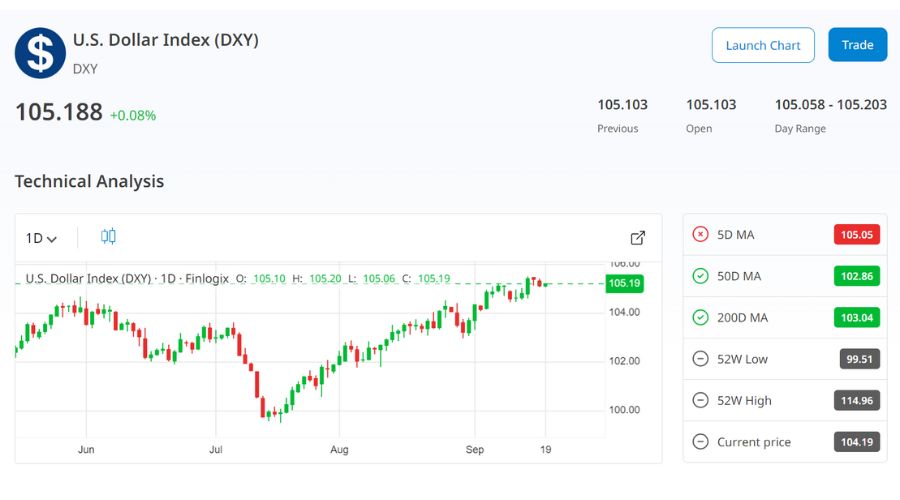

Index Overview

- Peak Value: The DXY touched its zenith at 164.72 in February 1985.

- Lowest Value: It recorded its lowest at 70.698 in March 2008.

- Recent Data: As of September 16, 2020, the DXY stood at 93.15.

- Trend Insight: Since its initiation in March 1973, there has been a discernible depreciation of the US dollar against its reference currencies.

- Key Influencers: The DXY's trajectory is shaped by:

- Inflationary or deflationary movements in the US dollar and the currencies in the basket.

- Economic dynamics, be it growth spurts or downturns, in the associated countries.

Navigating the Nuances: USDX, DX, and DXY at ACY Securities

When delving into the realm of the US Dollar Index, three acronyms might catch your attention: USDX, DX, and DXY. It is common for newcomers to scratch their heads, pondering the distinctions among them.

Understanding USDX

The term 'USDX' stands as the overarching reference for the US Dollar Index. Employing this term ensures clarity, especially when discussing the original dollar index.

Deciphering DX

The designation 'DX' carries dual significance. For futures traders, DX followed by the month and year code signifies the futures contract on the ICE Exchange. Concurrently, when looking at the value of the Dollar Index in its raw form (often termed as the cash or spot index), 'DX' stands out, devoid of any month or year code. It is worth noting, however, that some data providers may adopt alternative symbols.

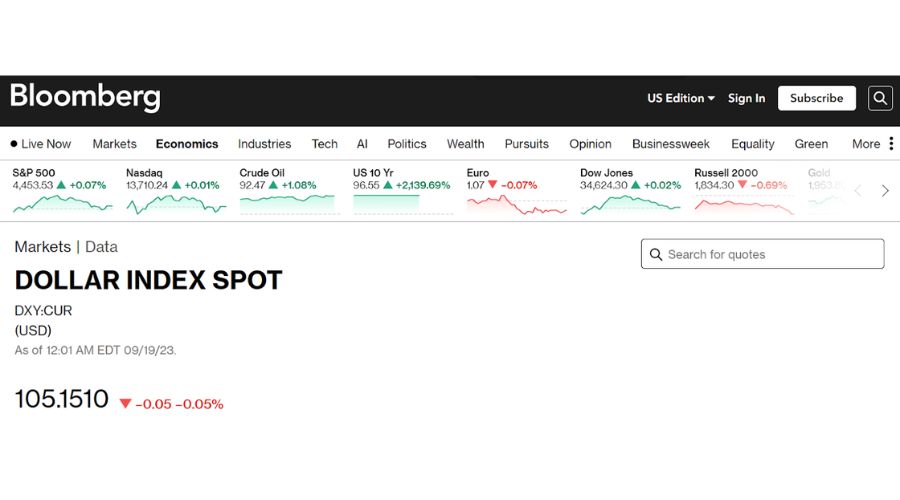

Demystifying DXY

When Bloomberg Terminal users aim to view the index, they tap into the ticker 'DXY', leading some to affectionately label the index as the "Dixie". While DXY predominantly hints at the dollar's cash or spot rate, DX, despite its future connotation, can also point towards the same rate. A tad perplexing, isn't it?

ACY Securities' Take

To maintain consistency and clarity for our users, at ACY Securities, we reference it as the "US Dollar Index (DXY)". This choice ensures that our audience, whether novice or seasoned, navigates the landscape with precision and confidence.

Interpreting Movements in the DXY

The US Dollar Index (DXY) serves as a barometer for the US dollar's value relative to its global peers.

DXY on the Rise

A climbing DXY indicates that the US dollar is appreciating against its basket of currencies. This uptrend is often associated with an increased demand for the USD, signalling a robust US economy in comparison to the global landscape. A rising DXY tends to attract higher funding inflow into the US, indicating enhanced investor confidence in USD-anchored assets. Such a scenario often correlates with controlled inflation and a resilient US economy.

Furthermore, during global economic uncertainties, the USD often emerges as a sanctuary for speculators, amplifying its value even further.

Declining DXY

Conversely, a dip in the DXY denotes a depreciation in the value of the US dollar. Such a downturn might hint at potential vulnerabilities in the US economy. During these phases, foreign fundings might become scanty, with investors displaying diminished interest in US-centric assets.

Several factors can sway the DXY, including but not limited to:

- Interest rates: Lower interest rates in the US can correlate with a declining DXY.

- Economic indicators: Pessimistic data can dent trader sentiment and thereby the value of the USD.

- Geopolitical events: Events like trade conflicts can spur uncertainty, prompting traders to shy away from the dollar, leading to its devaluation.

In essence, the movement of the DXY encapsulates a myriad of economic, political, and global influences, making it a critical tool for traders, economists, and policymakers alike.

The Interplay Between DXY and Various Financial Instruments

The DXY has a strong correlation with various financial instruments, including commodities and the stock market. Let us take a look at them one by one:

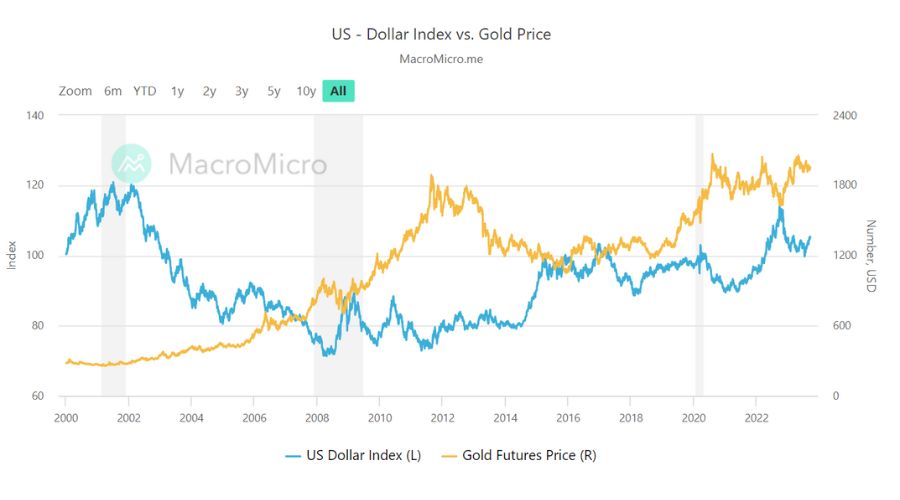

DXY and Gold

The relationship between the DXY and gold prices is predominantly inverse. As the DXY climbs, gold prices often retreat, prompting traders to pivot towards the USD as a preferred financial allocation. Conversely, during periods of economic uncertainty or when the DXY wanes, gold, as a traditional safe-haven asset, witnesses an uptick in demand. Traders gravitate towards gold as a hedge against currency devaluation, safeguarding their assets.

On the chart, there is a negative correlation between the US dollar and commodities, such as gold. When the USD price rises, the price of gold drops, and vice versa.

DXY and Commodities

Commodities, notably oil, priced in dollars, are significantly influenced by fluctuations in the DXY. As the DXY ascends, these commodities effectively become pricier for non-US purchasers due to the strengthened dollar, often curbing demand and leading to declining prices.

In contrast, when the dollar weakens, commodities like oil become more appealing to foreign buyers, pushing prices upward.

DXY and Equity Markets

The stock market is profoundly sensitive to the ebb and flow of the USD's value. A buoyant DXY tends to draw traders to US equities, channelling substantial funding into the American financial system. This inflow benefits domestic companies as the allure of their stocks rises. Conversely, international firms can face headwinds when repatriating their earnings; a robust USD diminishes their revenues when converted back to dollars.

Trading the US Dollar Index

Traders can generate returns by trading the DXY, which is available in various financial instruments like futures contracts, ETFs (Exchange Traded Funds), etc. The Intercontinental Exchange (ICE) offers a futures contract, which allows traders to easily trade the DXY at a predetermined time and price. Although there is always a risk factor associated with any trading instrument, future contracts provide traders with the opportunity to hold a large position with low capital.

Traders can take advantage of ETFs such as Invesco DB US Dollar Index Bullish Fund or employ strategies like leverage trading to gain potential benefits. CFD (Contract for Differences) trading offers leverage that helps traders benefit from strong and weak markets.

Benefits of Monitoring the US Dollar Index for Traders

For forex traders, the DXY serves as a barometer, offering insights into the vitality of the US currency. It empowers them to speculate on market movements and discern overarching trends. A rising DXY usually heralds a robust USD, while a declining value suggests potential softness in the currency. Keeping abreast of the DXY is paramount for traders. The index offers a snapshot of anticipated market movements based on the USD's strength or weakness.

By closely monitoring it, they gain a clearer understanding of the US economy's health and its standing in the global financial arena.

Conclusion

The DXY stands as an invaluable metric, offering traders profound insights into the intricate tapestry of global trading and financial markets. As the USD remains a preferred venture haven, understanding the DXY dynamics becomes crucial in forecasting USD's market movements. Furthermore, the flexibility to trade the DXY through diverse financial instruments amplifies its importance. Beyond its utility for traders, the DXY also has ripple effects on global commodity pricing.

Take the Next Step with ACY Securities

For those looking to delve deeper into trading the DXY or expanding their trading knowledge, ACY Securities provides a suite of educational resources and expert-led webinars tailored to all skill levels. Learn more about Indices, Gold, Oil, and other tradable instruments we have on offer at ACY Securities.

You can also explore our MetaTrader 4 and MetaTrader 5 trading platforms including access to our free MetaTrader scripts. Then try out your own trading strategies on your own free demo trading account.

Try These Next