What is Leverage and How to Use Leverage in CFD Trading?

2023-08-23 16:24:11

Leverage trading is the secret weapon of many savvy traders, acting as a financial magnifying glass that amplifies both potential gains and associated risks. By enabling traders to enter large positions without committing the full capital upfront, leverage becomes an essential tool in modern trading platforms, especially when coupled with trusted brokers like ACY Securities.

Picture this: You aspire to buy a house. Instead of shelling out the entire sum, you pay a small deposit and borrow the rest. This principle resonates with leverage trading in financial markets.

The Mechanics:

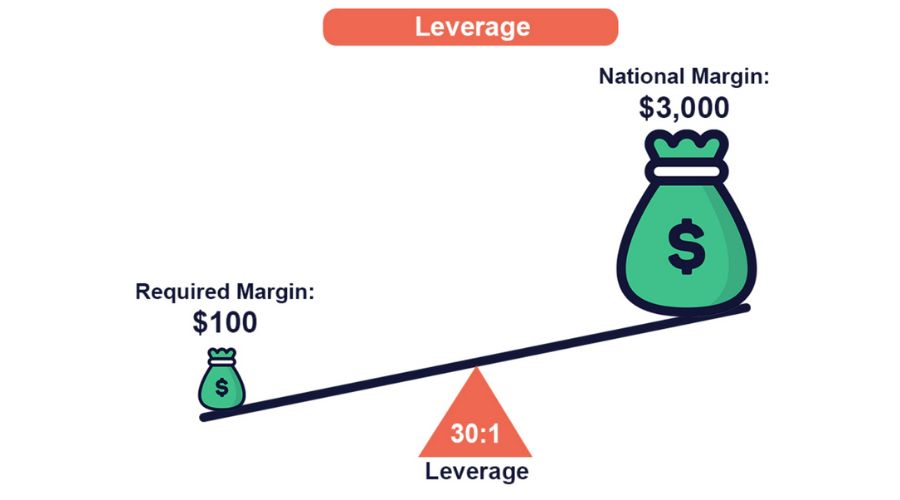

- Concept: Leverage is expressed as a ratio. For example, with a 10:1 leverage, every $1 in your pocket allows you to command $10 in the market.

- Application with ACY Securities: Imagine you're interested in taking a $10,000 position in an asset that is currently experiencing a strong trend, but you only have $1,000 of your own funds. With leverage, you can control a larger position than your available funds would normally allow. In this scenario, you're effectively gaining access to an additional $9,000 from the broker, allowing you to take advantage of the financial opportunity even though you don't have the full amount upfront.

- Outcome: Returns or detractions are calculated based on the full $10,000 position. A 10% appreciation rewards you with $1,000 (a 100% gain on your initial stake). Conversely, a 10% dip erases your initial capital.

Layman’s Takeaway:

Consider leverage as a strategically positioned ladder, letting you pluck apples from a towering tree without waiting for nature's course. But, like any ladder, it needs stability. With ACY Securities' reputable trading platform, you get the leverage's benefit alongside tools for informed decisions. While opportunities are abundant, a strategic approach with due diligence is paramount.

To learn more about leverage trading, please click on the following link.

Defining Leverage Trading

Leverage trading acts as a magnifying glass for traders, magnifying both potential returns and associated risks. Often represented as ratios like 10:1, 100:1, or even 500:1, leverage allows traders to control larger positions with a relatively small capital.

For instance, leveraging $1,000 at a 100:1 ratio empowers a trader to manoeuvre a $100,000 position. While this tool is prevalent across various markets - be it stocks, commodities, ETFs, treasuries, or predominantly in foreign exchange - it is crucial to wield it judiciously.

Yet, leverage is akin to a double-edged sword. Its allure lies in the possibility of amplified profits, but the inherent risks of magnified losses cannot be sidelined. Thus, while leverage can augment your trading prowess, its potential pitfalls demand attentive handling.

How Leverage Trading Operates

Imagine the process of acquiring a home with the aid of a mortgage. Typically, you would front a down payment and the bank covers the remaining amount. In leverage trading, the assets are usually stocks or currencies rather than homes. Similarly, as with mortgages, there's interest on the borrowed sum.

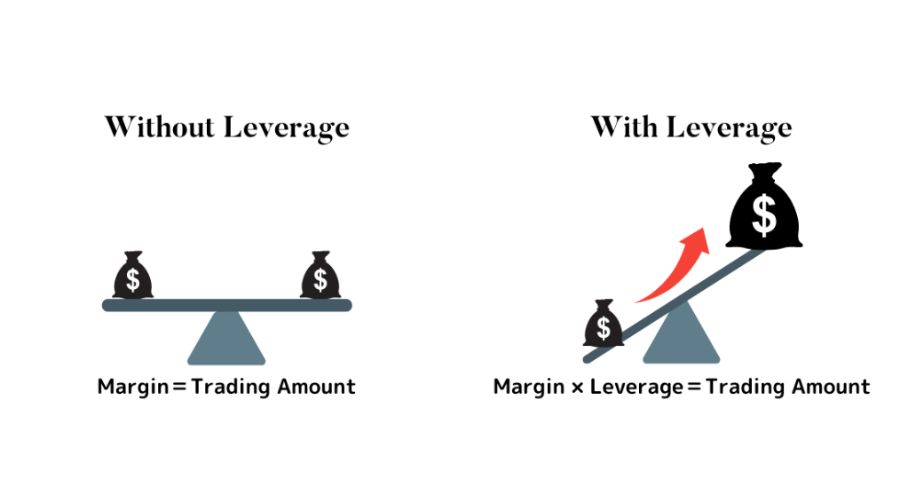

The beauty of leverage lies in the minimal amount of upfront funds required, often referred to as the 'margin' or 'deposit'. This deposit can potentially grant control over assets valued exponentially higher. Think of it as leveraging a down payment to procure a property worth multiple times more. The catch? If the asset's value escalates, so do your gains. On the other hand, a decline can result in losses, potentially exceeding your initial margin.

Like any financial endeavour, leverage trading is accompanied by costs, including brokerage fees, and spread differences. Furthermore, factors like market volatility and liquidity are critical considerations. Hence, before venturing into the world of leverage trading, comprehending associated expenses and inherent risks is paramount.

Terms to Know If You Want to Trade with Leverage

- Leverage Trading: This allows traders to control a larger position with a comparatively smaller amount of money. Represented in ratios like 10:1 or 100:1, it is akin to amplifying your position with a powerful magnifying glass.

- Marginal Trading: Envision making a small down payment for a significant purchase. With marginal trading, you might buy an asset worth $1,000 by only putting down $100 as collateral. It is a small stake that enables a much larger transaction.

- Margin Call: A margin call is the financial market's way of signaling a trader that they need to add more funds to their account. Think of it as a game alerting you to top up your credits. It is triggered when the market moves against your position, nudging you to deposit additional capital to maintain your trade.

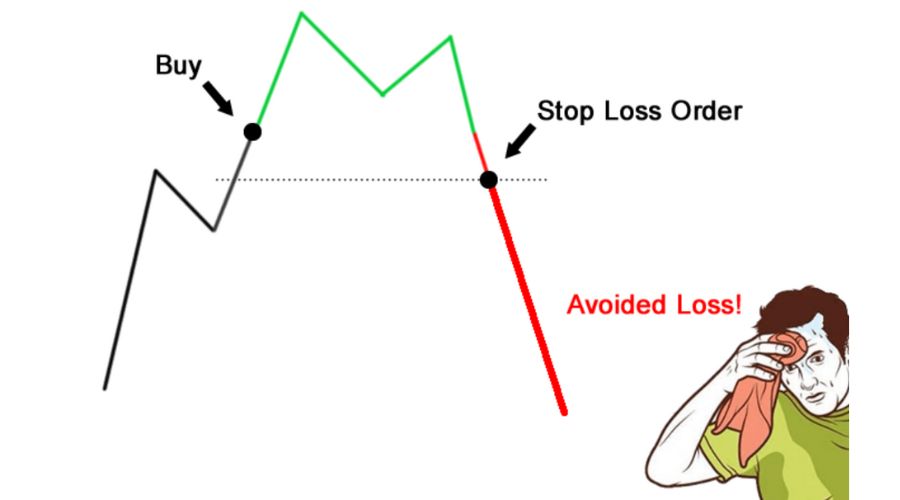

- Stop-Loss Order: This is a trader's safeguard. By pre-setting a level at which your trade will automatically close, you protect yourself from larger potential losses. Imagine having a contingency plan ready to deploy when market conditions become unfavourable.

- The Spread: This represents the difference between the bid (buy) and ask (sell) prices of an asset. The larger the spread, the greater the gap between buying and selling prices, often hinting at heightened risk or lower liquidity for that asset.

Margin Trading: This is a method that permits traders to amplify their market positions by furnishing a deposit, termed as 'margin'. The margin acts as a guarantee for the loaned funds.

Leverage: Can be visualised as the magnifying power given by brokers, allowing traders to control positions far greater than their actual capital input. While this can elevate potential returns, it amplifies risks equivalently. The margin requirement is the safety net deposit you offer up.

Think of leverage as a loan enhancing your trading prowess, but always bear in mind the heightened risks. Approach leverage with due diligence.

Dive into Leveraged Products:

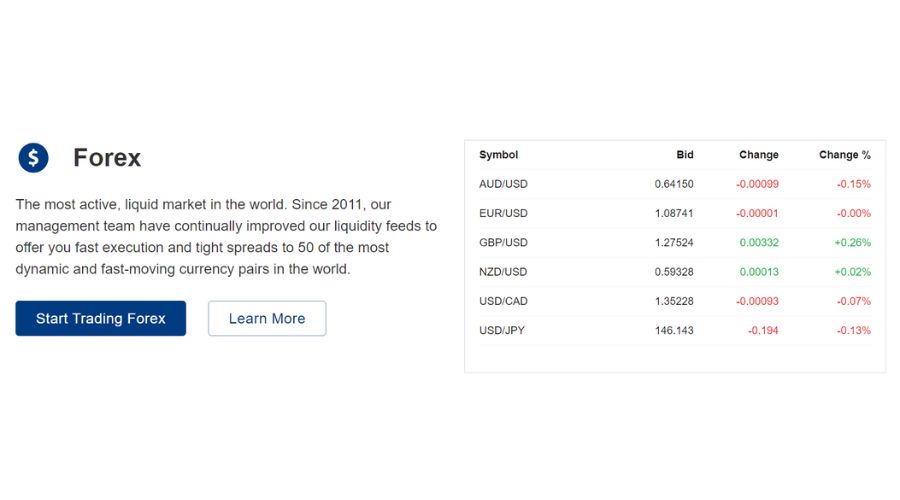

1. Forex Market: As the largest financial arena on the globe, the forex market facilitates currency trades. Its allure lies in the extensive leverage it offers, permitting traders to command vast positions. Operating around the clock from Monday to Friday, the Forex market's dynamism abounds with chances to capitalise on shifting currency values.

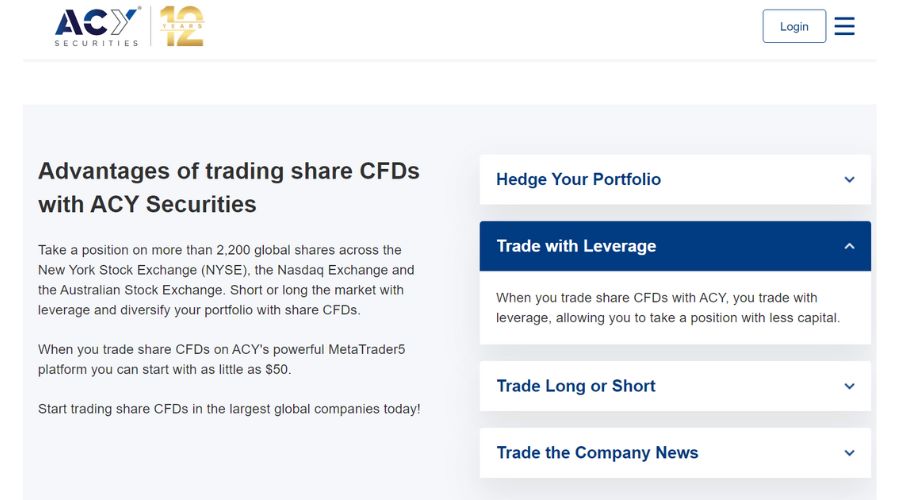

2. Contract for Differences (CFDs): CFDs are a hit with adept traders because they grant the ability to leverage vast positions without possessing the underlying asset. In CFDs, the game is all about astute predictions of price swings, eschewing actual asset ownership.

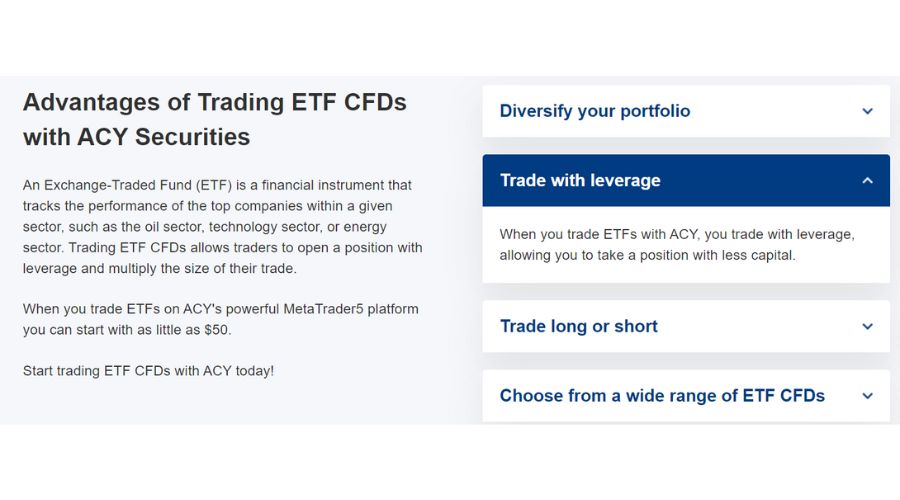

3. Exchange-Traded Funds (ETFs): Envision ETFs as diverse baskets of financial instruments available for purchase or sale on stock exchanges, akin to individual company shares. However, a word of caution: leveraged ETFs can be volatile and may not be suited for protracted investment horizons.

Pros and Cons of Leverage Trading

Warren Buffett remarked, "When combined, ignorance and leverage can produce captivating outcomes." Indeed, while leverage trading is a formidable tool for traders, it is also a double-edged sword.

Advantages of Leverage Trading:

1. Magnified Returns: The core allure of leverage is its capability to supercharge returns. For instance, with a 100:1 leverage, a mere $100 capital gives you a foothold in a $10,000 position. This scalability ensures that you do not need significant funds to utilize advantageous opportunities.

Drawbacks of Leverage Trading:

2. Amplified Losses: The other side of enhanced gains is magnified losses. Markets are unpredictable, and should a leveraged trade swerve off-course, the fallout can be severe. This might even trigger a margin call, demanding additional funds to sustain your position.

3. Heightened Risk: Leveraged trading inherently carries increased risk. It is vital to manoeuvre it judiciously to sidestep potential hazards.

Markets Apt for Leverage

Leverage can be used in various markets such as real estate, forex, stocks, commodities, indices, bonds, CFDs, and ETFs. However, adding leverage to already volatile markets can be risky. Therefore, it is important to have an informed strategy for safe and successful leveraged trading.

A Glimpse into Leverage Trading

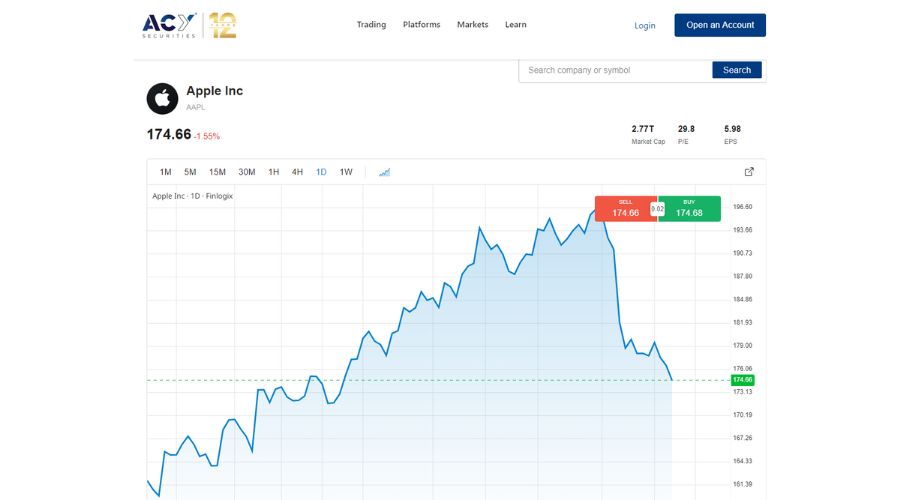

- Imagine holding $1,000, and you are bullish about Apple shares. Through leverage trading, that amount can commandeer a more considerable chunk of Apple.

- With 100:1 leverage, you control assets worth $100,000. Should Apple stock surge from $200 to $250, your leveraged position nets a whopping $25,000, a stark contrast to the modest $250 without leverage.

- Conversely, any downturn in stock value proportionally intensifies losses. A dip to $150 could mean a $25,000 setback with leverage, compared to a $250 decline with a regular position.

Hence, leverage promises amplified gains but at the cost of escalated risks. Astute judgment and readiness for possible losses are crucial when wielding leverage in any financial arena.

How Much Leverage Is Right?

Selecting appropriate leverage hinges on various considerations. Whether you opt to trade within your means or stretch your boundaries, it is paramount to ground decisions on sound research, expert counsel, and reputable data, steering clear of raw emotions or mere hunches.

For novices, beginning with minimal leverage is prudent. This eases you into the intricacies and overheads of trading without diving into deep waters prematurely. By incrementally progressing, you can fortify your trading acumen while keeping excessive risks at bay.

The Double-Edged Sword of Leverage

Consider this: trading with $1,000 versus $100,000 paints starkly contrasting pictures. With leverage, traders can amplify positions 10x, 50x, or even 100x relative to their initial capital. While this boosts potential returns, it also scales up the susceptibility to losses.

When leveraged trades pay off, they indeed offer impressive returns, sidestepping the spectre of margin calls. But caution is essential. Starting with conservative leverage, mastering trades, and finetuning strategies are the stepping stones to mitigating risks while maximizing gains. Balancing risk and reward is the essence of astute leverage trading.

Managing the Risks of High Leverage

Every trading venture grapple with uncertainties, which are magnified when factoring in high leverage. However, an arsenal of tools exists to circumvent these risks. Among them, the stop-loss order stands out.

A stop-loss order, a linchpin in risk management, offers traders the leeway to exit positions once specific price thresholds are breached automatically. Whether it is a fixed stop-loss or one hinged on market indicators like support and resistance levels, it is pivotal in capping potential downturns.

In summary, the integration of a stop-loss order in trading portfolios cannot be overstated. It bestows traders with a robust safety net, curtailing potential losses and ensuring a more controlled and educated trading voyage.

Top Leverage Trading Platforms

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are among the most widely recognised platforms for leverage trading, supporting up to 500:1 leverage. Here are some features that stand out:

- Real-time Price Charts: Stay updated with the market's pulse, monitoring price movements as they happen.

- Technical Indicators: Enhance decision-making with a suite of advanced tools analysing market trends.

- Market Insights: Gain deeper perspectives from professionals to better understand the trading environment.

- Risk Management Tools: Safeguard your assets and navigate risks seamlessly.

For those new to the platforms or wishing to test out their strategies, MT4 and MT5 offer demo accounts. This facilitates a hands-on approach without real financial commitments.

Finding The Right Broker: Key Considerations

Selecting a broker is not merely about finding someone to execute trades; it is about ensuring a partnership that aligns with your trading aspirations. When in the market for a broker, weigh these factors:

- Regulation: Choose a broker overseen by top-tier regulatory bodies. This adds an assurance of safety and credibility.

- Reputation: Scour through trader reviews and testimonials. A broker's standing in the community often speaks volumes.

- Platform Support: Ensure the broker provides support for your preferred trading platform, be it MT4, MT5, or any other.

- Risk Management Tools: Protecting your capital is paramount. The availability of risk management tools should be a consideration.

- Demo Account: Especially beneficial for newcomers, demo accounts provide a sandbox environment to hone skills without real monetary risks.

At ACY Securities, we provide valuable educational resources and expert-led webinars to empower traders with the knowledge and skills needed to navigate liquidity challenges successfully. Join us to deepen your understanding of forex liquidity and enhance your trading strategies. Experience the benefits of trading in a liquid market with ACY Securities today.