How to Use Sentiment Analysis in Trading

2025-03-06 14:10:27

Trading isn’t just about numbers and charts—it’s about people. Behind every market move, there are traders making decisions based on their emotions, biases, and perceptions of risk and reward. This collective mindset is what we call market sentiment and understanding it can provide a powerful edge in trading.

Sentiment analysis helps traders gauge the overall attitude of market participants—whether they are feeling optimistic (bullish) or pessimistic (bearish). More importantly, it helps traders identify when the majority is likely to be wrong, which can create opportunities to trade against the crowd.

In this guide, we will cover:

- How to use sentiment analysis for trading decisions

- The best sentiment indicators for day trading

- How to combine sentiment analysis with technical analysis

- Using social media sentiment for stock and forex trading

By the end, you’ll have a solid foundation in using sentiment analysis to anticipate market moves and improve your trading strategy.

What is Market Sentiment?

Market sentiment represents the overall emotional state of traders at a given time. It reflects whether most market participants are feeling confident and buying (bullish sentiment) or fearful and selling (bearish sentiment).

This psychological factor is crucial because markets tend to move in the opposite direction of extreme sentiment. When most traders are overwhelmingly bullish, it often means that most buyers are already in the market, leaving little room for further upside. Conversely, when most traders are extremely bearish, a potential reversal may be near as selling pressure exhausts itself.

Sentiment analysis helps traders:

- Identify potential turning points in the market when sentiment reaches extreme levels.

- Avoid trading with the herd when market emotions become one-sided.

- Find high-probability trade setups by combining sentiment with other forms of analysis.

To effectively analyse sentiment, traders rely on specific indicators and tools that measure how different market participants are positioned.

Best Sentiment Indicators for Day Trading

For short-term traders, sentiment data needs to be real-time and actionable. By understanding where most of traders are positioned, you can decide whether to align with or trade against the crowd.

1. Finlogix Free Trading Sentiment Tool

One of the best free sentiment tools available is the Finlogix Sentiment Tool. This tool provides real-time data on the percentage of traders who are long (buying) or short (selling) across various forex pairs, indices, and commodities.

This type of sentiment analysis is particularly useful because when sentiment is extremely one-sided, experienced traders look for opportunities to take the opposite position.

Example on USD/JPY where I would be looking to Short based on the majority been long

How to use it effectively

- Extreme sentiment signals reversals: When 60% or more traders are on one side (long or short), it may indicate that the market is due for a correction.

Real Example on USDJPY:

We can clearly see that the trend of the market is going down, therefore we would be in profit if we follow the signal from the sentiment tool.

- Monitor shifts in sentiment: If the sentiment ratio suddenly flips (e.g., from 70% long to 60% short), it can signal a significant momentum shift in the market and maybe a good exit signal depending on the fundamentals factors as well

- Combine with technical analysis: Use sentiment data to confirm support/resistance levels or trend exhaustion before entering a trade.

For example, if 90% of traders are long on EUR/USD, it suggests that most retail traders are buying, and there may be limited upside. A contrarian trader would start looking for technical signals to short the pair, anticipating a reversal.

2. Commitment of Traders (COT) Report

The COT report, published weekly by the Commodity Futures Trading Commission (CFTC), provides insight into the positioning of three types of traders:

- Commercial Hedgers: Large institutions and businesses using futures for hedging.

- Large Speculators: Hedge funds and professional traders who trade for profit.

- Retail Traders: Individual traders, who often follow trends and get caught at market extremes.

The most useful insights come from observing large speculators, as they typically drive market trends. Retail traders, on the other hand, tend to be wrong at major turning points, making their positioning a potential contrarian signal.

How to Access and Download the COT Report

The official source for the COT report is the CFTC website. Here’s how you can access it:

Step 1: Go to the CFTC Website

- Visit: CFTC official website

Step 2: Choose the Right Report Type

There are four versions of the COT report:

- Legacy Report – The original report with fewer trader categories.

- Disaggregated Report – Provides a detailed breakdown of trader positions.

- Supplemental Report – Focuses on specific contracts.

- Traders in Financial Futures Report – Useful for forex and financial markets.

For most traders, the Disaggregated Report or the Legacy Report is the most useful but it will depend on what is the end function you want.

Step 3: Download the Report

- Click on the report format you want:

- Short format (summary data)

- Long format (detailed breakdown)

- You can download it as a CSV file or view it as a web page.

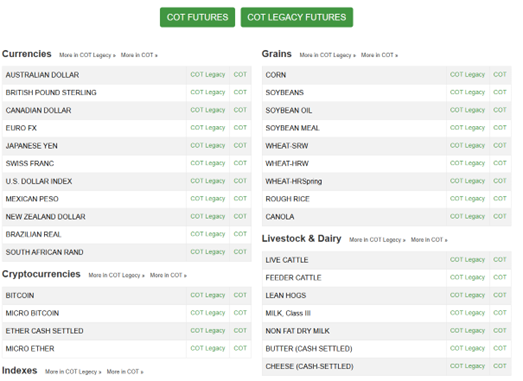

Alternative: Using Third-Party Websites

If you find the official report too complex, you can use third-party websites that present the data in a more user-friendly format:

- Tradingster.com – Interactive COT charts

- BarChart.com – Visual COT data

These platforms allow you to analyse COT data visually without manually processing the raw files.

How to Interpret the COT Report

The COT report categorises market participants into three main groups:

1. Commercial Hedgers (The Smart Money)

- These are large institutions (e.g., banks, corporations, commodity producers) that use futures to hedge against price movements.

- They are not trading for profit but to manage risk.

- Example: A gold mining company might sell gold futures to lock in prices and protect against a drop in gold prices.

Why it matters: Commercial hedgers often take positions opposite to market trends because they are hedging. Their activity can signal market turning points.

2. Large Speculators (The Trend Setters)

- These include hedge funds and institutional investors who trade for profit.

- They typically follow trends and drive major market moves.

- Example: If hedge funds are building long positions in crude oil futures, it indicates they expect higher oil prices.

Why it matters: Large speculators' positioning can confirm the strength of a trend. If they start unwinding their positions, it could signal a trend reversal.

3. Small Speculators (Retail Traders)

- These are individual traders and smaller firms trading for speculative purposes.

- They often get caught on the wrong side of the market, especially at extremes.

- Example: If small speculators are heavily short EUR/USD, it may indicate an upcoming reversal to the upside.

Retail traders tend to be wrong at key market turning points, so extreme positioning can be a contrarian signal.

Combining Sentiment Analysis with Technical Analysis

Sentiment analysis is most effective when used alongside technical analysis. Here’s how traders can combine the two:

- Use sentiment to identify market direction, and technical analysis to time entries.

- If sentiment is overwhelmingly bullish, check for resistance levels where price may reverse.

- If sentiment is overwhelmingly bearish, look for support levels for potential long trades.

- Look for sentiment divergences.

- If price is making new highs, but sentiment is turning bearish, it may signal a weakening trend.

- If price is making new lows, but sentiment is turning bullish, it could indicate an upcoming reversal.

- Use sentiment shifts as trend confirmation.

- If sentiment moves from extreme bearish to neutral, it can signal the start of an uptrend.

- If sentiment moves from extreme bullish to neutral, it can signal the start of a downtrend.

Using Social Media Sentiment for Trading

In today’s world, markets don’t just react to news reports and economic data—they also respond to social media sentiment. A single post from an influential trader or CEO can trigger massive price movements.

How to monitor social sentiment

- Twitter/X: Influential traders, hedge fund managers, and CEOs often share insights.

- Google Trends: Rising search interest in a stock or currency pair can indicate growing market attention.

- Reddit & Discord: Meme stocks and crypto movements often start in online communities.

How to trade social sentiment

- If a stock suddenly trends on Twitter, it could signal an upcoming move—but watch for overreaction.

- If Google searches for “buy gold” spike, it may indicate increasing retail interest, which could mean the trend is overextended.

Social sentiment can create trading opportunities, but it should always be verified with technical and fundamental analysis, like this example of an opportunity on BTC, when trump published that he “Loves Bitcoin” what do you think it could possibly happen? Bitcoin goes UP!!

The Post

The Effect

Sentiment analysis is a powerful tool that helps traders understand market psychology and position themselves ahead of major moves.

Key takeaways:

- Extreme sentiment levels often signal reversals.

- Use Finlogix and the COT report to gauge market positioning.

- Combine sentiment with technical analysis for precise trade execution.

- Monitor social media for sentiment-driven price movements.

By integrating sentiment analysis into your strategy, you can avoid emotional trading and make more data-driven decisions.

Want to see sentiment analysis in action?

Join Luca every Wednesday for a free live webinar where he walks through a complete sentiment-based trading strategy using real market examples. You’ll learn how to interpret sentiment data, identify trade setups, and apply the tool to your own trading approach.