Best Forex Pairs with Lowest Spreads Weekly Review - 11th August to 15th August 2025

2025-08-18 17:26:23

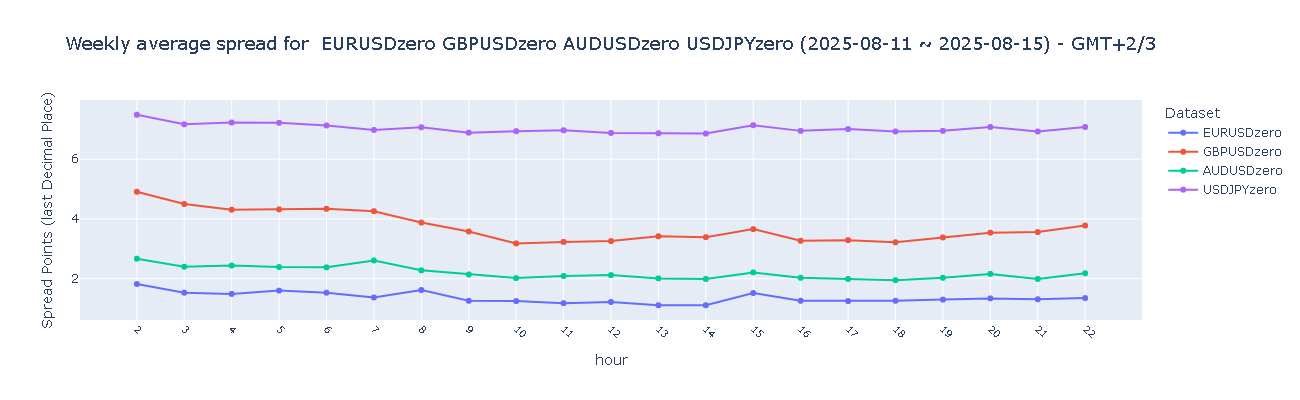

Chart I. Weekly Average Spread for Major Currency Pairs (EURUSD, GBPUSD, AUDUSD, USDJPY)

(Note: The below chart excludes the spread data of the first two hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

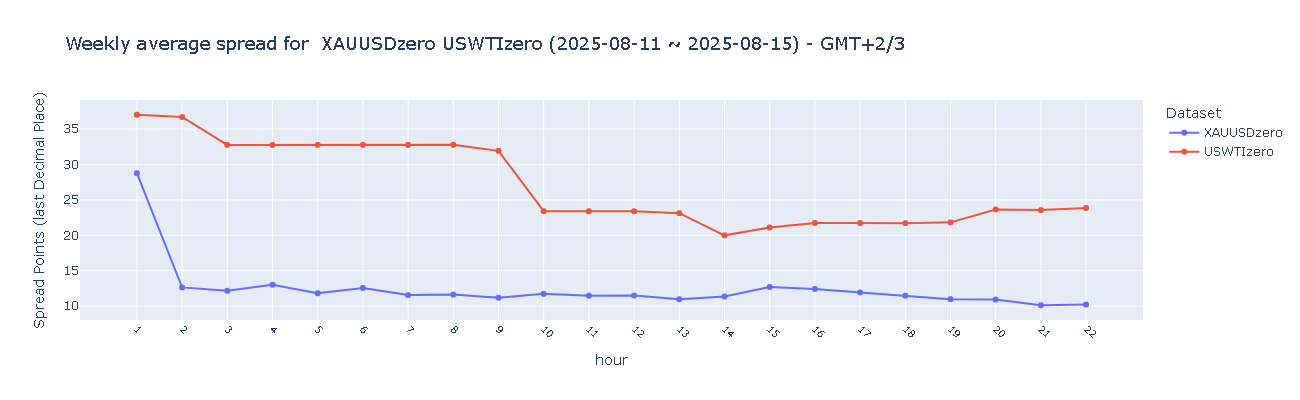

Chart II. Weekly Average Spread for Gold and US Crude Oil (XAUUSD, USWTI)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

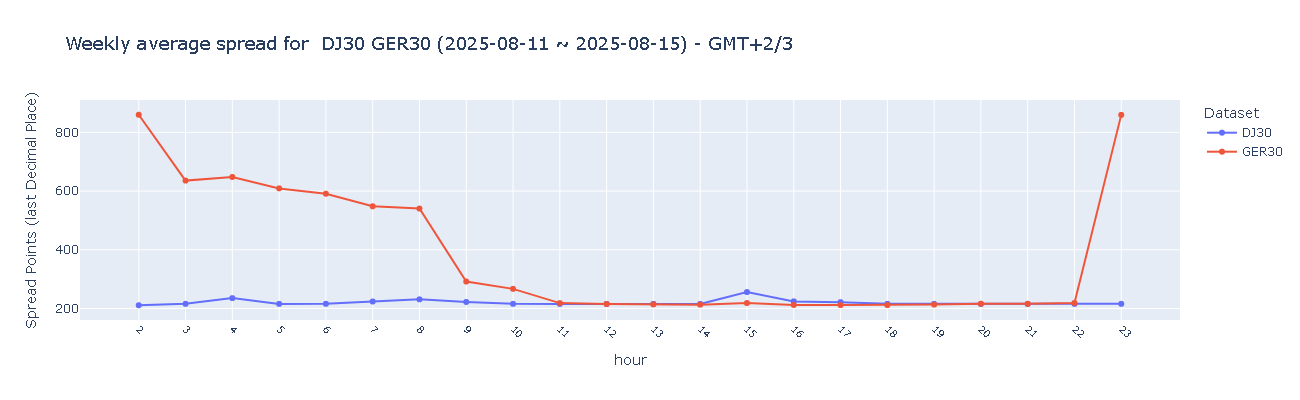

Chart III. Weekly Average Spread for German 30 Index and Dow Jones 30 Index (GER30, DJ30)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

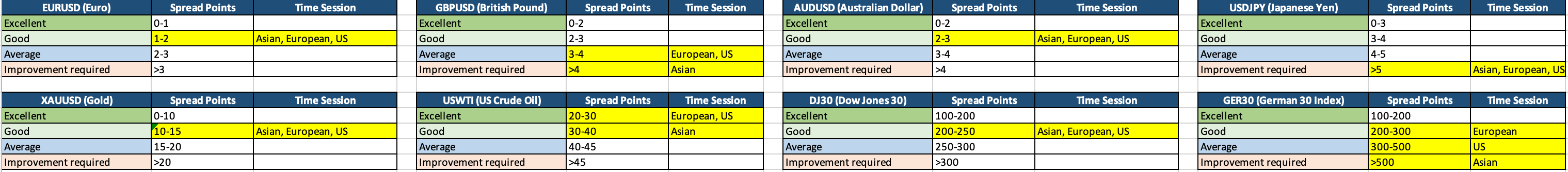

Weekly Average Spread Review Results:

Majors Currency Pairs:

EURUSD (Euro) maintained Good spreads (1–2 points) across Asian, European, and US sessions, reflecting consistently favorable trading conditions throughout global markets.

GBPUSD (British Pound) average (3–4 points) during European and US sessions, and reached Improvement Required (>4 points) in the Asian session, showing less favorable conditions in Asia.

AUDUSD (Australian Dollar) maintaining Good spreads (2–3 points) across Asian, European, and US sessions. Performance remained stable overall.

USDJPY (Japanese Yen) recorded Improvement Required spreads (>5 points) across Asian, European, and US sessions, indicating persistent volatility and higher trading costs across all trading hours.

Gold and US WTI Oil:

XAUUSD (Gold) with Good spreads (10–15 points) across Asian, European, and US sessions.

USWTI (US Crude Oil) achieved Excellent spreads (20–30 points) in the European and US sessions, and Good spreads (30–40 points) in the Asian session.

Dow Jones 30 and German 30 Indices:

DJ30 (Dow Jones 30) maintained Good spreads (200–250 points) across Asian, European, and US sessions, showing strong and steady liquidity globally.

GER30 (German 30 Index) maintained Good spreads (200–300 points) during the European session, widened to Average (300–500 points) in the US session, and deteriorated to Improvement Required (>500 points) in the Asian session, highlighting strong time-zone dependency in trading conditions.

延伸阅读