Best Forex Pairs with Lowest Spreads Weekly Review – 31st March to 4th April 2025

2025-04-10 16:24:42

Chart I. Weekly Average Spread for Major Currency Pairs (EURUSD, GBPUSD, AUDUSD, USDJPY)

(Note: The below chart excludes the spread data of the first two hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Chart II. Weekly Average Spread for Gold and US Crude Oil (XAUUSD, USWTI)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Chart III. Weekly Average Spread for German 30 Index and Dow Jones 30 Index (GER30, DJ30)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

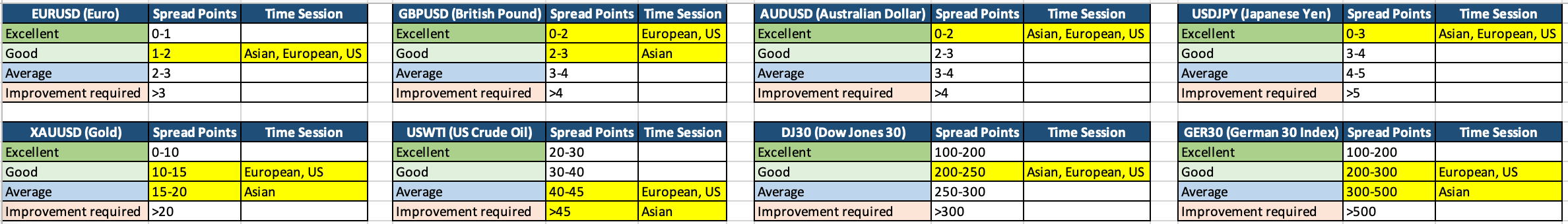

Weekly Average Spread Review Results

Majors Currency Pairs:

All major FX pairs (EURUSD, GBPUSD, AUDUSD, USDJPY) maintained Excellent to Good spread levels throughout the week. AUDUSD and USDJPY stood out with Excellent spreads across all sessions, while EURUSD and GBPUSD showed slight variations but remained within acceptable levels.

Gold and US WTI Oil:

Gold (XAUUSD) experienced Good spreads during European and US sessions, but widened to an Average level during the Asian session, indicating higher trading costs in lower liquidity hours.

USWTI Oil showed its worst performance during the Asian session, where spreads exceeded 45 points (requiring improvement). Conditions improved to Average during the European and US sessions, though it did not reach optimal levels.

Dow Jones 30 and German 30 Indices:

DJ30 (Dow Jones 30) delivered Good spreads across all sessions, consistently ranging between 200–250 points. However, it did not meet the Excellent criteria, suggesting room for improvement in spread efficiency.

GER30 (German 30 Index) achieved Good spreads during the European and US sessions, but performance dropped to Average in the Asian session, aligning with reduced activity during off-peak hours.