USD Weakness Continues: Technical Outlook Signal Further Downside

2025-02-14 09:45:32

Overview

- USD on Bearish Stance: Despite positive CPI numbers, the weak employment rate led to a bearish continuation.

- EUR & GBP Momentum: Continued upside with EUR approaching 1.05331 and GBP breaking above 1.25497.

- AUD & NZD Strength: AUD remains bullish towards 0.63305, while NZD targets 0.57232 amid USD weakness.

USD on a Bearish Stance, No Bullish Follow-Through

The USD remains bearish as positive CPI data failed to ignite bullish momentum. This can be attributed to a weak employment rate, undermining any bullish outlook for the Dollar.

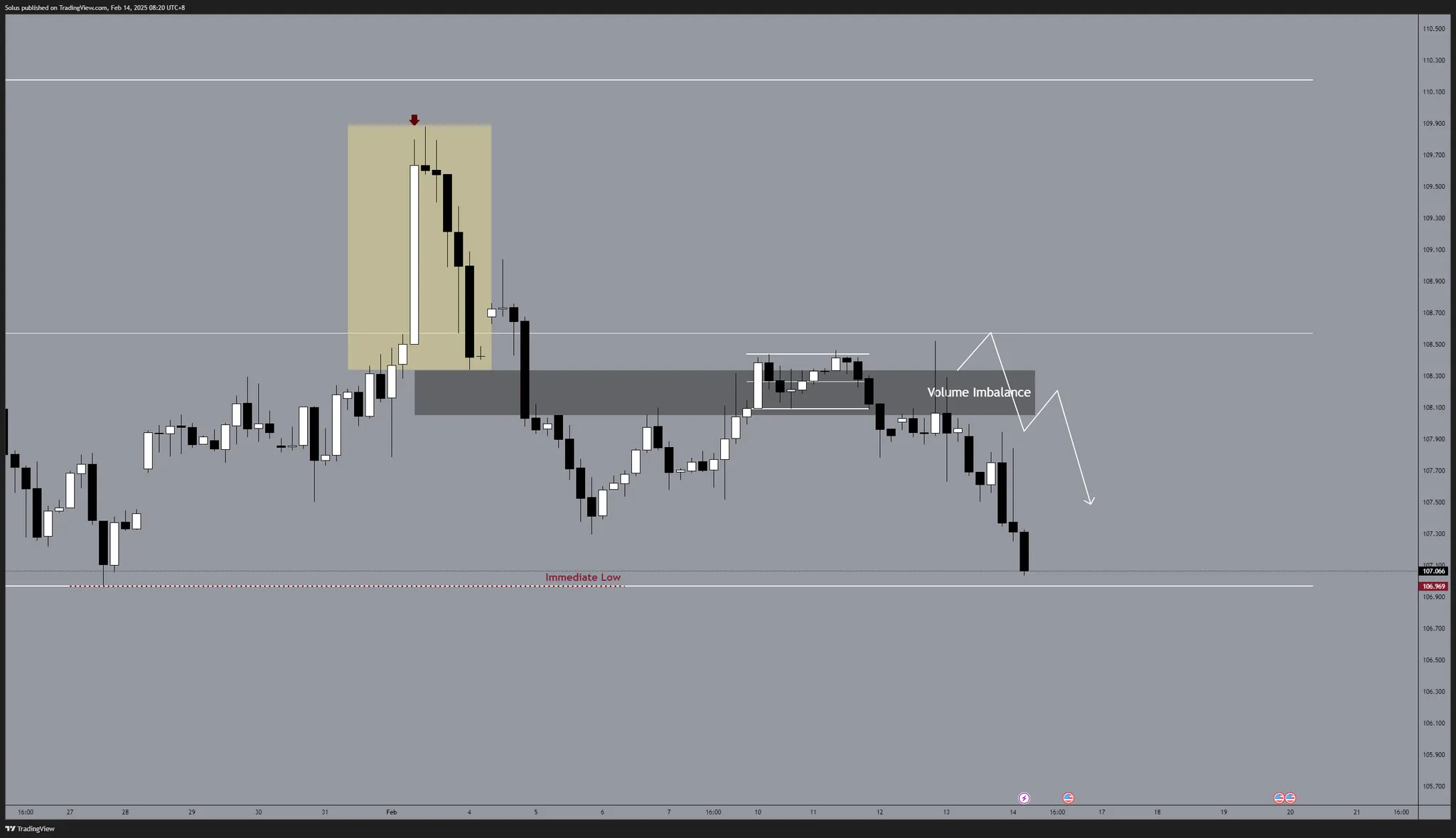

Pre-CPI Price Action

Before the CPI release, we mapped out three potential scenarios for the Dollar.

For more details, check out our previous analysis here.

Post-CPI

After the CPI release, initial reactions showed a brief positive move; however, the Dollar failed to sustain gains due to ongoing concerns about employment rates.

Scenario 2 played out, pushing the Dollar downward towards the 110.176 level.

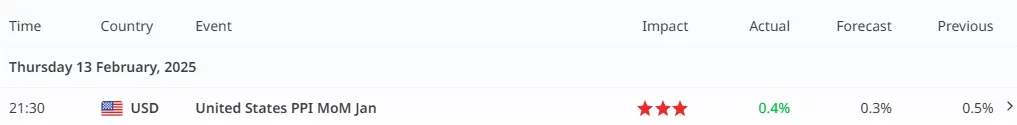

PPI Numbers Supporting CPI Count, Yet Bearish Outlook

While a higher PPI reading was anticipated following the elevated CPI, it did not improve the outlook for the Dollar due to weak employment figures.

Dollar on the Daily Chart

Higher timeframes show no signs of strength for the Dollar, suggesting continued downside movement.

US10Y Outlook

US10Y maintains a bearish stance, reinforcing the negative outlook for the Dollar.

Impact on the Majors

AUD: Bullish Continuation

AUD continues its bullish trajectory, eyeing the 0.63305 level for a potential trend shift from sideways to uptrend. A decisive break above this level would confirm a strong bullish stance.

NZD: Approaching 0.57232 Significant High

NZD is gaining momentum as the USD weakens. The next key level is 0.57232, where we anticipate a reaction that will determine whether the bullish trend continues or slows down.

EUR & GBP on Continued Upside Momentum

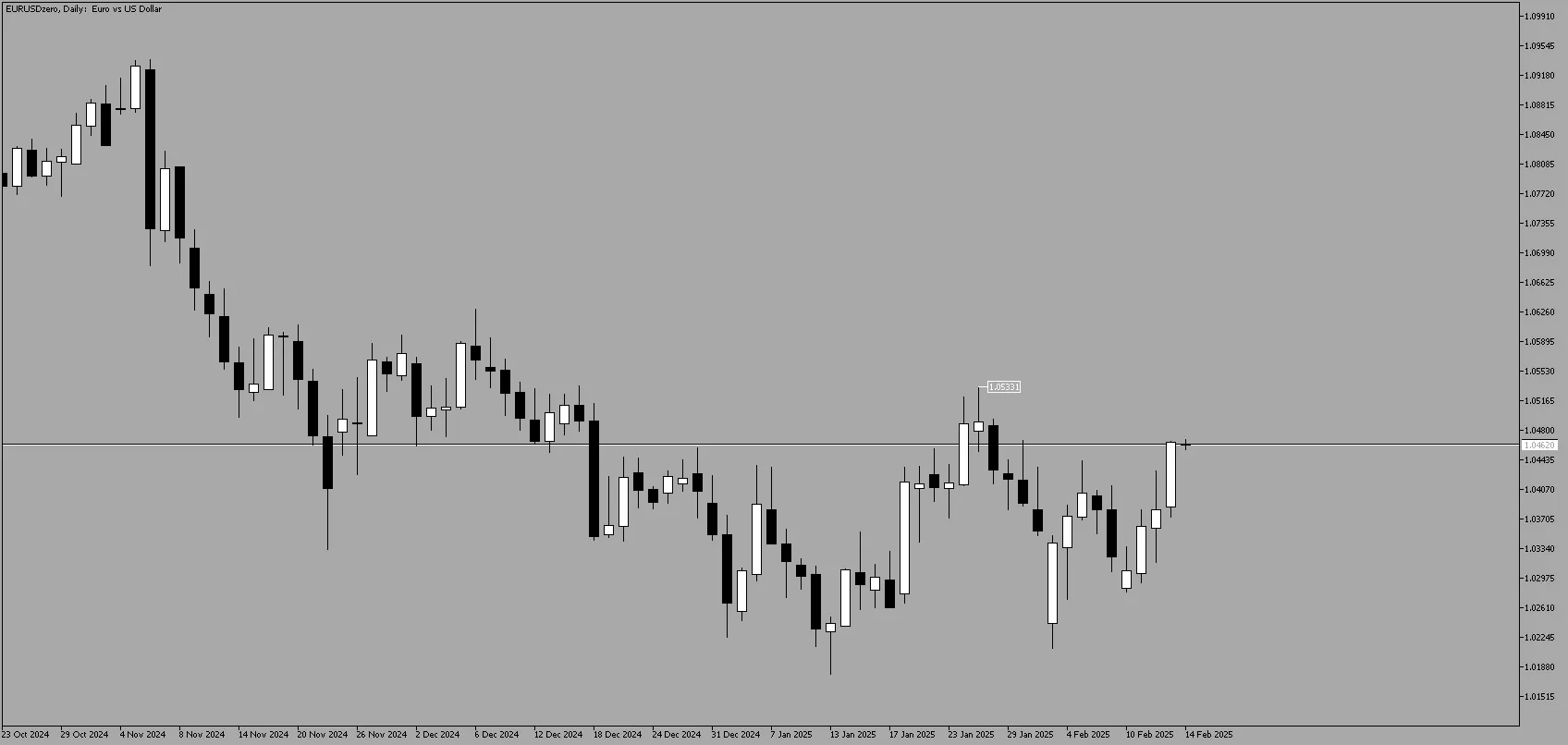

EUR Daily

EUR is nearing the 1.05331 resistance level with strong bullish momentum and no signs of weakness. A continued push is likely in the coming days.

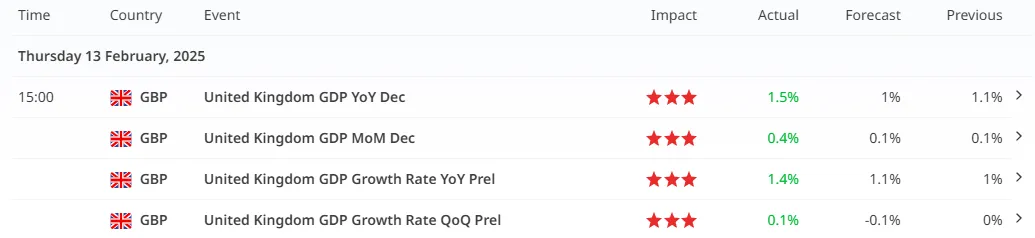

GBP Daily

GBP has broken above the 1.25497 level, confirming a bullish environment. We anticipate sustained momentum as long as it stays above this level.

Positive GDP Growth readings further support the bullish outlook for GBP.

CAD: Bearish Breakdown

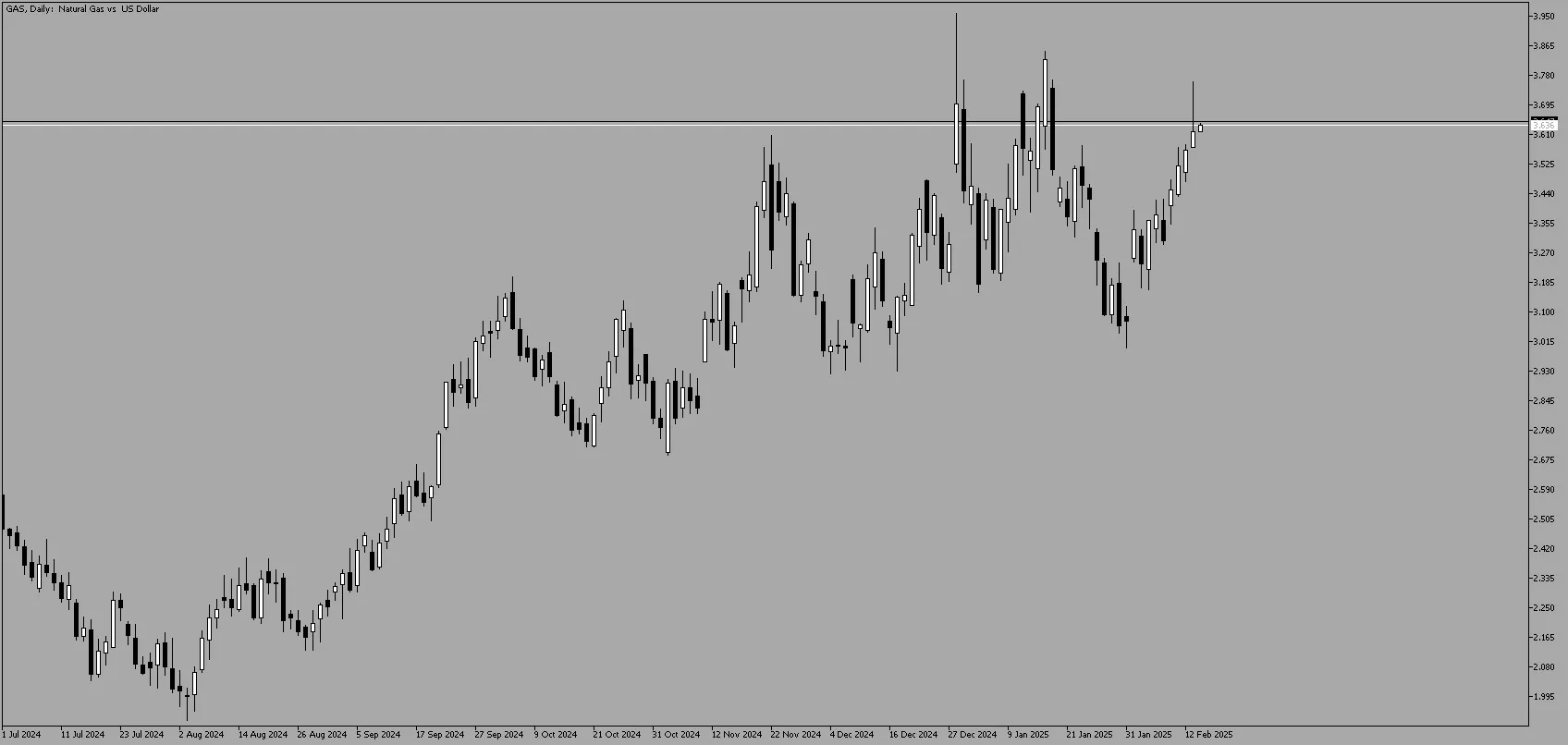

GAS Daily

CAD continues to show strength against the Dollar, confirming a bearish outlook for USDCAD.

CAD's strength is further emphasised by Dollar's continued weakness, indicating more downside for USDCAD.

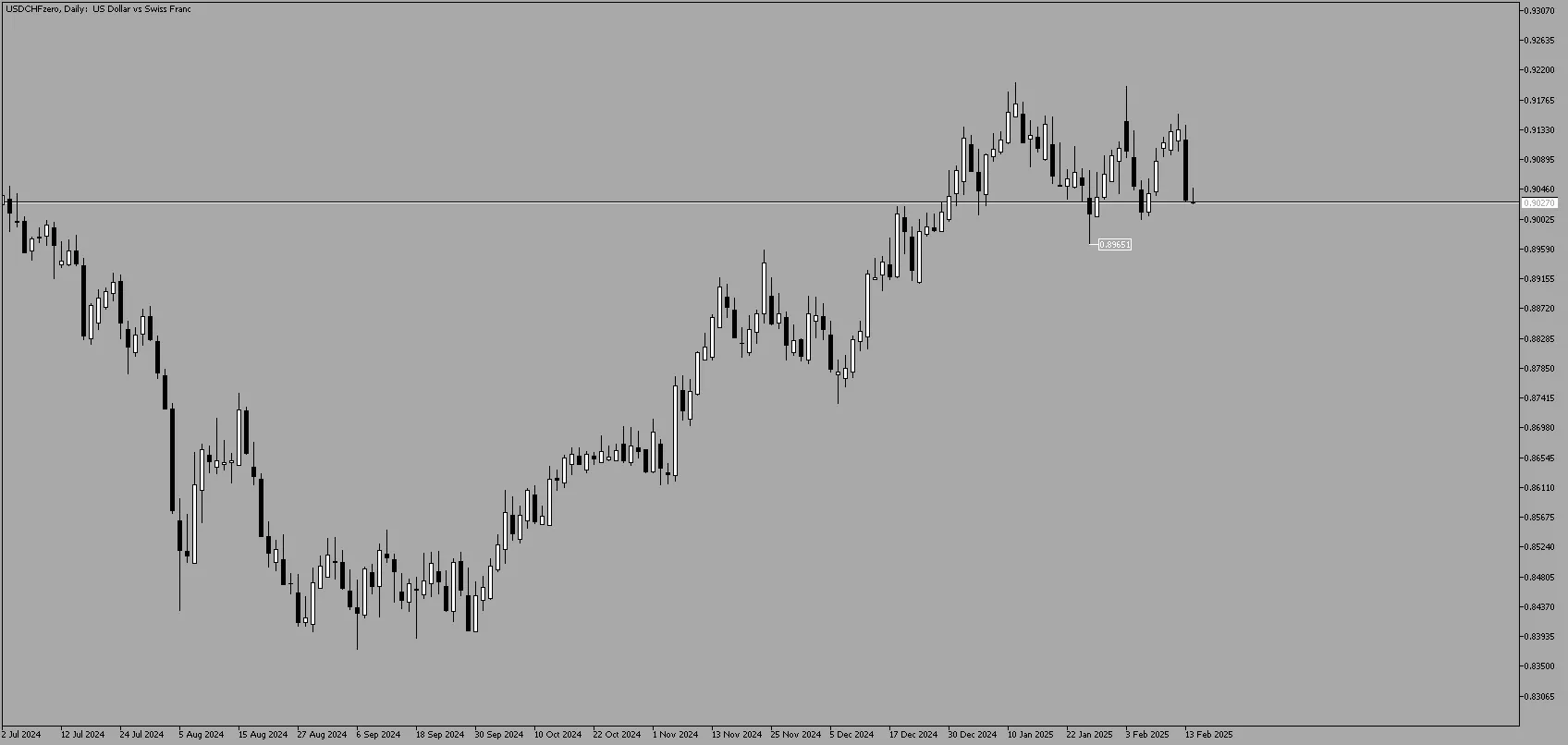

CHF

USDCHF experienced a significant drop and is now approaching the 0.89651 support level, which could trigger a further downside move.

Despite the positive CPI numbers, the overall sentiment for the USD remains bearish due to weak employment figures. As a result, the Dollar is expected to continue its downward trajectory, influencing the bullish momentum observed in other major currencies.

“The market rewards discipline, not emotion.”

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

延伸阅读