Will the US Dollar Pump or Dump after this week's NFP

2025-06-02 17:40:17

- The U.S. Dollar remains weak near year-to-date lows, lacking momentum for an upside move ahead of Friday’s crucial NFP report

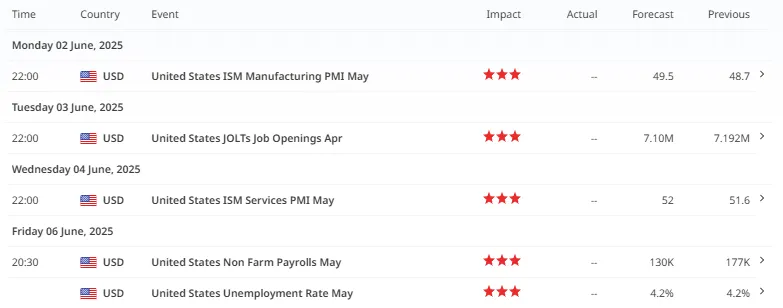

- Key economic data this week, ISM PMIs and ADP employment, could influence the Dollar’s direction, with NFP acting as the decisive factor for rate cut expectations

- A weak Dollar may boost major currency pairs and gold, while a break below 99 could push the Dollar toward year-to-date lows, and a break above 99.7 could signal recovery

As we approach the release of the U.S. Non-Farm Payrolls (NFP) report this Friday, anticipation is building around the Dollar's next move, along with major currency pairs. The U.S. Dollar may either continue its downside trajectory or find a spark for renewed recovery. It’s also important to note that the greenback remains near its year-to-date lows, suggesting potential for further bearish movement, especially given the lack of strong signals that the Dollar is regaining traction on a global scale.

Daily - No Momentum for Upside Still

What does not look good for Dollar bulls is the greenback is still lacking strength and trading below equilibrium of the overall daily range. Dollar failed to hold the 100 level and the risk of trading below the 99 level is increasing as the Dollar will yet to experience volatility on the incoming red folders for the U.S. Dollar.

Key Red Folders for the Dollar and Majors

Key high impact news to watch out this week are the ISM Manufacturing PMI, which is expected to remain in contraction territory, followed by Wednesday’s ADP Employment data and ISM Services PMI. A strong ADP number may give the Dollar some lift ahead of NFP, but the real test comes Friday.

Markets are pricing in a sharp slowdown in job creation, from 177K to 130K, and any significant miss could drive the Dollar sharply lower, especially if wage growth also cools. On the other hand, if the NFP surprises to the upside and wage data holds steady, it could renew confidence in the Dollar and reduce expectations of Fed rate cuts. If the NFP surprises to the upside and wage data holds steady, it could renew confidence in the Dollar and reduce expectations of Fed rate cuts.

Major Impact on the "Majors" & Gold

For EUR/USD and GBP/USD, a weak Dollar could push prices higher, while USD/JPY may unwind if yields drop. Same case can be applied with AUD/USD, NZD/USD, USD/CAD and USD/CHF. Gold, which thrives on Dollar weakness, could also push the safe-haven asset to news highs with low hanging target at 3400 level if Friday’s data disappoints. With the Dollar hovering near year's all-time low, this week’s data will likely set the tone for the next big move.

Technical Outlook on The Greenback

A breakdown of the 99.129 level down to 99 could increase pressure on the U.S. Dollar that could further send it to the year-to-date lows.

A breakout of the 99.700 level could renew Dollar strength for a potential recovery.

Check Out Our Market Education

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment — With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

Follow me on LinkedIn: Jasper Osita

Join me in Discord: The Analyst Guild

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.