Market Outlook for The Week Ahead Navigating Tariff Tensions and Inflation Trends

2025-03-03 07:34:39

The FX market remains volatile as geopolitical tensions and economic indicators continue to shape market sentiment. The latest developments, particularly regarding US trade policies, have reinforced a risk-off mood, boosting demand for safe-haven currencies like the JPY, CHF, and the USD

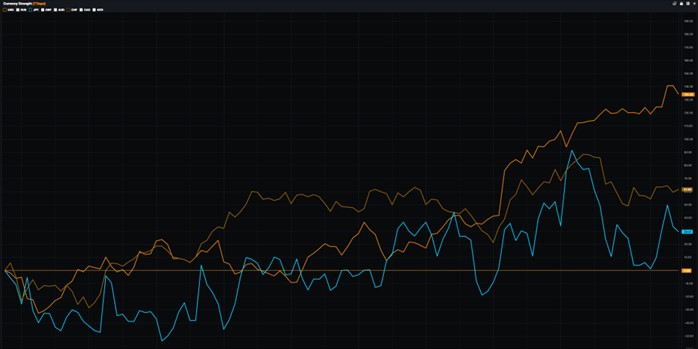

Currency Strength

USD: Tariff Policy and Inflationary Pressures

Former President Donald Trump’s renewed focus on tariffs has been a key driver of recent currency movements. The upcoming 25% tariffs on Mexican and Canadian imports, set to take effect on March 4, alongside an additional 10% tariff on Chinese goods, have strengthened the USD. Markets have responded with risk aversion, leading to declines in equity indices and further reinforcing the dollar's status as a safe-haven asset.

DXY H4

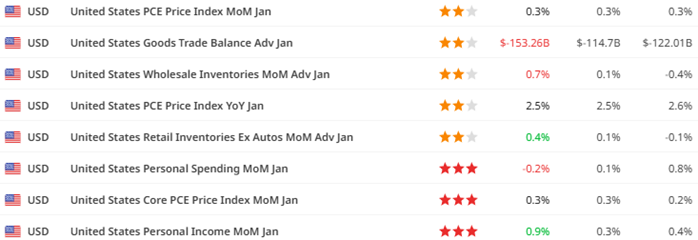

Meanwhile, inflation dynamics remain a crucial factor for the Federal Reserve’s monetary policy stance. The latest Personal Consumption Expenditures (PCE) report for January, released on February 28, showed a year-over-year increase of 2.5%, down slightly from December's 2.6%. The core PCE, the Fed’s preferred measure of inflation, also eased to 2.6% YoY. While this indicates a modest cooling in inflation, concerns persist that upcoming tariffs on imports from Mexico, Canada, and China could reignite inflationary pressures. Investors remain watchful as these trade policies may impact future inflation trends and influence the Fed’s decision-making.

USA PCE

CAD: Facing Tariff Headwinds

The Canadian dollar (CAD) has been under pressure as US tariff measures take centre stage. USD/CAD has surged past 1.44, and further escalation could push the pair toward its multi-decade high near 1.48. Despite expectations of steady GDP growth at 1.8% quarter-over-quarter, external risks related to trade restrictions are likely to overshadow domestic fundamentals. Should the US reconsider or soften its stance, CAD may regain some lost ground, but the outlook remains fragile.

SEK: Overextended Gains?

The Swedish krona (SEK) has outperformed among G10 currencies, with EUR/SEK dipping to one-year lows near 11.10. The rally, however, appears stretched given Sweden’s economic backdrop. Consumer spending surged at the end of 2024, but the sustainability of this trend remains uncertain, especially after a sharp price increase in January. While near-term momentum favours SEK, longer-term durability is contingent on stronger underlying growth.

JPY: Weighing Rate Hikes and Market Volatility

Japan’s latest inflation figures surprised to the downside, largely due to government subsidies on energy prices. While this initially dampened expectations for a Bank of Japan rate hike, Governor Kazuo Ueda's concerns over persistent food inflation suggest that policy tightening remains on the table. Furthermore, the JPY has benefited from heightened market uncertainty, with USD/JPY trading near 150. Should risk-off sentiment intensify, the yen could see further upside.

USDJPY H4

Investors should brace for heightened volatility as markets navigate trade policy shifts and central bank actions. The USD remains supported by trade tensions and a cautious Fed stance, while CAD faces external risks from tariffs. SEK’s rally may be overstretched, and the JPY continues to benefit from risk aversion. Meanwhile, NOK’s outlook hinges on policy execution and broader risk sentiment. As always, staying nimble and closely monitoring economic releases will be key to navigating the current FX landscape.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.