Gold Eyes $3,000: Safe-Haven Demand Rises Amid Tariff Wars

2025-03-13 11:43:14

Market Overview: US & Global Retaliation, DOW, NAS, S&P

- EU & Canada Retaliate: The EU imposed $28.3B in tariffs on US goods, while Canada hit $20.8B worth, targeting steel, aluminum, and key exports.

- Trump’s Response: Vows strong retaliation, escalating trade tensions and market uncertainty.

- Stock Market Impact: DOW, NAS, and S&P see volatility, with investors shifting to safe-haven assets.

- Gold Surges: Goldman Sachs raises 2025 gold forecast to $3,100/oz, citing central bank demand and trade tensions. A break of $2,956 ATH could push prices higher up-to $3000.

- Dollar Weakens: Trade war pressures USD, benefiting gold. AUD and CHF strength further supports gold’s rally.

- Key Levels for Gold:

- Support: $2,936 - $2,940

- FVG Range: $2,925 - $2,930

EU Hits Back: Retaliation Escalates Over US Metal Tariffs

The European Union has responded forcefully to the United States’ latest 25% tariffs on steel and aluminum, announcing countermeasures targeting up to €26 billion ($28.3 billion) worth of American exports. These tariffs focus on key industries, including agriculture and manufacturing, potentially putting pressure on the Biden administration ahead of upcoming trade discussions.

As negotiations unfold, EU trade chief Maros Sefcovic is working to de-escalate tensions and find common ground. However, if diplomatic efforts fall short, the EU has signaled its readiness to broaden its retaliatory tariffs, further intensifying the transatlantic trade dispute.

Trump Responds: Retaliation Looms as EU Tariffs Escalate Trade War

President Donald Trump has vowed a strong response to the European Union’s countertariffs, declaring, “Of course I’m going to respond.” His latest remarks come after the EU slapped retaliatory duties on $28.4 billion (€26 billion) worth of U.S. goods in response to Washington’s 25% tariffs on steel and aluminum.

Canada has also joined the trade dispute, imposing 25% tariffs on $20.8 billion worth of American exports, including steel, aluminum, and key consumer goods.

While some U.S. industries back the tariffs as a means of protecting domestic jobs, businesses warn that rising costs could hurt consumers. With global markets reacting to the growing uncertainty, tensions continue to mount as world leaders weigh their next moves.

As tariff wars escalate, uncertainties in a global scale increases and investors flock on “safe-haven” assets.

Gold Back on Track as Tariff Wars Escalate with EU Retaliation

Goldman Sachs has recently raised its year-end 2025 gold price forecast to $3,100 per ounce, up from the previous estimate of $2,890. This revision is primarily attributed to sustained central bank demand for the precious metal. Forecast still hasn’t change due to tariff wars, making Gold attractive

The bank estimates that structurally higher central bank demand will add 9% to the gold price by year-end. Additionally, a gradual boost to ETF holdings, as interest rates decline, is expected to further support gold prices. If policy uncertainties, including tariff concerns, remain elevated, Goldman Sachs suggests that gold prices could surge to $3,300 per ounce by the end of 2025.

Weak Dollar Lifts Gold

With Dollar suffering from recent trade wars, Gold continues to benefit from this. Dollar already closed below the range. With soft CPI print came out recently, lower expected, we could see the greenback to further tumble down and push Gold to the upside.

Aussie and Swissie Strength, “Strengthens” Gold

As Dollar weakens vs the Aussie Dollar and Swiss Franc, this could further drive Gold to new highs in the coming days unless Dollar slows down its bearish pace and potentially, create reversal signs.

Gold Near All-Time High Level

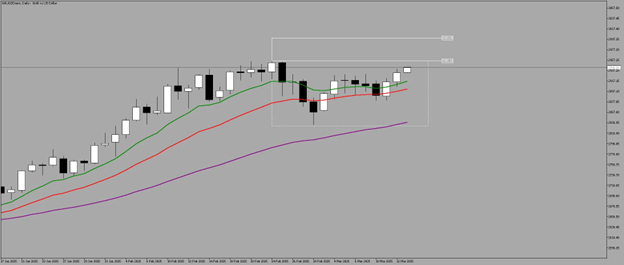

Daily

Gold is now trading near all time high level with imminent breakout as no signs of weakness are in place.

A break of 2956.18 ATH level could trigger high potential for Gold to reach Goldman’s target of $3000.

Moving averages 10, 20, 50 are also supporting the strong trend of Gold.

4-Hour

Potential pullback levels for continuation trades:

- 4-Hour Breakout Level - 2936 - 2940 Support Level

- 4-Hour Fair Value Gap Range - 2925.36 - 2930.70 Level

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

延伸阅读