Bitcoin Awaits CPI Shock: Will BTC Break Higher or Reject From Key FVG Zones?

2025-06-11 01:46:23

- BTC consolidates below $110K ahead of CPI, with price sitting above key H4 and D1 FVG level.

- A soft CPI may trigger a bounce from FVG support toward $111,800 and higher.

- A hot CPI risks a bull trap, with rejection and breakdown targeting $104K-$103K.

Macro Meets Crypto

Bitcoin (BTC/USD) has rallied sharply in recent sessions, recovering from its June lows and reclaiming the $109K level. However, just as BTC approaches a key resistance level, the market is now bracing for today’s U.S. CPI release at 8:30 AM EST, a macro event that could heavily sway risk sentiment and crypto flows.

While Bitcoin is often touted as inflation-resistant, in practice, it behaves more like a high-beta tech asset, closely tied to liquidity cycles and rate expectations. Here’s what to watch:

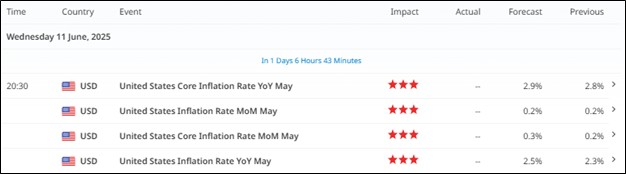

- Headline CPI YoY (May): 2.5% (Prev: 2.3%)

- Core CPI YoY: 2.9% (Prev: 2.8%)

- MoM CPI: 0.2-0.3%

If inflation remains sticky, expectations of a Fed pivot could be pushed further out, potentially triggering risk-off flows that hit crypto. But a soft CPI could reignite bullish risk appetite, further fueling BTC’s momentum.

BTC Daily Outlook

Bitcoin is currently trading inside a broader range, with price yet to tap into the Daily FVG sitting at $106,500-$108,400 level just above $110,000 while still respecting the Weekly FVG tapped last week.

- Key resistance zone: D1 FVG at $109,000-$110,500

- Weekly FVG support: $98,000-$100,700

- Daily FVG support: $106,500-$108,400

- Structure suggests bullish reclaim, but now nearing decision point

BTC 4H Outlook

The 4H timeframe shows a clean range, with potential for a liquidity sweep below, aligning with confluence at both the 4H and Daily FVG level, where price is currently consolidating above.

- H4 FVG: $108,000-$108,500

- D1 FVG aligns above: $106,500-$108,400

- Current range highs are stalling below $110.5K

Bullish CPI Case for BTC

A softer-than-expected CPI print could trigger renewed risk-on sentiment across the markets and Bitcoin looks technically primed to capitalize on it.

- Soft CPI fuels broader risk-on sentiment

- BTC confirms breakout above $110K level

- Targets: $112,000-$115,000

- Longs validated on pullbacks to H4/D1 FVG confluence

- Weekly structure remains intact and favorable

Bearish CPI Case for BTC

A hot CPI print could strengthen the dollar (DXY) and trigger risk-off flows, leading BTC to reject from the current range highs.

- CPI surprises to the upside - dollar strength - crypto risk-off

- BTC rejects from $110K level - resulting to a fake-out or bull trap

- Break below H4 FVG opens downside back to Weekly FVG

- Target range: $105,000-$102,000

- Break of structure confirms deeper retracement

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.