Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

2025-07-01 12:05:43

Goal of This Lesson

To help you master the origins, structure, and practical use of Japanese candlesticks - the most powerful charting method for reading price action, understanding institutional behavior, and timing entries with precision.

A Brief History: Where It All Started

Japanese candlesticks were developed in the 1700s by a Japanese rice trader named Munehisa Homma, often considered the father of price action. He traded at the Dojima Rice Exchange in Osaka - the first official futures market in the world.

Homma discovered that price is driven not just by supply and demand, but by trader emotion. He began to record price fluctuations using visual candles, noting the open, high, low, and close for each trading day. His system allowed him to anticipate price turns based on recurring psychological patterns - the foundation of what we still use today.

Fun Fact: Homma reportedly made over 100 consecutive winning trades using this system - centuries before the term "technical analysis" existed.

Real-Life Analogy: Reading the Price Story

Imagine you’re watching a football game - but instead of seeing the full match, you’re only shown the final score. That’s what line charts do. You miss who was winning, momentum swings, and key plays.

Candlestick charts are like watching the entire game in slow motion - you get to see when bulls were in control, when bears took over, and where the momentum shifted.

What Is a Japanese Candlestick?

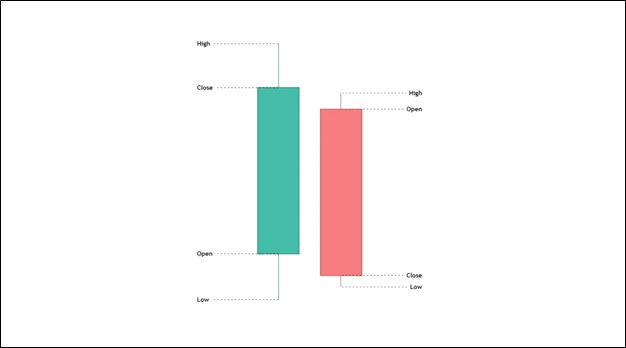

Each candlestick captures four key data points over a specific time period:

- Open – where price started

- Close – where price ended

- High – the highest price reached

- Low – the lowest price reached

Candle Anatomy:

- Body: difference between open and close (measures the range price opened and closed)

- Wick/Shadows: range beyond the body (measures how high and low price went after it opens and before closing)

- Color/Direction: shows who’s in control - buyers (bullish/green) or sellers (bearish/red)

- Bullish - Price closed above the opening price

- Bearish - Price closed below the opening price

- Neutral - Price moved but closed where it started

Why Use Candlesticks Over Other Chart Types?

| Chart Type | Limitation |

| Line Chart | Shows only closing prices - no detail on highs/lows |

| Bar Chart | Similar info as candlesticks, but harder to read visually |

| Renko | Filters out noise, but ignores time and lacks real price movement |

| Heiken Ashi | Smooths trends but distorts actual price data |

| Candlestick | Easy to read, highly detailed, shows real momentum, rejection, and reversal signs |

Must-Know Candlestick Concepts

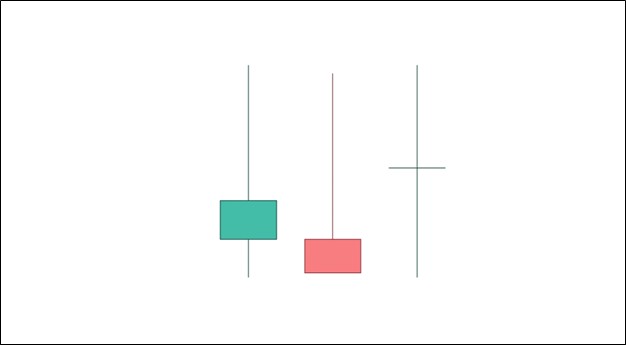

Wick Behavior

- Long upper wick = rejection at higher prices

- Long lower wick = rejection at lower prices

- Both wicks = indecision or high volatility

Body Strength

- Large body = strong momentum and conviction

- Small body = pause or consolidation

- Doji = market balance or upcoming shift in control

Context Over Patterns

- One candle alone doesn't tell you much. Combine patterns with:

- Support & resistance

- Trend direction

- Moving averages or other tools

- Volume spikes

Top 5 Candlestick Patterns Every Trader Should Know

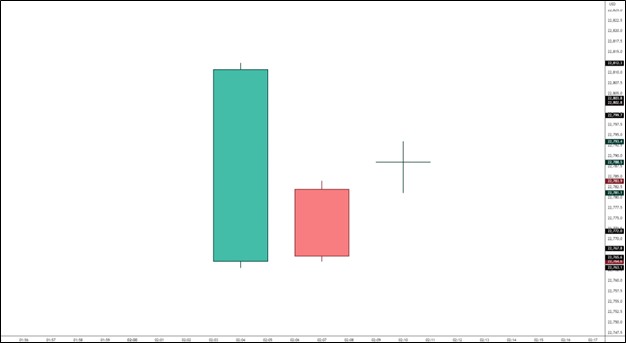

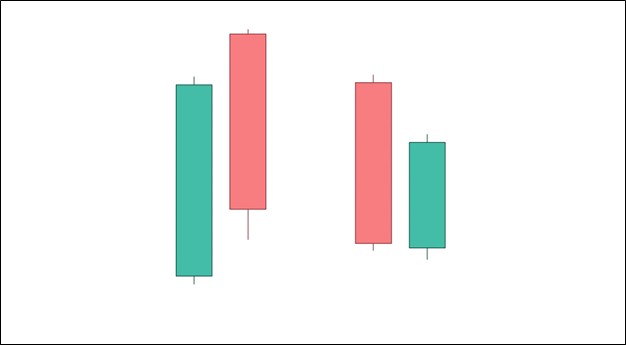

1. Engulfing Pattern (Bullish or Bearish)

- One candle fully “engulfs” the previous candle’s body

- Bullish: after a downtrend, suggests reversal

- Bearish: after an uptrend, suggests exhaustion

2. Hammer / Inverted Hammer

- Small body, long lower wick (hammer) = potential bullish reversal

- Small body, long upper wick (inverted) = potential bearish reversal

- Appears after price fails to follow through

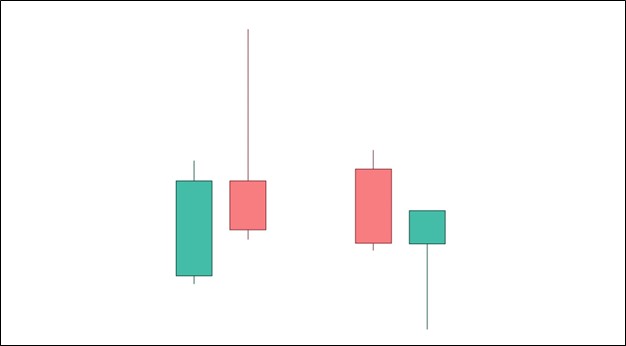

3. Piercing Pattern (Bullish or Bearish)

- Bullish pattern after a downtrend

- First candle is bearish

- Second candle opens lower but closes more than halfway into the first

- Signals strong buying interest

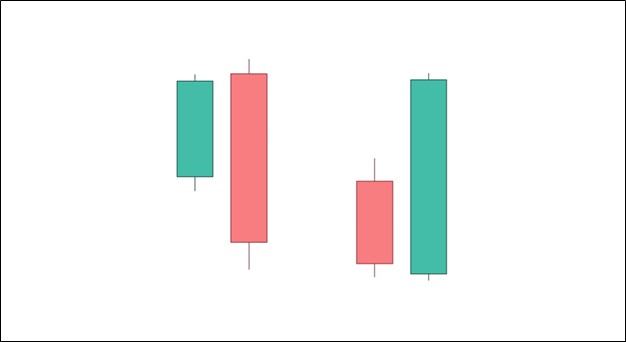

4. Morning Star / Evening Star

- Three-candle reversal pattern

- Morning Star (bullish): bearish → neutral → bullish

- Evening Star (bearish): bullish → neutral → bearish

- Best used near trend exhaustion or support/resistance

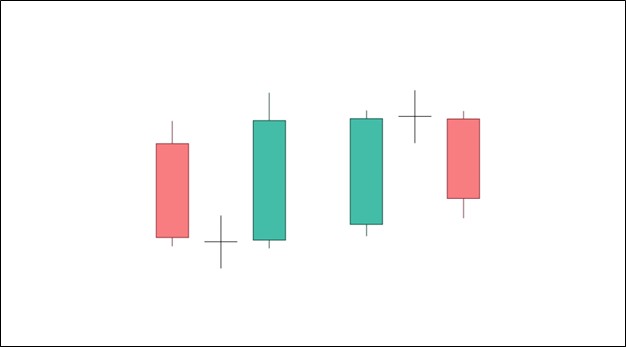

5. Doji (Neutral Reversal Signal)

- Open and close are nearly the same

- Small or no body, long wicks

- Appears after strong trend and may warn of reversal or pause

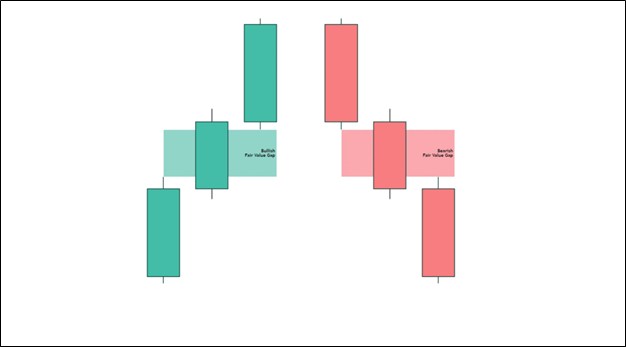

6. Fair Value Gap (FVG) Candle

- Occurs after a strong move

- Leaves imbalance between candle body/wick and the next

- Entry when price returns to fill the gap and shows rejection

How to Use Candlesticks in Any Strategy

Whether you’re using:

- Support & Resistance

- Trendlines

- Indicators (e.g., RSI, MACD)

- Fibonacci retracements

- Moving Averages

Candlestick patterns act as your confirmation trigger - they help time your entry, confirm your bias, or signal a possible shift in direction.

Quick Checklist When Reading a Candle

Ask yourself:

- Is the body large or small?

- Are the wicks telling me something was rejected?

- Does this candle align with the trend or go against it?

- Did it form near a key level?

- Is the next candle confirming or rejecting the signal?

Pro Tips: How to Use Candlesticks Effectively

- Match candles with structure breaks for confirmation

- Combine candle reading with session timing

- Apply multi-timeframe analysis for precise entry

Final Thought

Japanese candlesticks are not just visual aids - they’re a universal language of price. They show strength, rejection, indecision, and intent in a way no indicator can. Whether you're trading Smart Money Concepts or classic price action, candle mastery is non-negotiable.

Learn to read candles, and you’ll learn to read the market.

Check Out My Contents:

Strategies That You Can Use:

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News:

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices:

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold:

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

延伸阅读