How To Trade Fibonacci Retracements with Smart Money Concepts

2025-07-11 09:32:46

Goal of This Lesson

To show how smart money traders don’t just rely on Fibonacci levels—they combine them with Fair Value Gaps (FVGs) and multi-timeframe confirmations to capture institutional-grade trades, especially at deep discount levels (61.8%–78.6%).

The Smart Money Narrative – Why the 61.8–78.6% Zone is Gold

Picture this:

A wholesaler never buys at retail prices. They wait patiently for bulk discounts, stacking inventory when prices are cheapest—because the goal is simple: buy low, sell high.

This same principle applies to smart money trading.

Institutions, banks, and algorithmic programs don’t chase price—they engineer pullbacks and liquidity grabs to buy from impatient sellers. They love entering trades in deep discount zones, particularly around the 61.8% to 78.6% Fibonacci retracement range—often referred to as the "golden pocket."

That’s where the best risk-to-reward is. That’s where dumb money exits, and smart money enters.

Why This Works with Smart Money Concepts (SMC)

- Fibonacci gives you a mathematical measure of pullback depth.

- Fair Value Gaps (FVGs) show where imbalance exists—areas institutions use to re-enter positions and fill un-filled orders

- Liquidity Sweeps highlight retail stop-hunts engineered by smart money.

- Lower Timeframe Confirmations offer confirmation that the move is real—not just another retracement.

Put it together, and you have a precision timing model to enter with confidence—not hope.

How to Execute the Strategy

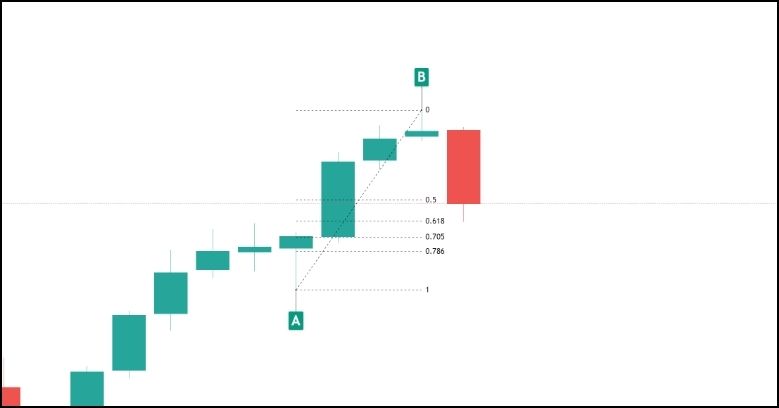

Step 1: Identify the Higher Timeframe Impulse

- Go to you higher timeframe. To learn more about your profile and what timeframe to use, go check this out: Discovering Your Trader Profile: What Kind of Trader Are You?

- Draw your Fibonacci retracement from swing low (A) to swing high (B) of a clear impulsive move.

- Focus your eyes on the 61.8–78.6% zone. This is your institutional discount zone.

Pro-Tip: You will only get interested once price passes through the 0.5% or the equilibrium level.

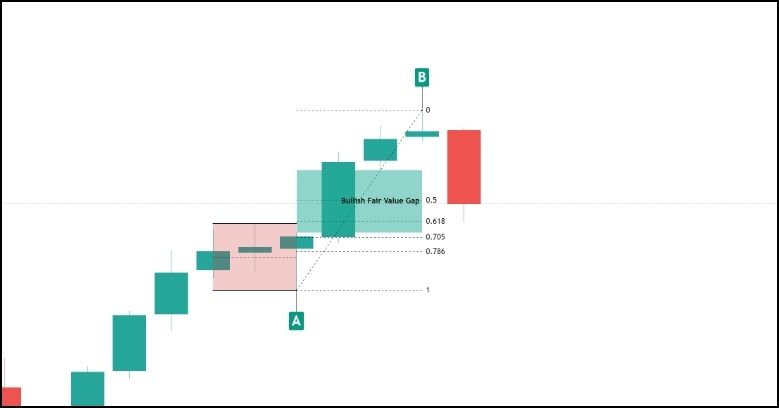

Step 2: Look for Confluence – Fair Value Gap + S&R Levels + Golden Pocket

Ask:

- Is there an FVG overlapping the golden pocket (61.8-78.6)?

- Was there a previous S&R level?

Learn about Fair Value Gaps here: Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

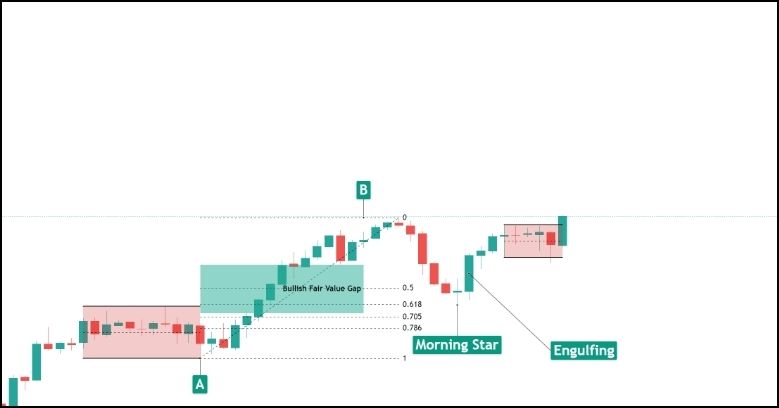

Step 3: Use Multi-Timeframe Analysis for Confirmation

Once inside the 0.618–0.786 zone, go to the Lower Timeframe:

- Wait for price to create:

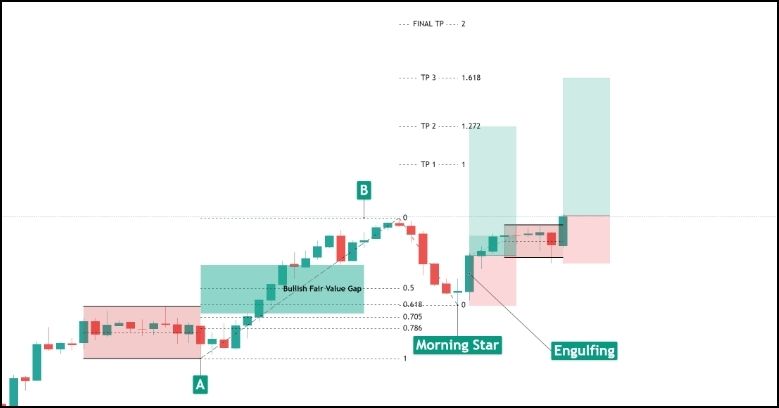

Step 4: Entry & Risk Management

- Enter on candlestick confirmation or lower timeframe breakout

- Stop-loss goes behind the candlestick pattern or price action level.

- Take-profits can use the Fibonacci 1.272 or 1.618 extension, or HTF swing highs.

Common Mistakes to Avoid

- Entering just because price hits 0.618—without confluence.

- Ignoring the HTF trend or impulse leg context.

- Trading without waiting for confirmation structure on LTF (liquidity + BOS + FVG).

Why the Strategy Has Edge

This approach follows how institutions approach the market:

- They build positions or closes hedges during retracements after price explodes.

- They need to induce sellers to get the liquidity they need to buy.

- They leave behind imbalances and structure that signal volume coming in.

By combining Fibonacci retracement with Smart Money logic:

- You avoid guessing and start executing with whales.

- You enter after confirmation, not just at levels.

- You trade in alignment with institutional footprints, not retail reactions.

Final Thoughts: Trade What the Market Shows—Not What You Assume

Fibonacci levels are just numbers until price gives you a reason to act.

The 61.8%–78.6% zone offers potential value, but the real edge comes from waiting for confirmation: liquidity grabs, FVGs, and structure shifts.

Don’t assume smart money is active—observe the clues, follow the flow, and only trade what the market confirms.

Start Practicing with Confidence — Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution — risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

延伸阅读