Japan’s Policy Dilemma Deepens Amid Global Tensions

2025-05-02 11:56:12

The Bank of Japan (BoJ) faces an increasingly narrow path forward, hemmed in by external shocks and domestic constraints. Hopes for another rate hike this year are fading rapidly, not because inflation has anchored or growth has roared back, but because Tokyo has opted for policy cohesion over monetary independence. A coordinated front with the government now takes precedence, especially considering the renewed US tariffs under Trump’s second term.

Japan’s export-heavy economy is once again caught in the geopolitical crossfire. The government has rolled out an emergency response package aimed squarely at shielding its manufacturing backbone particularly SMEs in the automotive supply chain from the aftershocks of rising trade barriers. The policy priority is unmistakable: avert a cascading wave of bankruptcies by easing financial stress. Measures include easing loan conditions and pushing financial institutions to avoid tightening corporate credit, even if fundamentals weaken.

This alignment between fiscal and monetary authorities essentially ties the BoJ’s hands. Hiking rates in this environment would run counter to the government’s survival strategy for its industrial base. And so, despite the BoJ’s formal independence, its policy flexibility is now functionally constrained by a broader national economic agenda.

On the FX front, the weak yen once a political liability has now become a strategic buffer. With the JPY hovering around 147 to the dollar, policymakers see its weakness as a counterbalance to US tariff pressures. A premature rate hike could trigger an unwelcome currency appreciation, undermining Japan’s export competitiveness and worsening the very trade dynamics Tokyo is trying to stabilize.

The economic backdrop remains fragile. CACIB now forecasts Japan’s real GDP growth for FY2025 at a subdued 0.4%, down from an already tepid 0.6%. The BoJ’s own forecast has also been cut, from 1.1% to 0.5%. Stagnant production, global economic softness, and tariff-induced disruptions all point to a real risk of technical recession, especially with Q1 GDP expected to print negative and Q2 and Q3 flatlining.

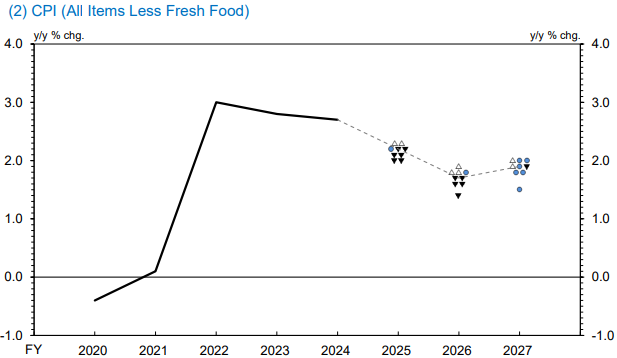

Inflation, meanwhile, is set to decelerate further. The BoJ’s core-core CPI outlook for FY2026 now stands at just 1.8% still below its 2% target. CACIB is even more cautious, projecting only 1.3%. This softening inflation trajectory, if confirmed, may eventually re-empower the BoJ to normalize policy, but not before mid-2026 at the earliest.

Interestingly, the one bright spot is real wage growth. With inflation slowing, households may see modest improvements in purchasing power a rare shift after years of wage stagnation. This could offer a foundation for domestic demand to recover, much like the post-Plaza Accord pivot in the late 1980s. CACIB expects that shift to gain traction, projecting FY2026 GDP growth at 1.2%, above the BoJ’s forecast of 0.7%.

BoJ Projection for CPI

Still, any path to rate normalization is likely to be slow and reactive. The real policy rate remains in negative territory. Unless domestic demand materially surprises to the upside, or external trade stabilizes in a meaningful way, further BoJ tightening looks unlikely before early 2026.

Additional Note: May 2025 Developments

- US Tariff Expansion: As of this week, Washington confirmed additional levies on semiconductors and automotive parts imported from Japan and South Korea, escalating the protectionist wave. This only reinforces Tokyo’s need to preserve currency competitiveness and liquidity support for exporters.

- China-Japan Trade Talks: Parallel negotiations between Beijing and Tokyo have reopened, with Japan pushing for exemptions from China’s counter-tariffs. A breakthrough here could offer some relief but remains uncertain.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.