Why the Australian and New Zealand Dollars Are Sliding Even as the U.S. Dollar Loses Strength

2025-04-08 10:48:30

Why the Australian and New Zealand Dollars Are Sliding Even as the U.S. Dollar Loses Strength

The foreign exchange market isn’t always straightforward.

While a weaker US dollar typically boosts other major currencies, both the Australian Dollar (AUD) and New Zealand Dollar (NZD) have been under steady pressure—even as the greenback loses ground.

If you’re wondering why two of the most widely traded risk currencies are falling in this environment, the answer lies beyond the dollar. This isn’t about USD strength—it’s about risk sentiment, global trade concerns, and regional vulnerabilities.

Let’s break down the forces behind the selloff and how traders can adapt.

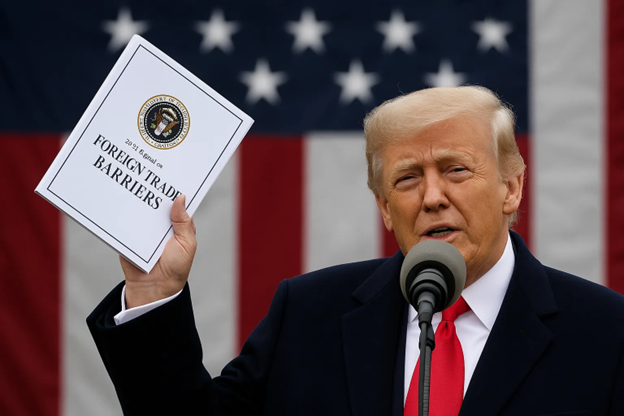

1. Trade Tensions Sparked a Risk-Off Move

On April 2, the United States announced a new round of tariffs targeting imports from key global suppliers—most notably in tech and clean energy sectors, with China squarely in the crosshairs. This move triggered a risk-off wave across global markets. Equities dipped, volatility jumped:

For risk-sensitive currencies like AUD and NZD, this was a red flag. These currencies thrive on global growth and open trade. When protectionism rises, their appeal fades fast.

2. AUD and NZD Are Deeply Exposed to China

Both Australia and New Zealand are tightly connected to China’s economy:

- Australia relies heavily on iron ore, coal, and LNG exports to China.

- New Zealand depends on China for dairy exports, tourism, and education revenues.

Any hint of slower Chinese demand, especially due to trade disruptions, hits both economies hard. Markets know this—and they price it in immediately.

As of April 7, 2025, the United States has implemented a series of escalating tariffs on Chinese imports:

- February 4, 2025: A 10% tariff was imposed on all Chinese imports.

- March 4, 2025: An additional 10% tariff was applied, bringing the total to 20%.

- April 2, 2025: A further 34% tariff was announced, effective April 9, 2025, increasing the cumulative tariff rate to 54% on Chinese goods.

These measures are part of the U.S. administration's strategy to address trade imbalances and concerns over China's trade practices. In retaliation, China has imposed its own tariffs on U.S. goods, including a 34% tariff effective April 10, 2025.

So while the US dollar may be losing some ground overall, fears of slower Asia-Pacific trade are pulling AUD and NZD even lower.

3. USD Weakness Isn’t Helping Risk Currencies Right Now

It’s important to note that the US dollar isn’t falling across the board. It’s mostly softening against safe-haven assets like the Japanese Yen and precious metals, not in a way that benefits risk currencies.

This kind of dollar weakness is part of a defensive market tone, not a bullish one. As a result, pairs like AUDUSD and NZDUSD are still sliding, despite what the DXY (US Dollar Index) might suggest.

4. RBA and RBNZ Rate Cut Expectations Add Pressure

Another layer of weakness comes from shifting interest rate expectations.

As the economic outlook becomes cloudier, traders are starting to price in the possibility that the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) could turn more dovish—or even prepare for rate cuts.

If the Fed holds steady while the RBA or RBNZ move toward easing, the result is narrower yield differentials and weaker currencies.

Actionable Strategy for Traders

So how should traders respond to this?

Here’s a simple, effective framework to navigate the current AUD and NZD environment:

1. Trade AUD and NZD on the Short Side

- Focus on selling rallies in AUDUSD and NZDUSD, especially into key resistance zones.

- Structure trades around risk-off continuation, using tight invalidation above recent swing highs.

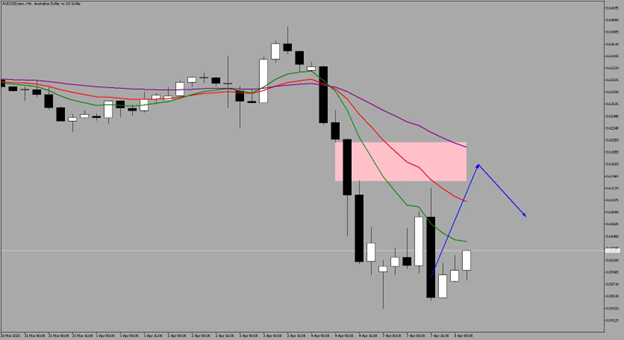

AUDUSD 4-Hour

Look for a draw on liquidity at:

- Previous Day’s High

- Look for a bearish pattern, market structure shift, at the 0.61383 - 0.62012 level for short side move.

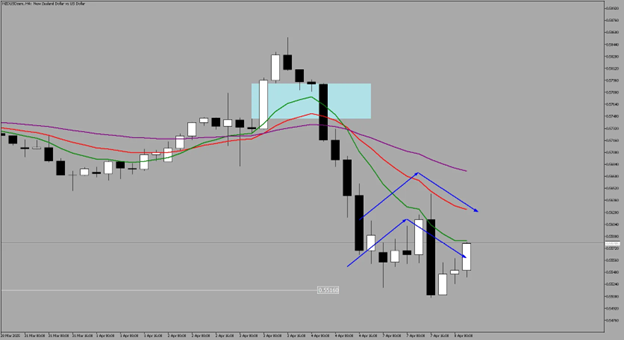

NZDUSD 4-Hour

Look for a draw on liquidity at:

- Previous Day’s High; Wait for technical confirmation for a breakdown.

- 0.56447 - 0.56816 extreme fair value gaps can be a short side also given a technical breakdown confirmation.

Choosing the Better Trade - Short Side

Daily

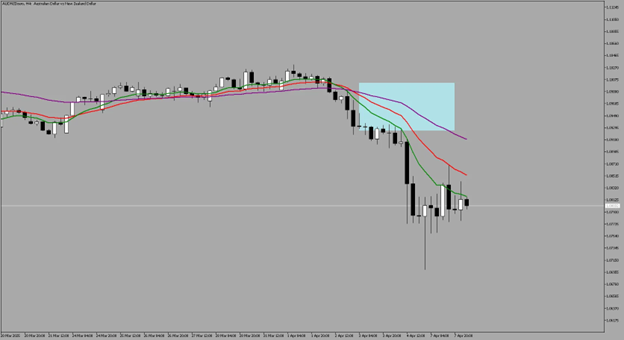

AUDNZD is an obvious downtrend and in an on-going downside momentum. We are seeing that NZD is getting more traction or strength over the Aussie.

4-Hour

With Kiwi is still obviously strong vs Aussie, the better trade in favor for shorts between Kiwi and Aussie is the AUDUSD as it will be easier for price to pull this than the former.

2. Watch for China and Commodity Headlines

- Monitor Chinese economic data, stimulus measures, and trade policy reactions.

- Keep an eye on Gold prices, which tend to lead AUD performance, and dairy index movements for NZD signals.

3. Pair Weak Currencies with Strong Safe Havens

- Crosses like AUDJPY and NZDJPY are highly sensitive to sentiment shifts and often offer cleaner technical setups.

- These pairs also amplify moves during periods of volatility.

- Look for shorts in favor of JPY. Same concept with USD pairs applies with AUDJPY and NZDJPY

4. Track Central Bank Commentary

- Any change in tone from the RBA or RBNZ will likely be market-moving.

- Set alerts for policy meetings, press conferences, or unexpected statements from policymakers.

Final Thoughts

The current pressure on the Australian and New Zealand dollars isn’t just about the US dollar—it’s about the return of risk-off sentiment and growing fears around global trade stability.

The April 2 tariffs reawakened market anxieties, and AUD and NZD—due to their China exposure and sensitivity to global demand—are taking the hit. As central banks reassess policy paths and investors pull back from risk, traders need to stay nimble and dialed into the macro picture.

In markets like these, context beats correlation.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

延伸閱讀