Trading Safe-Haven Currencies During Market Crashes Why XAU/USD and Other Assets Surge in Uncertain Times

2025-02-24 10:06:06

If you’ve been trading for a while—or even if you’re just getting started—you’ve probably noticed that when markets crash, some assets move differently than others. Stocks might be tumbling, but gold (XAU/USD) is climbing. The Japanese yen (JPY) is getting stronger. And the Swiss franc (CHF) is holding firm while other currencies drop.

But why does this happen? And more importantly, how can you take advantage of it?

This article will break down:

- What safe-haven assets are and why they matter.

- Why gold (XAU/USD) surges when markets crash.

- The role of interest rates and where money flows in a crisis.

- Other safe-haven currencies like JPY and CHF.

- How to trade these assets when uncertainty hits.

If you’ve ever felt frustrated watching the markets move without understanding why, this will clear things up. Let’s dive in.

What Are Safe-Haven Assets and Why Do They Matter?

Imagine you’re holding a few trades on stock indices like the S&P 500 or NASDAQ, expecting a steady rise. Suddenly, news breaks that a major bank is collapsing, inflation is out of control, or a war is escalating. Panic spreads, and within hours, the markets are in freefall.

This is where most new traders get caught off guard. Fear sets in, positions are liquidated, and the losses start piling up. But experienced traders don’t panic. They understand that money always moves somewhere—it never disappears, it just flows to safety.

Safe-haven assets are those that investors turn to during times of uncertainty. These assets hold or increase in value when financial markets are under stress. They act as a shield, protecting traders from the volatility and chaos happening elsewhere.

Gold is the most well-known safe haven, but certain currencies—such as the Japanese yen (JPY), Swiss franc (CHF), and, in some cases, the US dollar (USD)—also serve this role.

Now, let’s focus on gold and why it tends to rise when markets are in trouble.

Why Gold (XAU/USD) Rises During Market Crashes

Gold has been used as a store of value for centuries, but in modern financial markets, its role is much more than symbolic. It acts as a hedge against economic uncertainty, inflation, and currency devaluation.

One of the key factors influencing gold prices is interest rates. When central banks, such as the Federal Reserve, raise interest rates, holding gold becomes less attractive because gold doesn’t generate any yield. Investors would rather put their money into interest-bearing assets like bonds or savings accounts.

However, when interest rates fall—especially during recessions or financial crises—gold becomes far more attractive. Borrowing costs drop, the returns on other assets diminish, and investors seek the stability that gold provides.

Inflation also plays a critical role. When inflation rises, the purchasing power of traditional currencies decreases. People start losing faith in money and look for alternatives that won’t lose value over time. Since gold is a tangible asset that cannot be printed or manipulated like fiat currencies, it tends to rise when inflation is high.

Fear and uncertainty drive gold even higher. Markets don’t just move based on logic; they are heavily influenced by emotion. When traders panic, they rush to safety, and gold is often the first place they go. Whether it’s a financial meltdown, a geopolitical crisis, or a major recession, gold’s demand soars when investors seek stability.

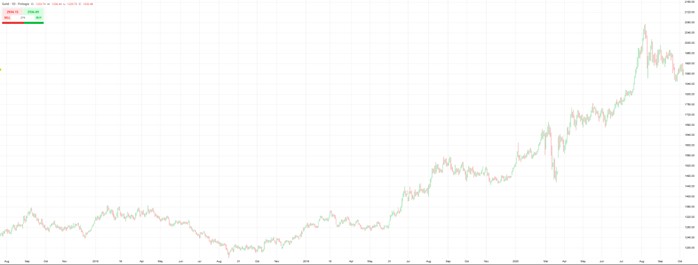

One clear example of this was the 2008 financial crisis. As stock markets collapsed and investors feared for the future, gold surged from around $700 per ounce in late 2008 to over $1,900 by 2011. More recently, during the COVID-19 crisis in 2020, gold hit an all-time high above $2,000 per ounce as central banks flooded the economy with money and investors sought a hedge against uncertainty.

XAUUSD Chart Daily 2020

But while gold is the most well-known safe haven, it’s not the only asset that traders turn to in times of crisis. Some currencies also play this role.

Beyond Gold: Other Safe-Haven Currencies to Trade

Gold may be the first choice for many investors during a market crash, but forex traders often look at specific currencies that tend to gain value in times of turmoil. The most notable safe-haven currencies are the Japanese yen (JPY) and the Swiss franc (CHF).

Japanese Yen (JPY): The Market’s Safety Net

The Japanese yen has long been considered a safe-haven currency. This might seem strange, considering Japan has high national debt, but the yen’s stability comes from its low inflation and consistent trade surplus.

During global crises, Japanese investors often bring their money back home, increasing demand for the yen. This phenomenon is known as "repatriation", and it strengthens the currency when global markets are crashing.

Another reason the yen strengthens is that Japan is relatively isolated from global financial risks. Unlike the US or European economies, which are highly interconnected with global trade and investment flows, Japan’s economy remains largely independent. This makes the yen a safe place to park money when uncertainty rises.

A great example of this was during the 2008 financial crisis. As global stock markets collapsed, USD/JPY dropped from around 120 to 90, reflecting the massive strength of the yen during the panic.

Swiss Franc (CHF): Europe’s Safe-Haven Currency

The Swiss franc is another strong safe-haven currency. Switzerland’s economy is known for its stability, low inflation, and strong banking system. Because of this, investors tend to move their money into Swiss assets when market turmoil strikes.

Switzerland’s neutrality in global politics and its strict financial regulations make the Swiss franc highly attractive during crises. However, the Swiss National Bank (SNB) sometimes intervenes to keep the franc from getting too strong, as an overly strong currency can hurt Switzerland’s export economy.

During the European debt crisis in 2011, the Swiss franc saw massive inflows as investors feared instability in the eurozone. This led the SNB to take extreme measures, including temporarily pegging the franc to the euro to prevent excessive appreciation.

The US Dollar (USD): A Safe Haven, But Not Always

The US dollar is often considered a safe-haven currency, but its behaviour depends on the type of crisis. In times of global liquidity shortages, the dollar strengthens because it is the world’s reserve currency, meaning central banks and large institutions hold large amounts of it.

However, in situations where the crisis is US-specific—such as concerns over US debt or economic instability—the dollar can weaken while gold and the Swiss franc rise.

How to Trade Safe-Haven Assets in a Market Crash

Understanding why safe-haven assets rise one thing is, but knowing how to trade them effectively is where the real opportunity lies.

The first step is to recognise market stress signals. If stock markets are selling off sharply, it’s a clear sign that safe-haven assets may be in play. Central bank actions, such as interest rate cuts or emergency stimulus measures, are also strong indicators that gold and safe-haven currencies may gain momentum.

During a crisis, traders typically go long on gold (XAU/USD), short USD/JPY or EUR/JPY (since the yen strengthens), and look for opportunities in USD/CHF or EUR/CHF. These trades align with the natural flow of money during market downturns.

Managing risk is essential when trading safe-haven assets. While these assets tend to move in a predictable direction during crises, volatility can be extreme. Using stop-loss orders, proper position sizing, and avoiding excessive leverage can help protect against unexpected market moves.

Safe-haven assets like gold (XAU/USD) and currencies like JPY and CHF offer traders a way to be an effective trader during market crashes instead of panicking. By understanding where money flows in times of crisis, traders can position themselves on the right side of the market.

Instead of fearing volatility, smart traders embrace it—because in every crisis, there’s an opportunity.

延伸閱讀