How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

2025-05-21 14:32:23

Goal of This Lesson

To help you understand what indices are, why they're a popular alternative to trading individual stocks, and how they can be a great fit if you want access to the stock market — without needing a large account or tracking dozens of companies.

You’ll learn:

- What you're actually trading (hint: it's not the index itself)

- How indices move and when to trade them

- Why they trend differently than Forex

- The key benefits — including long/short flexibility and low capital access

- How to choose an index that fits your time zone

By the End of This Lesson, You Should Be Able To:

- Understand what index CFDs are and how they work

- Know the major global indices and their sessions

- Compare index trading with Forex to choose what suits your style

- Recognize the benefits of trading with low capital and two-way exposure

- Approach index trading with clarity and confidence — without needing to be an investor

First Things First: You’re Trading CFDs — Not the Actual Index

If you're trading NASDAQ or S&P 500 on your platform, you’re not buying the real index. You're trading a Contract for Difference (CFD).

What is a CFD?

A Contract for Difference is an agreement or contract between you and your broker to exchange the difference in price of an asset between the time you open and close a trade CFDs are instruments that lets you speculate on the price movement of an asset — without owning the asset itself.

You profit or lose based on the difference in price from when you enter to when you exit the trade.

| Example | Outcome |

|---|---|

| Buy NAS100 at 17,000 → Close at 17,250 | ✅ Profit 250 points |

| Sell SPX500 at 5,200 → Close at 5,100 | ✅ Profit 100 points |

| Buy DAX40 at 16,000 → Close at 15,800 | ❌ Loss of 200 points |

CFDs allow you to:

- Trade up or down

- Use leverage

- Access global markets 24/5

- Start with low capital

You're not investing. You're trading — fast, flexible, and efficient.

What Is an Index?

An index is a basket of top-performing companies from a country or region. When you trade an index, you’re trading the overall strength or weakness of that market.

| Index | Region | Focus |

|---|---|---|

| S&P 500 | USA | 500 large-cap companies |

| NASDAQ 100 | USA | Tech leaders: Apple, Nvidia, etc. |

| Dow Jones | USA | 30 major industrial companies |

| DAX 40 | Germany | Germany’s leading firms |

| FTSE 100 | UK | UK’s top listed companies |

| Nikkei 225 | Japan | Japanese exporters and manufacturers |

| Hang Seng | Hong Kong | Tech and financial firms in Asia |

| ASX 200 | Australia | Australia’s largest corporations |

Trade Indices with Low Capital

One of the biggest advantages of index CFDs is accessibility. Unlike traditional stock investing that requires thousands of dollars, you can start trading indices with as little as $50–$200, depending on your broker.

| Traditional Stocks | Index CFDs |

|---|---|

| Need large capital to buy multiple shares | Access full market movement with small size |

| Limited to long-only investing | Go long or short freely |

| Must monitor each company individually | Trade the entire index in one chart |

- Start with as little as $50–$100

- Trade micro lots for better risk control

- Access the same markets as institutional traders

Note:

Getting involve with individual stocks could be beneficial with an objective of just investing and letting time to do its work. But if you want to capitalize a short price movement, trading indices would be of advantage over prior.

You don’t need to buy a share of every S&P 500 company — you just trade the movement of the index as a whole.

Trade in Both Directions: Long or Short

Index CFDs give you the ability to profit from both rising and falling markets.

| Trade Type | When to Use | What Happens |

|---|---|---|

| Long | When you expect the market to rise | You buy the index and profit from the rally |

| Short | When you expect a drop | You sell the index and profit from the decline |

Why this matters:

- You don’t need to wait for bullish markets to trade

- Shorting allows you to profit during sell-offs or negative news

- Gives you full flexibility in any market condition

When markets fall, they fall faster — and traders can benefit both ways.

Why Trade Indices Instead of Individual Stocks?

Trading individual stocks could be overwhelming since there are a lot, a couple of hundreds to thousand across the globe.

Trading indices simplifies everything:

| Stocks | Indices |

|---|---|

| Need to monitor many tickers | One index = full market picture |

| Limited to long-only; Some tickers allow you to short. | Can go long and short |

| Requires more capital | Start small with CFDs |

Benefits of Index Trading:

- One chart = a full economic snapshot

- Less noise, fewer surprises

- Reflects institutional movement and market sentiment

- Tracks broad performance instead of one company

- Great for macro traders and those who prefer structured moves

Best Times to Trade Indices

Just like Forex pairs follow sessions, so do indices. Each index has a “home session” when its underlying stock market is open — and this is when liquidity and movement peak.

| Session | Indices to Focus On | Core Trading Hours (UTC) |

|---|---|---|

| Asian | Nikkei, Hang Seng, ASX | 00:00 – 06:00 |

| London | DAX, FTSE | 07:00 – 11:00 |

| New York | NASDAQ, S&P 500, Dow Jones | 13:30 – 20:00 |

Even though index CFDs are available 24/5, it’s best to trade them during their core hours for cleanest price action.

Why Leverage is Lower for Indices (And Why That’s Safer)

Unlike Forex, where leverage can go as high as 1:500, indices are typically offered at 1:20 to 1:100 — and that’s for your protection.

Why?

- Indices move in points, not pips — and each point is worth more

- A 100-point move in NASDAQ can mean $100+ swings, depending on your lot size

- Lower leverage helps you avoid overexposure

| Market | Typical Leverage | Risk Profile |

|---|---|---|

| Forex | 1:100 – 1:500 | High-frequency, tighter stops |

| Indices | 1:20 – 1:100 | Slower, heavier moves per point |

You don’t need high leverage to make meaningful returns on indices — the instrument itself carries weight.

Forex vs. Index Trading: Side-by-Side

| Feature | Forex | Indices |

|---|---|---|

| Leverage | High (1:100–1:500) | Lower (1:20–1:100) |

| Trend Behavior | Choppy, fast reversals | Smoother, often session-driven |

| Market Hours | 24/5 | 24/5 (best during local stock hours) |

| Volatility | Short bursts, frequent spikes | Broader moves, more controlled |

| Capital Needed | Low, but higher risk | Low, with more defined movement |

| Best For | Fast scalpers, macro traders | Trend followers, structure-based traders |

You don’t need to choose. Many traders use both — indices for structure, Forex for speed.

What Moves Indices?

- Macroeconomic Data – CPI, NFP, Retail Sales, GDP

- Central Bank Announcements – especially from the Federal Reserve

- Corporate Earnings – Apple, Microsoft, Tesla influence NASDAQ

- Risk Sentiment – geopolitical tensions, debt concerns, volatility

- Volatility Index (VIX) – rising fear = declining indices

Action Plan

- Pick an index that matches your schedule (e.g., NASDAQ for NY session)

- Understand its session behavior — when it moves, why it reacts

- Start small — use micro lots, manage risk, trade clean setups

- Use both long and short opportunities — let the market tell you the direction

- Compare it to Forex — find what matches your personality

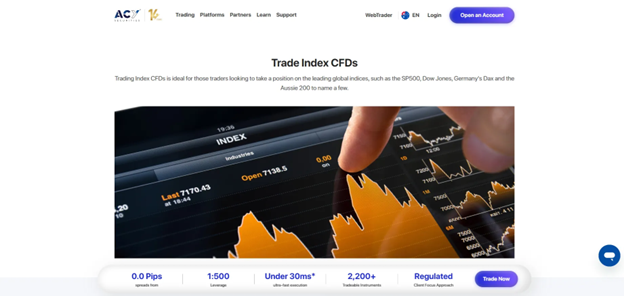

How to Start Trading Indices with ACY.com (Step-by-Step)

ACY offers fast execution, tight spreads, and access to all major global indices. Here’s how to get started:

✅ Step 1: Create an Account

- Visit ACY.com

- Click “Open an Account”

- Complete the registration with your details

- Submit your ID and proof of address for verification

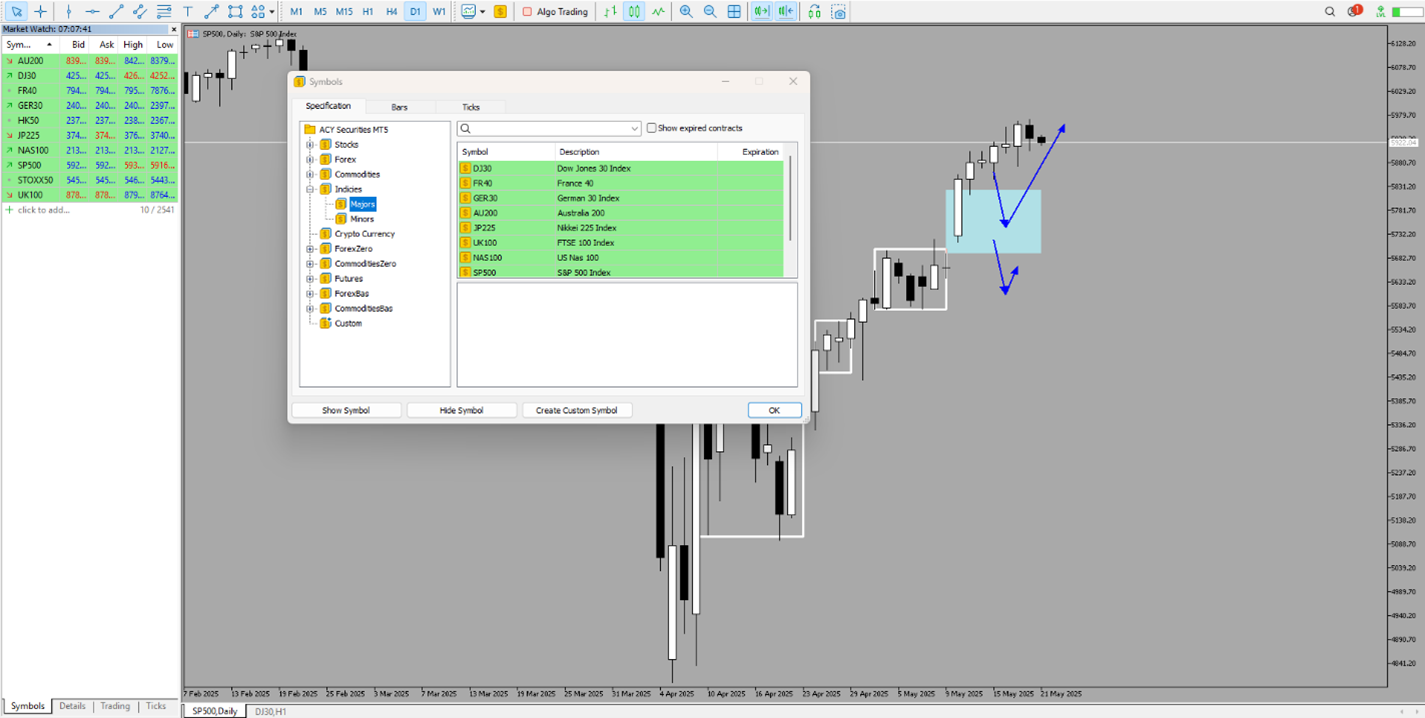

✅ Step 2: Choose Your Trading Platform

- Download MetaTrader 4 or MetaTrader 5 (available on desktop & mobile)

- Log in using your ACY account credentials

✅ Step 3: Fund Your Account

- Go to the Client Portal

- Choose from multiple funding options: bank transfer, credit card, etc.

- Start with as little as $50–$100 depending on your strategy

✅ Step 4: Add Index Symbols to Your Watchlist

In MetaTrader:

- Right-click on the Market Watch window

- Click Symbols

- Search and enable popular indices like:

- NAS100 – NASDAQ 100

- US30 – Dow Jones

- US500 – S&P 500

- GER40 – DAX

- HK50 – Hang Seng

✅ Step 5: Start Trading

- Open the chart of your chosen index

- Analyze price structure, news events, and volatility

- Click New Order, set your position size, direction (buy/sell), and stop-loss

- Monitor trades directly on the platform or mobile app

Tip: Start with demo first if you’re brand new. Then transition to live trading with small lot sizes and strong risk control.

Why Trade Indices with ACY.com?

- All Major Indices on MT4: NAS100, US30, US500, GER40, HK50 — accessible on desktop and mobile

- Near 24/5 Coverage: Trade around regular market hours, with options across time zones for full access

- Leverage Up to 20:1: Balances opportunity and safety

- Trade Long or Short: Profit from both rising and falling markets

- Technological Edge: Ultra-fast execution (~30ms), multi-asset CFDs, and deep liquidity from Tier 1 banks

Additional advantages:

- Ultra-low spreads: Spreads from 0.0 pips for Forex and equally competitive pricing on indices.

- Institutional-grade tools: Daily reports, market analysis, and educational resources

- Regulated by ASIC: Confidence and reliability in your trading environment

🧠 Final Analogy

Trading individual stocks is like betting on a single player.

Trading indices is like betting on the entire team — one chart, one sentiment, one clean structure.

You get broad exposure, smoother moves, and two-way trading flexibility — all without needing massive capital or holding overnight.

With tools like CFDs, you can:

- Trade both directions

- Start small

- Trade 24/5

- Access world markets in one chart

And with platforms like ACY.com, you’re set up with the infrastructure and support to grow into index trading confidently.

Check Out Our Market Education

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment — With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

Follow me on LinkedIn: Jasper Osita

Join me in Discord: The Analyst Guild

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

延伸閱讀