GBP/JPY Trading Strategy: How Correlation Can Predict The Beast’s Next Move

2025-08-13 12:35:35

Some traders crush it trading GBP/JPY in isolation - no doubt about it. But if you want a higher vantage point and a better read on volatility before it hits, you need to understand that GBP/JPY isn’t just moving on its own.

The truth is: GBP/JPY = GBP/USD × USD/JPY

That means this “Beast” is really the child of two majors. When you learn to read GBP/USD and USD/JPY together, GBP/JPY becomes less of a mystery and more of a calculated play. You’ll see explosive days forming before the breakout, dodge those slow, choppy traps, and trade more in sync with institutional order flow rather than fighting it.

Why Correlation Matters

Trading GBP/JPY solo can work - especially if you’re skilled in price action and SMC. But correlation acts like a weather radar for your trades. You’re not replacing your system; you’re adding another layer that tells you if the storm is building in your favor or about to blow sideways.

Instead of just reacting to GBP/JPY moves, you’ll know why they’re happening and whether they have the fuel to keep going.

The 3 Core Scenarios to Watch

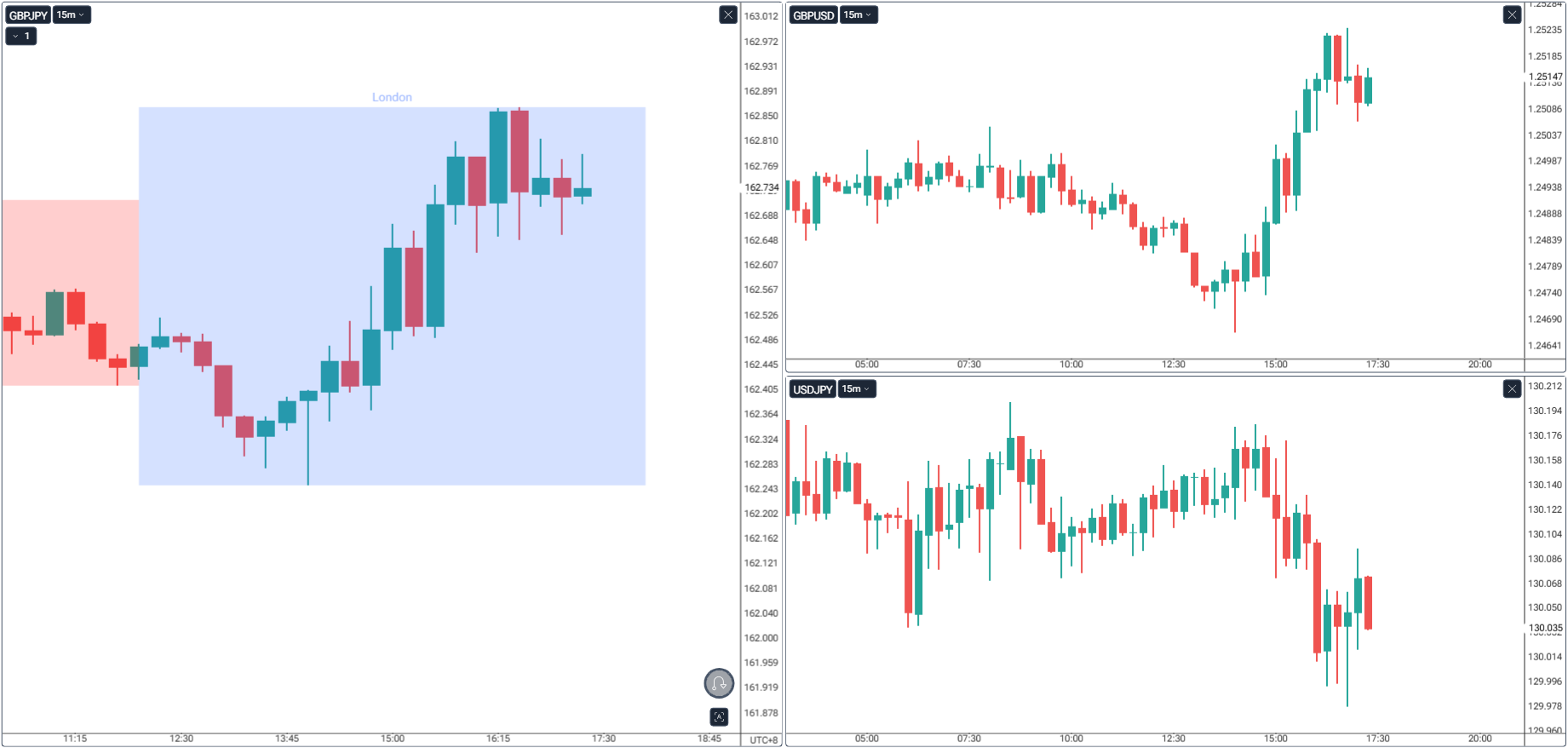

1. Both GBP/USD & USD/JPY Bullish = Explosive GBP/JPY Upside

When both majors are running hot, the Beast goes wild.

- GBP/USD rally = GBP strength vs USD weakness

- USD/JPY rally = USD strength vs JPY weakness

- Common denominator = JPY weakness + GBP strength → High-volatility upside

SMC Play: Look for London liquidity sweeps below Asian lows, followed by displacement moves and Fair Value Gap (FVG) entries.

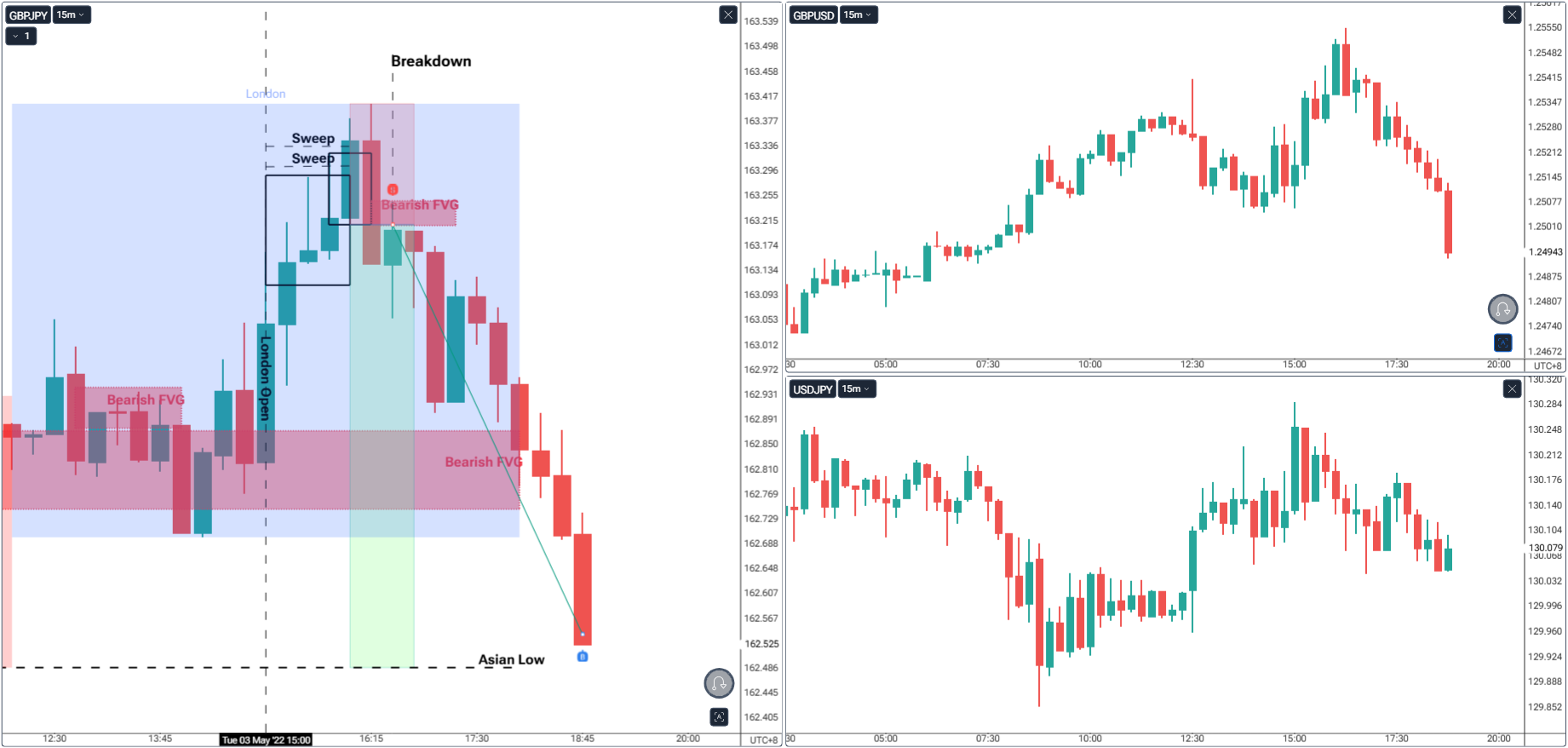

2. Both GBP/USD & USD/JPY Bearish = Sharp GBP/JPY Downside

When the pound is weak and the yen is strong, GBP/JPY drops like a stone.

- GBP/USD drop = GBP weakness vs USD strength

- USD/JPY drop = USD weakness vs JPY strength

- Common denominator = GBP weakness + JPY strength → Downside acceleration

SMC Play: Wait for liquidity grabs above intraday highs, then catch the shift in structure for continuation shorts.

3. Divergence = Choppy or Unreliable GBP/JPY Action

When GBP/USD and USD/JPY are moving in opposite directions, GBP/JPY gets torn apart.

- Example 1: GBP/USD bullish, USD/JPY bearish → GBP strength offset by JPY strength → Choppy range.

- Example 2: GBP/USD bearish, USD/JPY bullish → GBP weakness offset by JPY weakness → Erratic whipsaws.

SMC Play: Trade smaller, or skip entirely. The market’s telling you it doesn’t have one clear driver - forcing trades here drains accounts.

How to Apply This in Real Time

- Start with DXY (US Dollar Index) - Is USD broadly strong or weak?

- Check GBP/USD - Is GBP stronger or weaker than USD?

- Check USD/JPY - Is USD stronger or weaker than JPY?

- Decide on Bias - If both GBP/USD and USD/JPY point the same way for GBP/JPY, you have a trend alignment.

- Execute with SMC - Use liquidity sweeps, market structure shifts, and FVG retests for high-probability entries.

Why This Works

You’re reading GBP/JPY through the USD lens, seeing the tug-of-war between GBP and JPY in advance. This lets you:

- Filter out low-probability days before committing capital

- Catch the biggest runs early with more conviction

- Stay in sync with macro and institutional flows

Final Thoughts

Trading GBP/JPY without this filter is like betting on a relay race without knowing who’s running the first two legs. You can win - but with the GBP/USD & USD/JPY correlation, you’ll know which team is already ahead before the baton gets passed to the Beast.

If you want fewer false starts, cleaner entries, and a deeper read on volatility, start running GBP/JPY through this correlation lens. Pair it with Smart Money Concepts, and you’re no longer just reacting to the Beast - you’re predicting its next move.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.