ACY Securities' Low Spread Currency Pairs – 2nd June to 6th June 2025

2025-06-17 06:57:55

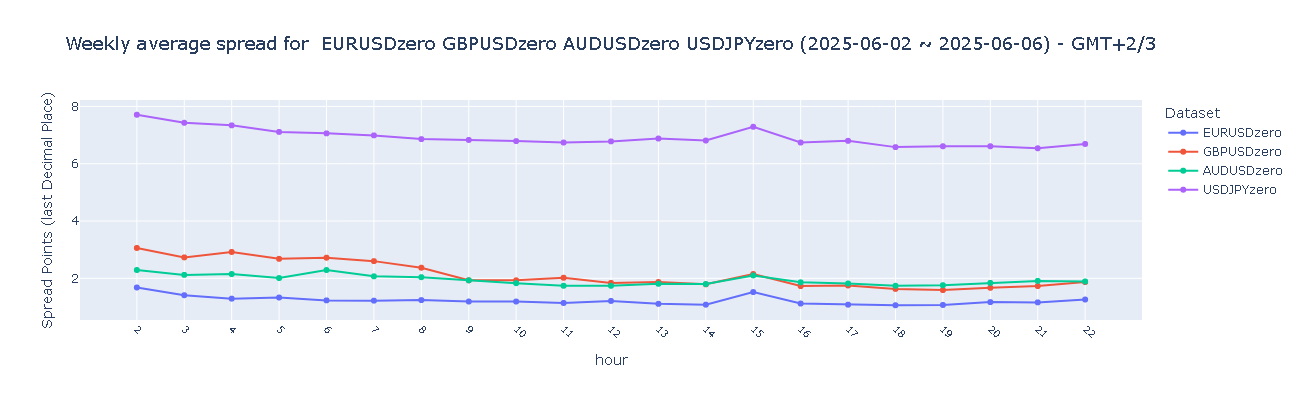

Chart I. Weekly Average Spread for Major Currency Pairs (EURUSD, GBPUSD, AUDUSD, USDJPY)

(Note: The below chart excludes the spread data of the first two hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Chart II. Weekly Average Spread for Gold and US Crude Oil (XAUUSD, USWTI)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Chart III. Weekly Average Spread for German 30 Index and Dow Jones 30 Index (GER30, DJ30)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Weekly Average Spread Review Results:

Majors Currency Pairs:

EURUSD maintained Good spread conditions (1–2 points) consistently across Asian, European, and US sessions, making it one of the most favorable pairs for trading across all major regions.

GBPUSD achieved Excellent spreads (0–2 points) during European and US sessions, but dropped to Good levels (2–3 points) in the Asian session, indicating slightly higher trading costs during Asia hours.

AUDUSD showed Excellent spreads (0–2 points) in the European and US sessions, while maintaining Good conditions (2–3 points) in the Asian session, demonstrating consistently strong liquidity across all markets.

USDJPY showed spreads worsened beyond 5 points during Asian, European, and US sessions, falling into the Improvement Required category. This indicates that despite occasional tight spreads, there were consistent occurrences of widened spreads above 5 points across all time zones, reflecting unstable liquidity or execution cost issues throughout the week.

Gold and US WTI Oil:

Gold (XAUUSD) had Excellent spreads (0–10 points) during Asian, European, and US sessions. This reflects high liquidity and cost-efficiency across all trading periods.

USWTI (US Crude Oil) displayed Excellent spreads (20–30 points) during European and US sessions, but dropped to Average (40–45 points) in the Asian session, — indicating potential cost concerns for off-peak trading.

Dow Jones 30 and German 30 Indices:

DJ30 (Dow Jones 30) maintained Good spreads (200–250 points) across Asian, European, and US sessions, showing solid liquidity and reliable execution throughout the week.

GER30 (German 30 Index) had Good spreads (200–300 points) during European hours, while spreads widened to Average (300–500 points) in Asian and US sessions. suggesting that optimal trading conditions are largely confined to European market hours.