U.S. Producer Prices Stall in June as Tariff Pressures Balance Service Slowdown

2025-07-17 09:56:27

On July 16, 2025, the U.S. Bureau of Labor Statistics reported that the Producer Price Index (PPI) for final demand remained unchanged in June a notable surprise compared to the expected 0.2% rise.

This flat reading, following a revised 0.3% increase in May, reflects a complex interplay in the economy where elevated input costs due to import tariffs were offset by a weakness in services sector prices

The flat monthly change in PPI masks diverging trends: goods prices climbed by 0.3%, driven partly by tariff-related cost pressures, while services prices dipped 0.1%, reflecting weak demand in sectors such as travel, lodging, and automobile services.

The modest lift in goods prices was evident in categories like household furnishings, appliances, toys, and electronics segments directly affected by the import levies implemented earlier this year.

Conversely, service cost declines included a 2.7% drop in airline passenger prices and a 5.4% fall in automobile retail prices, as falling volumes pressured vendors to absorb cost increases.

On an annualised basis, PPI rose 2.3% year-over-year, down from May’s 2.7% pace, marking a nine-month low in wholesale inflation.

Core PPI excluding volatile food and energy also remained unchanged for the month, slowing to 2.6% y/y from 2.8%

This mixed reading highlights that while tariffs continue to exert upward pressure on goods prices, broader inflation dynamics remain subdued due to softer service demand.

Economists have noted that this "muted tariff effect" thus far suggests limited upside inflation risk but most caution that as tariff waves expand, inflation pressure could intensify

Financial markets responded positively to the cooler-than-anticipated data. Investors recalibrated expectations for Federal Reserve policy, maintaining a bias toward a pause in rate hikes and even potential cuts later in the year.

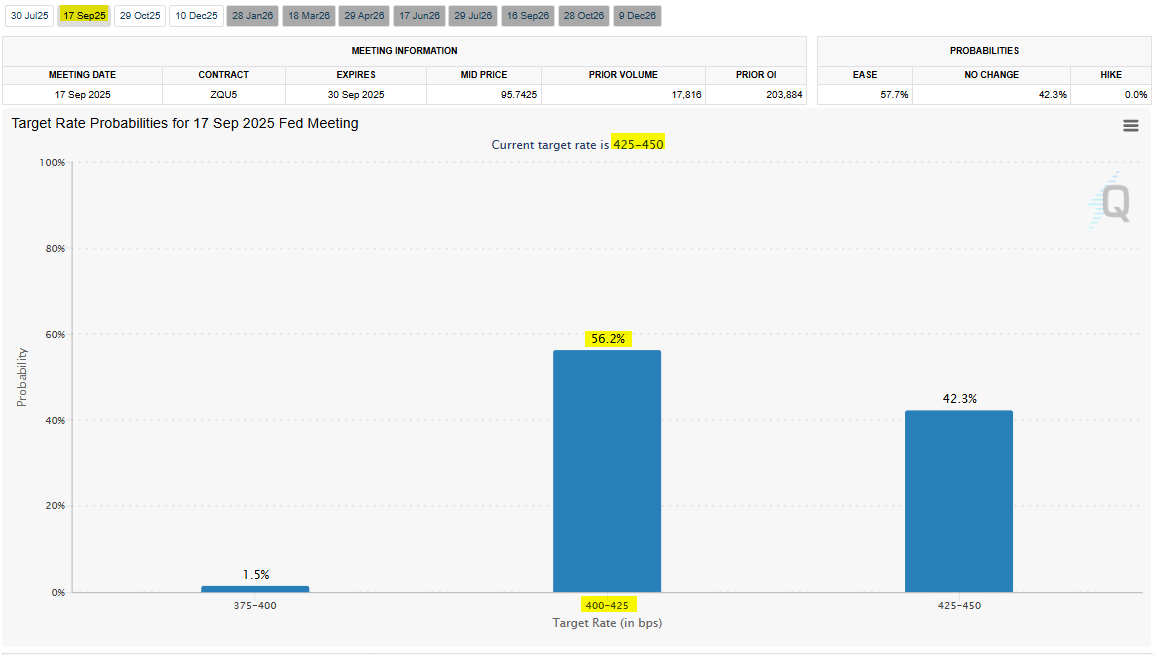

Indeed, futures markets are now pricing in a higher likelihood of Fed rate reductions beginning in September, contingent on continued inflation moderation and weakening labor data.

The Federal Reserve Beige Book, released alongside the PPI, painted a similar picture of rising economic activity tempered by growing input cost concerns and labor shortages tied to tariffs and policy changes.

Firms reported passing some costs onto customers but also expressed caution around future pricing capacity, especially as pre-tariff inventories are depleted.

What the PPI Signals for the Federal Reserve and the U.S. Dollar

The flat headline PPI reading in June, coupled with softening core inflation and continued weakness in services prices, provides the Federal Reserve with additional breathing room. Although the latest CPI report showed some firmness, the producer-side data tells a different story one of demand-side fragility that is beginning to outweigh supply-driven inflation, at least temporarily.

This dynamic is crucial because the Fed’s recent rhetoric has shifted to a more data-dependent, risk-balanced approach. With the PPI showing no monthly increase and core PPI decelerating to 2.6% on a year-over-year basis, policymakers are likely to interpret this as a sign that inflationary pressures particularly upstream are stabilizing.

The services sector, which accounts for a large portion of core PCE inflation (the Fed's preferred metric), is showing visible disinflation. Airline fares, retail margins, and hotel prices all components of service PPI declined in June, suggesting that price stickiness may be easing.

Market participants are increasingly pricing in a scenario where the Fed could initiate a rate cut as early as September (as shown on the image above), particularly if upcoming labor market data continues to soften and services inflation remains subdued.

Futures pricing currently reflects a roughly 65–70% probability of a cut before year-end, a sharp contrast to expectations earlier this year when persistent inflation risks dominated the outlook.

For the U.S. dollar, the implications are twofold. On the one hand, the stall in PPI reduces pressure on the Fed to maintain its hawkish stance, which in theory should weaken the greenback as interest rate differentials compress against peers like the ECB or BoE.

Indeed, the initial reaction in FX markets was mildly bearish for the USD, particularly against higher-yielding and inflation-sensitive currencies like the AUD and GBP.

However, this narrative is complicated by external factors such as sluggish European growth, political uncertainty in the UK, and ongoing yen weakness due to Japan’s yield curve control framework.

Ultimately, the dollar’s trajectory will hinge not just on the Fed’s next move but on relative economic strength and how other central banks respond to their own inflation challenges.

If the PPI trend persists and is confirmed by weaker CPI and labor market reports, the USD could enter a gradual softening phase, especially against EM and cyclical FX.

However, any resurgence in input costs due to tariff escalation or geopolitical tensions could reignite the inflation debate and delay the Fed’s easing path, providing renewed support to the dollar.

In short, the June PPI release does not singlehandedly dictate the Fed's next step, but it tilts the balance toward accommodation provided that downstream inflation and employment data align.

For dollar traders and rate strategists alike, this reinforces the importance of near-term data flow and global policy convergence in shaping market expectations.

Q1: What did the June 2025 U.S. PPI report reveal about inflation trends?

A: The June PPI showed no change on a month-over-month basis, coming in at 0.0% versus expectations of a 0.2% increase. On a year-over-year basis, headline PPI slowed to 2.3%, while core PPI (excluding food and energy) decelerated to 2.6%. This suggests that upstream inflation pressures are stabilizing, with goods prices rising modestly due to tariffs, while service sector prices declined, reflecting softer consumer demand.

Q2: How is the Federal Reserve likely to interpret the latest PPI data?

A: The flat PPI reading supports a more cautious and data-dependent approach from the Federal Reserve. With upstream price pressures appearing to moderate and services inflation showing early signs of softening, the Fed is less compelled to maintain a restrictive stance. This could open the door to a potential rate cut as early as September, especially if labor market and consumer price data continue to cool in the coming months.

Q3: Why did markets view the PPI data as dovish?

A: Markets interpreted the flat producer prices as a sign that inflation is not re-accelerating despite ongoing tariff pressures. This reinforced expectations that the Fed might have room to cut rates later this year. As a result, bond yields pulled back slightly and interest rate futures began pricing in a higher probability of easing, with traders now anticipating at least one 25bps cut before year-end.

Q4: What are the implications for the U.S. dollar?

A: A softer inflation backdrop reduces the urgency for the Fed to stay hawkish, which in turn lowers the interest rate premium supporting the dollar. The initial USD reaction was mildly bearish, particularly against higher-beta currencies. However, the broader FX impact remains conditional on how other central banks respond. If global peers remain dovish or face growth constraints, the dollar may hold up despite domestic easing.

Q5: Could tariffs still reignite inflation later this year?

A: Yes. While the current PPI suggests muted pass-through from tariffs, upcoming duties scheduled for August 1st on goods from Mexico, Japan, and the EU could eventually lead to higher input costs. If businesses begin to pass these costs on more aggressively especially once inventory buffers deplete both producer and consumer inflation could rebound, complicating the Fed’s path and reintroducing upside risks for the dollar.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.