Economic Uncertainty Drives Commodity Trends: Gold at $3000, Gas on the Rise, and Oil Steady

2025-03-18 09:54:25

Overview

- GOLD – Safe Haven Shines at $3000

- Gold has surged past the $3000 mark as investors seek protection from rising inflation, geopolitical risks, and economic uncertainty.

- Key Point: Escalating inflation and a weakening dollar have driven robust safe-haven demand, bolstering gold’s status as a store of value.

- GAS – Natural Gas Rallies on Tight Supply

- Natural gas prices are climbing due to supply constraints, strong seasonal demand, and improved export prospects.

- Key Point: Lower-than-expected inventory levels and strategic export contracts are driving upward price momentum in the natural gas market.

- OIL – Steady Prices Amid Oversupplies

- U.S. oil prices remain steady in the mid-$80s range, despite ongoing oversupply and high production levels, supported by global demand and coordinated production cuts.

- Key Point: Modest inventory drawdowns and effective OPEC+ measures are helping to balance the surplus and stabilize oil prices.

Gold Breaks $3000: What Fueled Its Ascent?

Gold has recently surged to the 3000 level, and a combination of global economic pressures and investor sentiment has driven this historic move. In today’s turbulent market, where uncertainty is the only constant, gold has once again proven its worth as a safe-haven asset.

U.S. Government Nears Shutdown but Deterred, Escalating Economic Risks Weigh on the Dollar

As the U.S. government teeters on the brink of a shutdown, several intertwined economic and political risks are influencing the performance of the U.S. dollar.

Here’s how these conditions have impacted gold:

- Safe-Haven Demand: Heightened political uncertainty and economic instability drive investors toward gold, a traditional safe-haven asset.

- Dollar Weakness: As fiscal concerns and a potential government shutdown weaken the U.S. dollar, gold becomes more attractive—both as a hedge against currency depreciation and because a lower dollar makes gold cheaper for international buyers.

- Inflation Hedge: Economic risks often fuel inflation fears. When investors worry that fiscal imbalances might lead to higher inflation, gold’s role as an inflation hedge becomes even more critical.

- Market Volatility: Increased uncertainty typically elevates market volatility, prompting a flight to quality. Despite short-term fluctuations, gold tends to gain momentum as confidence in traditional assets wanes.

In essence, the threat of a government shutdown and escalating economic risks have reinforced gold's appeal. As the U.S. dollar weakens and safe-haven flows increase, gold emerges as a robust store of value amid turbulent market conditions.

Inflation & Sentiment Further Pressured Dollar

Inflation Expectations: Recent reports show that inflation expectations for the next year have surged to 4.9%, while long-term expectations have risen to 3.9%—levels not seen in recent years.

Rising inflation remains a primary driver behind gold’s allure. As central banks struggle to curb rising prices, investors view gold as a hedge against the eroding purchasing power of fiat currencies. With inflation outpacing target levels, gold’s intrinsic value offers a safe haven that preserves wealth in turbulent times.

Economic Uncertainty Spurs Safe-Haven Demand

Economic indicators point to a growing uncertainty. With consumer sentiment at its lowest in over two years and markets jittery over trade tensions and policy shifts, investors are increasingly seeking the stability of gold. In a risk-off environment, gold’s safe-haven status becomes invaluable—its price rally reflecting a collective flight from riskier assets.

- Consumer Sentiment: The University of Michigan's Consumer Sentiment Index plunged to 57.9 in March, reflecting a sharp decline in confidence.

- Market Volatility: Despite easing volatility (with the VIX declining), underlying uncertainties persist in global markets.

$3000 Gold Target Forecast On-Point

As previously forecasted, ACY SecuritiesGold Nears Record Highs as Dollar Weakens, Fuel Outlook on N…, ACY SecuritiesGold Eyes $3,000: Safe-Haven Demand Rises Amid Tariff Wars, we have now broken out of the $3000 level.

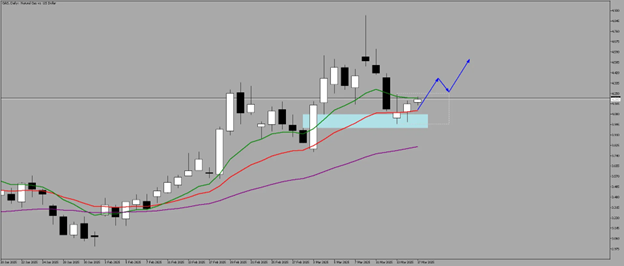

4-Hour

Gold surged to $3000 after breaking out of the 2956.18 level during the US session following a threat to a government shutdown.

Investors flocked into safety as the US economy remains uncertain.

1-Hour

Currently, Gold is sitting at the discount level of the range which acts as a support.

A break at the 3005 level could potentially propel price to new highs with a $3100 target.

Gold’s breakthrough to the $3000 level underscores its role as a reliable safe haven in turbulent times. Rising inflation expectations, weakening consumer sentiment, and the specter of a U.S. government shutdown have driven investors to seek stability outside traditional asset classes. As the U.S. dollar weakens and market volatility persists, gold stands out as a resilient store of value with a potential target of $3100 on further support.

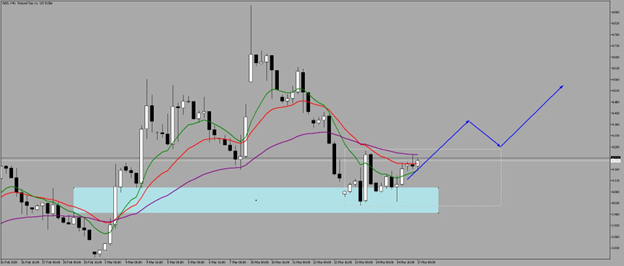

GAS: 2-Day Traction

Reuters reported that U.S. LNG facilities secured new export contracts with buyers in Europe and Asia. These agreements are expected to boost export volumes and tighten global supply, reinforcing upward pressure on natural gas prices.

Data released by the Energy Information Administration on March 15, 2025, indicated that natural gas inventories were lower than expected. This shortfall in storage underscores supply constraints amid heightened demand, particularly in anticipation of colder weather.

As colder-than-average forecasts took hold in major consumption areas, market observers noted a rally in natural gas prices on March 17, 2025. The combination of supply constraints, robust seasonal demand, and positive export news has driven this upward trend.

The natural gas market is currently navigating a challenging landscape where supply constraints, robust demand, and geopolitical uncertainties intersect. Specific developments—export contract announcements on March 14, lower-than-expected storage figures on March 15, and escalating geopolitical tensions on March 16—have all contributed to a notable price rally observed on March 17, 2025.

Daily

GAS, after getting support at 3.965 - 4.078 Fair Value Gap, is gaining traction and have not incurred down days as global supply tightens.

4-Hour

A break of 4.250 level and the 20-50-Day Moving Average could be a propeller for GAS to gain more traction to the upside.

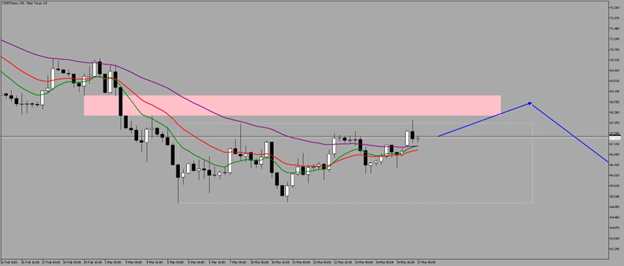

OIL: Persistent Weakness Amid Steady Production and Oversupply

Recent reports from the Energy Information Administration (EIA) indicate a modest draw in U.S. crude stocks, reflecting efforts by producers to curb oversupply. However, ongoing production levels remain high, keeping the market in a delicate balance.

Despite pressures to reduce output, U.S. shale producers have maintained steady production. The active rig count has stabilized near lower-end levels, suggesting cautious investment in new drilling but a commitment to meeting current demand.

Daily

Oil continues its downside move as it trades below the daily moving averages amidst oversupplies.

4-Hour

Potential resistance level is at 68.239 - 68.989.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.