TradingView vs. MetaTrader 5: Which is Best for You?

2025-09-29 16:22:19

Last Updated: September 29, 2025

This article is reviewed annually to reflect the latest market regulations and trends

TradingView vs. MetaTrader 5: An Honest Comparison for Serious Traders (2025)

It's the ultimate showdown for your screen space: the beautiful, intuitive charting of TradingView versus the raw, automated power of MetaTrader 5. Choosing your primary platform is one of the most critical decisions you'll make as a trader. Are you choosing the right tool for the job? This article isn't a simple "which is better" debate. Instead, it's a guide to help you find the platform that aligns with your personality and strategy. The core question isn't "which is best," but "which is best for you?"

What Kind of Trader Are You?

Before we dive into a feature-by-feature comparison, it's essential to establish the two core trader archetypes. Understanding where you fit on this spectrum will make your platform choice much clearer.

The Discretionary Chart Artist: This trader lives and breathes charts. Their edge comes from their ability to read price action, identify patterns, and use drawing tools to map out their trades. They rely on their analytical skill and intuition to make trading decisions.

The Algorithmic Systems Engineer: This trader's edge comes from developing, backtesting, and deploying automated trading strategies, often called Expert Advisors (EAs). They are comfortable with code and systems, and their success is built on the robustness of their algorithms. For a deeper dive into these two approaches, consider this article on manual day trading vs. MT5 automated trading.

TL;DR: (Too Long; Didn’t Read)

For those who want the key takeaways without the deep dive, here's the verdict at a glance:

For Charting & Analysis, TradingView is King: Its HTML5 charts, intuitive tools, and social features are unmatched for manual, discretionary trading.

For Automation & EAs, MT5 is the Workhorse: Its robust infrastructure, MQL5 language, and massive ecosystem make it the industry standard for algorithmic trading.

Broker Integration is MT5's Strong Suit: MT5 offers direct, widespread integration with thousands of brokers for faster, more reliable execution.

Ease of Use Goes to TradingView: Its modern interface and user experience are far more beginner-friendly than MT5's dated design.

The Pro's Choice is Often Both: Many serious traders use TradingView for analysis and MT5 for execution, leveraging the strengths of each.

Head-to-Head: TradingView vs. MetaTrader 5 Scoring Table

| Feature | Winner |

| Charting & Analysis | TradingView |

| Automated Trading (EAs) | MT5 |

| Custom Indicators & Scripts | MT5 (for quantity), TradingView (for ease of use) |

| Broker Availability & Execution | MT5 |

| User Interface & Experience | TradingView |

A Deep Dive into the Comparison

Now, let's explore the nuances of each category to understand why a "winner" was chosen and what it means for you as a trader.

Charting & Analysis

TradingView is the undisputed champion in this category. Its charts are clean, responsive, and highly customizable, with a vast array of drawing tools and indicators that are easy to access and use. The platform is web-based, meaning you can access your charts and analysis from any device without needing to install software.

MetaTrader 5, on the other hand, has a more dated and clunky charting interface. While it offers a decent selection of built-in indicators and graphical objects, the user experience can be frustrating for those accustomed to modern software design.

Automated Trading (EAs)

This is where MetaTrader 5 shines. The platform was built from the ground up for automated trading, and its MQL5 programming language is a powerful tool for creating complex trading robots (EAs). MT5's Strategy Tester is another key feature, allowing traders to backtest their EAs on historical data to assess their performance. The platform's ecosystem of EAs is vast, with a massive marketplace of both free and paid trading robots. When exploring automated trading, it's crucial to understand the psychological impact, as detailed in this article on using Expert Advisors to combat fear and greed. Additionally, scripts can help you get more freedom and less screen time with MT5 alerts.

TradingView's Pine Script is a more user-friendly language for creating custom indicators and simple strategies, but it's not as powerful as MQL5 for full-fledged automation. While you can create trading alerts in TradingView, you'll need a third-party tool to execute trades automatically.

Custom Indicators & Scripts

Both platforms have large communities of developers creating custom indicators and scripts. MetaTrader 5's MQL5 community is older and larger, offering a vast library of free and paid tools. However, the quality can be inconsistent, and it's essential to be aware of the risks of using third-party tools. To protect yourself, it's wise to learn about how to spot scam Forex Expert Advisors and 5 ways to spot a fake or repainting MT4/MT5 indicator.

TradingView's Pine Script editor is more user-friendly, and the platform's library of community-created scripts is constantly growing. While the selection may not be as extensive as MT5's, the quality is generally high, and the ease of use is a significant advantage for many traders.

Broker Availability & Execution

MetaTrader 5 is the clear winner when it comes to broker integration. The platform is the industry standard for forex and CFD brokers, with thousands of brokers offering it to their clients. This means you have a wide choice of brokers and can easily switch between them without having to learn a new platform.

TradingView has a growing list of integrated brokers, but it's still a fraction of the number that supports MT5. While you can use TradingView for analysis and then execute trades on a separate platform, the seamless integration of MT5 with so many brokers is a major advantage for active traders.

User Interface & Experience

TradingView's modern, intuitive, and web-based interface is a pleasure to use. The platform is easy to navigate, and its features are well-organized and accessible. The social trading features, such as the ability to share and comment on trading ideas, also contribute to a more engaging user experience.

MetaTrader 5's interface, in contrast, feels dated and can be overwhelming for new users. The platform is powerful and highly customizable, but it has a steeper learning curve and a less intuitive design.

Making MT5 Feel More Modern

Love MT5's execution but hate the interface? Here are 10 essential scripts and indicators that add the modern, quality-of-life features you're missing. For those new to this, a day trading for beginners starter pack of scripts can be a great starting point.

- Position Size Calculator: Automatically calculates the correct lot size for a trade based on your risk percentage and stop-loss level.

- One-Click Trade Panel: Allows you to open, close, and manage trades with a single click, saving you valuable time.

- Session Indicator: Displays the trading sessions of different financial markets directly on your chart, helping you to identify periods of high and low volatility.

- Order History Indicator: Visualizes your past trades on the chart, allowing you to analyze your performance and identify patterns in your trading.

- Spread Indicator: Shows the current spread for the instrument you are trading, helping you to avoid entering trades when the spread is too wide.

- Auto SL/TP Script: Automatically sets your stop-loss and take-profit levels based on a predefined risk-reward ratio. For more on this, see how to use MT4/MT5 indicators for risk management.

- Breakeven Script: Moves your stop-loss to your entry price once a trade has moved a certain distance in your favor, protecting your capital.

- Partial Close Script: Allows you to close a portion of your trade, securing some profits while letting the rest of the position run.

- Alerts on Trendline Break: Notifies you with an alert when the price breaks a trendline that you have drawn on your chart.

- Chart Screenshot Tool: A simple script to quickly take and save a screenshot of your chart for your trading journal.

For those looking to simplify their MT4/MT5 indicator and scripts stress-free, these tools can be a game-changer. And remember, scripts can be a powerful alternative to premium EAs.

Trading Philosophies & Platform Choice

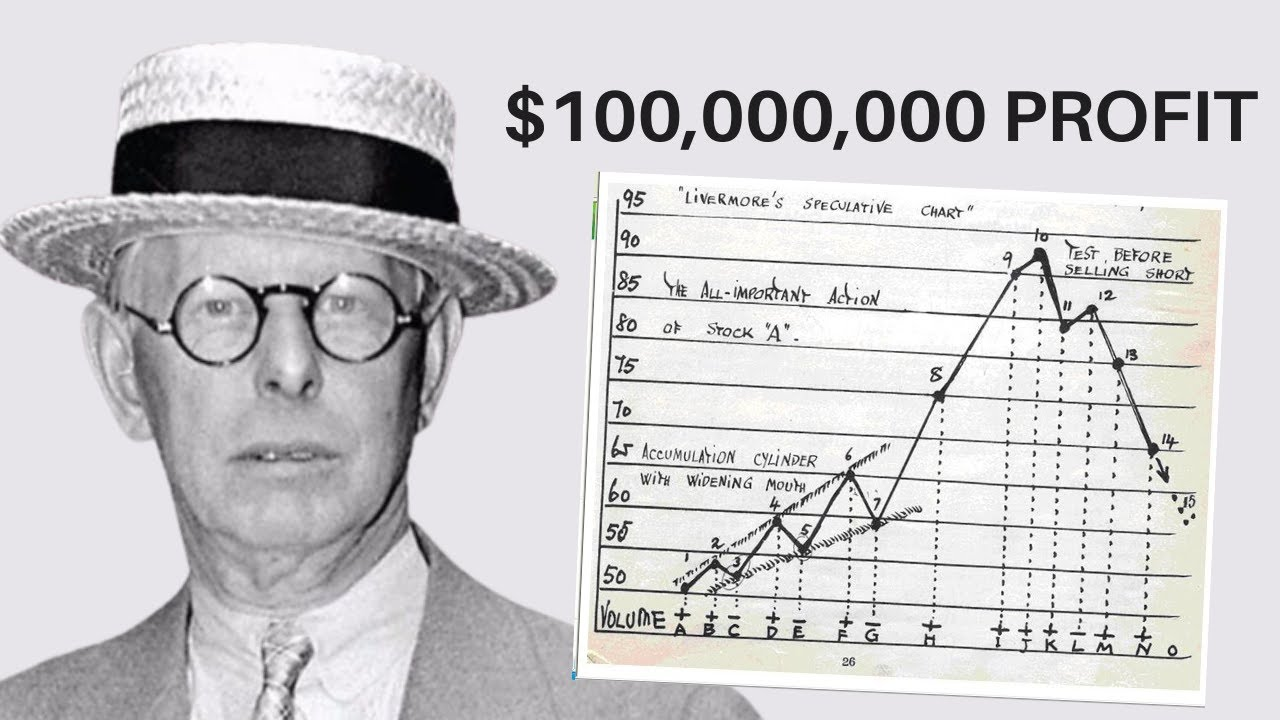

How Jesse Livermore Would Approach the Platform Debate

The legendary tape reader Jesse Livermore was obsessed with price action, timing, and execution. He would have been captivated by TradingView's charting capabilities for his analysis, or "reading the tape." The platform's clean charts and powerful drawing tools would have allowed him to identify his "pivotal points" with ease.

However, for execution, Livermore would have demanded the direct, no-fuss connection of MT5 to his broker. He believed in acting decisively once the market confirmed his opinion, and the speed and reliability of MT5's execution would have been non-negotiable. It's likely that in today's market, Livermore would have used both platforms in a professional setup: TradingView for analysis and MT5 for execution.

10 Lessons from "The New Market Wizards" on Choosing Your Tools

Jack Schwager's "The New Market Wizards" is a treasure trove of wisdom from some of the world's top traders. Here are 10 key lessons from the book and how they apply to your platform choice:

- "Find a method that fits your personality": This is the central theme of this article. The "Chart Artist" will naturally gravitate towards TradingView, while the "Systems Engineer" will find a home with MT5.

- "The importance of a robust methodology": Both platforms can support a robust methodology. MT5's backtesting capabilities are essential for algorithmic traders, while TradingView's deep charting tools are invaluable for discretionary traders.

- "Risk management is paramount": Both platforms can facilitate risk management, but MT5 EAs can enforce it automatically. A well-programmed EA can ensure that you never risk more than a predefined percentage of your capital on a single trade.

- "Discipline is the key to success": The right platform should support, not hinder, your discipline. For some, the automation of MT5 can enforce discipline, while for others, the clarity of TradingView's charts can help them stick to their trading plan.

- "Patience is a virtue": TradingView's alert system can help you patiently wait for your setup to materialize without having to be glued to your screen.

- "You have to be willing to make mistakes": Both platforms offer demo accounts, which are essential for testing new strategies and making mistakes without risking real money.

- "The market is a dynamic entity": The flexibility of both platforms allows you to adapt to changing market conditions. The vast libraries of custom indicators and scripts for both platforms can help you stay on top of market trends.

- "Don't be a hero": Both platforms can help you avoid being a hero by allowing you to set realistic profit targets and stop-losses.

- "Emotional control is essential": The right platform can help you manage your emotions. For some, the act of programming an EA in MT5 can be a way of detaching from the emotional rollercoaster of trading.

- "There is no single secret to success": The diversity of traders and strategies profiled in "The New Market Wizards" is a testament to the fact that there is no one-size-fits-all approach to trading. The same is true for trading platforms.

The Final Verdict: Can They Coexist in a Professional Workflow?

The "vs." debate is often misleading for serious traders. The ultimate solution is a hybrid approach. A professional workflow often involves using TradingView for charting, idea generation, and community insights, then turning to MT5, the dedicated, specialist tool, for robust backtesting and flawless trade execution. This approach allows you to leverage the strengths of both platforms, creating a powerful and versatile trading setup.

Your Top Questions on TradingView and MT5

Can I trade directly from TradingView with any broker?

No. While TradingView is expanding its integrations, only a limited number of brokers allow direct trading. MT5 connects to thousands of brokers globally.

Is Pine Script (TradingView) easier to learn than MQL5 (MT5)?

Yes, Pine Script is widely considered easier for beginners as it's designed specifically for creating indicators and simple strategies. MQL5 is a more complex, C++ based language built for high-performance algorithmic trading.

Is TradingView or MT5 better for beginners?

TradingView is generally better for learning technical analysis due to its intuitive interface and educational resources. MT5 can be overwhelming for new traders not focused on automation.

Why is MT5 still so popular if its interface is outdated?

Its popularity stems from its power as an execution and automation platform. For brokers and algorithmic traders, its stability, speed, and massive library of existing EAs are more important than a modern UI. For those looking for indicators, you can learn more about where to find or create exclusive best MT4/MT5 indicators.

Can I use TradingView charts but execute on MT5?

Yes, this is a very common professional workflow. Traders perform their analysis on TradingView and then manually place their trades on their broker's MT5 platform.

Conclusion

The choice between TradingView and MetaTrader 5 is not about which is "best," but about understanding your needs as a trader. Use TradingView to become a master analyst; use MT5 to become a master of execution. For many, the answer is not one or the other, but both.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.