USD/JPY: Correlation of DXY vs US10Y

2025-08-05 11:18:26

In our previous guide, USD/JPY: How to Trade the Fastest Moving Forex Pair with Precision, we laid out the roadmap for trading one of the most dynamic pairs in forex. From Tokyo session sweeps to yield-driven momentum bursts, USD/JPY revealed itself to be less about noise and more about narrative.

But there’s one question traders keep asking after mastering the basics:

Should I correlate USD/JPY with DXY or the U.S. 10-Year Yield?

Let’s put that question to rest once and for all.

Recap: Why USD/JPY Moves the Way It Does

As we covered previously, USD/JPY responds to:

- Interest rate differentials between the U.S. and Japan

- Risk-on vs risk-off sentiment

- Verbal or actual BoJ interventions

- Macro events like CPI, NFP, or Fed decisions

But there’s one force that consistently moves USD/JPY with almost surgical precision: the U.S. 10-Year Treasury Yield (US10Y).

Why Most Traders Default to DXY - and Why That’s a Problem

It’s natural to use the Dollar Index as a guide. After all, it tracks the strength of the U.S. dollar. But here’s the catch most don’t realize:

- DXY is made up of six currencies

- The euro makes up 57.6% of the index

- The yen accounts for only 13.6%

That means DXY mostly reflects EUR/USD behavior. So if EUR is rising due to European data, DXY might fall, even while USD/JPY is rising.

You end up following the wrong signal, missing setups, or worse, taking the opposite side.

US10Y: The Real Driver of USD/JPY

USD/JPY is incredibly sensitive to interest rate differentials, specifically the gap between U.S. and Japanese bond yields.

Unlike DXY, the U.S. 10-Year Treasury Yield (US10Y) offers a direct lens into what’s moving USD/JPY. Here's why:

- USD/JPY is highly sensitive to interest rate differentials

- US10Y reflects inflation, growth, and Fed expectations

- When yields rise, investors buy dollars, pushing USD/JPY higher

- When yields fall, money flows to safer assets like the yen, and USD/JPY drops

This isn’t just correlation - it’s mechanical causation.

Comparing Bananas to Apples

Tracking USD/JPY with DXY is like watching the euro to forecast the yen.

It can work in short bursts, but over time, it leads you down the wrong path.

Tracking yields, on the other hand, puts your finger on the real market lever.

When to Use DXY vs US10Y

| Situation | Use DXY | Use US10Y |

|---|---|---|

| Trading EUR/USD or GBP/USD | ✅ | |

| Trading USD/JPY intraday or swing | ✅ | |

| Assessing broad USD strength | ✅ | ✅ |

| Identifying misalignment or divergence | ✅ | ✅ |

Use DXY for sentiment, but use US10Y for precision when trading USD/JPY.

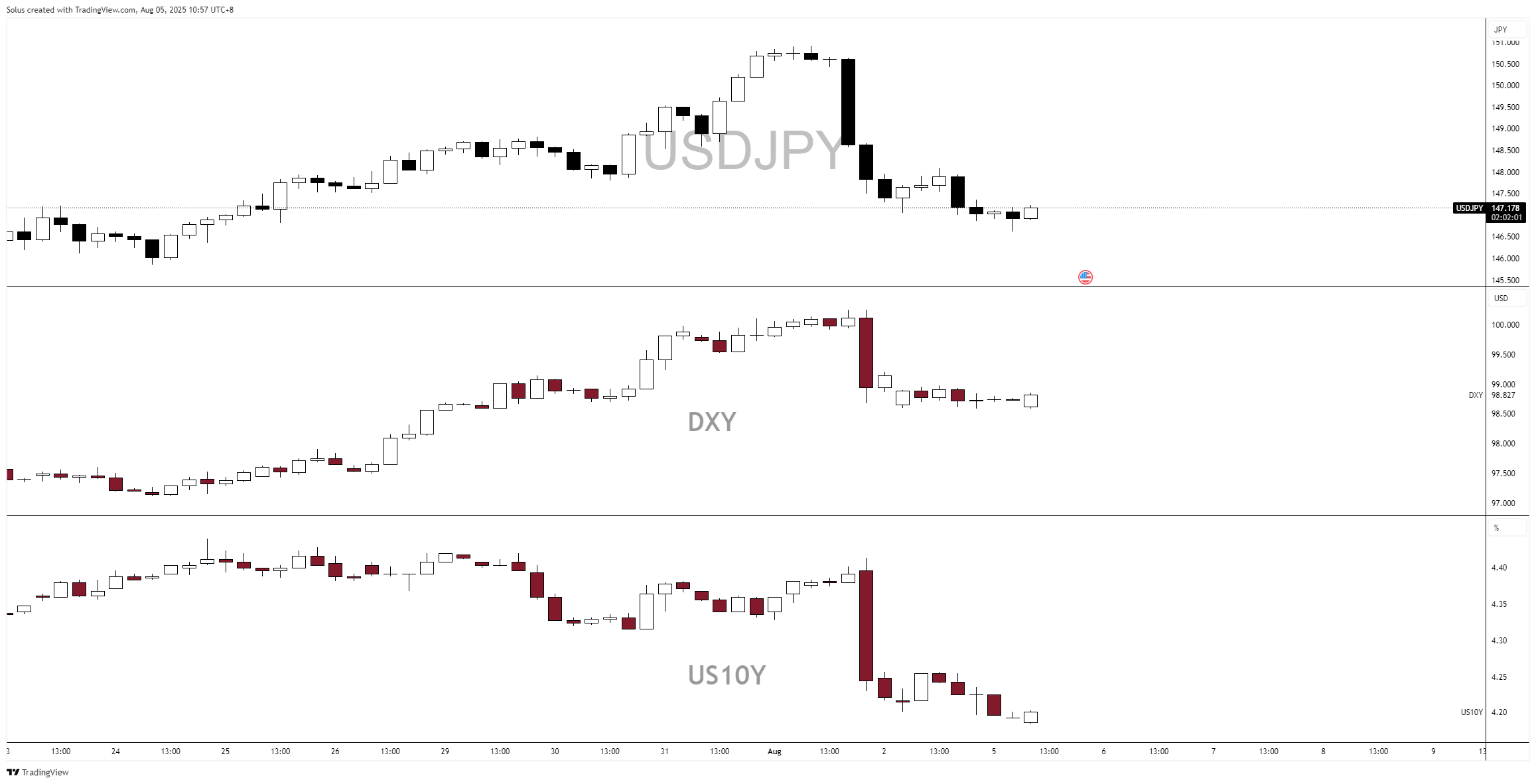

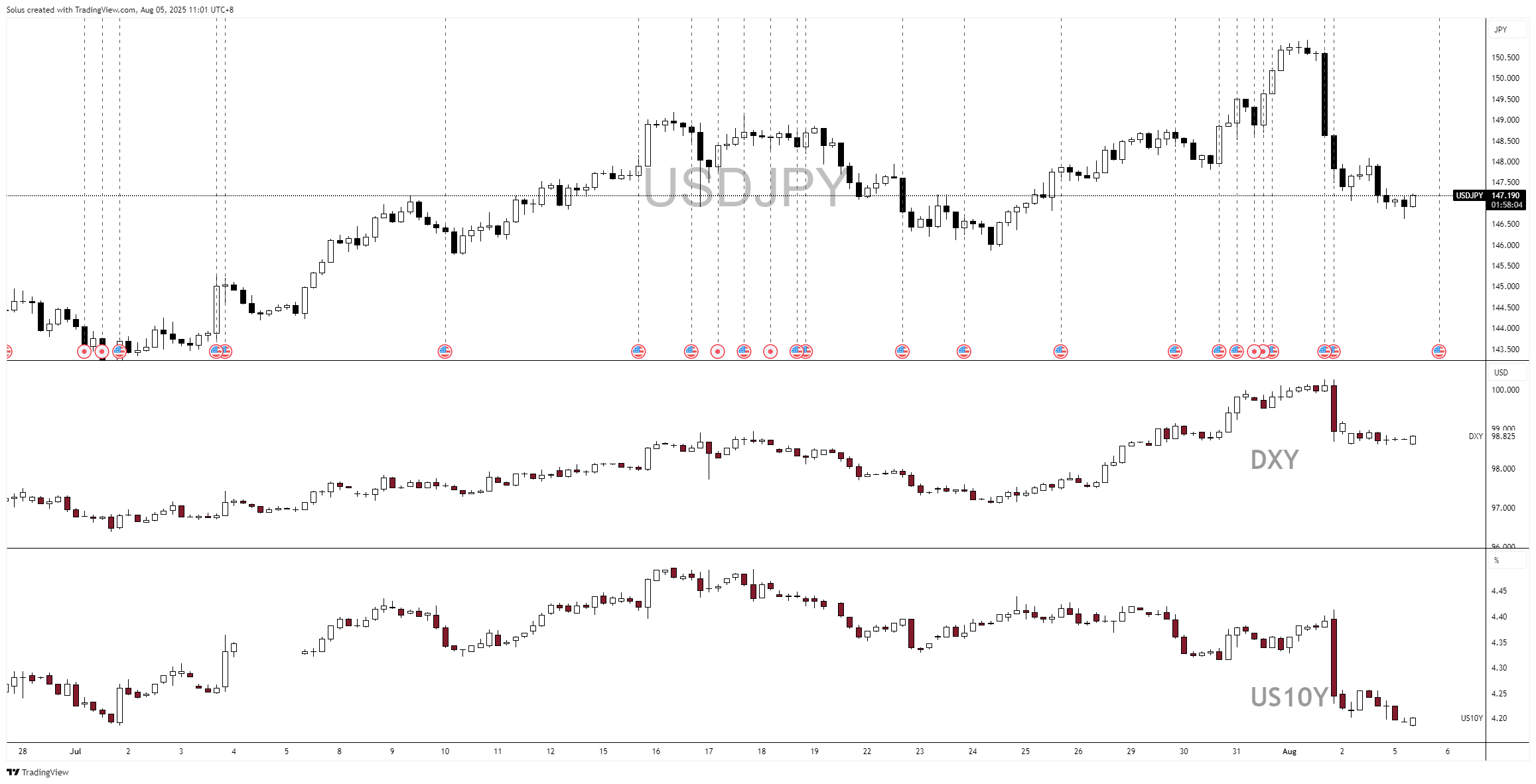

How to Overlay It All in One Chart

- Open USD/JPY on TradingView

- Add US10Y using the “Compare” feature

- Add DXY as a second overlay

- Watch how USD/JPY shadows yields, not the index

- During CPI, NFP, or Fed announcements, observe which leads and which lags

The pattern becomes clear. Yields lead. USD/JPY follows. DXY reacts.

Real-Life Analogy: The Wrong Forecast

Using DXY to trade USD/JPY is like dressing for the weather based on someone else's city.

Using US10Y is like stepping outside and feeling the air yourself. It’s live, local, and accurate.

Challenge for the Week

This week, before entering any USD/JPY trade:

- Check the US10Y chart

- Note whether yields are rising, falling, or ranging

- Align your directional bias accordingly

- Only take setups when your technical entry model (MSS, FVG, OB) aligns with the bond market’s message

Then compare what DXY is doing. You’ll spot the difference, and gain the edge.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading – A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.