Nasdaq Rebounds After 23,000 Sweep: Breakout or Rejection Ahead?

2025-09-04 12:53:43

The Nasdaq 100 reversed from its 23,000 sweep after ISM and JOLTs data. Now testing the 23,500 FVG, will it break higher toward 23,800 or face rejection?

- ISM and JOLTs data first fueled weakness, then relief, pushing the Nasdaq 100 into a liquidity sweep at 23,000.

- Alphabet’s antitrust win reignited tech momentum, helping the index reverse sharply and reclaim 23,450.

- Technical forecast: Nasdaq 100 now tests the 23,500 H4 FVG — breakout targets 23,800+, rejection risks a return to 23,300 or lower.

NASDAQ: From Weakness to Relief

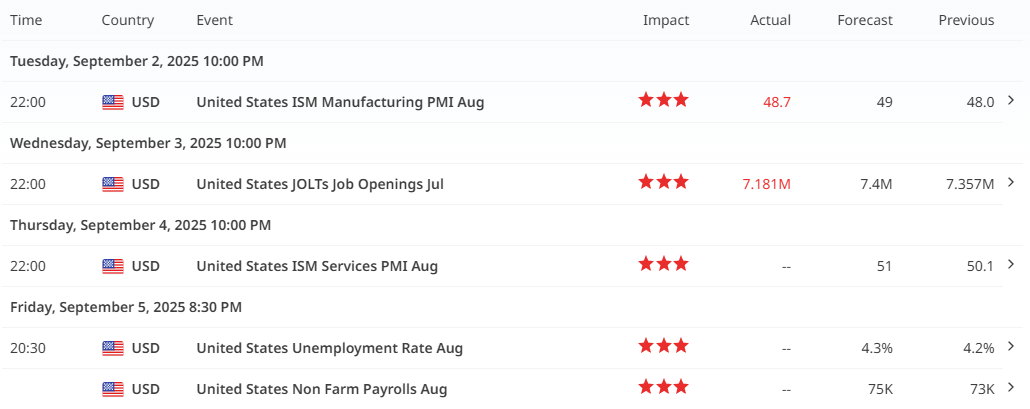

ISM Miss Sparks the Bearish Leg

The move began on September 2, when the ISM Manufacturing PMI printed at 48.7 vs 49 forecast, confirming ongoing contraction in the U.S. factory sector. This raised fresh concerns about economic momentum and pushed equities lower, particularly high-valuation growth stocks in the Nasdaq.

JOLTs Data Fuels Fed Rate-Cut Bets

A day later, the JOLTs Job Openings report showed a sharper-than-expected decline to 7.18M. While this initially reinforced the slowdown narrative, traders quickly reframed it as bullish for equities. A cooling labor market increases the probability of a September Federal Reserve rate cut, shifting sentiment from caution to opportunity.

Alphabet Antitrust Win Provides Relief Rally

The turning point came on September 3 when Alphabet secured a favorable antitrust ruling. Avoiding a breakup of its Chrome business, Alphabet surged nearly 8%, and Apple followed higher on confidence their partnership remained intact. This legal relief removed a major overhang on the Magnificent Seven and sparked a tech-led rebound, aligning with the bullish reversal scenario.

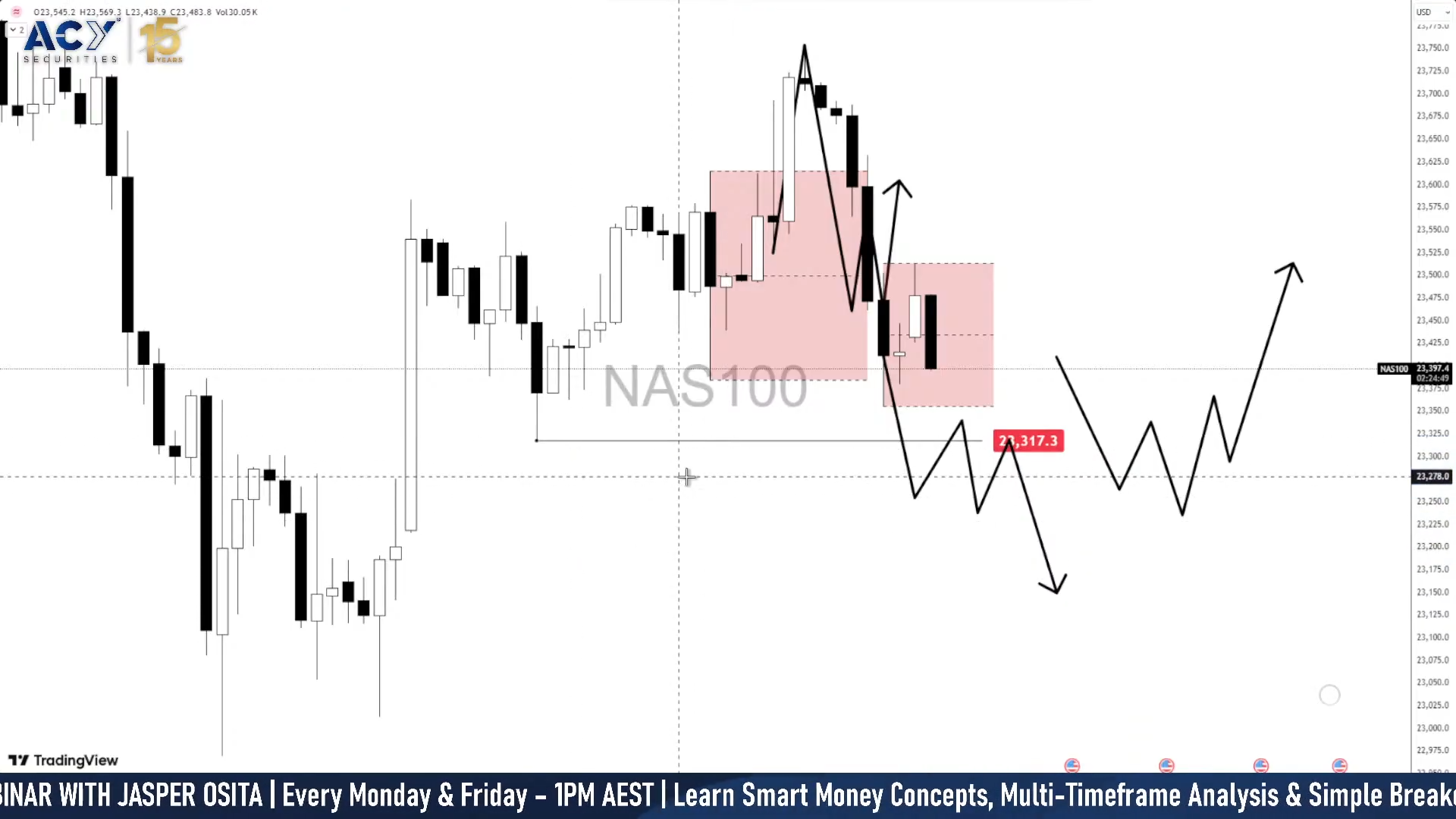

Nasdaq 100 Before vs After

The Forecast (Before)

In the earlier outlook, Nasdaq 100 was positioned inside a corrective range with two clear paths:

- Bearish Path – Rejection from the Fair Value Gap (FVG) could push price into 23,317 and sweep lower liquidity.

- Bullish Path – After liquidity was cleared around 23,317, the index could base out and flip structure higher toward 23,500+.

The roadmap anticipated a bearish sweep first, followed by the potential for a bullish reversal if liquidity was absorbed.

The Result (After)

That sequence played out cleanly:

- Nasdaq rejected the FVG, extending lower into the 23,080–23,100 zone near the August 26 swing low.

- Liquidity was swept at 23k, triggering a sharp rebound as structure flipped bullish.

- The index reclaimed 23,450, aligning with the reversal scenario outlined in the forecast.

Technical Outlook: Sweep of 23,000 and Reversal

The Nasdaq 100 has swept the 23,000 liquidity low, flushing out sell-side positions and confirming the August 26 swing low as a defended zone. This sweep was decisive: after clearing that level, price rejected strongly, printing impulsive bullish candles back into the mid-range.

This move marks a classic liquidity grab → displacement → reversal structure, with buyers stepping back in after stop runs were completed.

Impact of ISM and JOLTs on the Move

The ISM Manufacturing PMI miss (48.7 vs 49) was the first driver of the bearish extension. It triggered the risk-off flows that helped Nasdaq pierce through support zones and eventually sweep the 23,000 level.

Following that, the JOLTs Job Openings decline (7.18M vs 7.4M forecast) shifted the narrative. While the headline was weak, markets interpreted it as dovish for Fed policy, increasing September rate cut bets. That change in perception provided the macro tailwind for Nasdaq’s sharp reversal right after the sweep.

Bullish Sequence in Current Price Action

Post-sweep, Nasdaq has been climbing back and is now trading near 23,450, reclaiming lost ground. Two technical elements support the bullish view:

- Reclaim of H4 Fair Value Gaps (23,280–23,330): These inefficiencies acted as the base for the rebound and are now potential demand zones.

- Approach toward Bearish H4 FVG (23,500–23,550): This area is the immediate resistance. A clean break above would confirm bullish continuation.

Bullish Scenario: Break and Hold Above Bearish H4 FVG

If Nasdaq manages to clear and hold above the 23,500–23,550 H4 FVG, it confirms that buyers are firmly in control. This would validate the reversal as more than just a corrective bounce.

- Trigger: Clean breakout and acceptance above 23,550.

- Structure: Consolidation inside the H4 FVG followed by a strong push higher.

- Targets:

- 23,650 (short-term imbalance fill)

- 23,800–23,850 (upper resistance and prior highs).

- Invalidation: A failure to hold above 23,280 (support zone) would weaken this setup.

Bearish Scenario: Rejection From Bearish H4 FVG

If sellers defend the 23,500–23,550 zone, Nasdaq could fail to build momentum and turn lower. This scenario reflects distribution at premium pricing after the liquidity sweep.

- Trigger: Strong rejection inside the H4 FVG with a shift back below 23,450.

- Structure: Rejection → lower highs → breakdown through reclaimed support.

- Targets:

- 23,300–23,320 (mid-level pullback to demand zone).

- 23,080–23,100 (retest of the August 26 swing low).

- 23,000 sweep low could be revisited if selling accelerates.

- Invalidation: A daily close above 23,550 negates the bearish scenario and confirms upside continuation.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels – How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading-Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow – Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail – Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading – Naming Your Triggers

- Discipline vs. Impulse in Trading – Step-by Step Guide How to Build Control

- Trading Journal & Reflection – The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex – Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

Risk Management

The real edge in trading isn’t strategy - - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders – Updated 2025

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.