Global Trade Tensions Escalate: How U.S. Tariffs Are Impacting Forex Major Pairs

2025-04-04 11:28:21

The forex market is entering April with heightened volatility as global trade tensions flare up once again. Following the April 2 U.S. tariff escalation, global partners are responding with a mix of diplomacy, condemnation, and economic retaliation.

Overview

CHN – China Fires Back with Strategic Warnings

Beijing denounced the U.S. tariffs and signaled incoming countermeasures aimed at U.S. tech and agriculture.

Key Points:

- China demands immediate tariff removal.

- Messaging: “No winners in a trade war.”

JPY – Japan Labels U.S. Tariffs 'Regrettable'

Tokyo expressed disapproval and hinted at potential countermeasures if exemptions are not granted.

Key Points:

- PM Ishiba warns of negative impact on global trade.

- Government seeks diplomatic resolution first.

AUD – Australia Seeks Dialogue, Not Conflict

Canberra rejected the tariffs but avoided tit-for-tat moves, preferring diplomatic and legal routes.

Key Points:

- Australia calls tariffs “unjustified.”

- WTO action and exporter support on the table.

NZD – New Zealand Stays Cool Under Pressure

Wellington downplayed the damage and committed to calm engagement with U.S. officials.

Key Points:

- No retaliation planned.

- Leans on CPTPP and APEC dialogues.

EUR – EU Prepares $26B Retaliation Package

Brussels condemned the U.S. move and warned of WTO challenges and countermeasures.

Key Points:

- Von der Leyen: “Major blow to the global economy.”

- U.S. consumer goods in the crosshairs.

GBP – UK Takes 'Calm and Pragmatic' Stance

The UK expressed concern but chose to focus on securing carve-outs via trade talks.

Key Points:

- Starmer avoids immediate escalation.

- Contingency tariffs drafted as a backup.

CAD – Canada Hits Back with Auto Tariffs

Ottawa moved swiftly, targeting U.S. auto exports in response to what it called “disproportionate” action.

Key Points:

- Strategic retaliation targeting swing states.

- Ottawa committed to defending key industries.

CHF – Switzerland Warns of Global Instability

Though not directly targeted, Switzerland flagged global risks and rising CHF pressure.

Key Points:

- SNB watching CHF appreciation closely.

- Prepared to intervene if necessary.

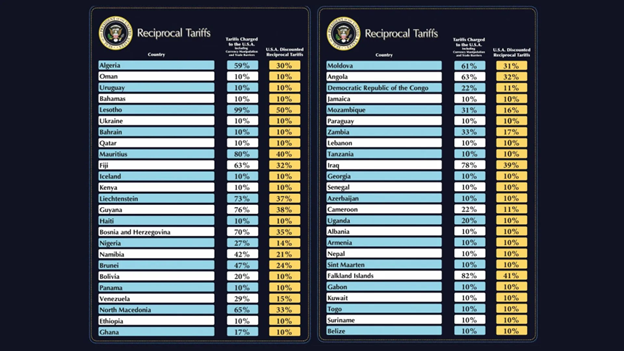

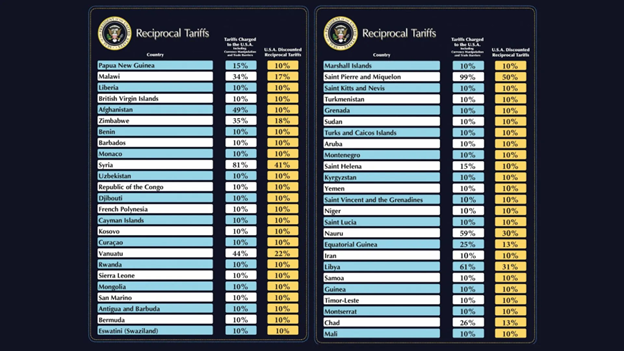

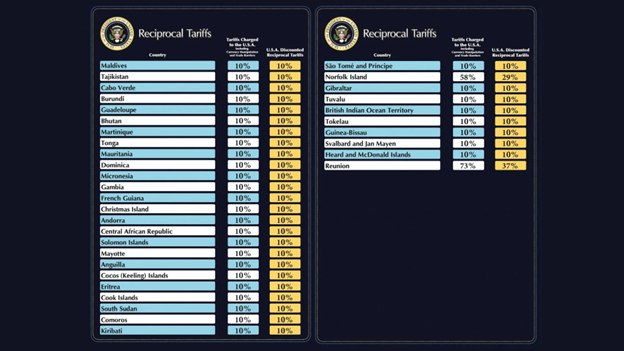

On-Going Tariffs Per Country:

China Responds: “We Will Take Countermeasures”

The Chinese Ministry of Commerce strongly denounced the new U.S. tariffs, labeling them as unilateral and harmful to global trade. Officials have warned of imminent countermeasures aimed at protecting domestic industries and national interests.

- China called for an immediate cancellation of the tariffs.

- State media reiterated: “There are no winners in a trade war.”

- Beijing is expected to target U.S. agriculture and tech in return.

Japan Calls U.S. Action “Extremely Regrettable”

Japanese officials expressed serious concern over the 24% tariff levied on Japanese exports, hinting at a possible review of trade agreements.

- PM Ishiba criticized the move’s potential impact on global trade.

- Japan is seeking exemptions but is not ruling out countermeasures.

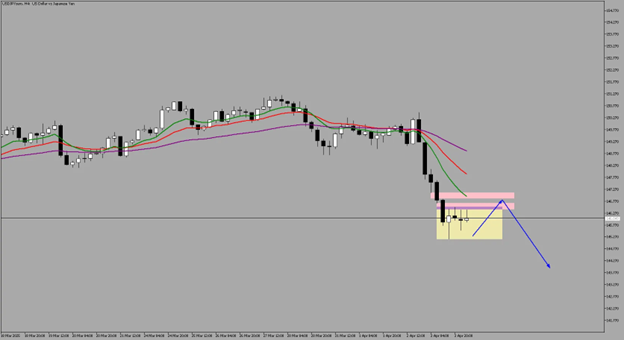

4-Hour

The Japanese Yen continues to strengthen on safe-haven demand. However, further appreciation may hurt Japan’s export competitiveness, prompting possible intervention warnings from the Bank of Japan.

Scenarios

- Bullish

- Dollar Rebound - Bullish Sequence

- Yen Bullish Sequence

2. Bearish

- Continued Yen Weakness

- 146.419 - 146.689 1st Level Short Opportunity

- 146.872 - 147.117 2nd Level Short Opportunity if 1st level fails

- Confluence short with moving average resistance levels

Australia: “Not the Act of a Friend”

Australia Maintains Diplomatic Route Amid U.S. Tariff Tensions

Australia was hit with a baseline 10% tariff but chose not to retaliate immediately. PM Albanese emphasized dialogue over escalation.

- Australia condemned the tariffs as unjustified.

- Government exploring trade diplomacy and WTO options.

- Financial support expected for affected exporters.

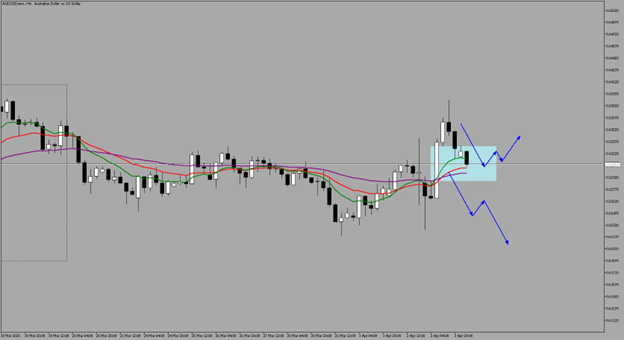

4-Hour

Aussie broke out of the 0.63410 level and currently pulling back at the 0.62873 - 0.63309 fair value gap level.

Scenarios

- Bullish

- 0.62873 - 0.63309 FVG Support Level

- Lower Timeframe Breakout - 1-Hour Timeframe

- 0.63890 High Breakout

2. Bearish

- 0.62188 - 0.62261 Immediate Low Breakdown

New Zealand: “We Won’t Escalate”

New Zealand Urges Restraint, Avoids Retaliation

New Zealand opted for a calm, diplomatic approach. Prime Minister Christopher Luxon confirmed the country would not impose counter-tariffs.

- NZ officials downplayed the severity of U.S. action.

- Engaging with the U.S. through APEC and CPTPP discussions.

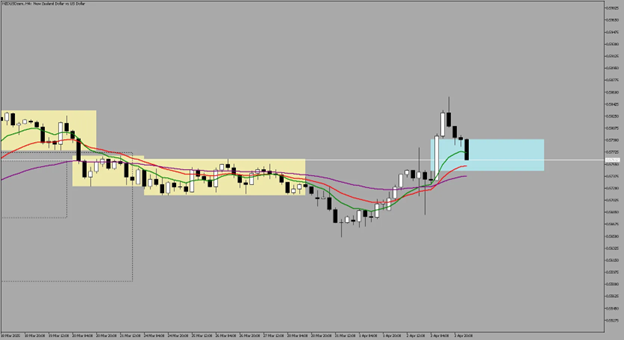

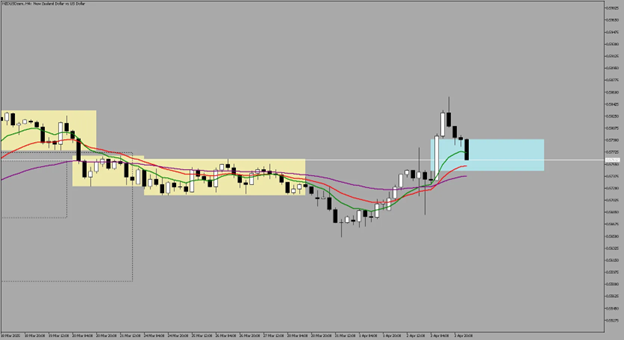

4-Hour

Kiwi tested the 0.58311 level and is pulling back from the level with potential bounce levels at 0.57449 - 0.57913.

If we get a positive reaction by looking for a breakout on intraday, we might see Kiwi to resume the upside move.

Scenarios

- Bullish

- Intraday breakout at 0.57449 - 0.57913

- Breakout of the next high at 0.58531

2. Bearish

- Trade through at the 0.57449 - 0.57913 fair value gap level

- Trade through at the 0.56485 - 0.56816 support level

European Union: “A Major Blow to the Global Economy”

EU Prepares $26 Billion Retaliatory Tariff Package

The European Commission called the U.S. move a unilateral provocation and warned of significant consequences for global supply chains.

- EC President von der Leyen said EU is preparing countermeasures.

- Retaliatory tariffs expected to hit U.S. consumer and industrial goods.

- Legal challenges at the WTO under consideration.

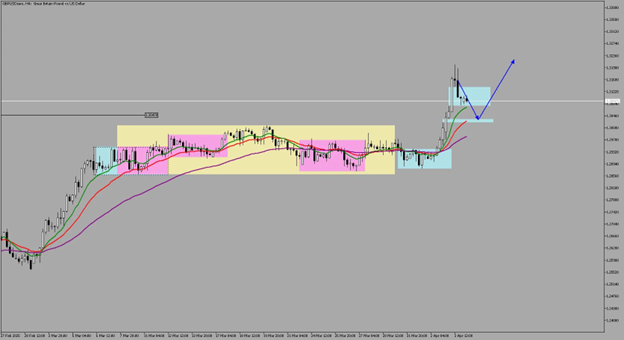

4-Hour

With firm retaliation, Euro has shown a strong ground against the Dollar.

Euro is now on new highs.

Scenarios

- Bullish

- Bounce opportunities at the 1.09246 - 1.10039 fair value gap level with moving averages confluence.

- Breakout of 1.11466 could further send Euro to the upside.

2. Bearish

- Breakdown of the 1.09246 - 1.10039 fair value gap level

- Euro trades below the moving averages

United Kingdom: “Calm and Pragmatic”

UK Eyes Trade Talks, Avoids Escalation—for Now

The UK’s response was measured. While condemning the U.S. move, Prime Minister Keir Starmer emphasized that Britain would not escalate trade tensions prematurely.

- Government exploring exemptions for key UK exports.

- Tariff response list drafted as a backup if negotiations fail.

4-Hour

After consolidating for a month, with tariffs, Pound has now broken out of the month range with new highs on the horizon.

The British pound remains steady but vulnerable to prolonged uncertainty. A positive breakthrough in UK–U.S. trade talks could be a bullish trigger.

Scenario

- Bullish

Bounce Support Levels - Look for longs:

- 1.30771 - 1.31369

- 1.30250 - 1.30357

Look for intraday breakout first to confirm support level.

2. Bearish

- Failure to hold of the bounce levels.

- Price trading below the moving averages.

Canada: Hits Back with Auto Tariffs

Canada Responds Directly to U.S. Trade Measures

Unlike other U.S. allies, Canada wasted no time in launching reciprocal action. Ottawa slapped tariffs on American auto parts and vehicles, signaling a sharp rebuke of the U.S. policy shift.

- Canadian officials called U.S. tariffs "disproportionate and harmful."

- Finance Minister: “We will defend our industries with precision.”

- Tariffs target states heavily involved in auto exports—seen as a strategic move.

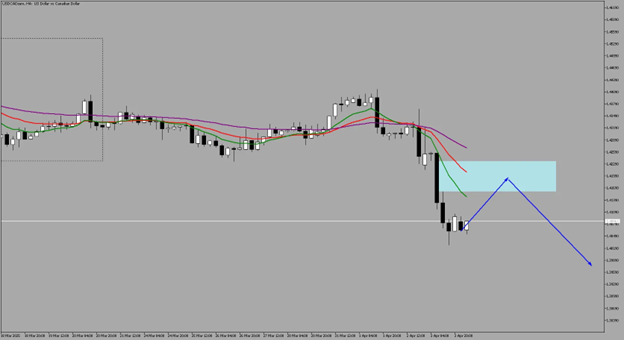

Daily

After a long stand-off, CAD has won the tug vs the USD. Despite on a long consolidation, USDCAD is already showing signs of favor towards CAD.

CAD has been trading below equilibrium or below 50% of the overall range, which signals a bearish outlook on USD and bullish on CAD.

4-Hour

Scenarios

- Bullish

- Retracement Trade until the 1.41606 - 1.42354 fair value gap level.

- Breakout at 1.40273 - 1.41042 intraday range.

2. Bearish

- Short opportunity at 1.41606 - 1.42354

Switzerland: Cautious, Watching Global Developments

Switzerland Stays Neutral but Warns of Global Instability

While not a direct target of U.S. tariffs, Switzerland remains on alert. The Swiss government emphasized that global trade instability poses a risk to Swiss exports and investor confidence.

- Swiss National Bank (SNB) noted trade tensions in its latest policy outlook.

- Emphasis on monitoring safe-haven inflows and inflation impact.

- SNB prepared to act if CHF strengthens excessively.

The Swissie’s safe-haven status makes it resilient against tariffs.

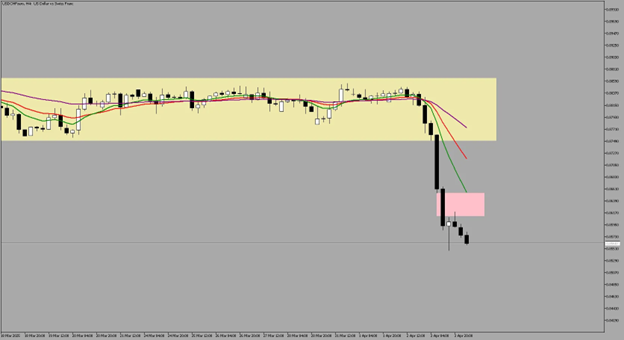

Daily

USD had a sharp decline vs CHF and is not showing any signs of stopping.

We are still in a strong downside momentum for the Swissie.

Fair Value Gaps to watch for Rebound for Downside Continuation

- 0.86104 - 0.86529

- 0.86642 - 0.87500

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.