Global Sell-Off: Forex Majors in Turmoil Amidst Trade Tensions

2025-04-07 14:51:44

Global Sell-Off: Forex Majors in Turmoil Amidst Trade Tensions

Overview:

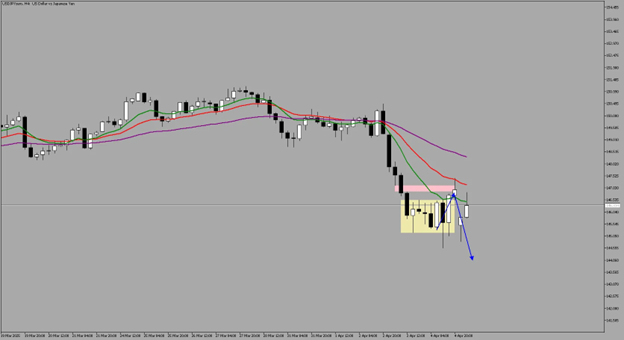

- JPY – Yen Soars on Safe-Haven Demand

- Yen surged as global trade tensions triggered risk-off flows, sending USDJPY sharply lower after tapping the FVG zone at 146.872–147.117. A break below 144.50 could open the door for further yen strength.

- Despite weak domestic sentiment (consumer confidence miss), the yen benefited from classic safe-haven rotation as traders fled equities and risk assets.

- AUD – Aussie Crashes to COVID Lows

- AUDUSD dropped below 0.60, pressured by the sharp sell-off in Australian equities (ASX 200 down 6%) and deteriorating risk appetite globally.

- China's retaliatory tariffs on Australian exports, including coal and barley, amplified downside risks as Australia remains tightly linked to Chinese demand.

- NZD – Kiwi Slips Ahead of Rate Decision

- Markets priced in a 25bps RBNZ cut (April 9) as inflation remains contained and external threats increase, pushing NZD lower.

- NZD remains vulnerable to China's slowdown, with export reliance on Asian partners making the Kiwi highly sensitive to ongoing tariff-driven disruptions.

- EUR – Euro Holds Firm Amid ECB Hawkishness

- ECB’s Holzmann pushed back against rate cut speculation, stating current rates no longer drag growth, helping EUR/USD rebound from 1.0780 support.

- Germany’s €500B stimulus plan buoyed sentiment in the Eurozone, keeping the euro supported despite the global sell-off.

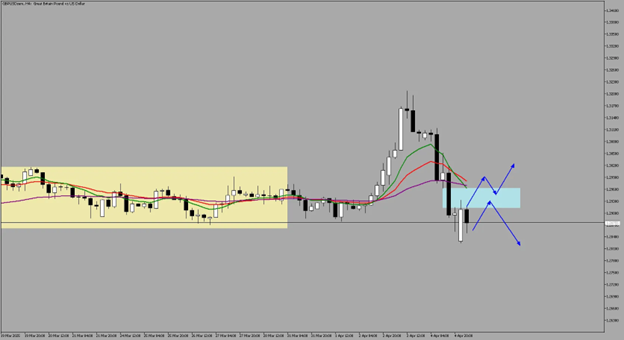

- GBP – Pound Whipsaws in Volatile Conditions

- GBPUSD rallied to 1.32 before sliding below 1.29, reacting to global sentiment swings and softening demand for high-beta currencies.

- Upcoming UK GDP data this Friday may provide directional clarity, especially as inflation remains elevated and the BoE remains cautious.

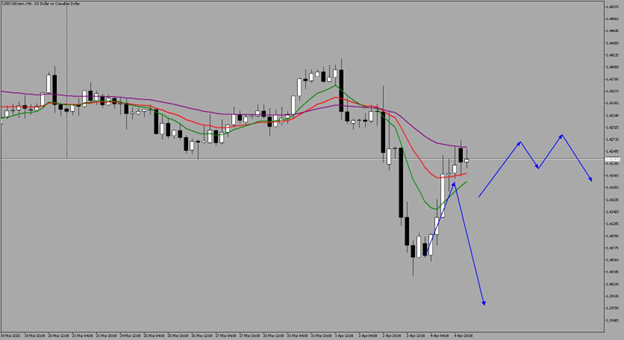

- CAD – Loonie Weakens on Jobs Miss and Tariffs

- USDCAD surged to 1.4366 following poor Canadian employment data and confirmation of U.S. tariffs on Canadian goods.

- Despite a rate cut to 2.75% by the BoC, the loonie saw a minor bounce at prior support but remains under pressure unless broader sentiment improves.

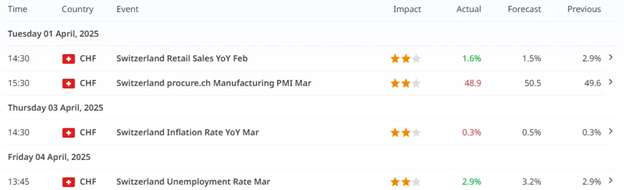

- CHF – Swiss Franc Strengthens on Safety Flows

- USDCHF broke to 5-month lows as capital moved into Swiss assets amid global equity stress and uncertainty.

- Strong Swiss economic data and CHF's traditional safe-haven appeal supported the currency, despite the SNB’s dovish tone and recent rate cut to 0.25%.

Global markets endured a turbulent week as U.S.-led trade tensions escalated, triggering a broad sell-off across equities, commodities, and currencies. The fallout from newly announced tariffs sent shockwaves through the forex market, with traditional major currencies tumbling—even as the U.S. dollar itself weakened.

Volatility Index: On A Heightened Risk Amidst Tariff Threats

With fear gripping markets on a global scale—not just in the U.S.—the VIX has surged to new highs, breaking above its 2020 highs.

Government Bonds: Flight to Safety From US Risky Market

As turmoil continues to rattle global markets and risk-off sentiment deepens, investors are flocking to government bonds as their safe-haven of choice.

The result: a sharp pivot into safe-haven assets like the US-10 Year Government Bonds, Japanese yen and Swiss franc, while risk-sensitive currencies such as AUD, NZD, and CAD struggled.

JPY – Yen Outperforms on Classic Safe-Haven Flow

The yen saw strong inflows as global uncertainty and equity volatility rose. Despite Japan’s own challenges, USD/JPY fell sharply as investors sought shelter.

JPY benefited from geopolitical risk hedging

Historically a go-to haven in crises, the yen outperformed as global trade tensions heightened.

Consumer Confidence Lower Than Forecast

Despite safe-haven inflows into the Japanese yen amid global market turmoil, consumer confidence is expected to decline. This reflects lingering concerns over inflation pressures seen in recent weeks, though those risks have since eased as the Bank of Japan maintains a dovish policy stance.

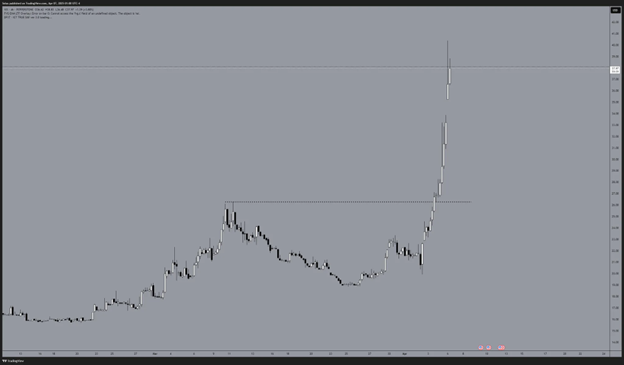

4-Hour

Yen reacted with a strong downside after touching the FVG level sitting at 146.872 - 147.117. This has been outlined in our latest post and video: https://www.youtube.com/watch?v=sD-Xc01d6rE&t=98s

A breakdown of the 144.50 level could push Yen to further strength vs the US Dollar.

AUD – Australian Dollar Tumbles Below Pandemic Levels

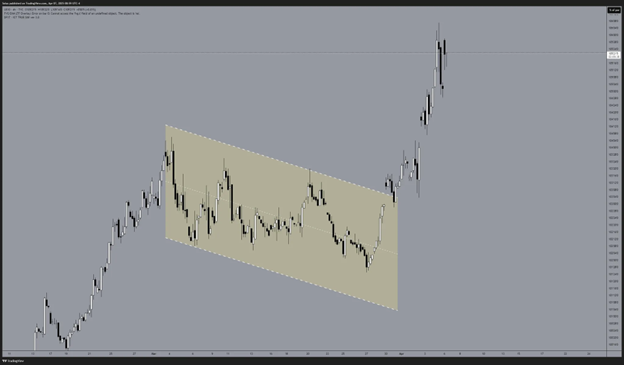

Daily

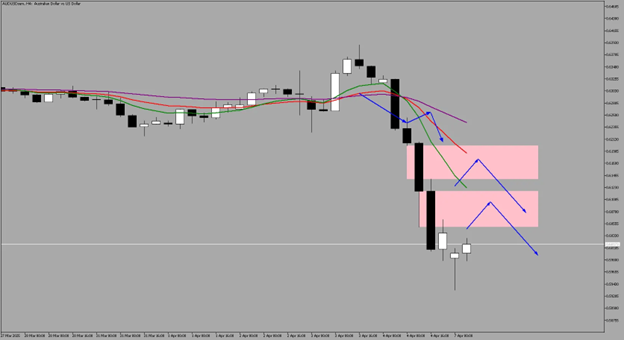

4-Hour

The Australian dollar fell beneath 0.60 USD, marking its lowest level since the COVID-19 era. The sell-off followed steep equity losses and rising concerns that Australia’s export-driven economy will suffer amid a global trade slowdown.

ASX Daily

With Aussie tumbling down, the AU200 opened on Monday with a strong decline as a reaction over trade tensions with the US that pushed the Australian markets in a risk-off sentiment.

China exposure amplified downside risk

With Australia's economy tightly linked to China, any threat to trade flows directly weighs on AUD sentiment. China retaliated against U.S. tariffs by imposing additional tariffs on American goods such as agricultural products, automobiles, and certain industrial goods. This move was part of broader trade tensions between the U.S. and China, impacting global supply chains and market stability. Additionally, China's imposition of tariffs on Australian exports, including barley, wine, and coal, further escalated trade disputes between the two nations. These retaliatory actions underscore China's strategy to protect its domestic industries while navigating complex international trade dynamics.

Key Pressures:

- AUD/USD hit pre-pandemic lows under 0.60

- ASX 200 dropped over 6%, wiping $160B in minutes

- Commodity and risk sentiment deteriorated rapidly

- Chinese tariffs on Australian exports

Rebound Levels on Aussie

- 0.60493 - 0.60493

- 0.61383 - 0.62012

With a strong decline, we are looking for a rebound with further downside in play with Aussie.

NZD – Kiwi Weakens Ahead of Anticipated Rate Cut

While initially firm, the New Zealand dollar began retreating as expectations of a rate cut from the Reserve Bank of New Zealand intensified. With external demand in question and inflation in check, the RBNZ is likely to act cautiously in the coming days.

RBNZ expected to cut rates by 25bps on April 9

Markets have priced in a dovish pivot due to manageable inflation and rising global risks.

External demand worries continue

Trade reliance on China and regional partners leaves NZD vulnerable during geopolitical escalations.

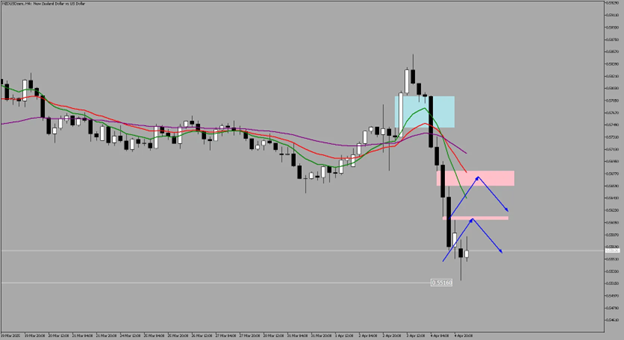

Daily

The pair briefly rose midweek before succumbing to bearish momentum as risk appetite faded.

With anticipation of rate cuts and a weaker stance over the US tariffs, Kiwi edged lower and now on a more potential downside move that can reach the next low at 0.55160 level.

4-Hour

Potential Rebound Levels

- 0.56589 - 0.56811 - Immediate Imbalance Rebound Level

- 0.56088 - 0.56135 - Extreme Imbalance Rebound Level

EUR – Euro Resilient Amid ECB Pushback and German Stimulus

Despite market stress, the euro found strength in renewed Eurozone stimulus efforts and hawkish ECB commentary downplaying rate cut urgency.

ECB’s Holzmann dismissed rate cut pressure

ECB’s Holzmann dismissed rate cut pressure, emphasizing that current interest rates were no longer a drag on growth or inflation. His comments aimed to support EUR stability amid ongoing market uncertainties and economic challenges in the Eurozone.

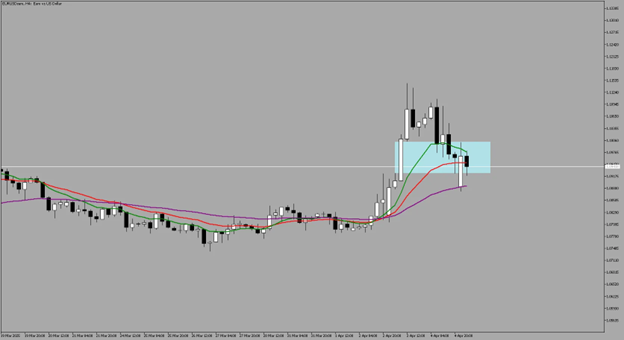

Daily

4-Hour

Despite global sell-off, Euro is still seen as holding its ground at the 1.09246 - 1.10021 Fair Value Gap level.

If we break past the Fair Value Gap, we could see Euro to gain traction with targets at 1.11 - 1.115 level.

GBP – Sterling Whipsaws on Risk Sentiment Swings

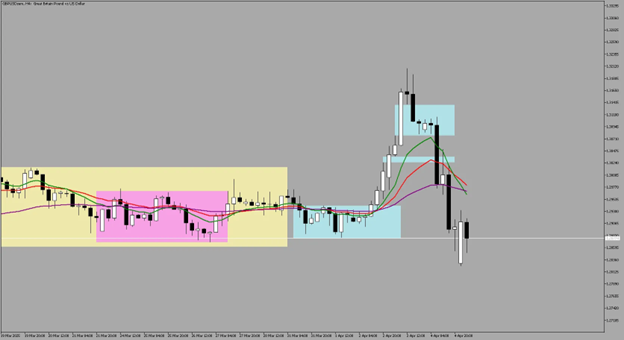

Daily

The pound saw one of the widest ranges of movement last week, initially rising on USD weakness before falling on fading risk appetite and renewed inflation concerns. With tariffs also in play, this weighed down the pound with risks of a “risk-off” sentiment.

4-Hour

Pound took out look bounce levels from the the 1st FVG sitting at 1.30771 - 1.31369 until the 1.30250 - 1.30357 level.

Unless we break past the previous FVG at 1.29126 - 1.29623, we might see further downside with Pound.

Key Driver this Week for the Pound

At the end of the week, we’d like to see an end of week push with GDP numbers release this Friday.

CAD – Tariffs and Weak Jobs Undermine the Loonie

The Canadian dollar struggled to maintain footing amid weaker employment numbers and confirmed U.S. tariffs targeting Canadian exports.

Employment contraction and a higher jobless rate raised further concerns about Canada’s economic trajectory.

With negative releases with CAD it quickly rebound at the level which it broke down previously.

Daily

We are back at the 1.42389 breakpoint level. With CAD in a renewed strength over the US, we’d like to see a reaction on that level.

4-Hour

We’d like to see a market structure shift on the 4-Hour timeframe where price breaks and creates a new low for downside potential.

CHF – Franc Gains Ground as Markets Flee Risk

The Swiss franc firmed across the board as risk-averse investors favored traditional safe-haven currencies, despite dovish SNB policy adjustments.

USDCHF broke down to 5-month lows

Daily

Franc strength accelerated amid broad U.S. dollar weakness and equity market stress.

Robust Economic Data

With economic data favoring a positive outlook on the Swissie, CHF continues to strengthen over the Dollar.

Global capital flowed into Switzerland

In times of crisis, the franc often benefits from capital preservation motives, and April was no exception.

4-Hour

Rebound Levels for Further Downside:

- 0.86104 - 0.86529

- 0.86642 - 0.87500

Final Takeaway: This Was a Confidence Shock, Not a Dollar Story Alone

Last week’s market turmoil wasn’t just about the U.S. dollar weakening—it was about confidence collapsing across multiple regions. From equity meltdowns to central bank pivot expectations, traders abandoned risk and rotated into protection mode. Only JPY and CHF emerged with strength, while commodity and growth-linked currencies sold off sharply.

Trading Quote of the Week

"Amateurs focus on rewards. Professionals focus on risk."

– Mark Minervini

In trading, the desire for profit is universal, but the ability to manage risk is rare. Mark Minervini, a U.S. Investing Champion and legendary momentum trader, emphasizes what separates consistent winners from over-leveraged losers: risk management first.

Many retail traders enter a position daydreaming about gains — “What if this hits 5R?” — but professionals ask, “What happens if I’m wrong?”

This shift in mindset doesn’t just protect your capital — it unlocks long-term growth through consistency, emotional stability, and capital preservation.

Actionable Approach – Risk-First Trading in 4 Steps

1. Start Every Setup With a "Risk Audit"

Before you even think of the potential gain:

- Identify where you’re objectively wrong (your invalidation point)

- Place your stop-loss there — not based on gut feeling

- Define your max risk per trade (1–2% of total equity)

2. Flip the Reward Mindset: Think in R-Multiples

- Aim for trades that offer at least 2R to 3R potential

- Don’t take trades that don’t meet your risk-to-reward filter

- This ensures that even a 40–50% win rate can be highly profitable

3. Prioritize Capital Preservation Over Ego

- Accept that not every setup will win

- Keep losses small, controlled, and quick

- A small loss today allows you to fight another day — with focus and clarity

4. Build Emotional Resilience Through Discipline

- When you manage risk properly, losses don’t shake your confidence

- You stay in the game longer and build real mental strength

- Confidence comes from consistency — and consistency comes from risk control

Think like a casino

Casinos don’t win every bet, but they manage risk and edge across thousands of events. Be the house. Let your edge play out — with risk as your gatekeeper.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.