Why Smart Money Concepts Are Trending - And How Orders Move the Market

2025-06-17 10:37:18

Goal of This Lesson

To help you understand why Smart Money trading is gaining attention, how it reveals the true nature of market movement, and how you can start thinking like institutions, by following order flow, not headlines.

Why Smart Money Is Trending And Will Continue to Trend

Smart Money Concepts (SMC) are exploding in popularity, and for good reason.

For decades, retail traders have relied on indicators that lag, most breakout strategies that fail, and news reactions that mislead. But now many are seeing with a new lens why markets move:

Markets move because of orders.

Not tweets.

Not charts alone.

Not even news.

Just orders, buying and selling pressure.

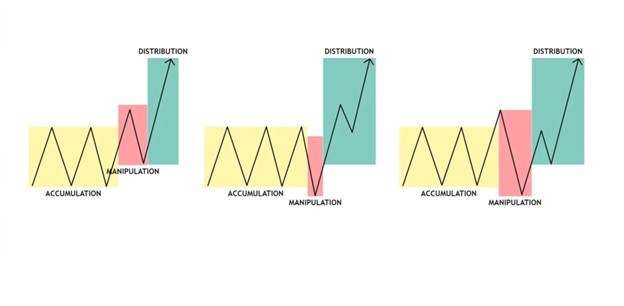

SMC is trending because it explains what actually moves price:

- Accumulation and distribution of orders

- Liquidity hunts to fill large positions (not to pick on you)

- Institutional footprints like Price Imbalances and Breaks in Structure

The Market = A Marketplace of Orders

Forget the charts for a second. Think of the market like a real-world product. Let me break it down for you:

Imagine the market like a store shelf.

If there’s more demand than supply, price goes up.

If there’s more supply than demand, price drops.

Price = Auction of Buy & Sell Orders

Every candle you see is just the result of who’s buying, who’s selling, and how urgently.

Institutions don’t enter the market randomly. They look for liquidity pools to fill their big orders. That’s what causes price to sweep highs, displace, and form gaps. They need to manipulate or engineer price to get filled without causing slippage. So they:

- Hunt for liquidity (where stop orders are)

- Trigger breakouts (to lure in retail)

- Reverse from premium zones (to sell high or buy low)

What News Actually Does (Hint: It Doesn’t Cause the Move)

Many traders believe news moves the market.

But here’s what really happens:

News is a catalyst not the cause. News doesn’t move the market. Reactions to the news do. And reactions influences market participants to make orders, either they sell in panic or buy in greed.

It triggers volatility.

But the movement comes from the rush of orders that follow it.

Think about it:

- CPI comes in soft → traders rush to buy gold → orders surge → price explodes up

- Fed hikes rates → institutions reposition → sell orders flood the market → USD spikes

It’s not the news headline that moved price. It’s the reactions to it in the form of buying and selling.

What About “Pump and Dump”? Why Is It Trending?

The term “pump and dump” has gone viral in crypto but it applies in all markets.

And here’s the truth:

Most “pumps” are engineered by whales and institutions to fill their orders.

Most “dumps” happen once the whale already reached their target and enough orders are ready to be filled.

How It Works:

- Price is “pumped” aggressively, either through news, hype, or a breakout.

- This creates FOMO. Retail traders rush to buy in, thinking the move is real.

- Once price hits reaches a level with enough orders, and institutions already hit their targets, they quietly begin to offload their positions. Sometimes, they do it in one go, causing a big surge to the opposite direction.

- As their sell orders fill, price reverses sharply. That’s the “dump.”

It’s not always malicious. It’s just how large players fill orders.

Why It Matters:

- If you don’t understand SMC, you’ll buy the top.

- If you do, you’ll see the setup forming and either avoid it or trade the reversal or continuation.

Real-World Example: Oil and the Geopolitical Conflict

Let’s take the current oil market:

When news broke that Israel struck Iran, many headlines screamed “war pushes oil higher.”

But the real reason oil prices surged?

Shipping routes were disrupted.

Access to oil became limited.

Buyers rushed to secure supply.

That rush of demand-side orders caused a spike in price.

It’s not the war itself, but the impact on supply and demand which shows up on the chart as volume, liquidity grabs, and displacement.

Again:

Too much supply = price drops

Too much demand = price rallies

How Smart Money Works

SMC is built around a simple idea:

Institutions engineer price moves to fill orders.

They:

- Sweep liquidity above/below key levels to grab orders

- Create displacement unintentionally due to orders that matched

- Leave behind imbalances as their footprints

- Return to fill those imbalances

- Expand the move once orders are filled

It’s the ultimate order-based logic—not based on guessing direction, but reading how price behaves around key liquidity zones.

How to Trade With Smart Money in Mind

Here’s how to stop guessing and start trading with precision:

The Smart Money Model (Execution Steps):

- Wait for a liquidity sweep of a key level (stops or highs/lows taken)

- Look for displacement with a clear imbalance

- Confirm MSS (Market Structure Shift) that the market is wiling to shift to a new direction

- Enter on return to the Imbalance or FVG

- Target opposing liquidity or the next key swing level

- Use time/session context for timing (e.g., NY Open, London Breakout)

You’re not chasing price. You’re waiting for price to do what institutions do before joining.

Why Institutions Don’t Trade Like Retail

Institutions aren’t looking for MACD crossovers or RSI divergence. Though a lot of big institutions are still using indicators as these still provide valuable insights based on historical data.

Overall, the main thing is, they trade based on orders that can fill theirs. They’re managing millions to billions and need liquidity to build size.

That’s why they:

- Sweep retail to large institution stops to fill orders

- Favor price imbalances to re-enter or remove hedges

- Don’t care about “being right”, they care about positioning

Your job as a smart trader is not to predict. It’s to track what the big players are doing and ride with their order flow.

Final Takeaway: Price = Orders. Always.

At the end of the day, price only moves because of orders.

Whether it’s war, inflation data, or central bank speeches, none of it matters unless traders act on it.

Markets don’t care about opinions. They respond to transactions.

Smart Money Concepts strip away the noise and focus on:

- Who’s getting trapped

- Who’s entering size

- Where orders lie

- When to strike with precision

Check Out My Contents:

Strategies That You Can Use:

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

The Ultimate Guide to Understanding Market Trends and Price Action

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Learn How to Trade US Indices:

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold:

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.