Risk Management and Position Sizing: Essential Trading Strategies

2023-06-25 22:16:15

At ACY Securities, we understand the importance of risk management in trading. It is not just a necessary component but a powerful tool that can safeguard your capital and pave the way for consistent profits. By implementing effective risk management strategies, you can navigate the volatile financial markets with confidence and peace of mind. Our team of experts recognises that careful risk management is the key to long-term success.

Implementing risk management strategies is essential for traders. It allows you to mitigate the impact of losing trades, protecting your trading account from potential jeopardy. Through proper position sizing and risk assessment, you can maintain a secure position and shield your capital from unnecessary risks. Prioritising risk management empowers you to navigate the market confidently and safeguard your overall trading portfolio.

Master the Art of Risk Management

In the ever-evolving world of trading, market conditions can change rapidly. This is where risk management becomes even more crucial. At ACY Securities, we equip traders with the tools and knowledge to adapt to these changing dynamics.

Our range of educational risk management resources enable you to assess risk tolerance, make informed decisions, and adjust position sizes accordingly. By staying ahead of the curve, you can navigate the markets with confidence and take advantage of profitable opportunities.

Read on to learn more about risk management and explore the world of trading with ACY Securities.

Understanding Trading Risk

Definition of risk in trading

Risk in trading refers to the potential of losing money that a trader invests. It encompasses the possibility of unfavourable events occurring in financial market transactions. When we trade, there is always the chance that things may not go as planned, resulting in financial losses.

Making price predictions is an integral part of trading, but these forecasts may need to be corrected, leading the market to move in the opposite direction of our expectations. The inherent unpredictability and potential for undesirable outcomes make trading inherently risky.

Types of risks in the market

- Market risk, also known as systemic risk, is associated with general market conditions and includes economic trends, political developments, interest rate adjustments, inflation, and market volatility.

- Interest rate risk is a subtype of market risk and refers to the impact of fluctuating interest rates on the value of fixed-income instruments such as bonds. Bonds with lower coupon rates tend to decrease in value when interest rates rise, while existing bonds generally increase in value when interest rates decline.

- Currency risk, or exchange rate risk, is another type of risk that traders encounter when trading with foreign currencies. Changes in exchange rates can affect the value of investments when translated back into the trader's home currency.

Assessing Risk Tolerance

Understanding your risk tolerance level is crucial for making informed investment decisions. Begin by defining your financial objectives, including the timeframe for each objective and the level of risk you are willing to undertake to achieve them.

Evaluating your risk tolerance will help you align your investment strategies with your goals and ensure a balanced approach to managing risk.

Risk Management Techniques

Implementing effective risk management techniques is essential for successful trading. By employing strategies such as setting risk tolerance levels, using stop-loss orders, diversifying portfolios, and monitoring risk exposure, traders can mitigate potential losses and safeguard their capital.

Setting Risk Tolerance Levels

An essential risk management technique is setting risk tolerance levels. By establishing these limits, you can protect your funds and prevent significant losses that could deplete your capital and hinder your ability to capitalize on future trading opportunities.

For example, if you have determined that your risk tolerance is 5% per trade, it means that you are willing to accept a maximum loss of 5% of your trading capital on any given trade. This helps you maintain discipline and avoid excessive risk, ensuring that your overall trading strategy remains sustainable.

Using Stop-Loss Orders

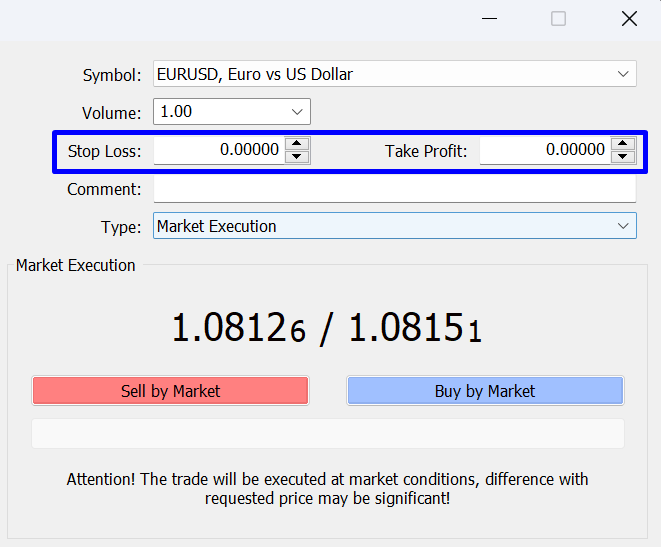

One effective risk management technique is the use of stop-loss orders. A stop-loss order is a command that automatically closes a trade when the price reaches a specified level.

By setting a stop-loss order, traders can determine the maximum loss they will accept on a trade. If the price moves against its position and reaches the specified level, the trade is closed, helping to mitigate potential losses.

Stop-loss orders are a crucial risk management tool, allowing traders to protect their capital and limit downside risk during trading activities.

For example, when trading in the forex market, a trader may face the risk of a market reversal or a trade going against him. Traders can set a predetermined price level at which their position will be automatically closed if the market moves against them. This helps limit potential losses and protect the trader's capital.

For instance, if a trader buys a stock at $50 per share and sets a stop-loss order at $45, the trade will be automatically closed if the stock price falls to $45, reducing the trader's risk exposure. Stop-loss orders are an essential tool for risk management and play a significant role in preserving capital and managing downside risk.

Diversification and portfolio allocation

Diversification and portfolio allocation are essential risk management techniques employed by traders to minimize risk. By diversifying their holdings, traders aim to reduce their exposure to any single trade or industry. This involves spreading their risk across a variety of assets or markets. Traders allocate a suitable portion of their trading capital to each position while considering the correlation between the assets.

At ACY Securities, we understand the importance of diversification in risk management. That's why we offer our traders access to a wide range of markets through our MT4 and MT5 platforms.

With over 2,200 trading instruments available, including Forex, Precious Metals, Indices, Commodities, Cryptocurrencies, ETFs, and Share CFDs, you can diversify your portfolio and reduce risk by investing in different asset classes.

Our extensive selection of trading instruments empowers you to implement effective risk management strategies and increase your chances of long-term trading success.

Monitoring and Adjusting Risk Exposure

A crucial aspect of risk management is the continuous monitoring and adjustment of risk exposure. It is essential to keep a record of your trades and regularly evaluate their performance. Monitor the overall profitability of your transactions and analyse the common elements among successful and failed trades. By conducting this evaluation, you can identify patterns and areas for potential improvement. This valuable information allows you to make informed decisions and adjust your risk exposure accordingly.

At ACY Securities, we understand the importance of monitoring and adjusting risk exposure in trading. Our platform provides you with the necessary tools and resources to track and evaluate your trades effectively. By staying vigilant and adapting to changing market conditions, you can enhance your risk management strategies and increase your chances of long-term trading success.

Our dedicated team is committed to supporting you on your trading journey and helping you optimise your risk management approach. With ACY Securities, you can stay proactive in monitoring your risk exposure and maximize your potential for profitable trading.

Position Sizing Strategies

Implementing these position sizing strategies can help traders effectively manage risk and optimize their trading strategies for long-term success.

Fixed Dollar Risk

One effective position sizing strategy is the fixed dollar risk technique, which involves determining the maximum amount of money a trader is willing to risk overall. By dividing the maximum risk amount by the predefined stop loss amount, the position size can be calculated. This approach ensures a consistent level of risk exposure across different trades.

Percentage Risk per Trade

Another position sizing strategy is the percentage risk per trade. With this method, traders allocate a specific percentage of their total trading funds to each trade. For example, a trader might choose to risk 3% of their capital on each transaction. This approach provides flexibility and allows for adjusting position sizes based on changes in the value of the trading account.

Volatility-Based Position Sizing

Volatility-based position sizing takes into account the market or asset's volatility and adjusts the position size accordingly. For instance, higher volatility may warrant a smaller position size to compensate for potential larger price swings and associated risks. Conversely, lower volatility may allow for a larger position size.

Kelly Criterion

The Kelly Criterion is a position sizing strategy that considers both the probability of successful and unsuccessful trades and the expected return on each trade. It aims to optimize long-term growth by determining the optimal position size based on these factors.

While the Kelly Criterion can be useful, accurately estimating probabilities and expected returns can be challenging.

Risk Management Tools and Resources

Utilising risk management tools and resources is essential for traders to effectively manage their exposure to risk. These tools can include specialised software, trading journals, economic calendars, and seeking professional advice, providing traders with the necessary insights and strategies to protect their capital and navigate the markets with confidence.

Risk Management Software

Specialised risk management platforms offer various features for risk assessment and monitoring. These tools enable traders to monitor and evaluate their holdings, set stop-loss orders, determine position sizes, and generate risk reports. Some brokers also provide built-in risk management software and tools to mitigate potential risks.

Trading Journals and Performance Tracking

Trading journals provide valuable insights into significant economic indicators, central bank statements, geopolitical developments, and market news. Economic calendars and news sources are excellent resources for accessing trading journals. By staying updated on upcoming market conditions that may impact their positions, traders can adjust their risk exposure as needed.

At ACY Securities, we provide access to daily news and analysis, enabling traders to stay informed and adapt their risk management strategies accordingly.

Seeking Professional Advice and Education

Consulting with experienced trading professionals or financial advisors can be instrumental in achieving effective risk management. These experts can offer valuable guidance, deeper insights, and tailored trading plans based on your objectives and risk tolerance. They provide ongoing support and knowledge, helping you develop a robust risk management plan.

Additionally, ACY Securities offers educational resources, courses, and workshops designed to enhance traders' understanding of risk management principles and methods. We believe in empowering traders with the necessary education to make informed risk management decisions.

Visit our website today to explore our risk management solutions and take control of your trading journey.

Case Studies and Examples

Real-life examples of successful risk management and position sizing

One real-life example of successful risk management and position sizing is demonstrated by Paul Tudor Jones during the 1987 stock market crash. Jones, a hedge fund manager, accurately predicted the market drop and implemented effective risk management techniques.

Through careful position sizing and risk management strategies, he was able to protect his capital and even generate significant gains during the crash.

This exemplifies the importance of proper risk management in navigating volatile market conditions.

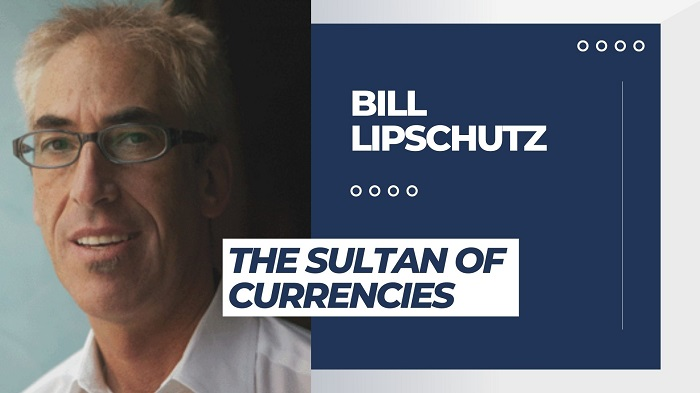

Another notable example is Bill Lipschutz, a renowned forex trader. Lipschutz showcased the significance of position sizing in his trading approach.

By diligently managing his risk and limiting the amount of capital allocated to each trade, Lipschutz was able to safeguard his capital and avoid substantial losses. His success highlights the role of position sizing in preserving trading capital and achieving long-term profitability in the forex market.

Lessons learned from common mistakes and failures

Learning from past mistakes is crucial to avoiding their repetition. Traders must develop robust trading plans and analyse the causes behind previous failures.

By adopting a proactive approach, traders can prevent costly and detrimental errors from occurring again, saving both time and money.

Studying real-life examples and practicing effective risk management and position sizing techniques can significantly reduce the likelihood of repeating past mistakes.

Conclusion

Risk is an inherent aspect of trading, and while it cannot be entirely eliminated, traders can mitigate potential losses and enhance their chances of sustained trading success. At ACY Securities, we understand the importance of effective risk management and provide traders with the necessary tools and resources to navigate the markets with confidence.

By utilising risk management strategies such as setting risk tolerance levels, using stop-loss orders, diversifying portfolios, and monitoring risk exposure, traders can protect their capital and optimize their trading performance.

With our dedicated support team and world class educational resources, ACY Securities is committed to supporting traders in their risk management efforts and helping them achieve their trading goals.

Start your journey towards successful risk management with ACY Securities today.