Everything You Need to Know About Guaranteed Stop Loss Orders in LogixTrader

2024-07-31 16:42:09

Introduction

Discover how to utilise the LogixTrader trading platform to set a guaranteed stop loss order, ensuring your trades are safeguarded against unexpected market movements. A guaranteed stop loss order (GSLO) is a powerful tool that can protect your positions by guaranteeing your exit price, regardless of market volatility. In this blog post, we will explore what a GSLO is, how it works, and how you can set it up on LogixTrader to enhance your trading strategy.

What is a Guaranteed Stop Loss Order?

A Guaranteed Stop Loss Order (GSLO) is a type of stop loss order and an important risk management tool that ensures your position is closed at the exact price you specify, regardless of market conditions. In the forex trading industry, where market volatility can lead to significant price gaps, a GSLO provides an extra layer of protection by guaranteeing the execution price. This means that even if the market experiences extreme fluctuations, your trade will be closed at the predetermined price, safeguarding you from slippage and unexpected losses.

How Does a GSLO Work in Forex Trading?

In forex trading, market conditions can change rapidly, leading to potential slippage where the execution price of a trade differs from the intended stop loss price. With a GSLO, you eliminate the risk of slippage by ensuring your trade will be executed at the set stop loss price. This is particularly beneficial during periods of high market volatility or unexpected economic events, which can lead to the market gapping over your regular stop.

Key Benefits of a Guaranteed Stop Loss Order:

- No Slippage: Your trade is executed at the specified price without any deviation.

- Peace of Mind: Reduce anxiety by knowing your potential losses are capped.

- Enhanced Risk Management: Effectively manage your trading risks and reduce your worst-case scenario.

Why Choose a Guaranteed Stop Loss Broker?

Not all brokers can offer a guaranteed stop loss. MT4 and MT5 brokers, for example, typically cannot provide this service due to platform limitations. However, at ACY Securities, we leverage our advanced LogixTrader platform to offer this crucial feature to our clients. By choosing ACY Securities, you can benefit from the added security and peace of mind that guaranteed stop loss orders provide, ensuring your trades are protected against unexpected market movements.

Advantages of Using LogixTrader's Guaranteed Stop Loss Orders:

- Enhanced Security: Guaranteed execution of stop loss orders.

- User-Friendly Platform: Easy to set up and manage your GSLOs.

- Comprehensive Support: Dedicated customer service to assist with any queries.

- Competitive Edge: Stay ahead in the trading game with advanced risk management tools.

How to Set a Guaranteed Stop Loss Order in LogixTrader

Setting up a GSLO on the LogixTrader platform is simple. Follow these steps to ensure your trades are protected:

- Select the Symbol: Choose the symbol you wish to trade in the Watchlist.

- Choose the 'Guaranteed Stop Loss' Option: Under the Stop Loss section, select Guaranteed Stop Loss.

- Enter Your Desired Stop Loss Price: Specify the exact price at which you want your position closed.

- Confirm and Place Your Order: Review the details and click Place Order.

Here is a handy tutorial video of how to Set a Guaranteed Stop Loss Order in LogixTrader.

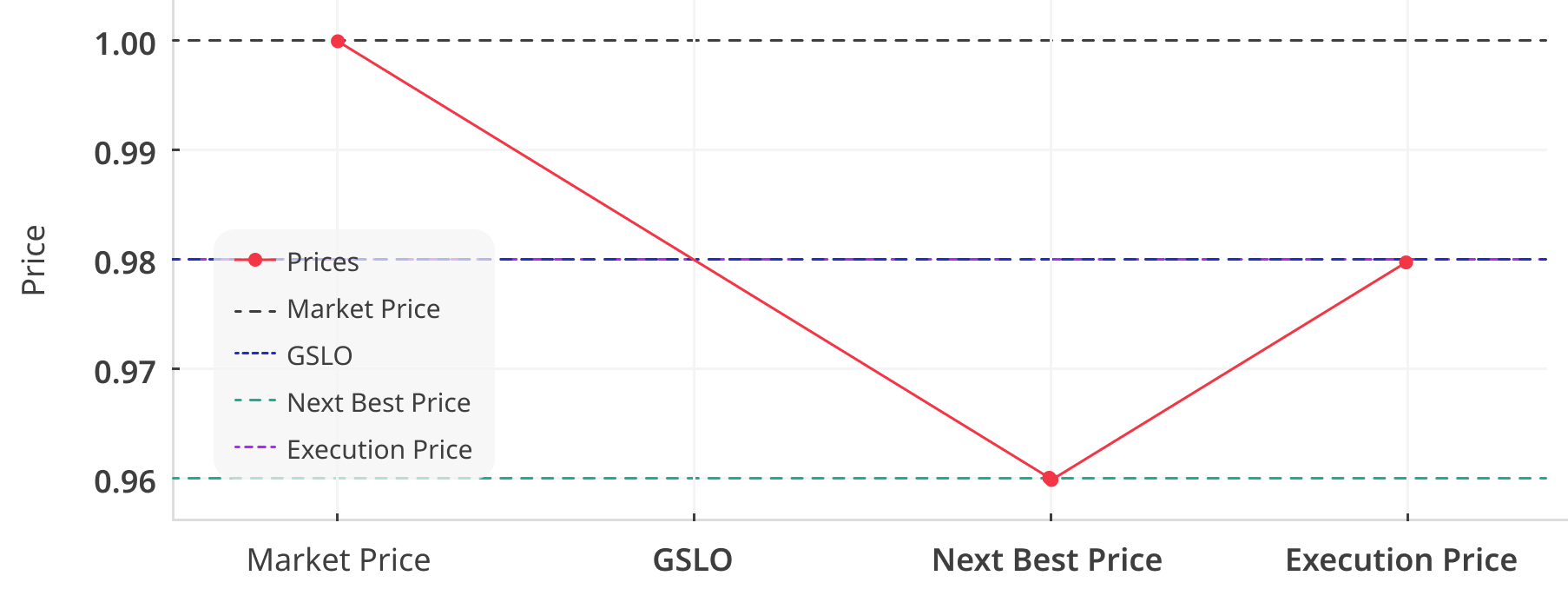

Example 1: GSLO Within Price Range

- Market price: 1.00

- Your GSLO: 0.98

- Next best price: 0.96

- Execution price: 0.98 (We cover the 0.02 slippage)

In this scenario, your GSLO ensures your trade is executed at 0.98, even if the market price moves to 0.96. ACY Securities covers the slippage, providing you with guaranteed execution.

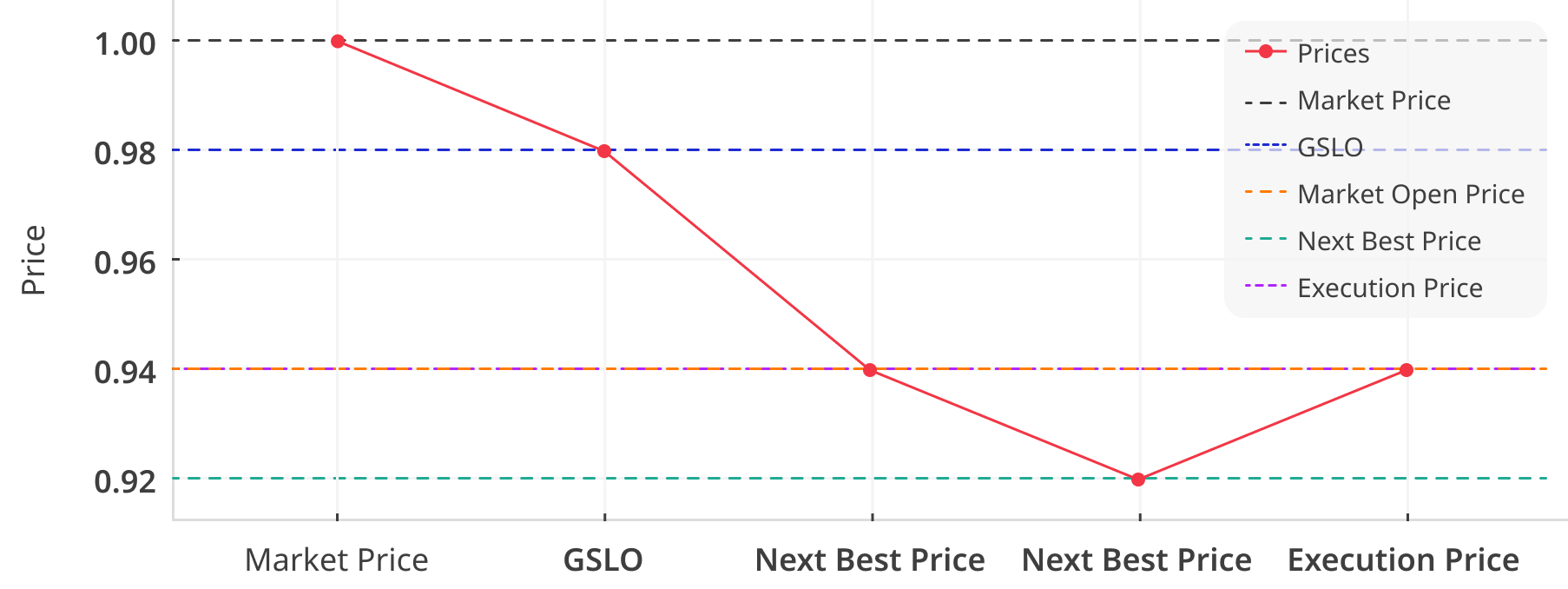

Example 2: GSLO with Market Gapping

- Market price: 1.00

- Your GSLO: 0.98

- Market open price: 0.94

- Next best price: 0.92

- Execution price: 0.94 (We cover the 0.02 slippage)

In this scenario, the market open price is 0.94 which is a gap of 0.06 from the market close of 1.00. The next best price is 0.92 however, we have executed your order at the market open rate of 0.94 and covered the 0.02 slippage. We do not cover the gapping.

The Role of Slippage in Forex Trading

Slippage occurs when the market moves quickly, causing the execution price of an order to be different from the requested price. This can be particularly problematic during periods of high volatility or low liquidity. With a GSLO, you are shielded from slippage as your trade will be executed at the guaranteed price.

Market Gaps and Their Impact

Market gaps happen when there is a significant difference between the closing price of one trading session and the opening price of the next. These gaps can occur due to various factors such as economic news, geopolitical events, or market sentiment changes. With LogixTrader and our GSLO, you can help to minimise losses during unexpected market movements.

The Importance of Risk Management in Forex Trading

Effective risk management is crucial for long-term success in forex trading. By using GSLOs, traders can better control their losses and make more informed trading decisions. This is particularly important for traders who like to trade high-impact news events, where the chance of gapping and slippage is heightened.

Tips for Setting Up a Guaranteed Stop Loss Order

- Analyse the Market: Before setting your GSLO, conduct a thorough analysis of the market conditions and potential risks.

- Determine Your Risk Tolerance: Understand how much you are willing to lose on a trade and set your GSLO accordingly.

- Monitor Economic Events: Stay informed about upcoming economic events that could impact the market and adjust your GSLO as necessary.

- Regularly Review Your Strategy: Continuously assess and refine your trading strategy to ensure it aligns with your risk management goals.

Conclusion

Guaranteed Stop Loss Orders are an essential tool for any serious forex trader, providing peace of mind and protection in volatile markets. With LogixTrader, setting up a GSLO is simple and easy, allowing you to focus on your trading strategy without worrying about unexpected losses. Try out a guaranteed stop loss order on LogixTrader today and experience the benefits for yourself.

Find out more about LogixTrader

- Getting Started with LogixTrader: Learn the basics of LogixTrader and how to set up your account.

- Utilising the Built-In Economic Calendar: Stay informed with real-time economic events and updates to make informed trading decisions.

- Mastering LogixTrader Order Types: Learn how to Perform a Market Order, Limit Order or a Stop Order on the LogixTrader Platform.

- How to Build a Watchlist in Logixtrader: A step-by-step on creating a watchlist, adding commodities, forex pairs, stocks, and more.

- Frequently Asked Questions: Find out answers to common questions about the LogixTrader trading platform.

Experience Our New Innovative Trading Platform LogixTrader today.

Try These Next