U.S. Government Shutdown Looms: Dollar Weakens Amid Economic Uncertainty

2025-03-14 11:35:34

Overview:

USD – Mixed Sentiment, Awaiting Clarity

- USD shows indecision, consolidating after recent volatility.

- DXY hovering near support, potential for breakout or deeper pullback.

- FOMC expectations and economic data driving short-term movements.

JPY – Weak but Defending Key Zones

- JPY remains weak overall, but showing some stability near key levels.

- USDJPY hovering near highs, intervention risk remains a factor.

- BOJ policy stance still a major driver, influencing long-term outlook.

AUD – Struggling for Momentum, Limited Upside

- AUD remains sluggish, unable to break key resistance zones.

- AUDUSD stuck in a tight range, with bearish pressure intact.

- RBA outlook and China demand key factors for direction.

NZD – Weak but Holding Support

- NZD remains bearish overall, struggling to gain traction.

- NZDUSD trying to defend support, but lacks strong buying interest.

- RBNZ cautious on rate cuts, limiting further downside for now.

EUR – Weakness Persists, Struggling for Direction

- EUR remains under pressure, struggling to gain upside momentum.

- EURUSD facing resistance, potential for further downside if USD strengthens.

- ECB stance remains dovish, limiting recovery potential.

GBP – Choppy Price Action, Cautious Outlook

- GBP lacks strong direction, caught in broader market uncertainty.

- GBPUSD testing key levels, but lacks bullish conviction.

- BOE policy outlook remains uncertain, affecting sentiment.

CAD – Oil-Driven Moves, Facing Resistance

- CAD remains tied to oil fluctuations, limiting clear trend development.

- USDCAD consolidating, with potential for a breakout on new catalysts.

- BOC remains cautious, keeping CAD range-bound for now.

CHF – Sideways but Holding Strength

- CHF remains resilient, showing range-bound behavior with a slight bullish tilt.

- USDCHF struggling below key MAs, indicating CHF strength over USD.

- EURCHF also consolidating, reflecting investor caution in the Swiss market.

U.S. Faces Government Shutdown as Deadline Looms

The U.S. government is on the verge of a shutdown, set to take effect at 12:01 a.m. ET on Saturday, March 15, 2025, unless Congress finalizes a funding agreement before midnight on March 14.

Why Is a Shutdown Happening?

- Budget Stalemate – Lawmakers are at odds over federal spending levels. The House has proposed a $6 billion boost in defense spending, offset by $13 billion in cuts to non-defense programs, including a $1 billion reduction for Washington, D.C.

- Policy Clashes – The proposed bill includes controversial measures, such as increased funding for deportations and cuts to domestic programs, which have triggered Democratic opposition.

- Executive Tensions – President Donald Trump’s recent moves, including federal worker dismissals and aid suspensions, have intensified the standoff. Democrats seek safeguards against further job cuts and program rollbacks, while Republicans resist additional constraints.

What Happens If the Government Shuts Down?

- Federal Workers Affected – Hundreds of thousands of employees could face furloughs, delaying public services.

- Disruptions in Public Services – Essential functions like Social Security card processing, food safety inspections, and agricultural assistance may be delayed.

- Economic Ripples – The shutdown could dampen GDP growth and heighten uncertainty in financial markets.

Where Do Negotiations Stand?

With the March 14 deadline fast approaching, talks between Democrats and Republicans continue, but a resolution remains elusive. If no agreement is reached, the shutdown will add further strain to an already complex economic landscape.

Morgan Stanley Warns: More US Dollar Weakness Ahead

Morgan Stanley warns of further US dollar weakness after its worst start to a year since 2008 (down 3% in 2025). Risks include a potential government shutdown, slowing growth, and rising global asset values.

The bank recommends long positions on the euro (target: 1.12), the pound (target: 1.33), and the yen (target: 145) as investors shift toward European fiscal expansion and tighter monetary policies.

Morgan Stanley remains bearish on the dollar, expecting continued weakness.

Bessent: Dollar’s Slide Reflects Market Rebalancing

United States Treasury Secretary, Scott Bessent, sees the dollar’s decline as a market correction amid shifting economic policies. After an initial post-election surge, concerns over tariffs, uncertainty, and potential Fed rate cuts have weakened the USD.

Bessent cautions that a government shutdown could further disrupt the economy.

The US government shutdown risk, economic slowdown, and global monetary policy shifts are key drivers of dollar depreciation.

Black Rock: Dollar Will Continue to Weaken

“It looks like in the short term it will weaken. Looking at the Fed rate cut expectations this year, being priced into 3 rate cuts. It will continue to weaken but as the market digests a potential 1 rate cut this year due to inflationary elements, tariffs, corporate tax cuts, fiscal spending, we could see the Dollar to pickup.” - Thomas Taw, Head of APAC, Black Rock

The Dollar’s Decline: What It Means for Markets and Your Money

The U.S. dollar is facing one of its most challenging starts to a year in over a decade, and investors are taking notice. With a 3% decline in 2025 alone, Morgan Stanley’s latest warnings paint an increasingly bearish picture for the greenback. But what does this mean for global markets, businesses, and everyday consumers?

Why Is the Dollar Losing Strength?

Several factors are driving the dollar’s weakness:

- Slowing U.S. Economic Growth – As economic momentum cools, investors are shifting capital into markets that show stronger fiscal and monetary resilience.

- Federal Reserve Rate Expectations – The Fed appears to be pivoting toward rate cuts, making the dollar less attractive compared to currencies in economies with tighter monetary policies.

- Global Asset Repricing – Rising stock and bond values outside the U.S. are drawing investors away from dollar-denominated assets.

- Political and Fiscal Uncertainty – The looming U.S. government shutdown and unresolved tax policy discussions are adding to investor hesitation.

Winners and Losers in a Weaker Dollar Environment

- Winners: Exporters & Commodities

A weaker dollar typically benefits U.S. exporters as American goods become cheaper for foreign buyers. Additionally, commodities like oil and gold often rise in value as the dollar depreciates.

- Losers: Consumers & Importers

On the flip side, a weaker dollar makes imported goods more expensive, potentially driving up inflation on everyday products from electronics to clothing. Travelers heading abroad may also feel the impact with a reduced purchasing power overseas.

The Global Shift Away from the Dollar

Morgan Stanley sees opportunity in European and Asian currencies as governments in these regions pursue policies that make their assets more attractive. The bank is particularly bullish on:

- Euro (EUR/USD target: 1.12) – Fueled by increased German government spending and stronger EU economic policies.

- British Pound (GBP/USD target: 1.33) – Gaining from post-Brexit fiscal measures and monetary tightening.

- Japanese Yen (USD/JPY target: 145) – Investors are betting on Bank of Japan tightening, further strengthening the yen.

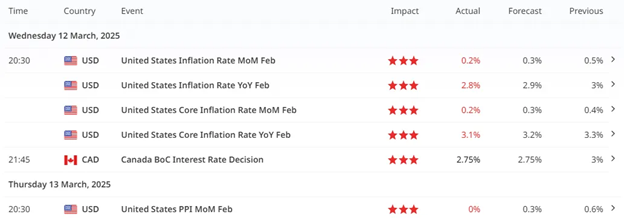

Soft CPI & PPI Print

Soft US inflation data for February suggests cooling, keeping the Dollar weak with potential downside ahead. This could make the Fed more inclined to push rate cuts.

Could the Dollar Bounce Back?

Daily

In technical perspective, transition to recovery is still uncertain as price is still far from the moving averages 10-20-50 day.

4-Hour

While long-term sentiment remains bearish, some traders are positioning for a short-term recovery. 10-day to 20-day Moving Average on the Daily Timeframe suggests price testing a potential transition from a downtrend move to a range-bound price action. However, any rebound may be short-lived unless the U.S. economy shows signs of stronger growth.

Unless we break the 104.300 resistance level and stays above it in confluence to a break of the moving average, we’d likely see Dollar to continue to stall.

Japanese Yen Index Stalling

Daily

Yen is still hovering at the resistance level with no signs of clear direction. Unless we break the range, Yen pairs would continue to be in indecisive price action.

USDJPY

USDJPY remains strong against the dollar, trading below key moving averages with no clear signs of a slowdown or a shift toward a potential reversal.

4-Hour

Prioritizing risk, the best approach is to wait for a decisive breakout in either direction—whether a transition to the upside or a continuation of the downside trend.

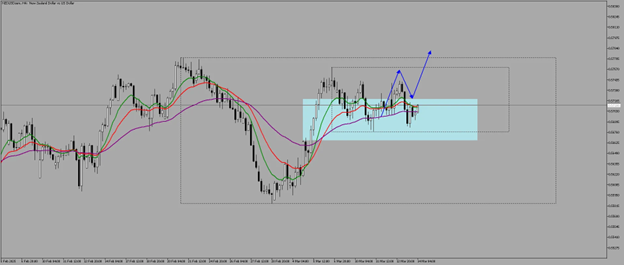

AUDUSD

Daily

The Aussie remains confined within a micro range inside the broader macro range. For short-term directional bias, a breakout from the micro range could signal a move toward testing the macro range.

4-Hour

Currently, the micro range leans bearish, trading below the 50% level and hovering near support. A breakdown could confirm further downside, while a bounce may signal a potential reversal.

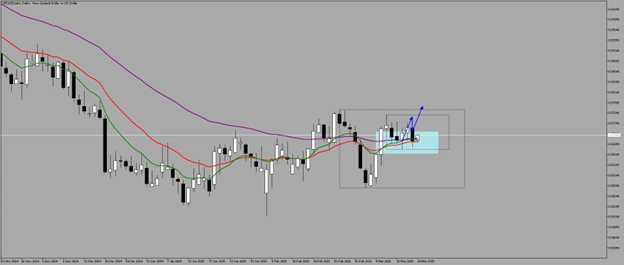

NZDUSD

Daily

Compared to the Australian Dollar, the NZD maintains a more bullish stance, trading above the equilibrium level. The 50% level acts as strong support, with no clear signs of weakness favoring the Dollar.

4-Hour

With the New Zealand Dollar maintaining a stronger bullish stance, we are watching for a breakout above the 0.57597 resistance level, potentially extending gains toward 0.57688.

AUDNZD

If USD is ⬇️ AUDNZD is ⬇️ = NZD is the better upside.

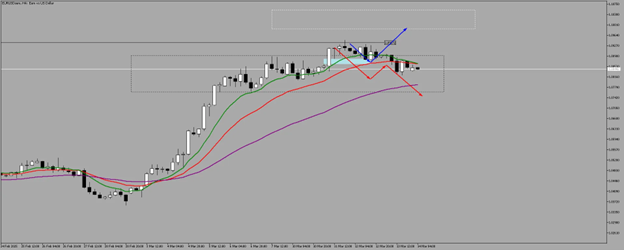

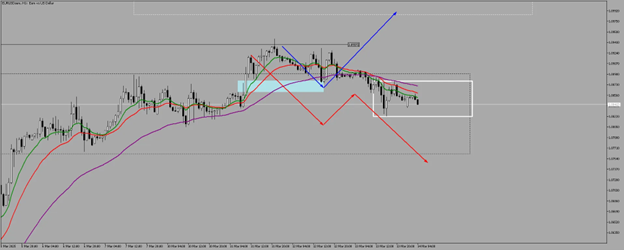

EURUSD

4-Hour

The Euro continues its upward momentum as growing investor confidence in European markets strengthens its appeal over the US dollar.

1-Hour

A breakout from the current micro range could signal the next directional move for the Euro, offering clarity on its trend.

Scenario:

- Bullish

- Break of the Micro Range at 1.08703

- Break of 1.09470

- Bearish

- Break of 1.08226

- Break of 1.07618

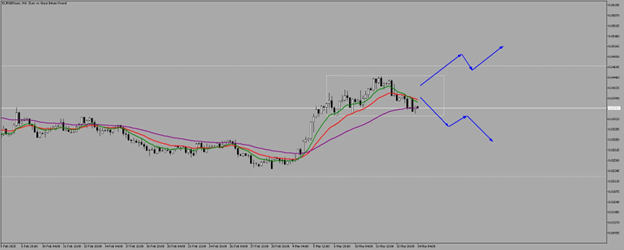

EURGBP

Daily

The euro continues to gain against the pound as EU members pledge to boost defense spending. With prices trading at a premium level, further upside remains in play.

4-Hour

If USD is ⬇️ EURGBP is ⬆️ = EUR is the better upside.

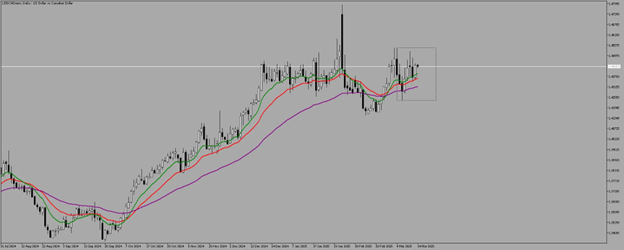

USDCAD

Daily

4-Hour

Unless USDCAD breaks out of its current range, whether above resistance or below support, price action will remain choppy and prone to whipsaws.

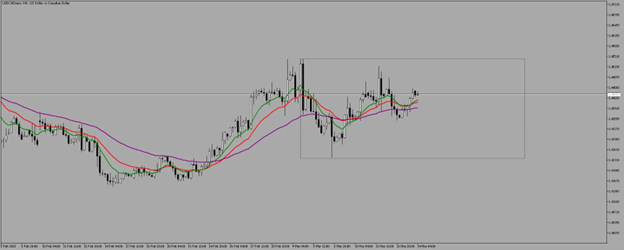

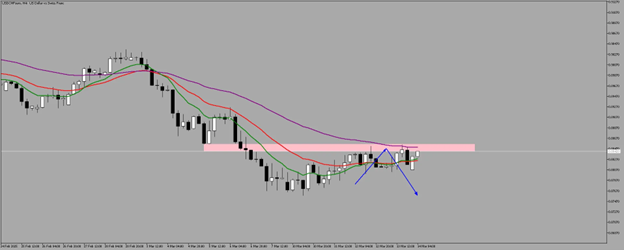

USDCHF

Daily

USDCHF remains in a bearish trend, trading below key moving averages. Price is rejecting resistance, signaling potential downside continuation toward 0.8750 - 0.8700, unless a breakout occurs.

4-Hour

USDCHF on the H4 timeframe is approaching a key resistance zone, aligning with the bearish trend on the higher timeframes. Price has formed a potential lower high, suggesting a rejection from the supply zone. If the resistance holds, a move lower toward 0.8780 - 0.8750 could follow. A breakout above could invalidate the bearish bias.

Final Thoughts

The dollar’s decline signals a broader shift in global finance—one that could reshape investment strategies, trade policies, and consumer behavior in the months ahead. Whether this is a temporary adjustment or the beginning of a prolonged downtrend depends on how U.S. policymakers, the Federal Reserve, and global investors react to evolving economic conditions.

For now, one thing is clear: The dollar’s dominance is being tested like never before.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Sonrakileri Deneyin

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know