USD/CAD Forecast: Surges to New Highs as Fed Holds - Key Scenarios Ahead of NFP

2025-07-31 15:39:19

- USD/CAD perfectly reacted to the H4 retracement zone forecasted in our webinar, confirming the power of patience and planning.

- The pair is now testing a critical H4 Fair Value Gap (1.3819–1.3822) that will dictate the next leg.

- Tomorrow’s NFP could be the catalyst that confirms whether bulls extend higher or a deeper retracement unfolds.

Narrative: A Forecast Turned Reality

Sometimes the market rewards patience and planning. That’s exactly what happened with USD/CAD this week. In our recent webinar (watch here at 51:32):

We outlined a roadmap: wait for the market to dip into a key retracement zone anchored on the 4-hour chart, then look for confirmation on the 15-minute timeframe before engaging.

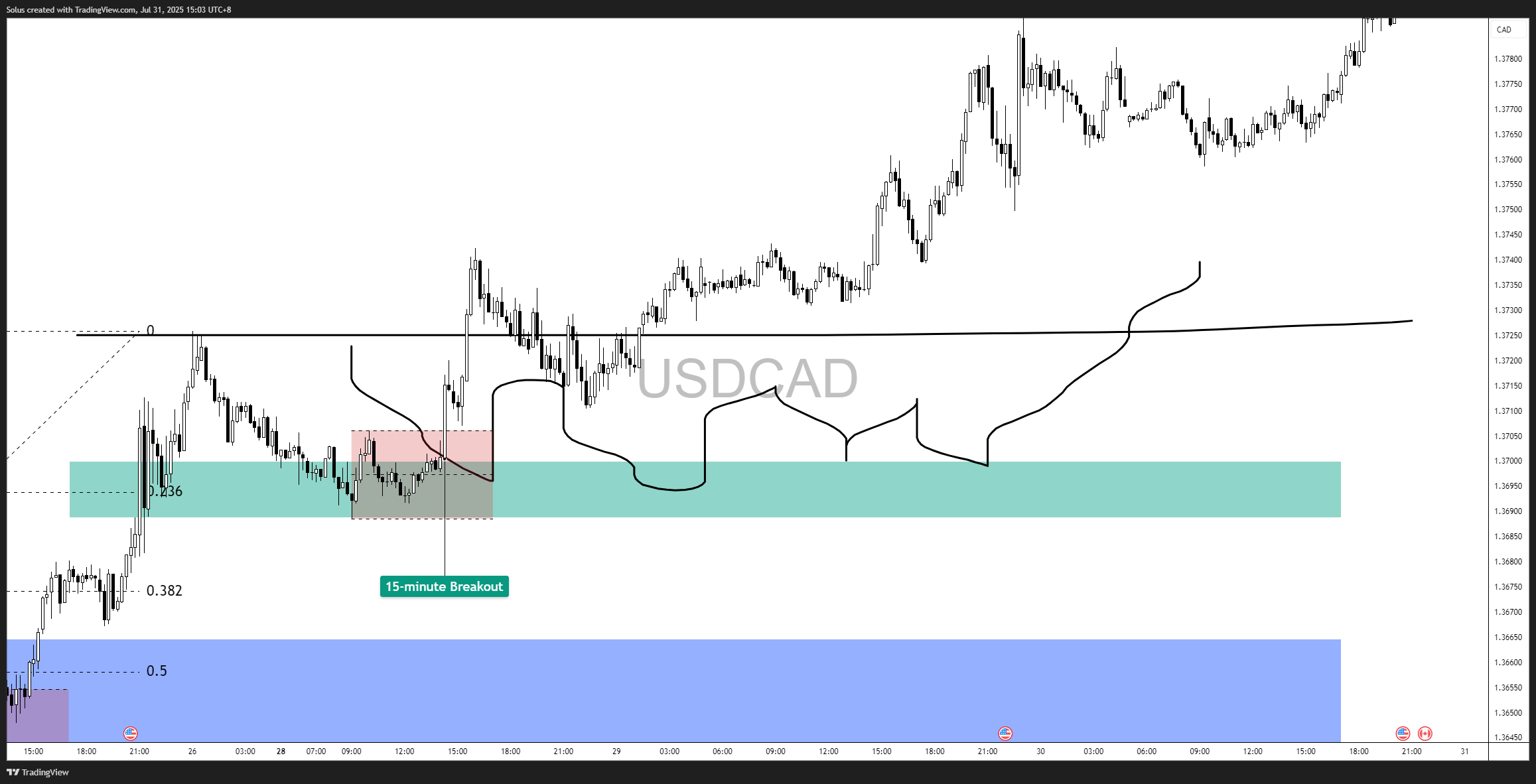

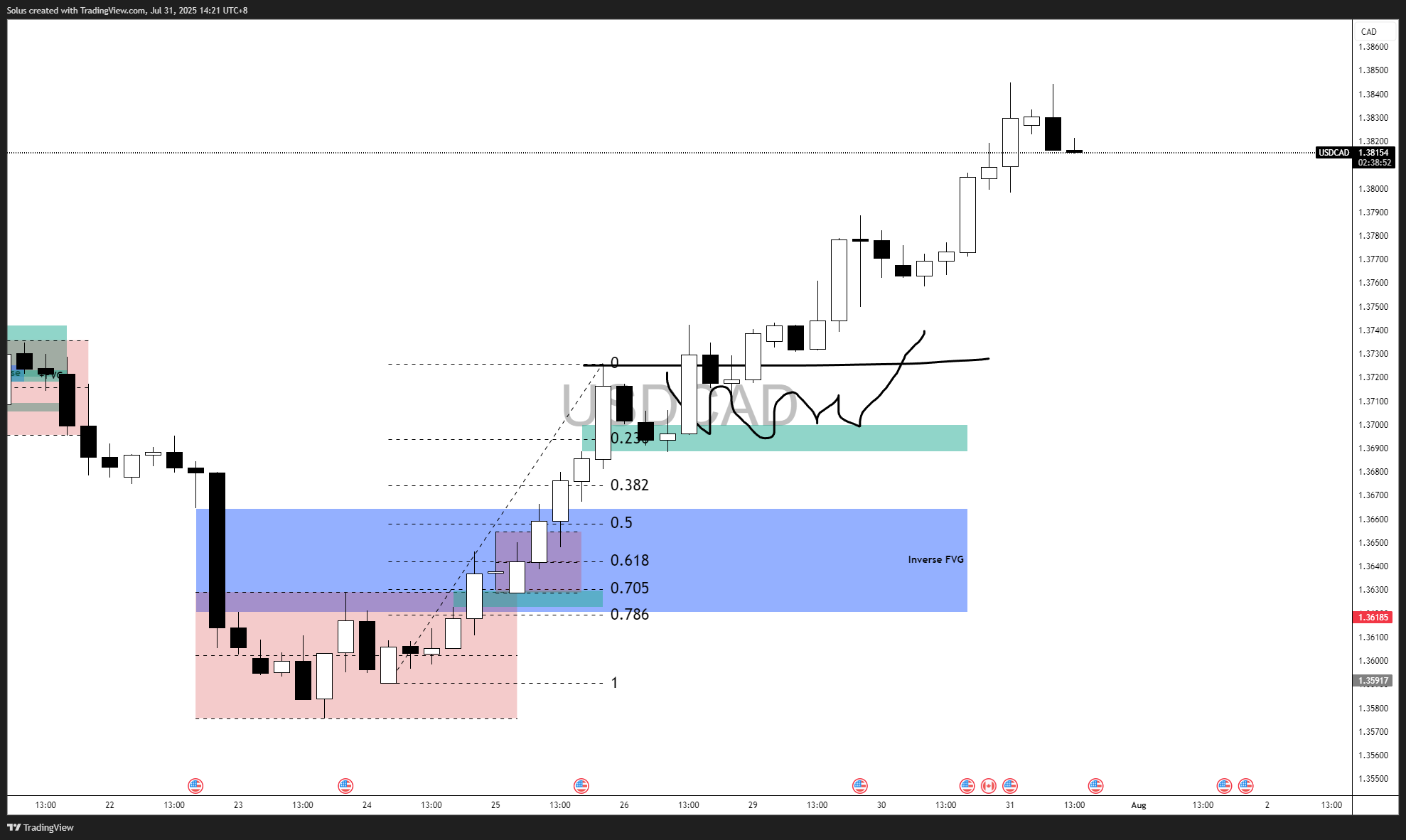

That’s exactly how it played out. Price cleanly dipped into the 0.236 retracement zone (green discount area) we highlighted, paused to build liquidity, then launched higher, breaking through the range highs. Traders who stayed disciplined and trusted the structure saw the setup materialize almost to the pip.

Before & After: Setup Materialized

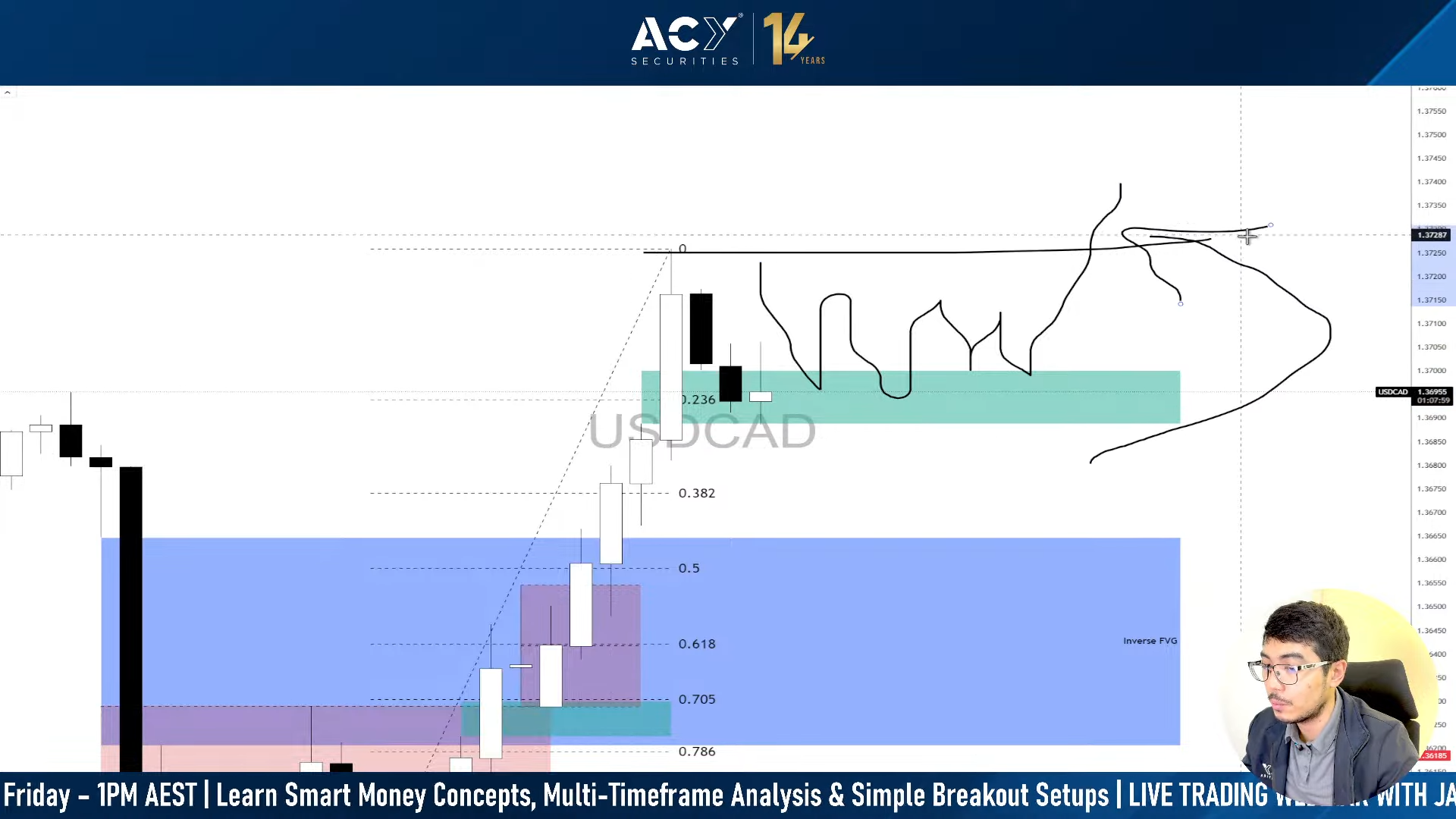

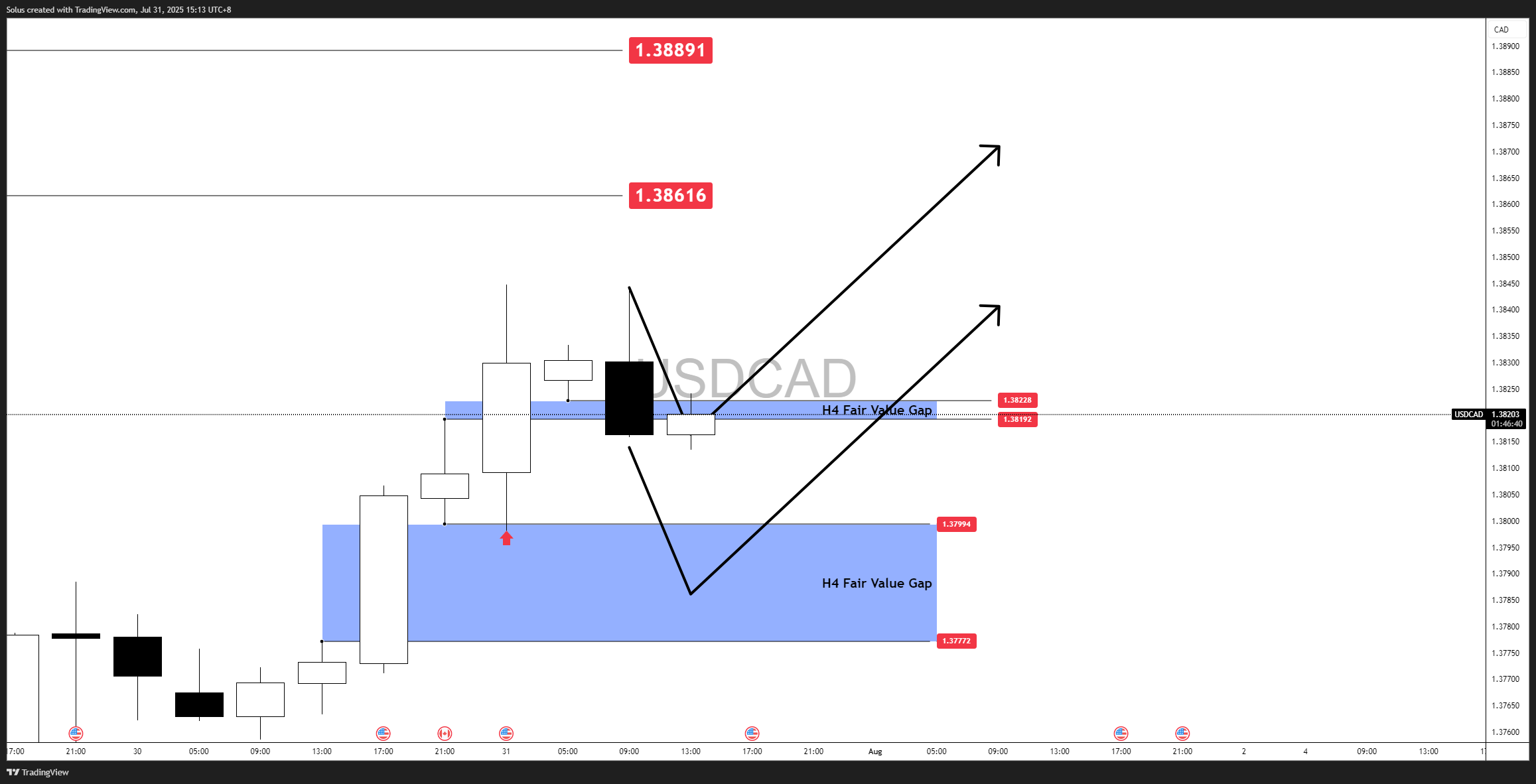

Before – Forecast from the Webinar

This was the original forecast where we highlighted the 0.236 retracement zone (green) on the H4 chart as the area to watch for bullish continuation.

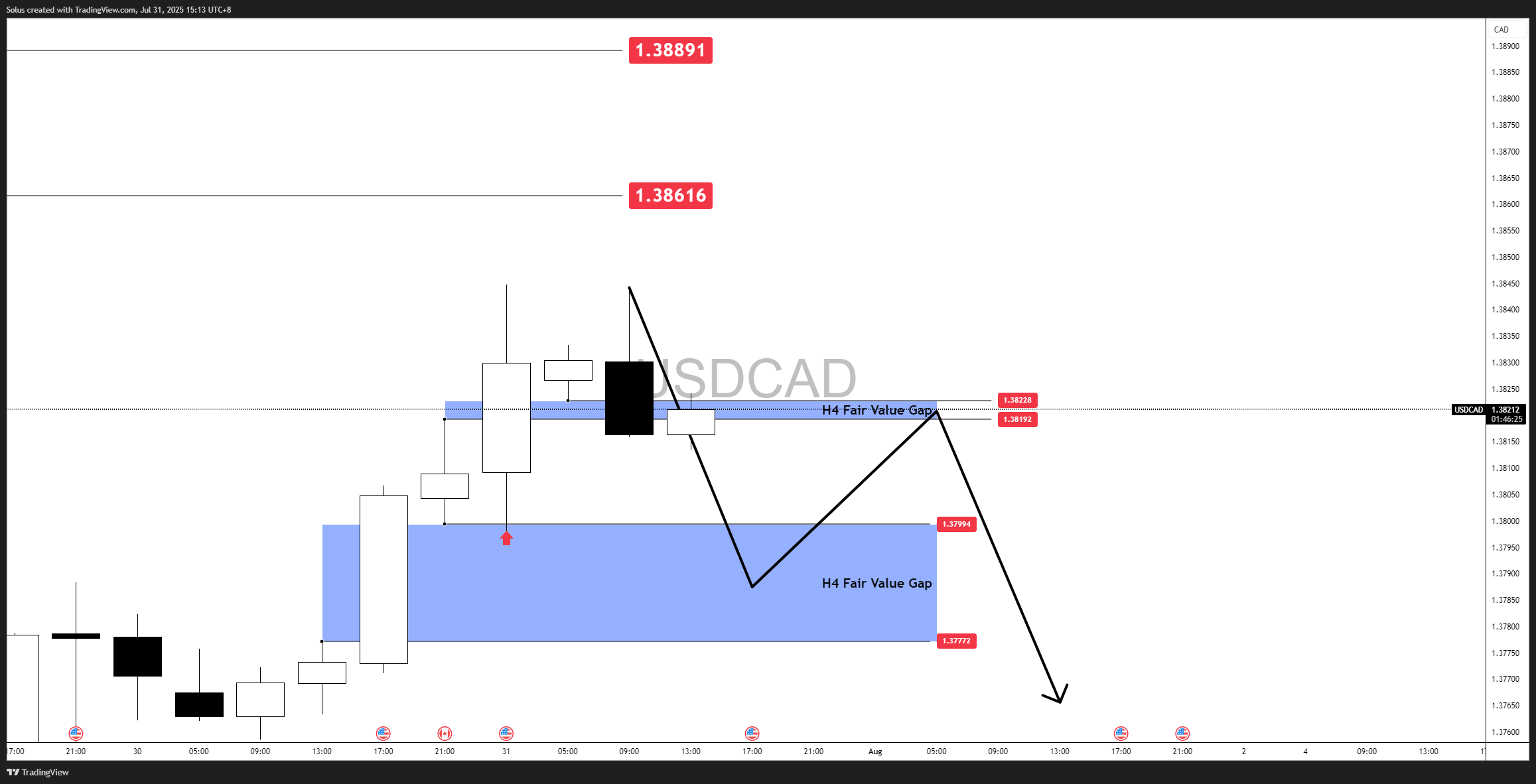

After – The Follow-Through Rally

Price dipped into the zone, consolidated, then broke out as expected, now trading above the range highs.

What’s Been Driving the Market

Several elements have been influencing USD/CAD beyond the charts:

- Federal Reserve Policy Pause – The Fed’s decision to pause rate hikes has left the USD stronger as markets now expect higher-for-longer policy, giving the dollar a solid foundation.

- Bank of Canada’s Stance – With the BoC taking a more cautious tone amid slowing domestic growth, CAD remains less attractive from a yield perspective.

- Trade and Tariff Tensions – Investors remain wary ahead of the August 1 tariff deadline, weighing potential US tariffs on Canadian exports, a factor that could further pressure the loonie.

- Oil Prices as a CAD Proxy – Rising oil prices have offered some support to CAD, but so far not enough to offset USD momentum.

These drivers have been the underlying fuel behind the breakout we anticipated, and they remain critical as the market positions itself ahead of tomorrow’s Non-Farm Payrolls (NFP).

Technical Outlook

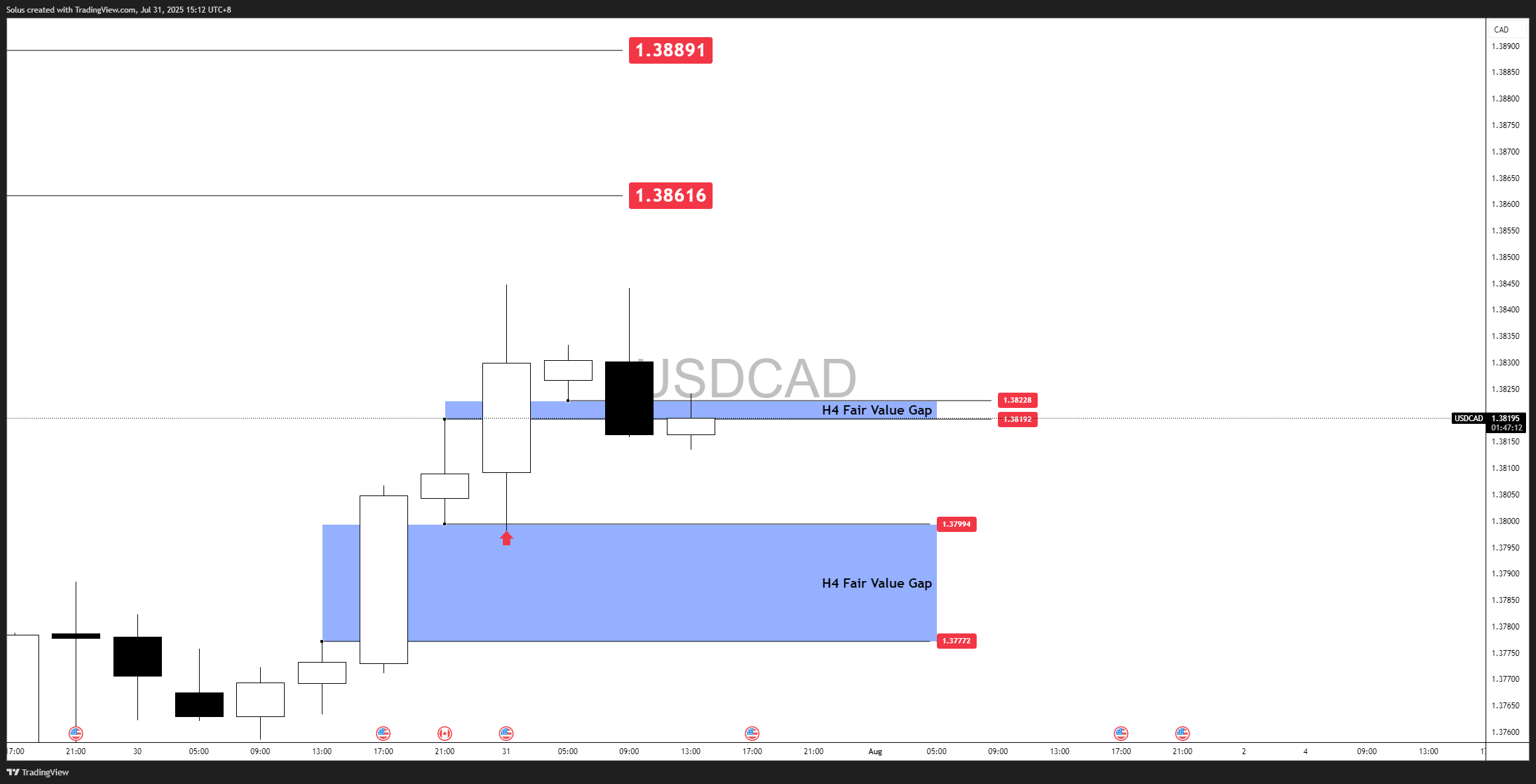

USD/CAD is currently hovering near the 1.3819–1.3822 zone, which aligns with a H4 Fair Value Gap (FVG) acting as short-term resistance. Price recently rallied into this level after confirming a bullish continuation from the previous discount zone we mapped out.

Two key H4 FVGs are now framing the market:

- The upper FVG (1.3819–1.3822) is the immediate decision point.

- The lower FVG (1.3777–1.3799) represents a strong area of potential demand and liquidity if price retraces deeper.

This structure sets the stage for two possible paths: a continuation of the bullish move, or a deeper retracement before attempting higher levels.

Bullish Scenario

The market maintains its bullish momentum by holding above the 1.3819–1.3822 zone. Buyers continue to absorb selling pressure, setting up another leg higher.

- A clean H4 close above 1.3822 would confirm buyers remain in control.

Targets:

- Immediate target: 1.3861 (first resistance)

- Extended target: 1.3889, which also coincides with a key liquidity pool above recent highs

Bearish Scenario

The market fails to hold the 1.3819–1.3822 zone, suggesting buyers are losing momentum. Price could then retrace deeper to collect liquidity before deciding the next direction.

- A clean rejection and close back below 1.3819, followed by sustained bearish momentum on the lower timeframes (M15–H1).

Targets:

- Short-term target: 1.3799 (top of the lower FVG)

- Extended target: 1.3777 (full fill of the lower FVG)

Final Takeaway

USD/CAD has delivered exactly what we mapped out in the webinar—reacting cleanly to the H4 discount zone and now consolidating at a critical decision point. Tomorrow’s Non-Farm Payrolls (NFP) release will be the next major catalyst that could fuel the next big move.

If NFP data reinforces USD strength, a breakout toward 1.3861–1.3889 becomes highly likely. However, a weaker-than-expected report could flip sentiment quickly, triggering a rejection back into the lower H4 Fair Value Gap (1.3777–1.3799).

Stay disciplined, wait for confirmation on the lower timeframes, and be prepared for a spike in volatility during the release.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know