Mastering Candlestick Charts and Patterns in Forex Trading

2023-06-29 13:37:39

At ACY Securities, we firmly believe that a strong grasp of candlestick charts and patterns is essential for success in the forex market. That's why we have crafted this comprehensive guide to help you navigate the intricacies of candlestick analysis. Whether you're a beginner aiming to grasp the fundamentals or an experienced trader seeking to enhance your skills, our guide is designed to provide valuable insights and practical knowledge.

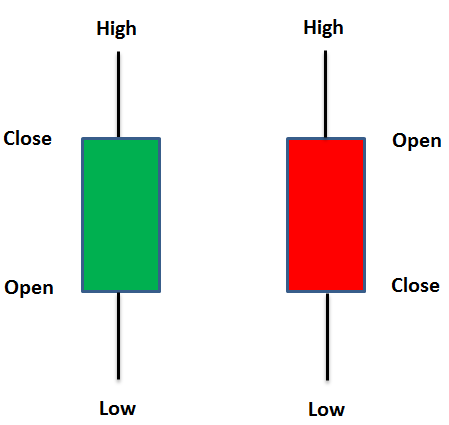

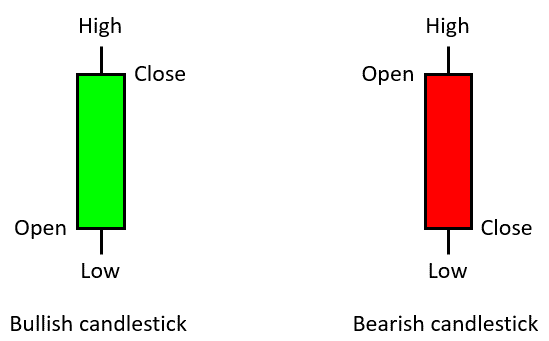

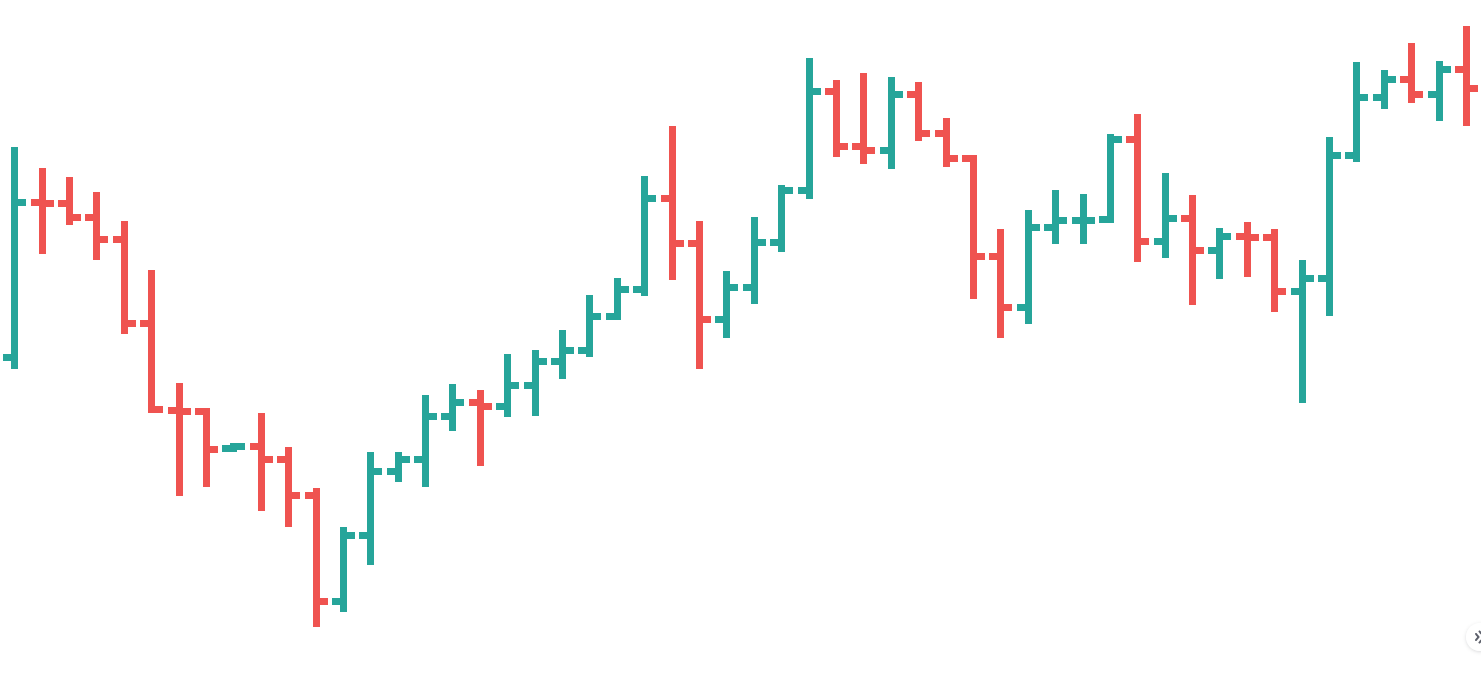

Candlestick charts, a popular technical analysis tool, depict the high, low, opening, and closing values of an asset within a specified time frame. Traders utilise these charts to analyse past patterns and predict future price movements. Candlestick signals can be single candles, such as the Doji, or multiple candles, forming recognisable patterns such as the bullish engulfing line, bearish hammer, or bearish hanging man.

Join us as we delve into the world of candlestick charts and patterns, unlocking their power to make informed trading decisions. Let us equip you with the tools and knowledge you need to navigate the forex market with confidence.

History of Candlestick Charts in Forex Trading

Candlestick charts can be traced back to Munehisa Honma, an 18th-century Japanese rice trader. The Western recognition and popularisation of candlestick charts came through Steve Nison, who published his book "Japanese Candlestick Charting Techniques" in 1991.

Since then, these techniques, along with others like Fibonacci analysis, have become widely adopted in modern forex analysis.

Understanding the Significance of Candlestick Analysis in Forex Trading

By offering insights into currency price fluctuations, information from candlesticks can improve trading strategies. Candlestick charts are a crucial tool for technical forex traders, offering valuable insights into price action, trend analysis, entry points, and more.

Understanding the meaning of forex candlesticks is essential for all currency traders, as it allows for quick and accurate recognition of various price actions. Whether trading forex or any other financial market, the analysis techniques applied to candlestick charts remain applicable.

By examining the "real body" and the shadows of candlesticks, investors can determine the relationship between the opening, closing, high, and low prices, ultimately shaping the form of the candlestick.

Types of Candlestick Charts and Their Characteristics

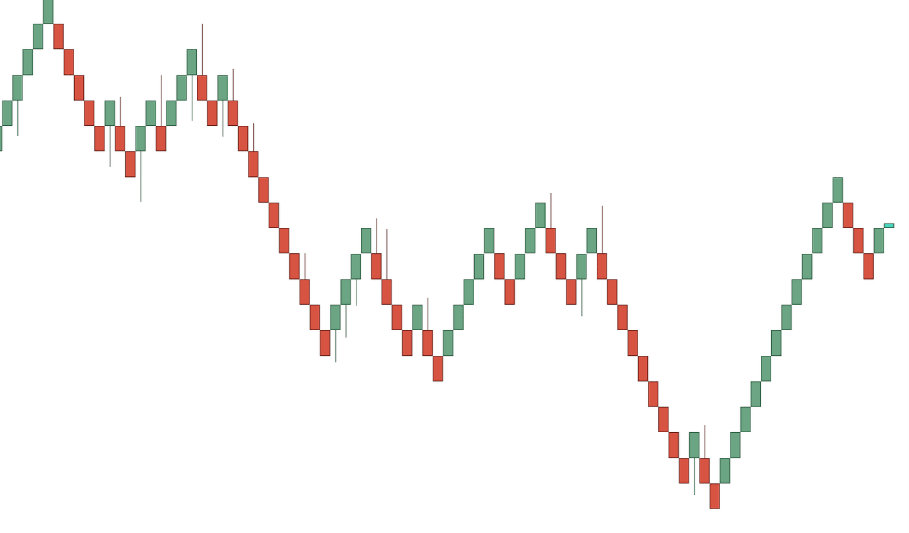

Trader behaviour can be revealed through the art of chart patterns, which visually depict the ongoing battle between supply and demand in the market. By closely observing these patterns, you can decipher moments when the buyers (bulls) seize control or when the sellers (bears) dominate the scene.

Among the various types of candlestick charts available, three stand out:

1. Standard Candlestick Chart: This classic chart displays the open, close, high, and low prices of a given period. The colour of the candle bodies reveals whether the trend is bullish (upward) or bearish (downward), providing valuable insights into market sentiment.

2. Heikin-Ashi Chart: By smoothing out price data, the Heikin-Ashi chart presents patterns with smaller bodies and less pronounced shadows, allowing for easier identification of trends and potential reversals.

3. Renko Chart: Unlike traditional charts, the Renko chart disregards the element of time and focuses solely on predetermined price levels. Bricks are plotted to represent price movements, offering a clearer picture of trends and eliminating the noise caused by time-based fluctuations.

Each type of candlestick chart provides a unique perspective on price action and trend analysis, giving traders different tools to understand and interpret market dynamics.

Explore these chart types to enhance your trading strategies and gain a deeper understanding of the ever-evolving financial markets.

Overview of Line, Bar, and Candlestick Charts

The field of technical analysis offers numerous trading indicators and tools to identify trends and predict reversals. Alongside technical indicators, the analysis of different chart types and their patterns is another valuable tool for examining price action.

These charts can present historical data for various assets, such as currency pairs, stocks, and cryptocurrencies, in different formats.

Among the most commonly used chart types are line charts, bar charts, and candlestick charts.

Line Charts

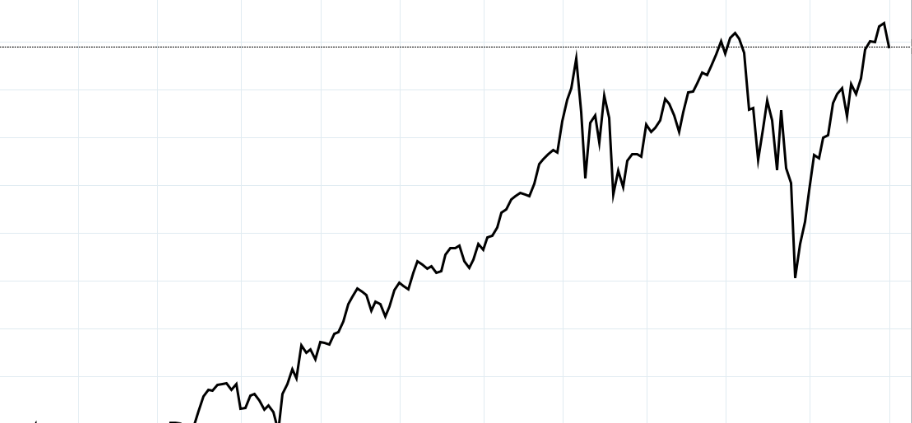

Line charts are the simplest and most basic type of chart. They plot the closing prices of an asset over a specific period and connect them with a continuous line. Line charts provide a clear representation of the overall trend and can help identify key support and resistance levels.

However, they lack detailed information about the highs, lows, and opening prices of the asset.

Bar Charts

Bar charts offer comprehensive information, surpassing the simplicity of line charts. Each bar on the chart corresponds to a specific period and showcases four key data points.

- The left side of the bar represents the opening price, while the right side denotes the closing price.

- The top of the bar indicates the highest price reached during that period, and the bottom reflects the lowest price reached.

- Traders can leverage bar charts to analyse price ranges, assess market volatility, and spot patterns like inside bars and engulfing patterns.

Candlestick Charts

Candlestick charts are often preferred due to their ability to provide a more detailed representation of price action and offer insights into market psychology.

Understanding the Composition of a Candlestick

At ACY Securities, we recognise the value of candlestick charts in providing detailed insights into price action and market psychology. Here's a breakdown of the components that make candlestick charts a preferred choice for traders:

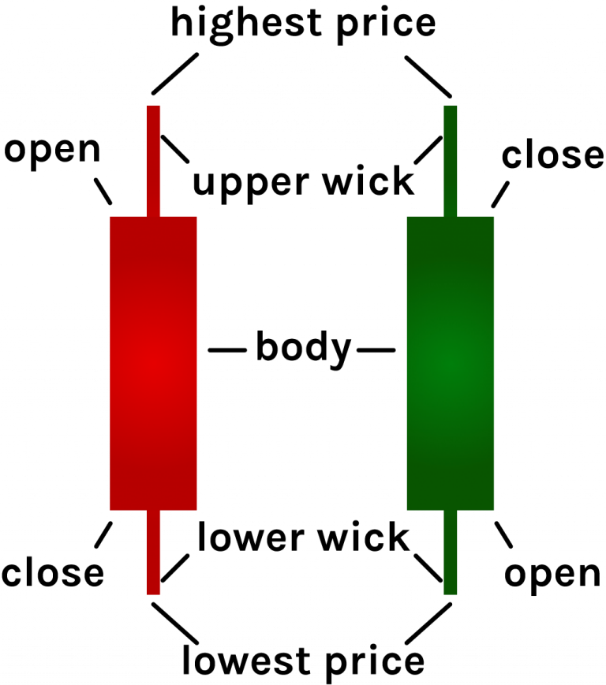

Candle Body

The body of a candlestick represents the asset's open and closing prices. The relationship between the open and close determines whether the candlestick is bullish (closing price higher than the open) or bearish (closing price lower than the open).

A Candle's Shadow/Wick

Candlesticks typically have two shadows, representing the high and low points of the price range. The upper shadow reflects the highest price reached, while the lower shadow indicates the lowest price.

In some cases, one shadow may be absent if it coincides with the open or closed position and lies on the same horizontal line as the body.

Candle Colour

The colour of the candlestick body signifies the direction of price change. A green or white body indicates an upward trend, while a red or black body suggests a downward trend. On most platforms, green and red candle bodies are commonly used, with the upper limit representing the closing price for green candles.

By understanding these components, traders at ACY Securities can gain valuable insights into market trends and make informed trading decisions. Candlestick charts offer a visual representation that goes beyond basic price levels, enabling a deeper understanding of market dynamics.

Watch here to learn more:

Common Candlestick Patterns and Formations: A Guide to Recognizing Key Market Signals

By offering a visual depiction of market sentiment and possible shifts in that sentiment, candlestick patterns prove valuable for traders. These patterns can be readily recognised, enabling traders to make decisive moves.

Chart patterns can be broadly classified into two categories:

- Reversal Patterns

- Trend Continuation Patterns

Reversal Patterns

Unlocking the secrets of market turning points, reversal patterns are formations of Japanese candlesticks that signal the end of one trend and the beginning of a new one. They offer traders valuable insights for strategic decision-making.

Bullish and Bearish Reversals

Experience the thrill of a market shift as bullish reversals transform downtrends into uptrends, while bearish reversals flip the direction from upswing to downturn. These patterns emerge during specific market conditions and provide opportunities for traders to anticipate trend reversals.

Examples of Reversal Patterns

Let's explore three captivating examples of candlestick patterns that indicate trend reversal:

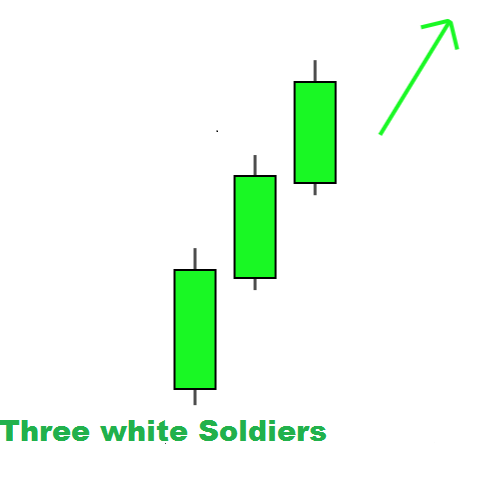

1. Three White Soldiers (Bullish Reversal Pattern)

The Three White Soldiers is a powerful reversal pattern consisting of three consecutive lengthy candlesticks. Each candlestick opens within the previous candle's body and closes above its peak, without long shadows. Ideally, these candlesticks open within the real body of the last candlestick in the pattern.

This sequential construction of candlesticks creates a pattern of higher highs and higher lows, demonstrating a surge of intense buying pressure. Traders take note: this candlestick pattern signals an imminent uptrend on the horizon.

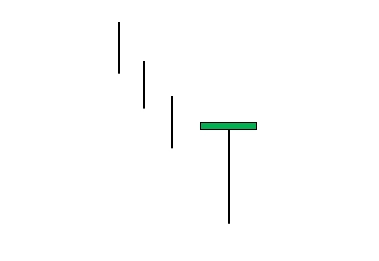

2. Dragonfly Doji: A Bullish Reversal Pattern

The Dragonfly Doji is a bullish reversal pattern that belongs to the Doji family. It is characterised by having its high, open, and close prices all at the same level, resulting in a candlestick with a long lower tail or shadow. The distinctive shape of this pattern resembles that of a dragonfly.

The presence of a Dragonfly Doji is an incredibly positive sign for traders. It suggests that the market has swiftly rebounded from previous lows and is now trading at or near its opening price. This pattern indicates a potential trend reversal and the emergence of bullish momentum.

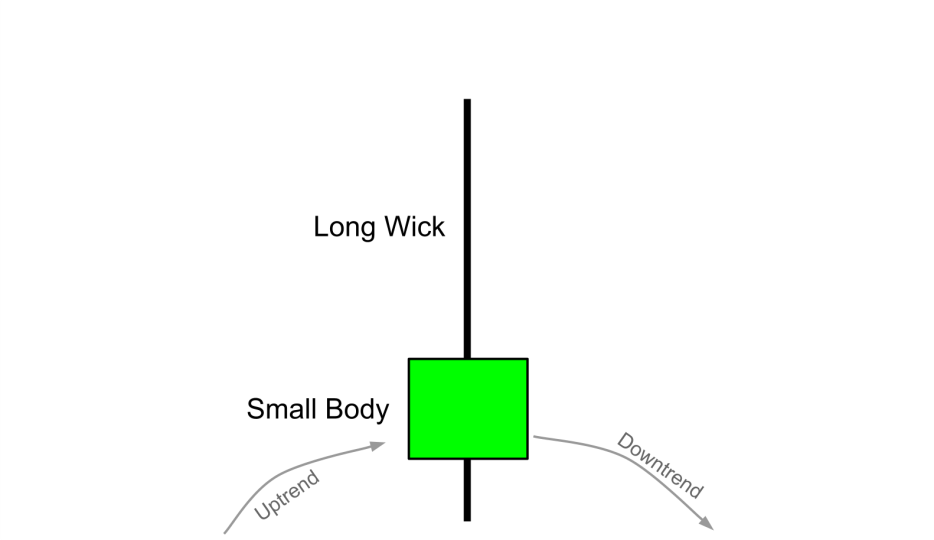

3. Shooting Star Candlestick: A Bearish Reversal Pattern

The shooting star candlestick is a single candle pattern that appears at the peak of an uptrend, signalling a potential reversal in the market. It is characterised by a short body and a long upside-down wick.

At the beginning of the candle, prices rise to new highs, forming this distinct shape. However, prices quickly reverse and retreat back towards the candle's opening.

The extended topside wick indicates the presence of a sizable group of sellers during the uptrend, though their impact might only be temporary. This pattern suggests a potential shift in market sentiment from bullish to bearish.

Understanding Trend Continuation Patterns

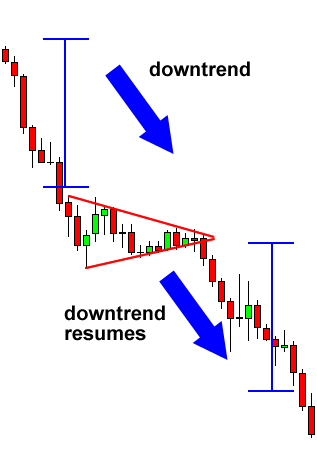

Trend continuation patterns are chart patterns that indicate a temporary pause in the current trend, suggesting that the price is likely to resume its previous direction after the consolidation. Traders often wait for a breakout and enter a position in the direction of the breakout to capitalize on the continuation of the trend.

It is important to note that not all continuation patterns result in the price continuing in the same direction. Some patterns can lead to a price reversal or a temporary deviation from the existing trend. Therefore, traders need to carefully analyse the specific pattern and its implications.

Before the consolidation phase, traders should determine the trend's direction and pinpoint the precise pattern the short-term price lines have created in order to trade trend continuation patterns effectively. Once the pattern is recognized, traders can set appropriate stop-loss and take-profit levels based on their risk assessment.

By following a systematic approach and understanding the dynamics of trend continuation patterns, traders can make informed trading decisions and optimize their profit potential.

Here are some common examples of continuation chart patterns:

- Flags: Flags are characterised by a rectangular shape formed by two parallel trendlines. The flag pattern occurs after a strong price move and represents a temporary pause or consolidation. Traders often look for a breakout in the direction of the initial trend to enter trades.

- Pennants: Pennants are similar to flags but have a triangular shape. They are formed by converging trendlines, creating a pennant-like structure. Pennants also indicate a temporary consolidation before the continuation of the trend. Traders watch for a breakout to confirm the direction of the trend.

- Rectangles: Rectangles are horizontal consolidation patterns formed by parallel support and resistance levels. The price oscillates between these levels, creating a rectangular shape. Traders anticipate a breakout above or below the rectangle to determine the trend continuation.

- Triangles: Triangles are chart patterns that exhibit a narrowing range between ascending or descending trendlines. They can be symmetrical (with converging trendlines), ascending (with a rising lower trendline), or descending (with a falling upper trendline). Traders look for a breakout to confirm the continuation of the previous trend.

By recognising these continuation chart patterns, traders can anticipate the resumption of a trend and make informed trading decisions based on the breakout direction and other supporting indicators.

The Distinction Between Forex Candlesticks and Candlesticks in Other Markets

Foreign exchange (FX) candlesticks differ slightly from candlesticks in other markets, such as stocks, ETFs, and futures. This is primarily because the FX market operates 24 hours a day, resulting in a continuous flow of price data. Unlike other markets, FX candlesticks typically represent the opening of one day as the close of the previous day, with fewer gaps in price patterns.

The only instances of gaps in FX candles occur when there is a difference between the Friday close and the Monday open. It's important to be aware of these gaps as they can impact the reliability of certain candlestick patterns.

In the FX market, candlestick formations may not strictly adhere to the conventional pattern, requiring creativity and adaptability to interpret their potential indications accurately.

Using Multiple Candlestick Patterns to Confirm Signals

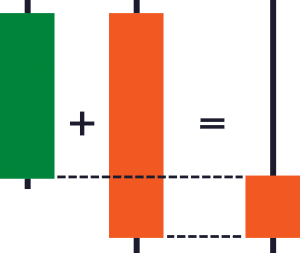

Candlestick charts are effective tools for predicting future price movements, but it is often necessary to wait for confirmation from consecutive candles before trading based on a specific pattern.

Additionally, combining multiple candlesticks can create new patterns on higher timeframes, providing valuable insights into market behaviour. To better understand this concept, let's consider an example.

Suppose you observe two consecutive bearish engulfing candles in a 1-hour timeframe. When you combine these two candles in a 2-hour timeframe, you may identify a shooting star or a bearish pin bar pattern.

This formation indicates a potential reversal or a signal that sellers may be gaining control.

By combining candlestick patterns, traders can gain a better understanding of market dynamics. This approach enables them to assess the prevailing trend and gauge the emotions of buyers and sellers over an extended period.

Trading Strategies: Unleashing the Power of Candlestick Analysis

Using Candlestick Patterns to Identify Trends and Market Reversals

Candlestick patterns can be powerful tools for traders to identify trends and potential market reversals. While reversal patterns are more commonly associated with market reversals, trend patterns can also provide valuable insights into the continuation of a trend.

By understanding different candlestick sequences and their alignment with the primary market direction, traders can gain confidence in spotting and riding trends.

Trend Continuation: For trend continuation patterns, traders look for specific candlestick sequences that indicate the end of a price correction within a trend and the resumption of the overall trend. These patterns typically consist of multiple candles, allowing traders to wait for confirmation before assuming the trend will continue.

By recognising these patterns, traders can make informed decisions to stay in the trend and maximise their profits.

Reversal Candle Formations: In the case of identifying market reversals, traders need to assess the reliability of the reversal candle formation. If the reversal signal is strong, traders have several options.

- First, they may choose to exit any positions they have in the direction of the previous trend.

- Second, they can tighten their stop-loss orders or close a portion of their position to secure profits if the reversal signal is not exceptionally strong.

- Finally, if they are not currently in a position, they can use the reversal signal as an opportunity to initiate a trade in the opposite direction. For example, if a bullish reversal pattern emerges, they may consider opening a new bullish trade.

By applying candlestick analysis and understanding different patterns, traders can enhance their decision-making process and potentially improve their trading outcomes.

Developing Effective Trading Strategies with Candlestick Analysis

Developing trading strategies based on candlestick analysis can be a powerful approach for traders.

Here are a few steps to consider when developing trading strategies using candlestick analysis:

- Learn and understand candlestick patterns: Familiarise yourself with different candlestick patterns and their interpretations. Study common patterns like doji, engulfing patterns, hammers, shooting stars, and more. Understand the meaning and implications of each pattern in different market contexts.

- Identify key support and resistance levels: Combine candlestick analysis with support and resistance levels on the price chart. Look for candlestick patterns forming near significant levels, as they can signal potential reversals or breakouts.

- Define entry and exit criteria: Determine clear entry and exit criteria based on the identified candlestick patterns. This could involve waiting for confirmation candles, specific price levels, or combining multiple patterns.

- Manage risk: Implement proper risk management techniques by setting stop-loss orders to limit potential losses. Consider the risk-reward ratio and adjust position sizes accordingly.

- Backtest and refine: Test your trading strategy on historical price data to assess its effectiveness. Analyse the performance of your strategy and make necessary adjustments based on backtesting results.

- Practice and adapt: Execute your strategy in a demo trading account or with small positions in real trading. Monitor the performance and adapt your strategy based on real-time observations and market conditions.

- Exercise prudence and self-control: Remember that there is no guaranteed success in trading. Be disciplined, exercise prudence, and follow your trading plan consistently. Stay informed about market news and events that may impact your strategy.

By following these steps, traders can develop effective trading strategies using candlestick analysis and improve their chances of making informed trading decisions.

Combining Candlestick Analysis with Technical and Fundamental Analysis for Enhanced Trading Insights

By integrating candlestick analysis with other technical indicators and fundamental insights, traders can enhance their decision-making process and elevate their trading success. Explore the vast array of technical tools available on ACY.com, including moving averages, oscillators, and chart patterns, to complement the signals generated by candlestick patterns.

Delve into fundamental analysis, analysing economic data, news events, earnings reports, and geopolitical factors to gain a deeper understanding of market sentiment and potential catalysts.

With the comprehensive educational resources from ACY Securities, you can uncover hidden opportunities and make informed trading decisions to stay ahead in the dynamic world of financial markets.

Technical Analysis: In the dynamic trading world, incorporating a holistic approach can significantly improve decision-making. By integrating candlestick analysis with technical indicators such as moving averages, oscillators (RSI, MACD), and chart patterns (head and shoulders, triangles, etc.), traders can validate and reinforce signals generated by candlestick patterns.

For instance, when identifying a bullish engulfing pattern, it becomes crucial to assess its alignment with key support levels or potential bullish divergences on the RSI indicator for stronger confirmation.

Fundamental Analysis: Fundamental Analysis plays a pivotal role by considering underlying factors that shape market dynamics. Evaluating economic data, news events, earnings reports, and geopolitical influences provides valuable insights. Candlestick patterns are invaluable tools for identifying potential turning points or trend reversals. However, reinforcing these patterns with fundamental analysis, such as cross-referencing a bearish engulfing pattern with negative news or poor earnings results, strengthens the overall bearish case.

Mastering the Art of Advanced Candlestick Analysis for Precise Market Insights

Japanese candlestick techniques and patterns

Japanese candlestick patterns are widely used in financial charts as they provide valuable insights for predicting future market actions. Let's explore some common examples of Japanese candlestick patterns.

One such pattern is the "Gravestone Doji," named after it resembles a tombstone. It occurs when the opening and closing prices reach their respective yearly lows.

When both the opening and closing prices of a security are at their period high, a bullish pattern called a “Dragonfly Doji” is formed. Its long lower shadow suggests a potential reversal of an uptrend.

The “Hammer Pattern” is characterised by a long lower shadow and a small or non-existent upper shadow. It typically signals a potential reversal in the market trend, whether bullish or bearish.

Heiken Ashi Candlesticks and Their Applications

The Heikin-Ashi method generates a Japanese candlestick chart that filters out market noise by averaging price data. Unlike traditional open, high, low, and close candlestick charts, Heikin-Ashi charts use a different formula based on two-period averages.

This smoothing effect helps identify trends and reversals, although it also obscures some price data and fills in certain gaps. Technical traders rely on the Heikin-Ashi method to better understand existing trends.

Strong uptrends are represented by white (or green) candles with no lower shadows, while strong downtrends are indicated by black (or red) candles with no upper shadows.

Trends, reversal points, and other standard technical analysis patterns can all be identified using candlestick charts.

Renko Charts: A Powerful Tool for Forex Trading

Renko charts offer a unique and visually appealing way to analyse price movements in the forex market. Like Japanese candlestick charts, Renko charts provide an alternative method of representing price data. Instead of using traditional time-based intervals, Renko charts use a series of identically sized bricks that show the magnitude of price changes.

These bricks are colored green or red, indicating upward or downward movements, respectively. By filtering out minor price fluctuations, Renko charts help traders focus on significant trends and reversals. Unlike traditional charts, Renko charts ignore time, ensuring all bricks are the same size. This makes it easier to identify key levels of support and resistance.

While Renko charts typically don't include shadows, some variations may incorporate wicks. However, the classic Renko style, as illustrated in the EURUSD chart, showcases bars without shadows, resembling Japanese candlesticks.

Discover the power of Renko charts and enhance your forex trading analysis with this visually captivating and effective charting technique.

Common Mistakes and Pitfalls to Avoid in Candlestick Patterns

While candlestick patterns can provide valuable insights into market sentiment and potential price reversals, traders should be cautious of common mistakes and pitfalls associated with their interpretation and application.

Misinterpreting Candlestick Patterns and Signals

Misinterpreting candlestick patterns and signals is a key pitfall to avoid. One mistake is assigning excessive significance to individual candlesticks without considering the surrounding context. It's important to remember that candlestick patterns are not infallible and can sometimes give misleading indications. Traders should seek confirmation from other technical indicators, such as trendlines, support, resistance levels, or volume analysis, to validate the signals provided by candlestick patterns.

Another mistake is failing to account for the timeframe being analysed. Candlestick patterns can appear differently on various timeframes, and their significance may vary accordingly. A pattern that appears strong in a shorter timeframe may be insignificant or unreliable in a longer timeframe.

Traders should also avoid cherry-picking specific candlestick patterns without considering the overall market conditions.

Failing to Adapt to Changing Market Conditions

Failing to adapt to changing market conditions is another common mistake. Markets are dynamic and constantly evolving, and what may have worked in the past may not necessarily work in the present or future. Traders need to be flexible and adjust their trading strategies accordingly.

Different market conditions may require different approaches, and a candlestick pattern that has been reliable in one market condition may lose its effectiveness in another.

Continuous monitoring and assessment of market conditions are crucial for adapting strategies to current circumstances.

Overreliance on Candlestick Analysis

Overreliance on candlestick analysis is a potential pitfall. While candlestick patterns offer useful insights, fundamental news, economic indicators, and general market conditions all impact markets.

Traders should complement candlestick analysis with other technical and fundamental forms to gain a comprehensive market view.

Additionally, implementing effective risk management methods is essential to minimise the potential impact of unfavourable outcomes.

Conclusion

Candlestick patterns are formed by the arrangement of individual candlesticks on a chart, providing valuable insights into market sentiment and potential price movements. Common patterns such as the doji, hammer, engulfing, and shooting star can offer guidance to traders.

By analysing the shape, size, and position of these patterns, traders can make informed trading decisions.

Discover the power of candlestick analysis and enhance your trading strategy at ACY Securities, where you can access a wide range of analytical tools and resources.

Try These Next