Becoming a Consistent Swing Trader: Trading Structure & Scaling Strategy

2025-10-16 08:56:40

How to Build Structure, Review, and Scale Your Trading Professionally

If you’ve made it this far through the Swing Trading Series, you’re no longer just a beginner-you’re building the foundation of a professional trader. From understanding what swing trading is to refining technical foundations and stepping into Smart Money Concepts, this final piece ties it all together. Because consistency isn’t about one great trade-it’s about building a system that produces repeatable results even when emotions try to take the wheel.

Let’s turn what you’ve learned into a lasting edge.

1. Building Your Trading Plan: Your Blueprint for Consistency

Every successful swing trader has a plan-not because it guarantees profit, but because it filters chaos. Think of it as your flight manual: when turbulence hits, you don’t improvise; you follow protocol.

Your plan should define:

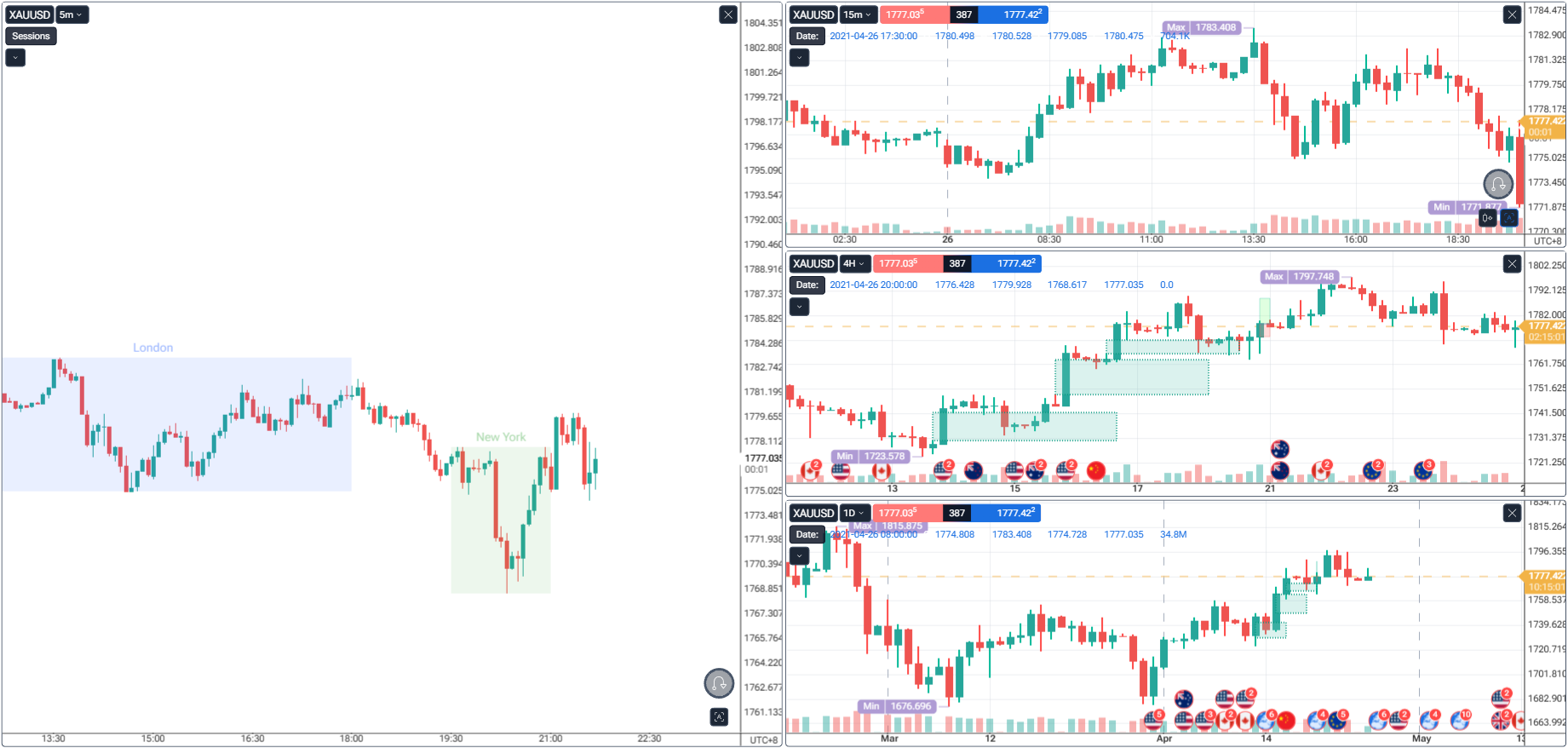

- Market Focus – Aim for one to two instruments you can truly master (e.g., Gold and NASDAQ). To ground your bias cleanly, use a top-down workflow like multi-timeframe analysis so your Daily sets direction, 4H frames structure, and 1H times execution.

- Entry Criteria – Spell out triggers you’ll act on (liquidity sweep → BOS → FVG). If you’re still developing your price-action eye, this technical foundations primer pairs well with SMC.

- Risk Rules – Keep risk per trade tight (often 1–2%). If you prefer rules of thumb for stops and targets, this Fibonacci guide to targets & stops offers a clean, mechanical way to frame exits.

Above all, your plan should fit on one page. The more concise it is, the more likely you’ll actually follow it under pressure.

2. The Daily, Weekly, Monthly Review System: Your Internal Mirror

You can’t improve what you don’t measure. Reviews transform you from reactive to adaptive. Each week, capture your best/worst trade, the rule you broke (if any), and the emotion you felt when you clicked the button. At month-end, narrate your equity curve: did you grow because of discipline or luck?

If you’ve struggled to journal consistently, borrow structure from The Psychology of Risk Management in Swing Trading (how emotions distort risk) and put it into practice with a simple trading journal & reflection routine. The combination gives you both the why (mindset) and the how (mechanics).

Track a few core metrics that actually drive outcomes: win rate, average R multiple, expectancy, and peak-to-valley drawdown. You don’t need a thousand stats; you need the few that change behavior.

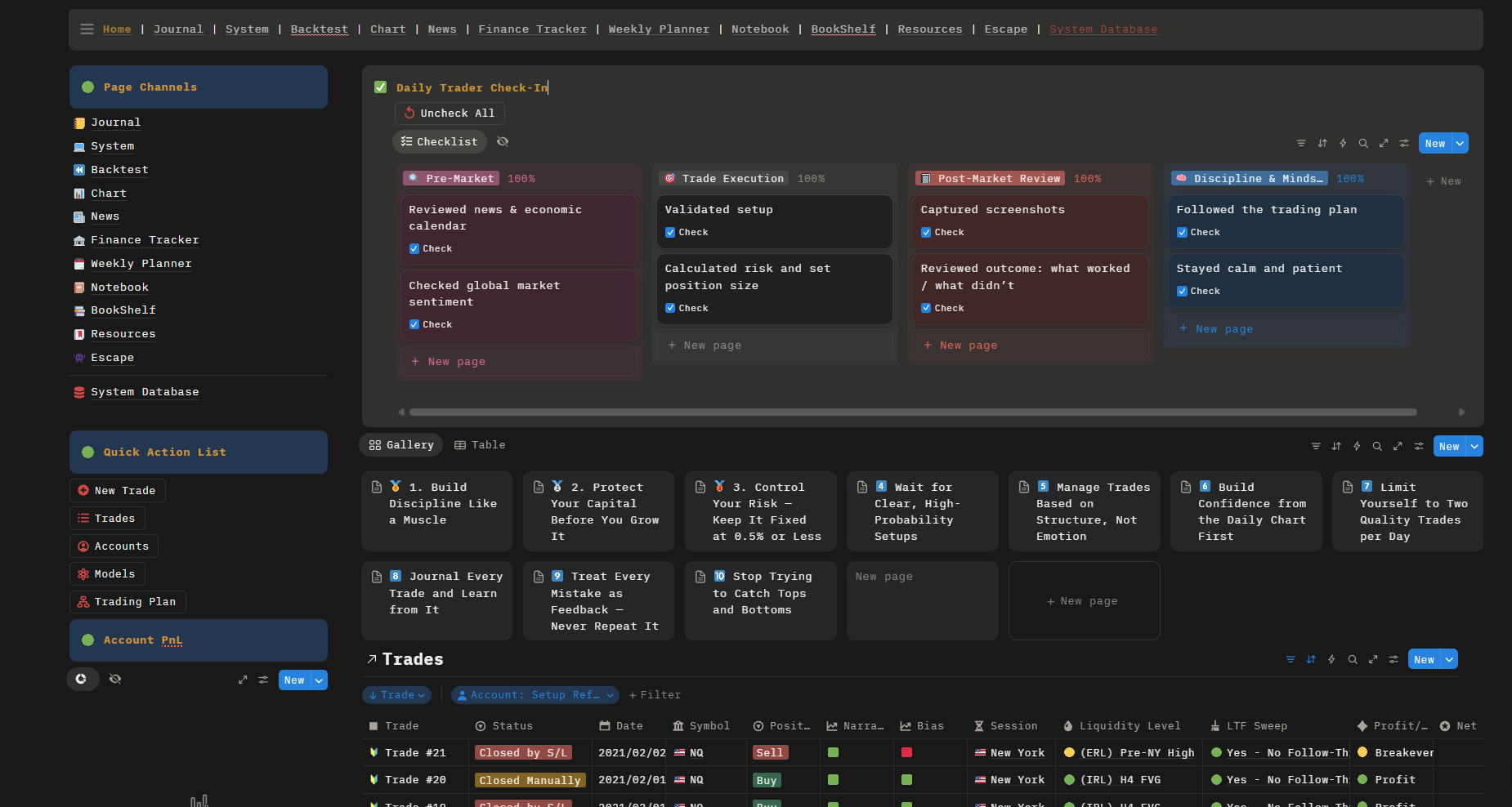

This is the heart of my process - my daily check-in and trading journal.

Every morning starts with a pre-market review: checking news, global sentiment, and the economic calendar. It’s how I make sure I’m trading with context, not impulse.

Each section has a purpose - Pre-Market, Execution, Post-Market, Discipline. Together, they keep me anchored. Before a trade, I validate setups and position size; after, I capture screenshots and note what worked and what didn’t. It’s not about perfection - it’s about accountability.

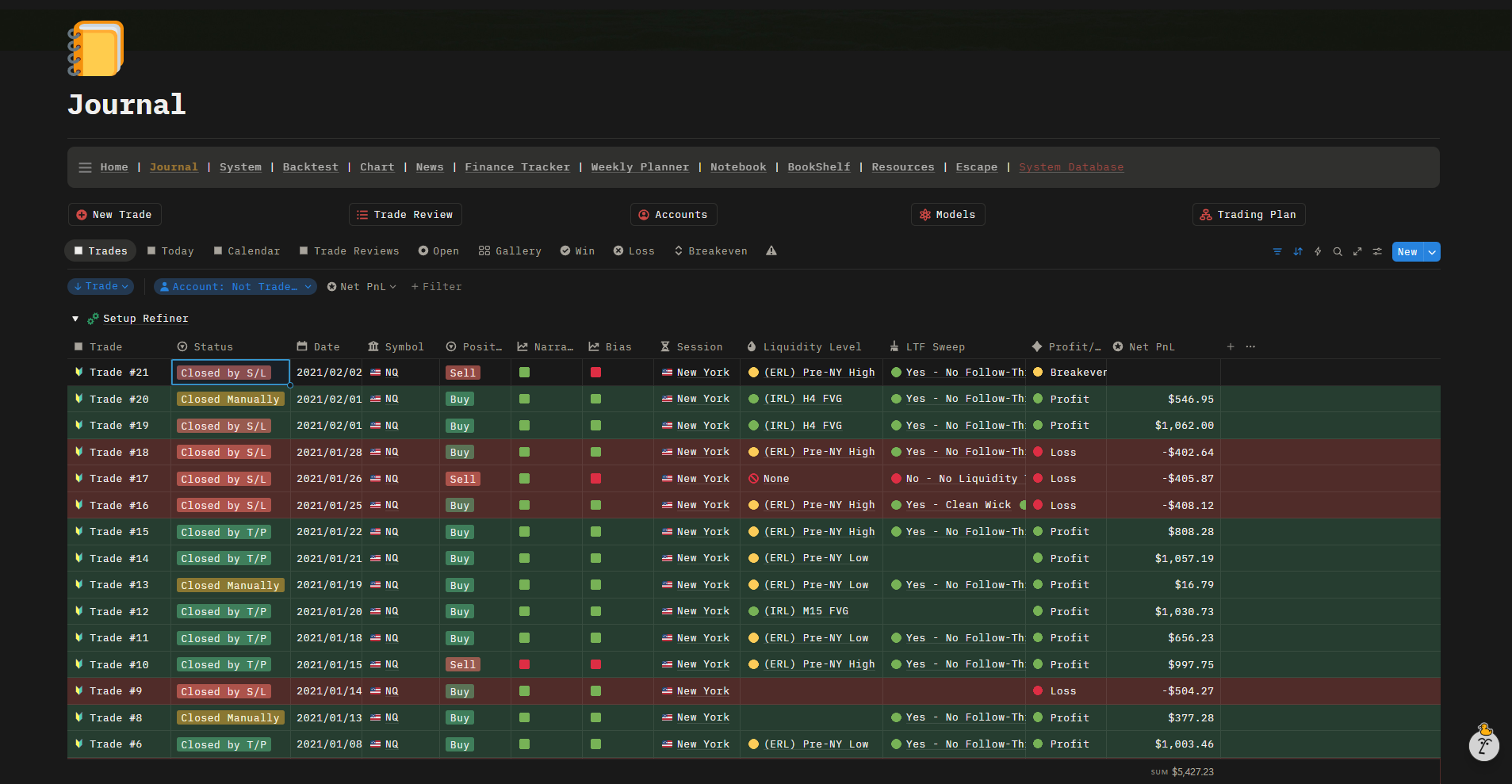

The second dashboard tracks every single trade in detail - session, bias, liquidity level, entry type, and outcome. Over time, it shows me the truth about my trading: which setups deliver, which ones drain energy, and how my behavior affects results.

It’s easy to say “be disciplined,” but this system makes it visible.

When I review my journal, I don’t just see numbers - I see patterns, growth, and habits forming.

This is where I measure my real progress, not by profit, but by consistency.

3. Portfolio Building: Balance Risk Across Markets

Swing traders have a unique edge-time. You’re not forced to trade every day, which means you can balance exposure across uncorrelated ideas. Don’t stack the same macro bet in different wrappers (e.g., long Gold, long Silver, and long AUD/USD often rhyme). Instead, think like a portfolio manager: one metals theme, one currency idea, one equity index.

To sharpen this, study how markets move together with market correlations & intermarket analysis. When a USD bull run pressures risk assets, or when real yields lean on gold, you’ll see it faster-and position size accordingly. The goal isn’t more trades; it’s smarter exposures that complement (not duplicate) risk.

4. Scaling Up: From Demo → Live → Funded Account

Scaling is mostly psychological. Plenty of traders can execute on demo; fewer can preserve discipline once capital size and external rules kick in.

A practical progression:

- Demo (30–60 days) – Prove process fidelity: entries, exit rules, no overtrading.

- Micro Live – Feel the emotions with tiny size; keep the exact same rules.

- Consistent Live – String together 6–8 solid weeks with controlled drawdown.

- Funded Challenge – Same playbook, more constraints. Many pass technically but fail emotionally.

- Scaling Plan – As size grows, reduce per-trade risk to protect longevity.

If your path includes prop programs, align your risk rules with this concise guide for challenge environments: The Ultimate Risk Management Plan for Prop Firm Traders (2026). And when timing matters-especially on indices-tighten execution windows with how to trade & scalp indices at the open using SMC. The same discipline that helps on the open strengthens your funded account performance overall.

5. The Power of Routine and Reflection

Consistency grows in repetition. Give your trading a heartbeat: a Sunday scan for bias, a mid-week check-in, and a weekly post-mortem. A little structure compounds into calm execution. If you need a nudge to make your habits stick, this quick primer on daily habits of profitable traders pairs perfectly with your review loop. And as your sample size grows, your results will start to reflect the math of compounding more than the noise of any single week.

6. How Backtesting Helps You Become a Consistent Trader

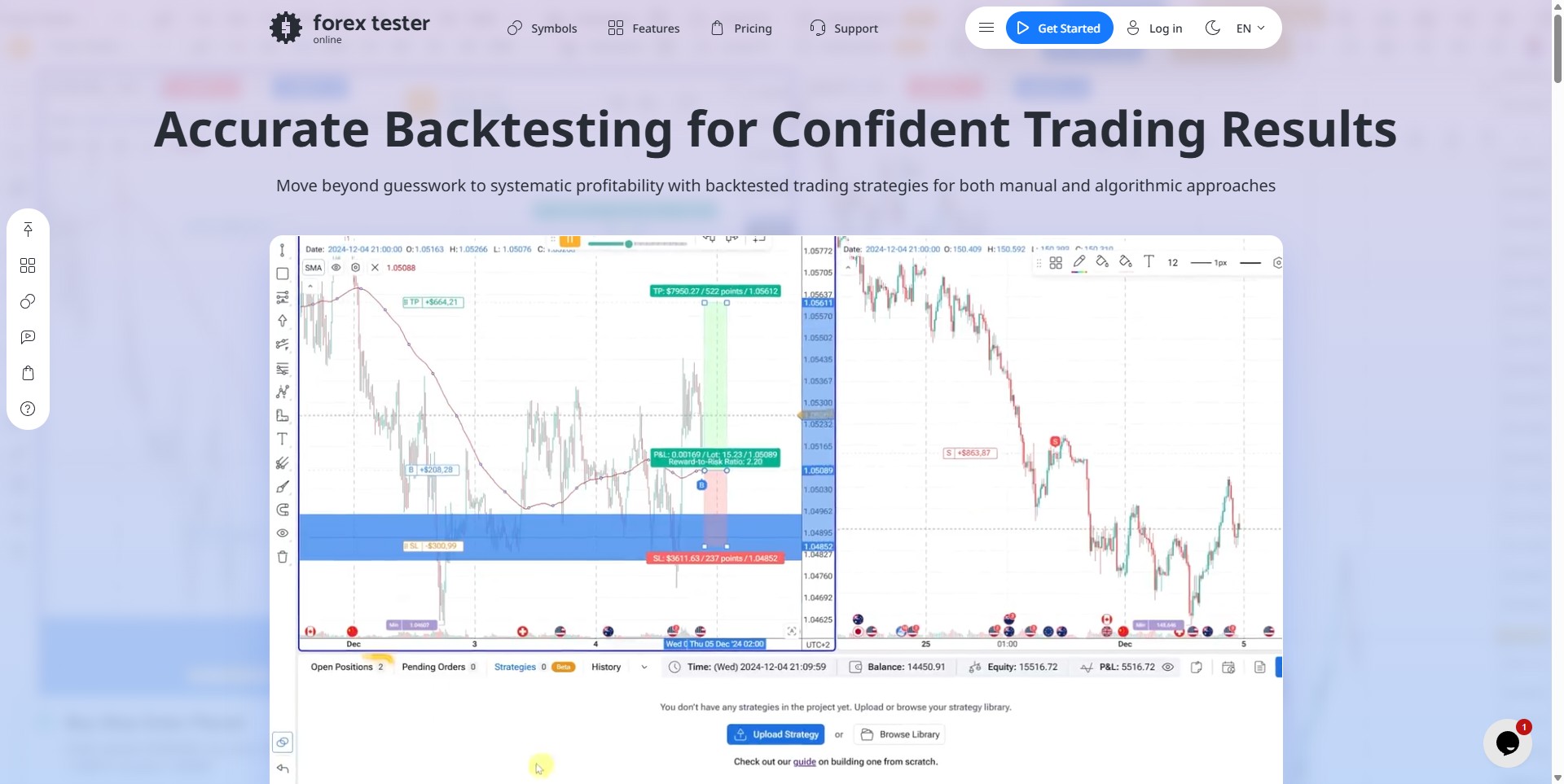

Backtesting is where theory meets truth.

It’s how I take ideas from charts and test whether they actually work when repeated over hundreds of trades. Without it, every trade feels like guessing - with it, I trade with proof.

When I started journaling seriously, I realized that tracking live trades only showed part of the picture. I needed something faster - a way to see years of data in days. That’s when I turned to backtesting.

It’s the bridge between learning and trusting your system.

By replaying price data and marking setups the same way I would live, I learned three things that changed my consistency forever:

Patterns Repeat More Than You Think.

You start recognizing liquidity sweeps, fair value gaps, and structural shifts forming again and again.

Your Edge Only Exists When Quantified.

Until you measure win rate, average R, and drawdown, you’re just hoping.

Confidence Comes from Data, Not Motivation.

When you’ve seen your model perform through hundreds of candles, hesitation fades - because your conviction is backed by evidence.

Featured Tool: Forex Tester Online

This is what I use when refining strategies - Forex Tester Online, a clean, professional platform built for realistic backtesting. It lets me replay the market on fast-forward, test entry rules across assets like EUR/USD or Gold, and evaluate my results with metrics that matter.

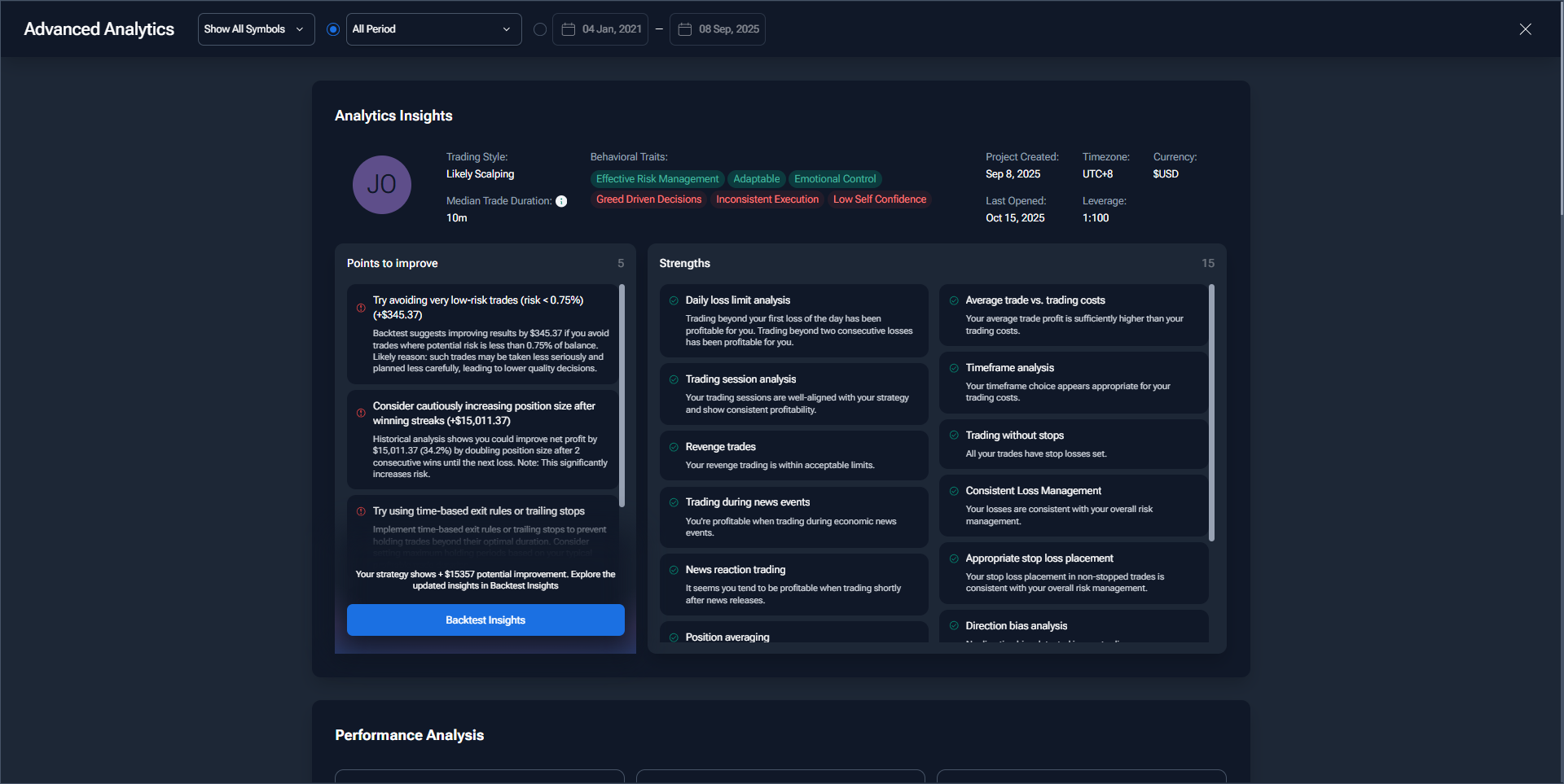

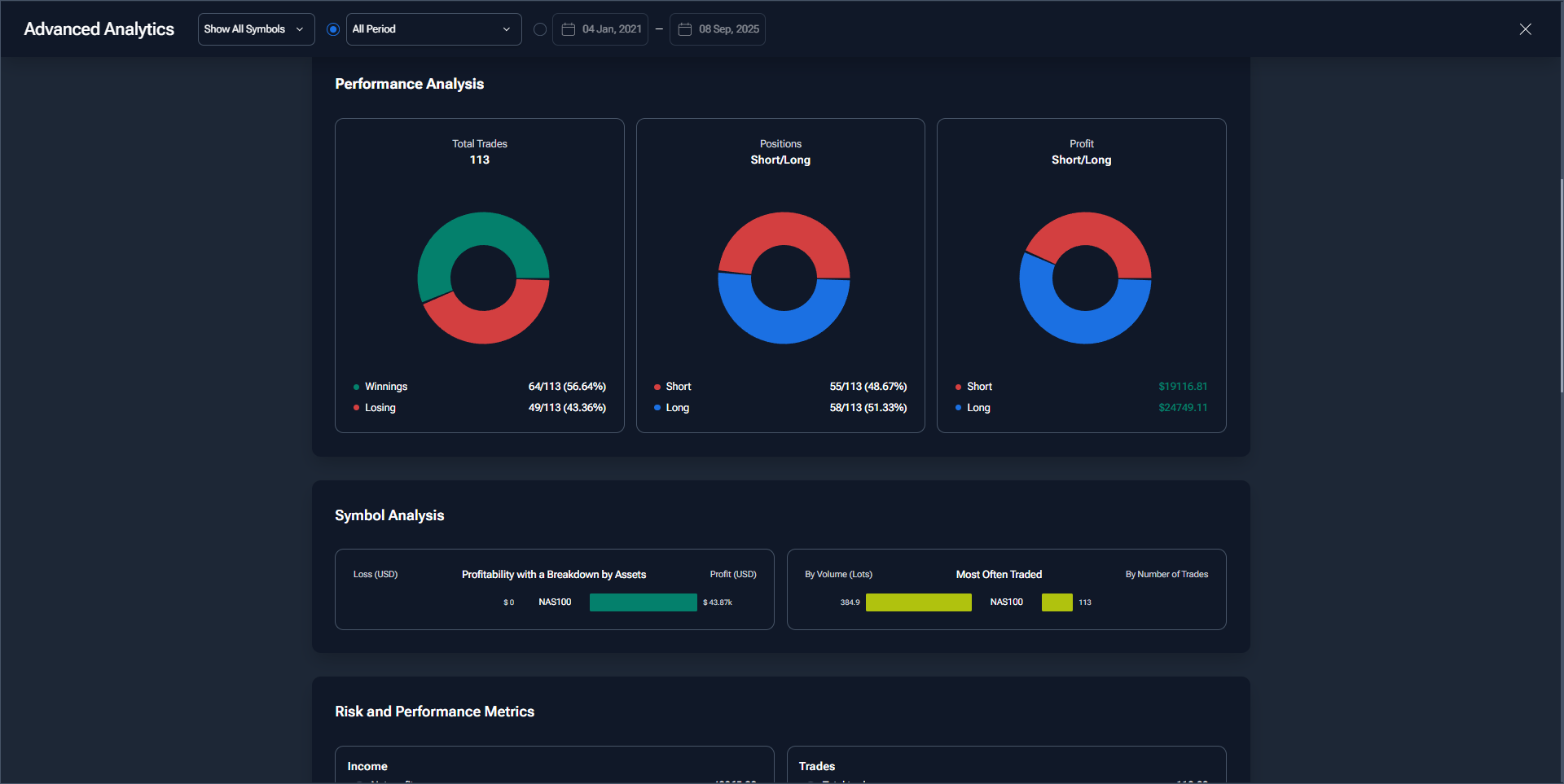

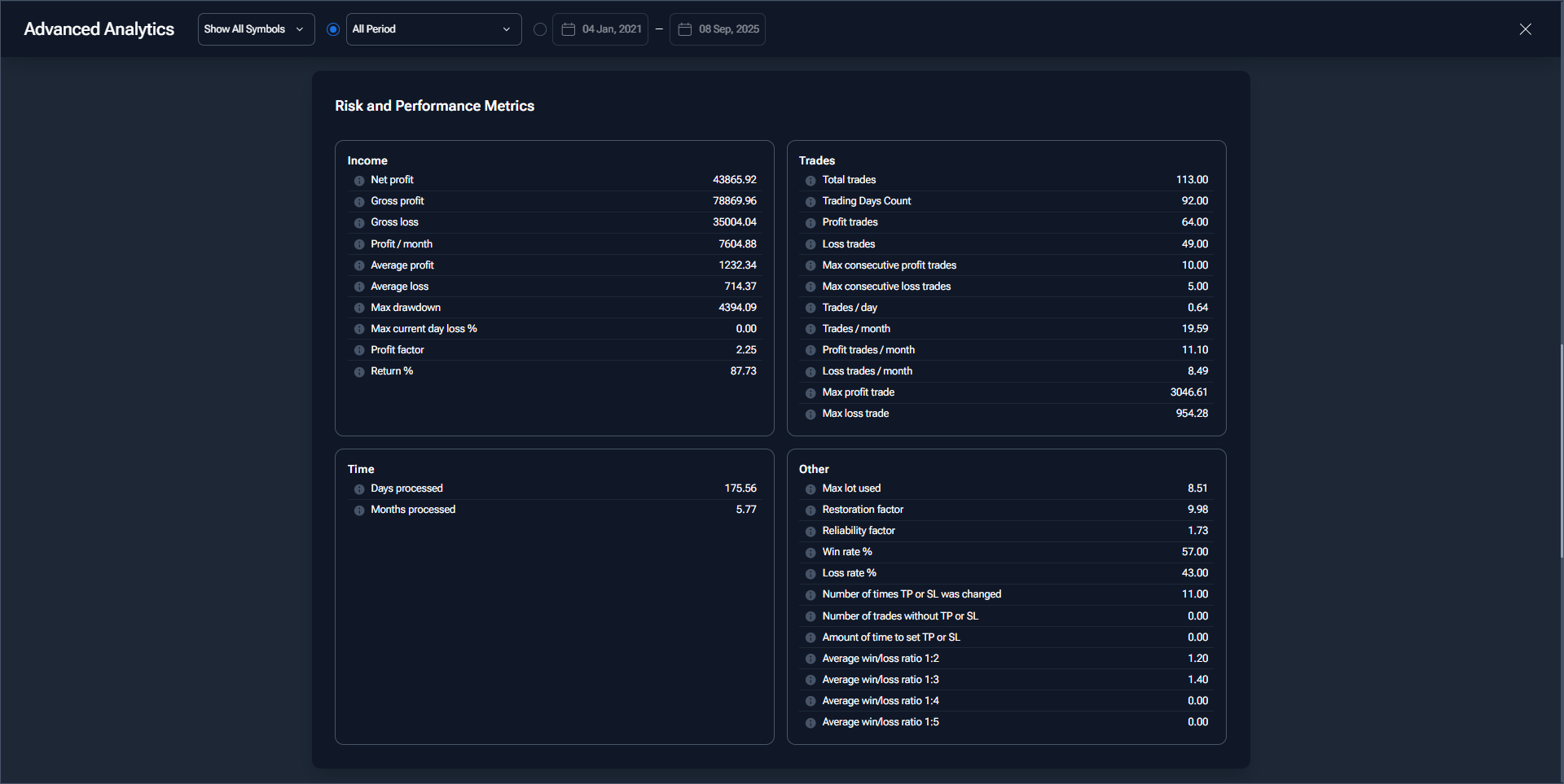

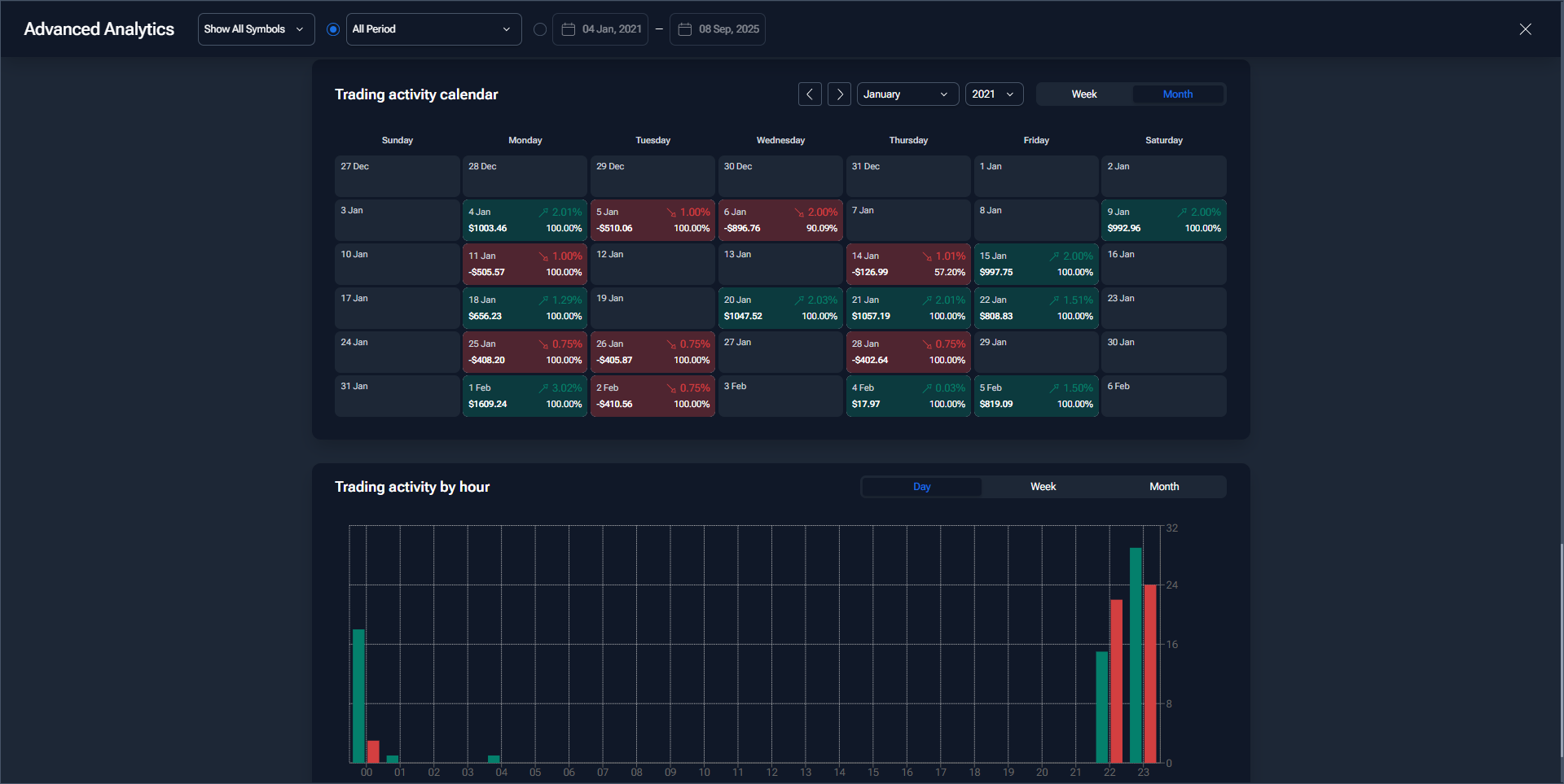

Advanced Analytics in Forex Tester Online

Forex Tester Online’s Advanced Analytics suite transforms backtesting into a complete performance laboratory - helping traders quantify, refine, and validate their strategy edge with precision.

The Trading Activity Calendar highlights profitable and losing days, allowing traders to identify their strongest sessions and optimal trading hours. This visual heatmap reveals hidden behavioral patterns - from weekdays that yield the best results to specific hours of consistent execution.

The Performance Dashboard compiles key trading metrics such as profit factor, drawdown, win rate, and average R-multiple, offering a clear snapshot of system stability over time. Traders can instantly assess whether their strategy remains robust across different market conditions.

Through Symbol and Position Analysis, users can pinpoint which assets contribute most to profitability and whether long or short positions dominate performance. This helps balance exposure and refine market focus.

Finally, the Behavioral Insights Panel bridges psychology with data - highlighting tendencies like overtrading, risk concentration, or inconsistency after winning streaks. It provides strengths and improvement points backed by historical outcomes, making backtesting both quantitative and behavioral.

Together, these analytics make Forex Tester Online not just a backtesting tool, but a strategic development environment - where traders evolve from testing setups to mastering data-driven consistency.

I can simulate years of trading data in hours, adjust risk settings, and track how each change affects my equity curve. It’s not just practice - it’s precision training for traders.

If you want to explore it, check out Forex Tester Online - it’s been one of the most practical ways for me to strengthen my setups before risking real capital.

Why Backtesting Matters

Backtesting gives me something emotional control never could - trust in the math.

When I take a trade now, I’m not trading hope; I’m trading a system I’ve already proven to myself hundreds of times in simulation.

It’s how I know when to hold, when to cut, and when to walk away - because I’ve already seen it play out before.

That’s how consistency is built: one tested idea at a time.

Real-Life Analogy: The Pilot’s Flight Log

A professional pilot never relies on memory. Every flight, condition, and error is logged. That’s how they survive turbulence and keep improving. Your trading journal is the same. Over time it becomes your personal radar-highlighting when you overtrade, which setups carry you, and where your discipline slips. It’s not about perfection. It’s about auditability: you can see what to fix next.

Final Thoughts

You’ve reached the end of the Swing Trading Series-but this is where real trading begins. You now understand rhythm, structure, psychology, risk, and institutional confluence. The next step isn’t to collect more strategies; it’s to apply the right one the same way, over and over. Markets reward clarity, not intensity. Keep your plan tight, your process repeatable, your patience unshakable-and let time do the compounding.

FAQs

How many trades should I take each month?

Aim for 6–12 quality trades. Selectivity beats frequency in swing trading.

Should I focus on one market or several?

Start with one until structure reading is second nature. Then add a non-correlated market to balance exposure (e.g., one index + one FX pair).

What win rate do I need?

Even 45–50% can produce strong results if your average reward is ~2R. The key is protecting downside and letting winners breathe.

When am I ready for a funded account?

When your rules don’t change under stress, your drawdowns are controlled, and your last 6–8 weeks show positive expectancy.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R - 3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC) - A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading - Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

- Why Patience in Trading Fuels the Compounding Growth

- Step-by-Step Guide on How to Manage Losses for Compounding Growth

- The Daily Habits of Profitable Traders: Building Your Compounding Routine

- Trading Edge: Definition, Misconceptions & Casino Analogy

- Finding Your Edge: From Chaos to Clarity

- Proving Your Edge: Backtesting Without Bias

- Forward Testing in Trading: How to Prove Your Edge Live

- Measuring Your Edge: Metrics That Matter

- Refining Your Edge: Iteration Without Overfitting

- The EDGE Framework: Knowing When and How to Evolve as a Trader

- Scaling Your Edge: From Small Account to Consistency

Market Drivers

- Central Banks and Interest Rates: How They Move Your Trades

- Inflation & Economic Data: CPI Trading Strategy and PPI Indicator Guide

- Geopolitical Risks & Safe Havens in Trading (Gold, USD, JPY, CHF)

- Jobs, Growth & Recession Fears: NFP, GDP & Unemployment in Trading

- Commodities & Global Trade: Oil, Gold, and Forex Explained

- Market Correlations & Intermarket Analysis for Traders

Swing Trading 101

- Introduction to Swing Trading

- The Market Basics for Swing Trading

- Core Principles of Swing Trading

- The Technical Foundations Every Swing Trader Must Master

- Swing Trader’s Toolkit: Multi-Timeframe & Institutional Confluence

- The Psychology of Risk Management in Swing Trading

- Swing Trading Concepts To Know In Trading with Smart Money Concepts

Risk Management

The real edge in trading isn’t strategy - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2026

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

- Martingale Strategy in Trading: Compounding Power or Double-Edged Sword?

- How to Add to Winners Using Cost Averaging and Martingale Principle with Price Confirmation

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next