ACY Securities Forex Spreads for EURUSD, GBPUSD and AUDUSD – 3rd June to 7th June 2024

2024-06-11 13:16:25

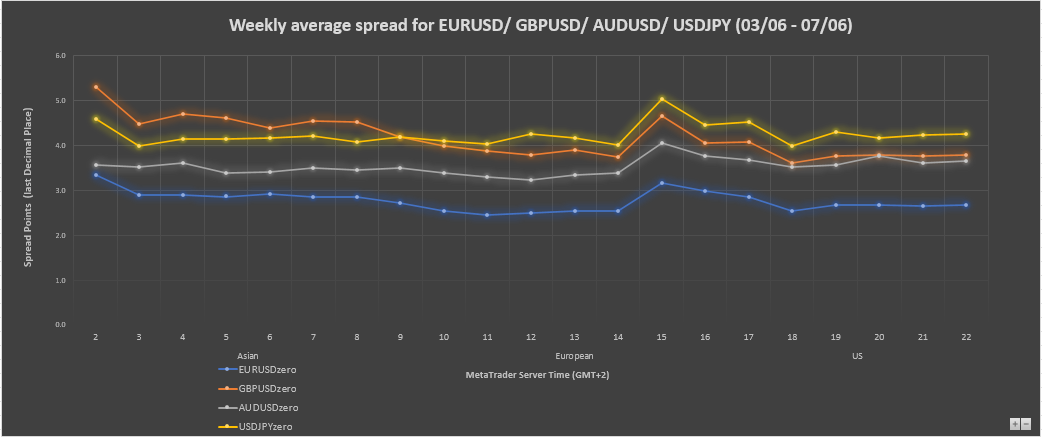

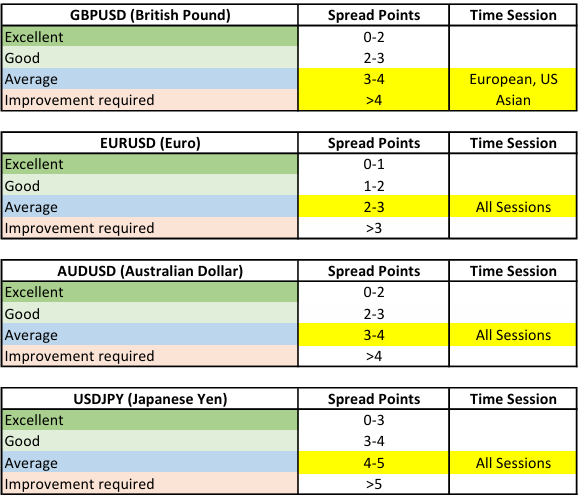

- Major currency pairs maintained consistent performance, with spreads ranging from 'Good' to 'Average' levels across all sessions. Specifically, AUDUSD, EURUSD, and USDJPY displayed average spreads ranging between 2-5 points throughout trading sessions.

- GBPUSD spreads showed initial weakness during the Asian Session but tightened to an average level during the EU/US Sessions, indicating improved market conditions over time.

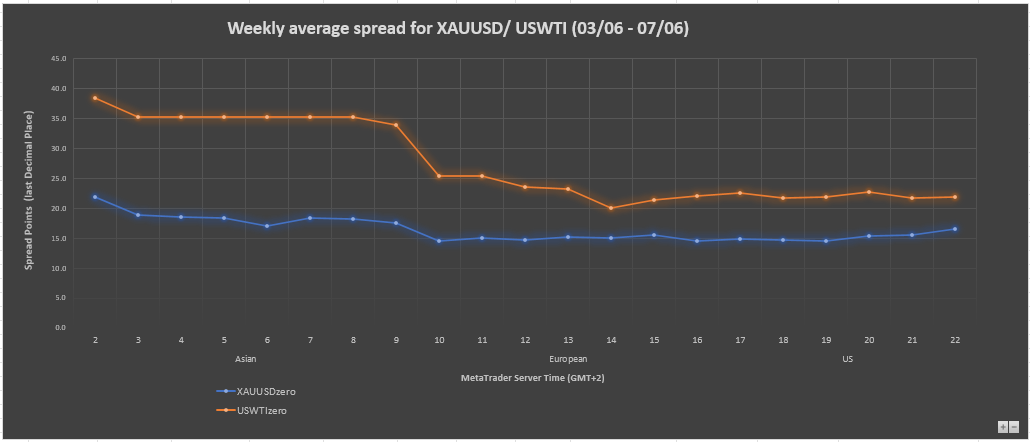

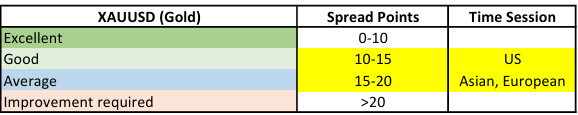

- Gold (XAUUSD) spreads started at an average level during Asian/EU sessions and improved to 'Good' during the US session, while USWTI oil spreads progressed from good to excellent levels across sessions. DJ30 spreads remained average due to subdued market activity, whereas GER30 spreads tightened significantly during EU/US sessions, reaching a 'Good' level after starting at average during the Asian session.

Major Currency Pairs - EURUSD, AUDUSD, GBPUSD and USDJPY

(Note: The above chart excludes the spread data of the first two hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Majors Currency Pairs

The Major currency spreads were generally performing at a 'Good' to 'Average' levels across four trading currency pairs during all sessions.

Specifically, AUDUSD spreads had been constantly ranging between 3-4 points, which was on an 'Average' level across all trading sessions. EURUSD spreads had been constantly ranging between 2-3 points, which was on 'Average' level across all trading sessions. USDJPY spreads had been constantly ranging between 4-5 points, which was on 'Average' level across all trading sessions. As well as GBPUSD spreads were at an 'Improvement required' level during Asian Session then tightened aggressively to an 'Average' level across several market events during the EU/ US Sessions.

Gold and US WTI Oil

(Note: The above chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

For the spread of XAUUSD, from the chart above it illustrates that the spreads were at an 'Average' level during the Asian/EU sessions then improved to a 'Good' level during the US session .

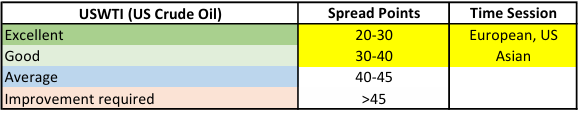

As for USWTI, its spread began at a 'Good' level during the Asian session and then progressed to an 'Excellent' level during the EU and US sessions.

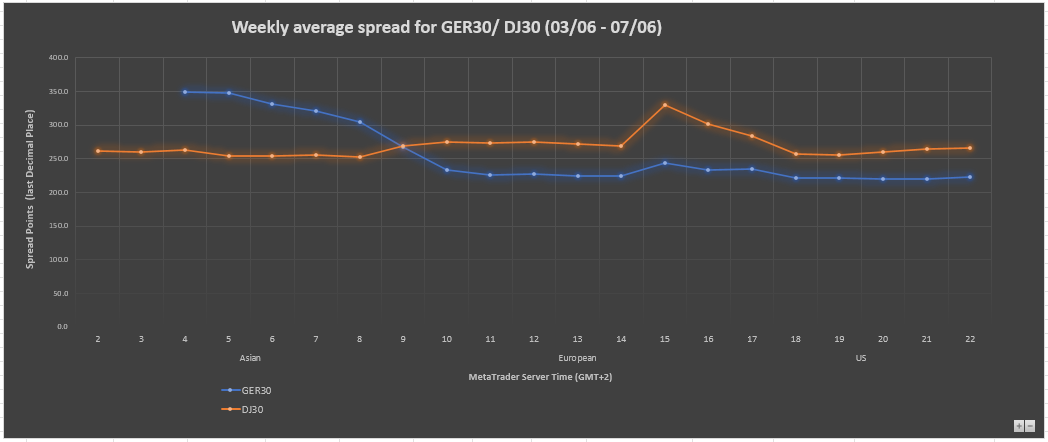

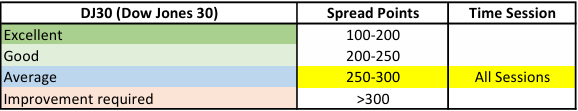

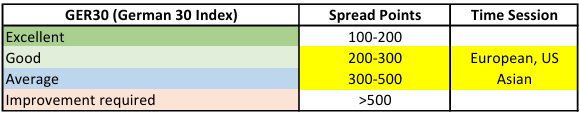

Dow Jones 30 and German 30 Indices

(Note: The above chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

The DJ30 spread experienced an 'Average' level spread during All sessions due to reduced trading activity and a subdued market condition.

In contrast, the GER30 initially experienced an 'Average' level spread during the Asian session due to reduced trading activity and a subdued market condition. However, it subsequently underwent significant tightening, reaching a 'Good' level (200-300) during the EU and US sessions.

Boost Your Bottom Line: Discover How Our Low Spreads Keep More Money in Your Pocket

It's no secret that trading costs can eat into your profits, limiting your financial gains. The higher these costs climb, the more money slips away from your pocket, leaving you with lower overall returns.

This is why our team is committed to providing you with transparency on our spreads across our most actively traded instruments.

Here are the top 5 benefits of trading with razor tight spreads:

- Scalping and high-frequency trading: If you are engaged in scalping or high-frequency trading strategies, low spreads are essential. This is the number one reason why active Gold and EURUSD traders using Expert Advisors switch to ACY Securities.

- Cost savings: Low spreads directly translate into cost savings for you. By keeping the spread tight, you can reduce your expenses on each trade, enabling you to retain more money in your trading account.

- Improved Trade Entry and Exit: Low spreads facilitate more efficient trade execution, enabling clients to enter and exit positions with greater precision. This results in reduced slippage and a higher likelihood of capturing desired price levels, enhancing overall trading performance.

- Increased Trading Opportunities: Tight spreads enable you to explore a wider range of trading strategies and take advantage of shorter-term price movements. The availability of low spreads across various trading instruments expands the scope for more trading opportunities.

- Competitive Edge: Trading with low spreads provides you with a competitive edge in the market. It allows for more favourable pricing compared to trading with a broker with higher spreads. Every pip counts.

Maximize your trading potential with ACY Securities' low spreads and optimize your trades by knowing the best times to trade forex. Discover the optimal trading hours for enhanced performance here.

Supercharge your trades with ACY Securities' low spreads.

Open a live account now.

ลองสิ่งเหล่านี้ถัดไป

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know