Trailing-Take-Profit: manage your risk with Capitalise.ai & ACY Securities

2023-02-15 14:33:52

Trailing-Take-Profit allows you to set your Trailing-Stop to trigger only after a certain profit was reached. Learn how you can lock your profits while guarding your trading position:

Perhaps a more difficult question than “when to buy”, is “when to sell”, right? How many times have you checked your favorite stock on the portfolio, just to discover a price drop eliminating most or all the gained profit? This is a real issue for day-traders; how long should we keep the cookie in the milk, before it is dropped and lost at the bottom of the cup.

Continuing with this analogy, setting a Stop-Loss/Trailing-Stop-Loss will leave you with some part of the cookie, but not most of it. And we are day traders, wanting to have as much of the cookie ($$$) as possible. So why settle? There is a sweet spot where the uptrend is just about to end, potentially flipping into a mighty downtrend. Selling at this point is sweeter than any cookie. Instead of sitting worried in front of reddening candles, just Capitalise it with a Trailing-Take-Profit as part of your exit condition!

What is Trailing-Take-Profit (TTP)

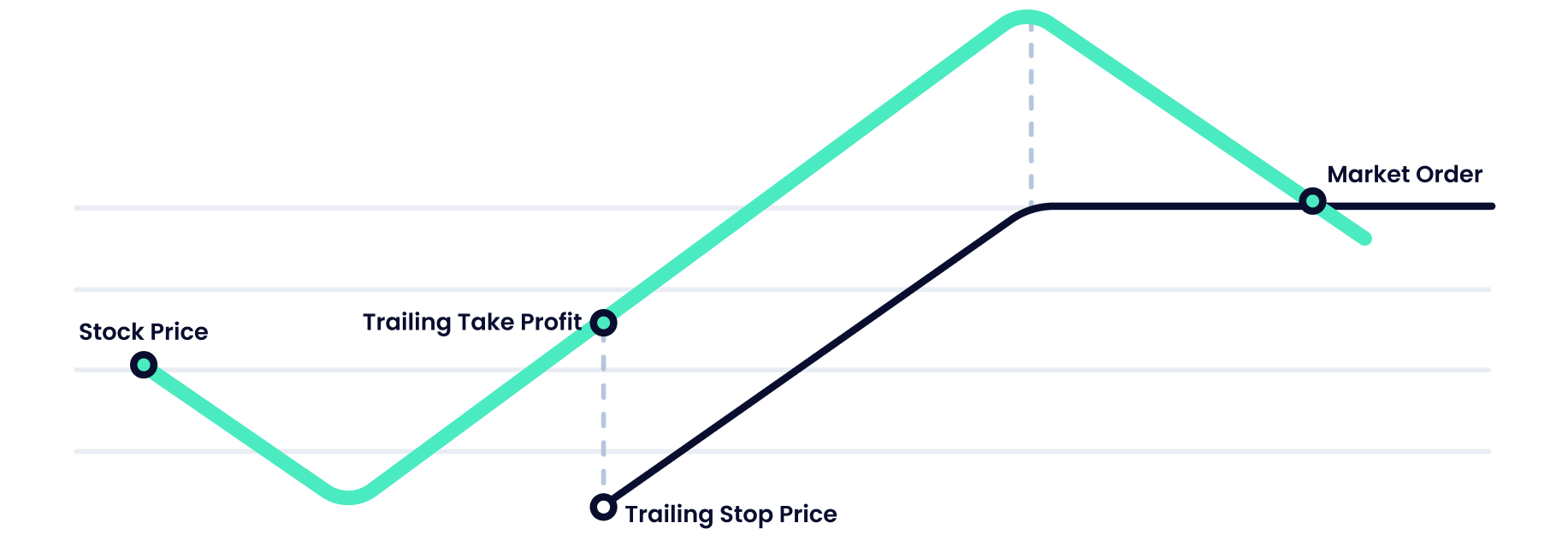

In one sentence – Trailing-Take-Profit allows you to set your Trailing-Stop-Loss to trigger only after a certain profit. Meaning, it follows the uptrend and sets to close the position above a specific profit and below a defined loss. In other words, by setting a TTP, one can make sure that the profits made during the rising of the asset are secured, before the price goes down, deleting the profits.

The advantage of TTP on TSL is that Trailing-Stop-Loss may close the position following a downtrend that occurs immediately after the entry, missing potential profits. Trailing-Take-Profit, on the other hand, will not close the position until the target profit was reached. Only once the specified profit was reached, the trailing-stop will get into action and close the position when a specified loss occurs.

How to set a Trailing Take Profit with Capitalise.ai

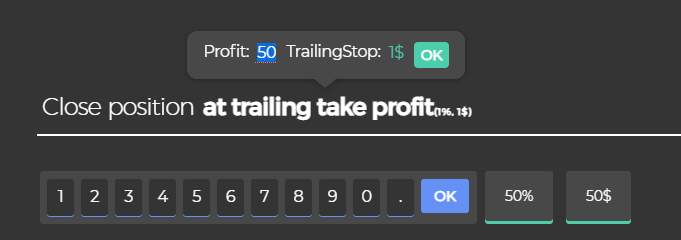

TTP requires to define 2 values:

- Profit

The nominal ($) or percentile (%) profit at which the Trailing-Stop will become active. - Trailing Stop

The nominal ($) or percentile (%) loss you are willing to incur after the defined Profit is reached. The position will be closed when the unrealized P&L drops below this value.

Skip the big red candles

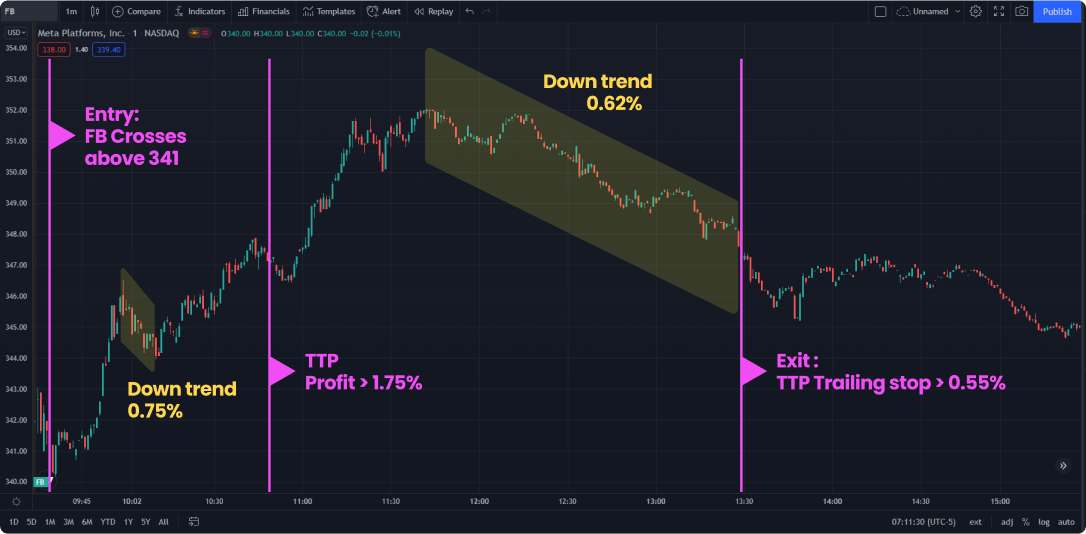

The below example will emphasize the power of TTP. The stock is FB. We set the entry when the price reaches 341, and close the position at trailing take profit (profit: 1.75%, TrailingStop: 0.55%).

As can be seen in the screenshot, the strategy kept the position open after the first rising candles, since the condition of profit>1.75 hasn’t been met. From a TTP Profit > 1.75%, the strategy will look for a trailing stop loss that is greater than (>) 0.55%.

Once that happens (the third yellow line), the position will be closed.

Now, there are 3 nice things here:

- ~2.5% of profits were captured in less than 3 hours.

- These profits were beyond the expectation (1.75%), and unwanted positions closing were spared, for if only the trailing stop loss was in use.

- More importantly, the profits were claimed before the downtrend that came afterward, and in spite of the red candles that popped up between the elevations. If only TSL was in use the strategy would have triggered an exit after the first downtrend (-0.75), leaving us with a profit of 0.9% and missing the uptrend that came after it, and an additional 1.8% of profits accumulated.

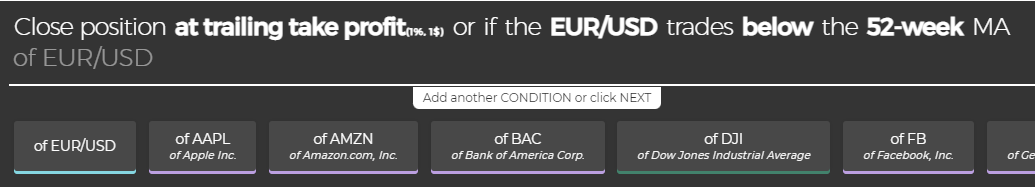

Combine TTP with additional exit conditions

The downside of TTP, when compared to TSL, is that TTP has more exposure (to the occurrences in the market) since it has an additional condition for when to stop. For example, if the downtrend starts just at the entry, TTP may take the position further down since no profits have been made. The best practice for setting a TTP is to use it in combination with other exit conditions. You can add a variety of tech indicators, time-based conditions, or news events to define your optimal exit strategy.

For example:

Plan like a human. Trade like a machine_

Automate your trailing-take-profit with Capitalise.ai & ACY Securities

With Capitalise.ai you can test and automate any trading scenario, using a simple & intuitive interface – no coding or technical knowledge required.

Simply type in your trading strategy in everyday English and Capitalise.ai will monitor the markets 24/7 for you. Once your conditions are met – your trading orders will be sent automatically to your ACY MT4 account.

Get started >>

100% free for ACY traders!

Sign-up to Capitalise.ai >>

Don’t have an ACY-Securities account?

Try These Next