USD Extends Rally as Inflation Keeps Sticky

2025-07-16 09:41:18

Over the last 24 hours, U.S. inflation once again made headlines and this time, it added real fuel to an already relentless dollar rally.

We’ve now marked the 10th consecutive day of upward pressure on the USD, and last night’s CPI release was the latest catalyst.

The initial market reaction was subtle a minor drop on the DXY in the first hour after the data release (10:30pm Sydney time), followed by a sharp reversal.

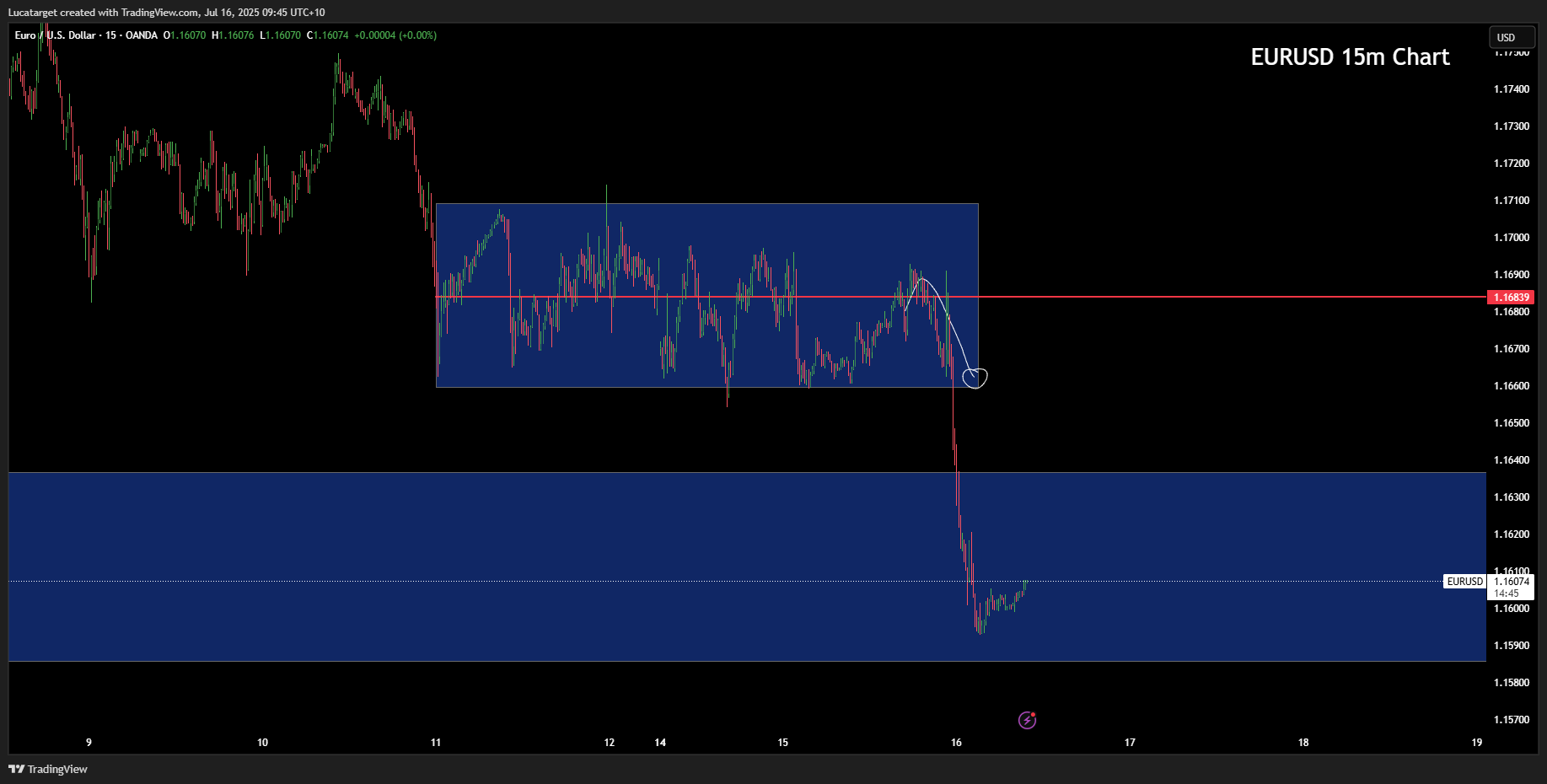

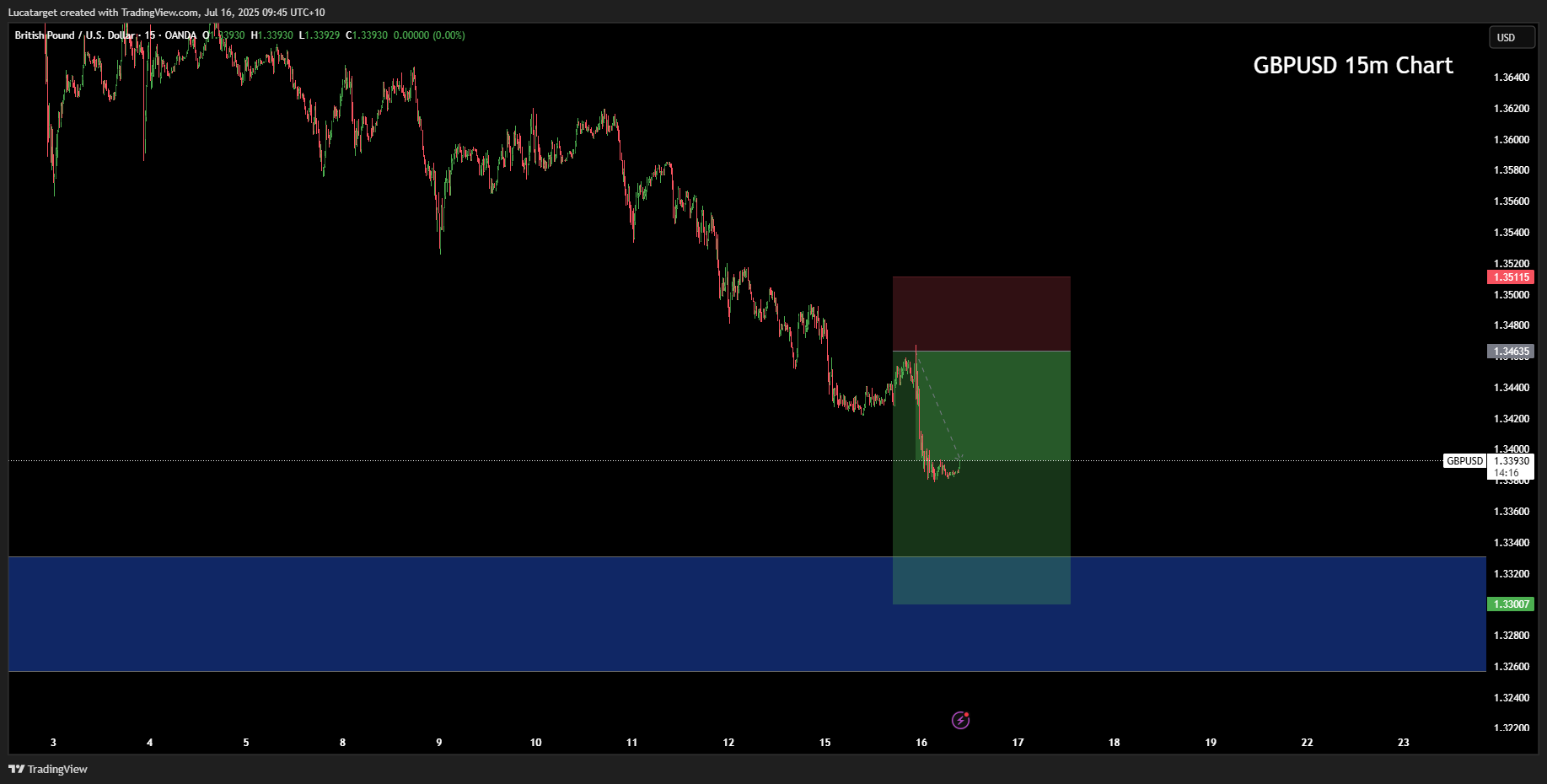

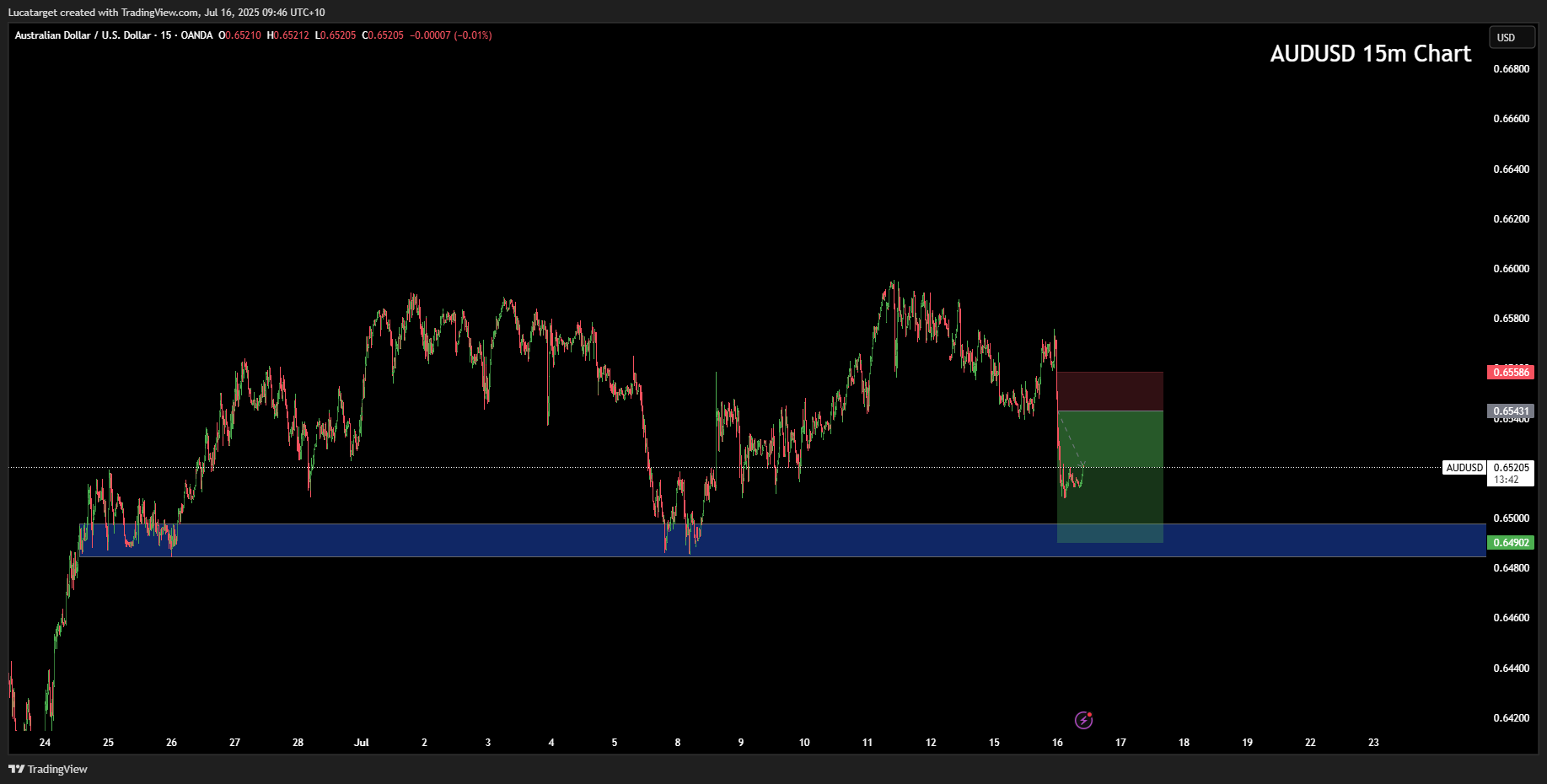

But once the dust settled, the dollar surged over 0.5% in just four hours, dragging EUR/USD, GBP/USD, and AUD/USD straight to the support targets I flagged in recent webinars.

So, what happened under the hood?

U.S. Inflation: A Subtle Shift with Big Implications

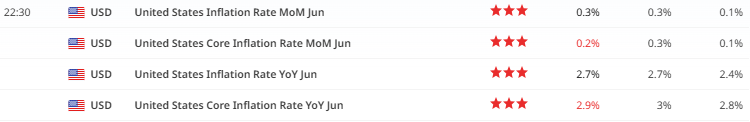

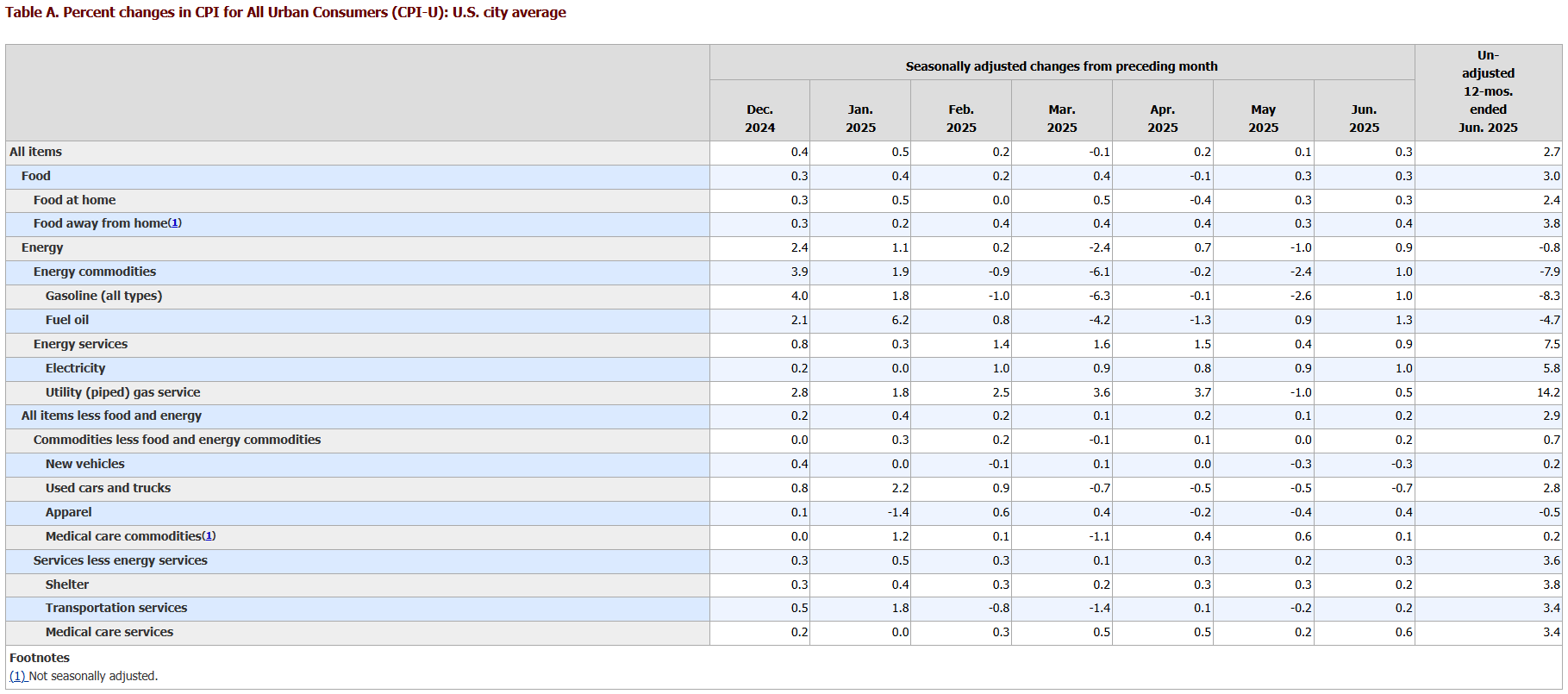

According to the Bureau of Labor Statistics, headline CPI for June came in at 2.7% YoY, ticking up from 2.4% in May.

Core inflation rose as well, hitting 2.9% YoY vs. 2.8% previously precisely in line with consensus.

But the real story was beneath the surface: categories like apparel, household furnishings, and toys previously disinflationary saw firm upward pressure, likely driven by the latest round of tariffs.

While used car prices dropped, helping to contain the overall figure, the underlying momentum shifted.

And markets noticed.

Even with the data coming in mostly as expected, the composition screamed "sticky inflation."

For the Fed, that’s enough to rule out near-term cuts, and for FX traders, it's a green light to keep buying dollars particularly with positioning still net short from earlier in the year.

Dollar Strength: Not Just a CPI Story

This USD rally isn’t just about inflation. The macro backdrop is aligning in a way that makes the dollar look like the cleanest shirt in a dirty laundry basket.

U.S. growth data is still resilient relative to peers. Last week's jobless claims, ISM services, and even Atlanta Fed’s GDPNow all reinforce that the U.S. economy is decelerating, not contracting.

Eurozone data, by contrast, continues to underwhelm especially in Germany. Soft PMIs, weak industrial output, and a fragile consumer all leave the EUR vulnerable. The ECB might talk hawkish, but forward markets are fading that.

Meanwhile, the UK is facing a different beast: inflation is falling but the growth impulse is fizzling fast. GBP/USD looks heavy not just on rates, but on capital flows and political risk.

And in Australia, the RBA faces stagflationary conditions inflation remains elevated, but growth is clearly slowing. AUD/USD broke the 0.6540 level last night with conviction.

This is a market where macro matters again.

CPI isn’t just noise it’s driving real allocation. The USD rally isn't overbought; it's being driven by a fundamental divergence in policy paths and macro performance.

I remain tactically long the dollar vs G10 currencies (EUR, GBP, AUD, NZD, JPY) and prefer to fade any risk-on rallies that don't come with a shift in real rate differentials.

With positioning still cautious, any correction should be viewed as an opportunity to reload, not exit.

Stay nimble, but don’t fight the dollar just yet.

Q: Why did the USD rally so aggressively after the CPI release?

A: Although the headline and core inflation numbers were broadly in line with expectations, the underlying details revealed sticky inflation pressures especially in tariff-affected sectors. That, combined with resilient U.S. growth, reinforced the idea that the Fed won't be cutting rates anytime soon, reigniting dollar strength.

Q: Why did EUR/USD, GBP/USD, and AUD/USD all sell off in sync?

A: These pairs are all facing their own domestic macro challenges, but the common thread was the surge in USD. With the Fed still hawkish relative to the ECB, BoE, and RBA, traders rotated out of these currencies and into the dollar, accelerating moves that were already in motion.

Q: Is this move in the dollar overdone?

A: Not yet. Positioning isn't overcrowded, and the macro divergence still supports further upside. While short-term charts may look extended, structurally there’s still room for continuation especially if the next batch of U.S. data stays firm.

Q: What’s the next big catalyst for FX markets?

A: The next inflation prints and labor market data out of the U.S. will be closely watched. For now, any data that reinforces economic resilience or sticky inflation will continue to support the USD narrative.

Q: How should forex traders position after the CPI?

A: Look for pullbacks in USD pairs to re-enter longs on USD/XXX and shorts on XXX/USD. The path of least resistance remains higher for the greenback, especially against currencies tied to softer central banks or weaker growth stories.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

ลองสิ่งเหล่านี้ถัดไป

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know