The USA Can’t be Resilient forever, how does the USD have left on the bullish trend?

2024-12-23 11:04:23

As 2024 comes to an end, traders, policymakers, are closely examining key currency trends and their ripple effects across the financial ecosystems. From the enduring strength of the U.S. dollar to the struggles of the British pound and the uncertainty surrounding the Japanese yen, the FX market offers a fascinating glimpse into the state of the global economy..

The Dollar’s Dominance A Testament to Economic Resilience

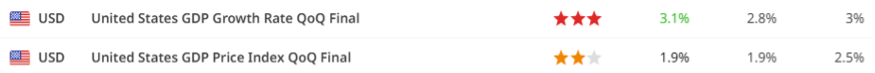

The U.S. dollar remains a formidable force in the FX market, buoyed by an economy that has consistently defied expectations. Revised GDP figures for the third quarter showcased robust growth, driven by resilient consumer spending and sustained business investments. This strength has been underpinned by the Federal Reserve’s steadfast approach to monetary policy, with Chair Jerome Powell reiterating the central bank’s commitment to taming inflation.

USA GDP

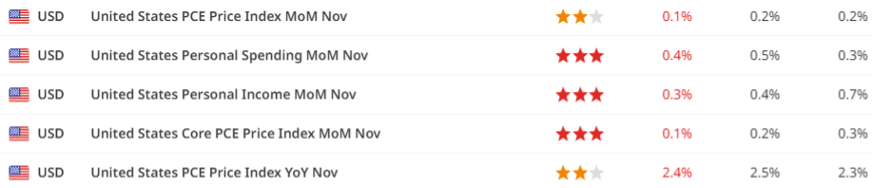

The Fed’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) deflator, has shown modest but persistent increases, reinforcing the need for vigilance. Coupled with a historically tight labor market and solid wage growth, these factors have enhanced the greenback’s appeal to investors seeking stability. The dollar has particularly outperformed against commodity-linked currencies like the Australian and Canadian dollars, as well as lower-yielding counterparts such as the euro.

USA PCE

However, questions remain about how long the dollar can sustain its dominance. The potential for a policy pivot by the Fed in 2025, alongside a global shift in risk sentiment, could test the greenback’s resilience in the months ahead.

DXY H4

The British Pound: Caught in the Crosswinds of Economic Uncertainty

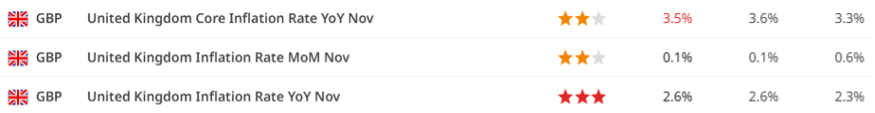

The British pound faces significant headwinds as the UK economy grapples with a fragile recovery. Persistent inflationary pressures have weighed heavily on households, with retail sales and consumer confidence indicators painting a bleak picture. High borrowing costs, a byproduct of the Bank of England’s earlier rate hikes, have further constrained economic activity.

UK CPI

Amid this backdrop, policymakers are increasingly divided. While some advocate maintaining higher interest rates to combat inflation, others argue for easing monetary policy to stimulate growth. The latter camp has gained traction as wage growth moderates and energy prices stabilize, reducing inflationary pressures. This policy indecision has amplified the pound’s vulnerability, leaving it susceptible to sharp fluctuations driven by data releases and geopolitical developments.

Brexit-related uncertainties continue to add to the pound’s woes, particularly as trade negotiations with the European Union remain fraught with challenges. With the UK economy teetering on the edge of stagnation, the pound’s outlook for 2025 appears precarious at best.

GBPUSD Daily Chart

The Japanese Yen: Balancing Act Between Policy and Market Forces

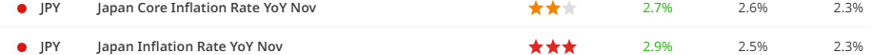

In Asia, the Japanese yen has been a focal point of volatility, driven by a unique set of domestic and international factors. Inflation in Japan has exceeded the Bank of Japan’s (BOJ) target for several months, yet the central bank has resisted aggressive rate hikes, prioritizing long-term wage growth and economic stability over short-term inflation control.

Japan CPI

This dovish stance has left the yen vulnerable to depreciation, particularly against the dollar. The situation has been exacerbated by speculative activity in the FX market, prompting Japanese authorities to issue warnings and consider direct interventions. Such measures are likely to come into play during the low-liquidity conditions of the holiday season, where market distortions are more pronounced.

USDJPY Daily Chart

Despite these challenges, I see potential for the yen to recover in 2025, particularly if global growth slows and demand for safe-haven assets increases. However, much will depend on the BOJ’s ability to strike a delicate balance between supporting the domestic economy and stabilizing the yen.

What’s next for 2025?

As we head into 2025, several themes are expected to dominate the narrative. Central banks around the world are recalibrating their strategies in response to shifting inflationary pressures, uneven growth trajectories, and evolving geopolitical dynamics. These adjustments will likely fuel heightened volatility, creating both opportunities and risks for market participants.

The interplay of economic data, fiscal policies, and external shocks—such as energy price fluctuations or geopolitical tensions—will be critical in shaping currency trends. Investors will need to adopt a nuanced approach, balancing short-term tactical plays with a focus on long-term structural shifts.

Moreover, emerging market currencies are poised to take centre stage as global capital flows react to changing interest rate differentials and risk appetites. Countries with sound fiscal positions and proactive monetary policies could attract inflows, while those grappling with high debt burdens or political instability may face currency depreciation.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know