Overview of BOJ and USD/JPY Dynamics as ECB Is Set to Cut the Rates One More Time

2025-01-24 09:36:56

The Bank of Japan (BOJ) has been navigating a delicate balance as it continues its gradual tightening cycle. Market expectations for a 25bps hike at the upcoming BOJ meeting reflect confidence in Japan's economic resilience, underpinned by improving wage growth and steady inflation figures. However, for the yen to gain significant traction, the BOJ would need to signal further hawkish moves, which seems unlikely in the short term.

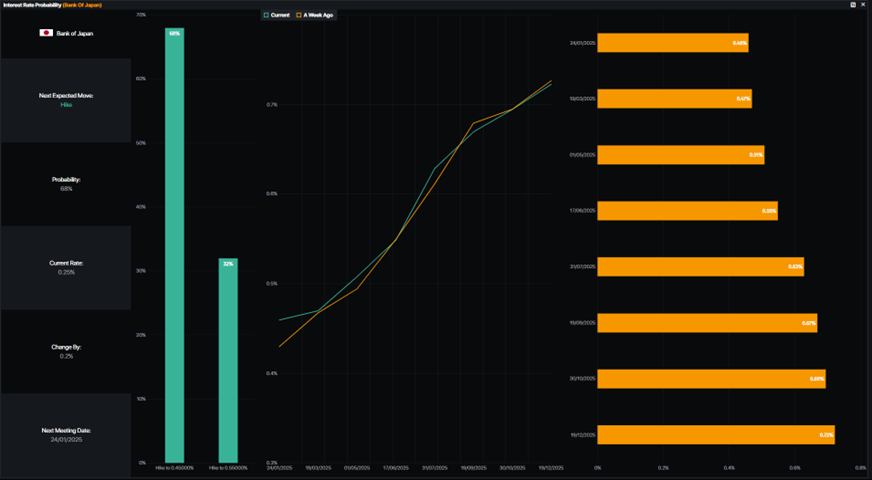

Hike Probability from BoJ

Despite recent yen weakness, the USD/JPY remains a focal point for traders due to the interplay between Japan's monetary policy and broader USD trends. The US dollar has shown resilience against the yen, even as it weakens against other G10 currencies. This divergence is driven by heightened US tariff risks under the new administration and the market's preference for safer assets amid global uncertainties.

USDJPY Chart

ECB's Position and EUR/USD Outlook

The European Central Bank (ECB) continues to prioritize rate cuts to stimulate a sluggish eurozone economy. Comments from key officials suggest that further easing is on the horizon, with market expectations aligning around a 2.0% policy rate by mid-year. However, this dovish stance contrasts with the US Federal Reserve's cautious approach, which has limited room for further cuts.

The divergence in monetary policy between the ECB and the Fed has kept downward pressure on EUR/USD. While the pair has flirted with parity, better-than-expected US economic data and persistent eurozone economic challenges suggest that sustained recovery for the euro remains a longer-term prospect.

Key Implications

- BOJ's Gradualism: The yen's performance hinges on the BOJ's ability to manage market expectations. While another rate hike is likely, any reluctance to accelerate tightening could weigh on the yen.

- USD Sensitivity to Trade Policies: The USD's strength remains tied to geopolitical risks, particularly the potential for escalated tariffs, which could bolster its safe-haven appeal.

- ECB's Easing Path: Persistent euro weakness reflects the eurozone's economic struggles. A reversal in the EUR/USD downtrend would require a significant shift in US growth dynamics or a more aggressive ECB stance.

Trade Idea: USD/JPY

Rationale: Given the BOJ's cautious stance and the USD's resilience against the yen, USD/JPY is likely to maintain its upward trajectory in the short term, especially if the BOJ refrains from signaling additional rate hikes.

- Entry: Buy USD/JPY at 155.50.

- Target: 157.50, reflecting continued dollar strength and limited yen upside.

- Stop Loss: 154.50, to mitigate risks from unexpected BOJ hawkishness or adverse USD movements.

Alternative Scenario: If the BOJ surprises with a hawkish tone, consider shorting USD/JPY below 154.00, targeting 152.00, as this would signal renewed confidence in the yen.

By focusing on these evolving monetary policies and their implications, traders can better navigate the complexities of the forex market and capitalize on shifting trends in key currency pairs.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

ลองสิ่งเหล่านี้ถัดไป

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know