Market Momentum Explained: Displacement, Manipulation & Imbalances in SMC

2025-04-15 11:25:35

Part 3: Market Momentum Explained: Displacement, Manipulation & Imbalances in SMC

Goal of This Lesson:

To teach you how to recognize true displacement and imbalance—the footprints left behind when smart money aggressively enters the market. This helps you filter false moves and only trust setups backed by real institutional power.

By the End of This Lesson, You Should Be Able To:

- Recognize real vs fake displacement

- Identify imbalance as the engine behind FVGs

- Only trust setups where price shows commitment, not randomness

- Use displacement as your confirmation filter for entries

What Is Displacement?

Displacement is a sudden, impulsive move in price away from a certain level caused by heavy, one-sided order flow—typically by institutional traders.

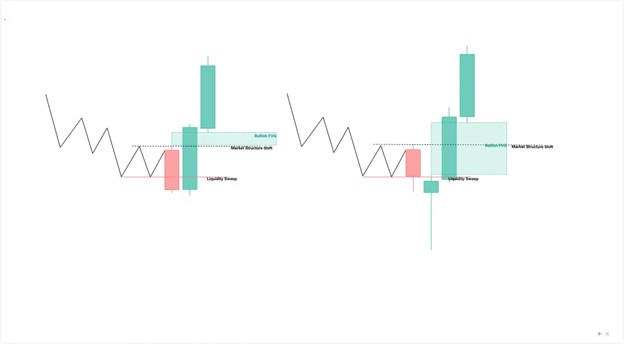

This usually occurs after a liquidity level has been filled or swept and creates an imbalance or fair value gap. If institutions are now in the market, a market structure shift must occur.

Displacement Parameters based on SSS Framework:

- Liquidity Sweep

- Price Surge

- Market Structure Shift

Displacement isn’t just a big candle. Its a combination of candles that shows a willingness to move to a certain direction.

It’s a move that sweeps liquidity, breaks structure, creates imbalance, and shows clear directional intent.

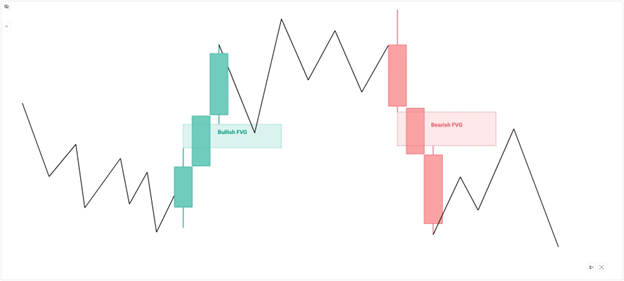

What Is an Imbalance?

Imbalance refers to a zone where price moved so fast in one direction that there was little or no opportunity for opposite orders to be filled.

This creates a Fair Value Gap (FVG)—a visual clue that the market left something behind.

This is usually formed after a displacement has took place. A good displacement should create inefficiencies or gaps that it leaves unfilled orders due to a strong expansive move.

Real-World Analogy:

Imagine a crowd of people sprinting out of a building all at once—some doors swing wide open, some close behind them.

That rush is displacement.

The doors left half-open? That’s the imbalance—where someone might come back to re-enter later.

How to Use Displacement in Your Model

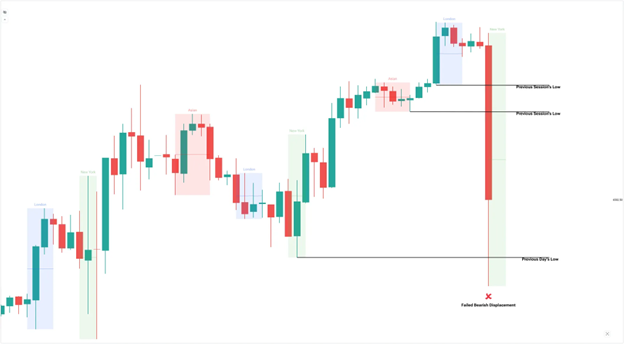

- Determine the higher time-frame direction.

In this case, we are already in a bullish leg after price created a bullish sequence with higher highs and higher lows.

2. Drop down to a lower timeframe to frame the trend direction.

Your higher timeframe trend must be in-sync or aligned with the lower timeframe.

3. Wait for the kill-zone or a key market session; London or New York session.

Mark out the kill-zones. These levels are based on time: Asian, London, New York Session.

4. Watch for sweep of a Key Level.

5. Wait for displacement candle (impulse move that breaks structure).

6. Mark the FVG it creates. Use that FVG for the entry on the retrace.

7. Set SL just beyond the fair value gap, TP at next ERL.

Displacement is what gives your FVG validity. No displacement = no trade.

Example Flow:

- Price sweeps (liquidity grab)

- Displacement candle breaks internal structure

- Clean bearish FVG is formed

- MSS + session timing confirmed

- Enter on retrace → Target next ERL

You didn’t chase a breakout—you waited for sweep, surge, and shift.

Beginner Mistake to Avoid:

Don’t trade every big candle.

If the move didn’t:

- Come after a sweep

- Create a surge

- Made a shift

…it’s probably not a true institutional displacement.

So You’ve Seen Displacement… Now It’s Time to Confirm Market Direction

At this stage, you now understand what displacement and imbalance look like — and more importantly, what they reveal: smart money stepping in with purpose.

But here’s the next big question:

How do you confirm that this wasn’t just a fast move… but the beginning of a real shift in direction?

This is where many traders jump in too early — they see a big candle, maybe even a gap, and assume a trend has begun.

But institutional traders don’t guess. A tell-tell sign that institutions are already in is there must be a market structure shift in the direction where the displacement took place.

That brings us to one of the most critical parts of your SMC foundation:

Market Structure Shift (MSS) and Break of Structure (BOS).

These aren’t just patterns — they are your confirmation tools. MSS tells you a shift is underway. BOS tells you the shift is real. Together, they form the structural map that institutions follow after a liquidity grab.

This is how you’ll know when to act — and more importantly, when not to.

Part 4: How to Confirm Trend Direction with Market Structure Breaks & Shifts (SMC Guide) is up next!

Try These Next