London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

2025-08-12 12:08:58

The Market’s Daily Blueprint

If you could predict where the day’s high or low will form, how much easier would trading be?

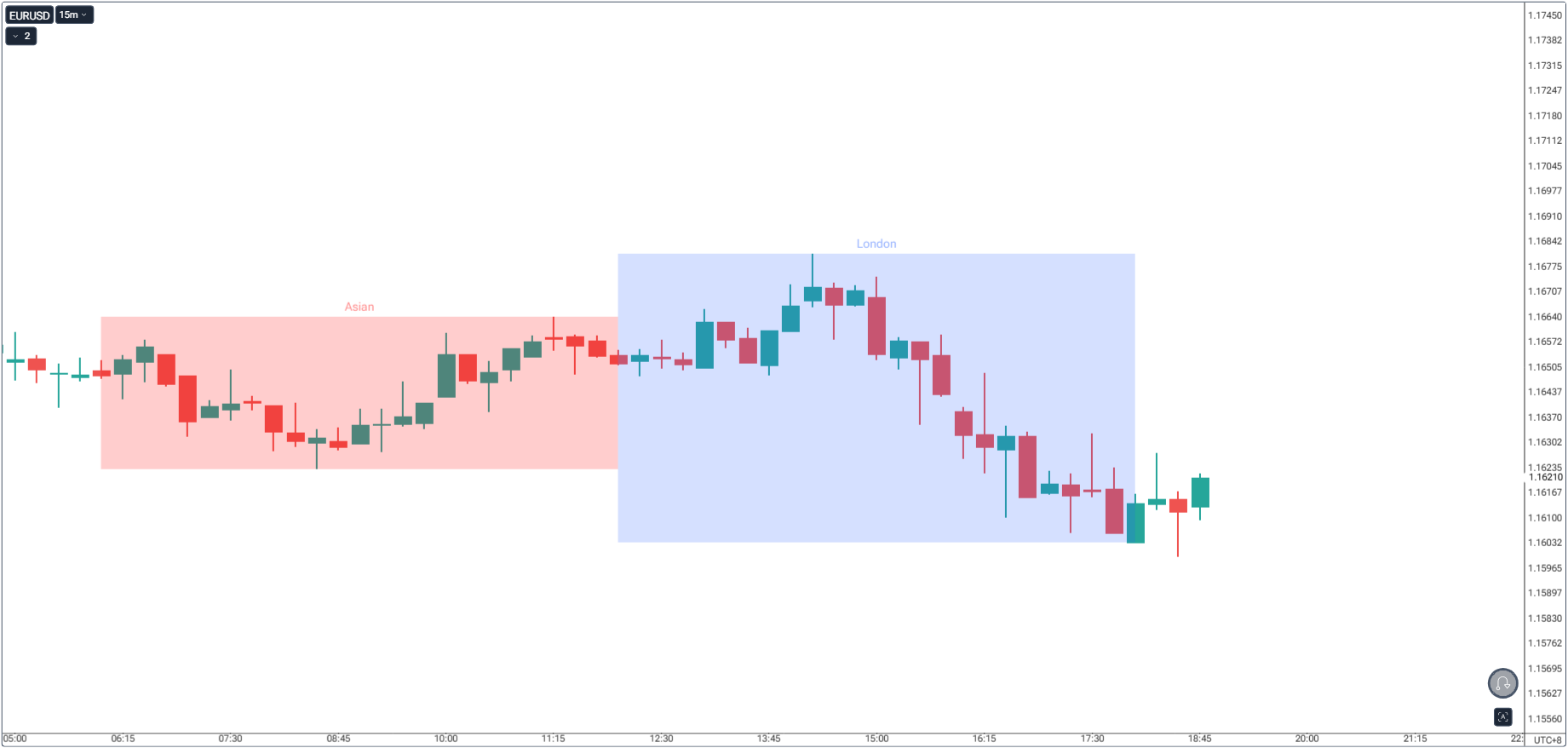

Here’s the secret most retail traders miss: on many days, the high or low of the entire trading day is formed during the London session.

This isn’t a random coincidence. It’s part of a repeatable market structure:

- Asia builds the trap.

- London triggers the trap and sets the day’s boundary.

- New York exploits the boundary to deliver the true move.

Once you understand this, you’re no longer reacting to the market - you’re anticipating the day’s playbook before it unfolds.

Why London Controls the High & Low of the Day

London dominates global FX volume, moving billions before New York even opens.

- Volume Surge: Over 35% of daily forex transactions occur during London.

- Liquidity Grab: Late Asian session highs/lows are loaded with stops, perfect for manipulation.

- Institutional Agenda: London’s move isn’t random - it’s designed to set up New York’s expansion or reversal.

Reality Check: The market is dynamic. Not every single day’s high or low is born in London.

On days with heavy New York news or unexpected macro catalysts, the extreme might be set later.

However, when London does set it, those moves are, if not most of the time, explosive - delivering some of the cleanest and fastest runs of the week.

In Smart Money Concepts, this is where the “Manipulation” phase happens in the daily Accumulation → Manipulation → Distribution cycle.

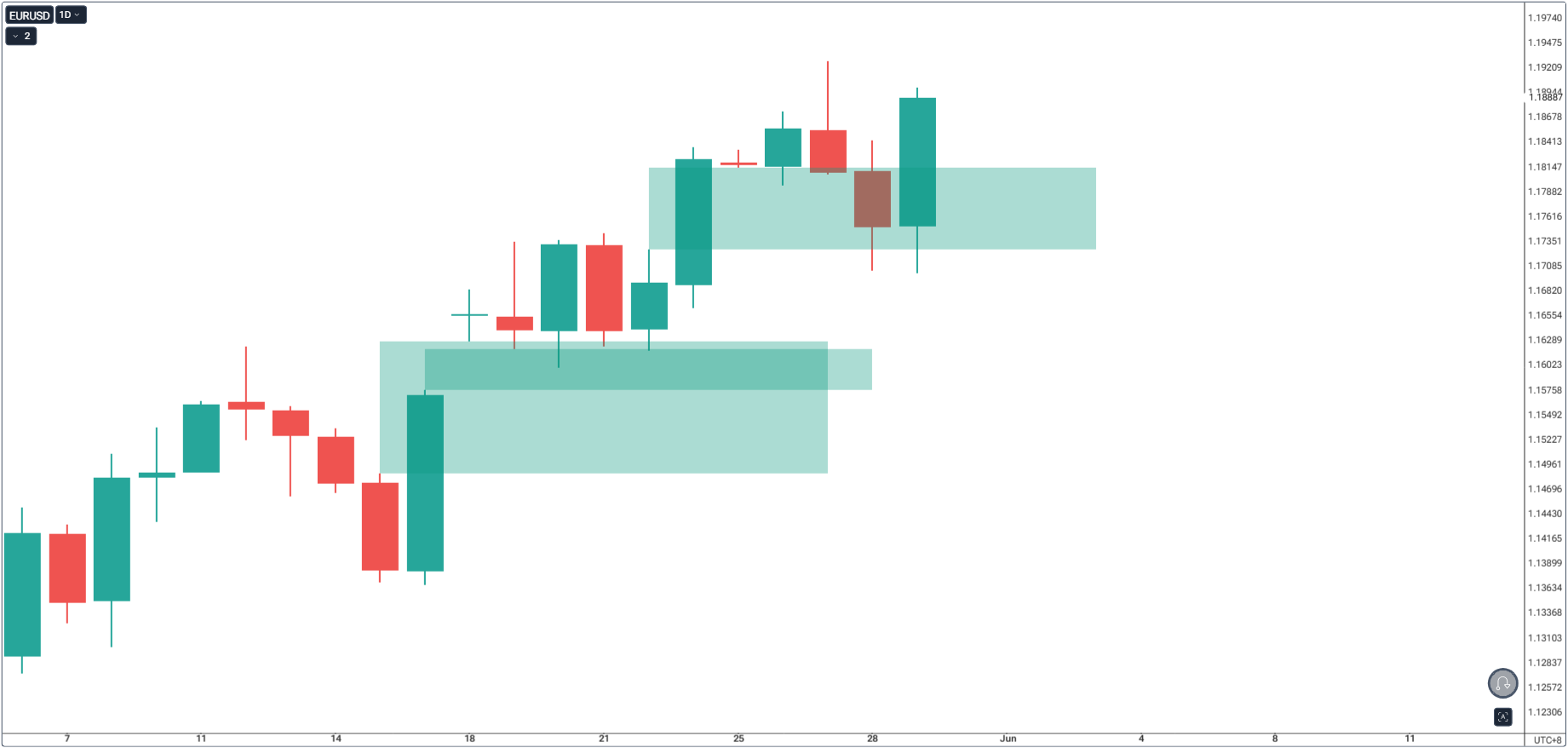

Higher Timeframe Bias – Your Filter for the Day’s High or Low

Before the London open, check:

- Daily & H4 bias: Are we trending bullish or bearish?

- If bullish → London is more likely to set the low of the day early, then run higher.

- If bearish → London is more likely to set the high of the day early, then sell off.

This one filter eliminates half of the fake-outs that catch retail traders off guard.

The London Session High/Low Playbook

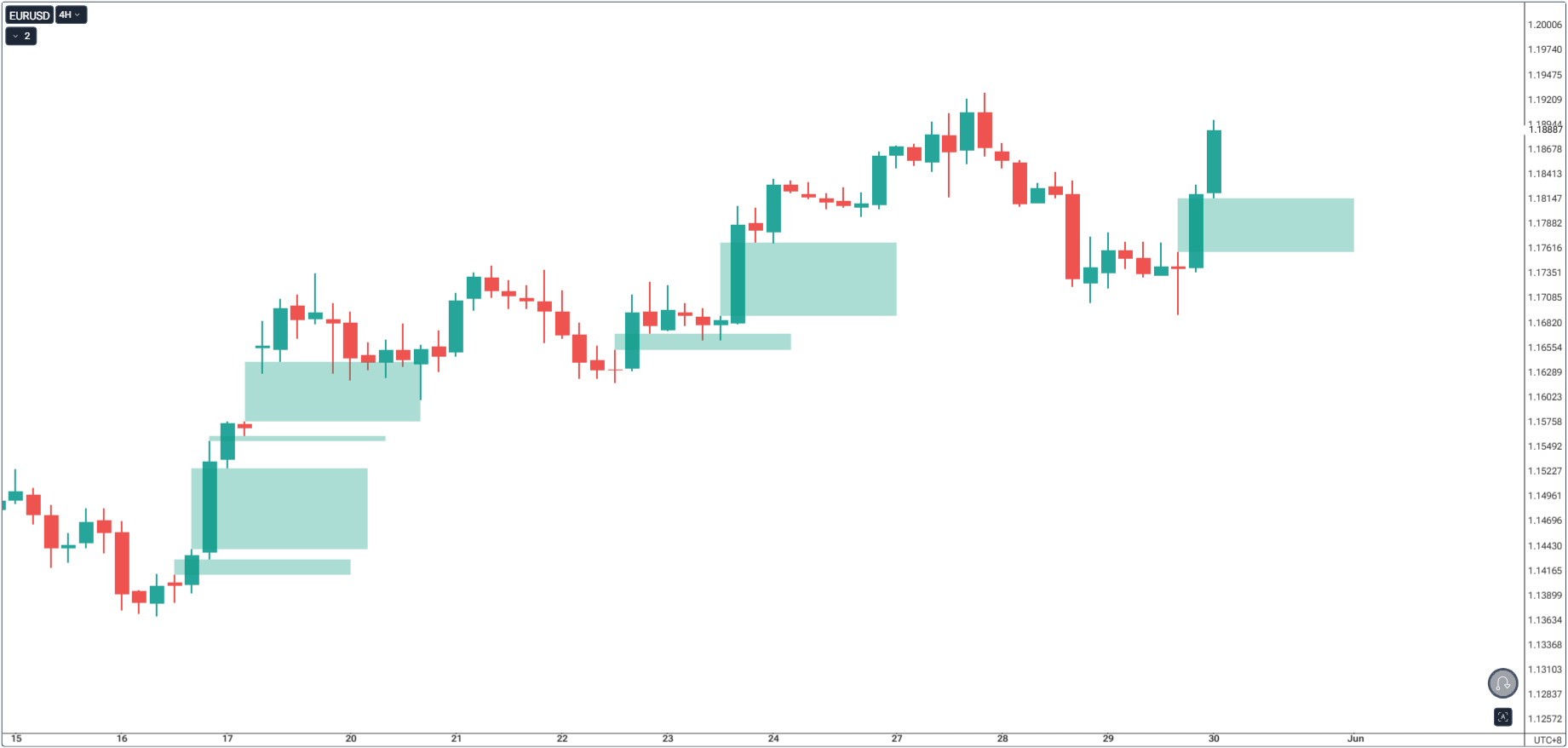

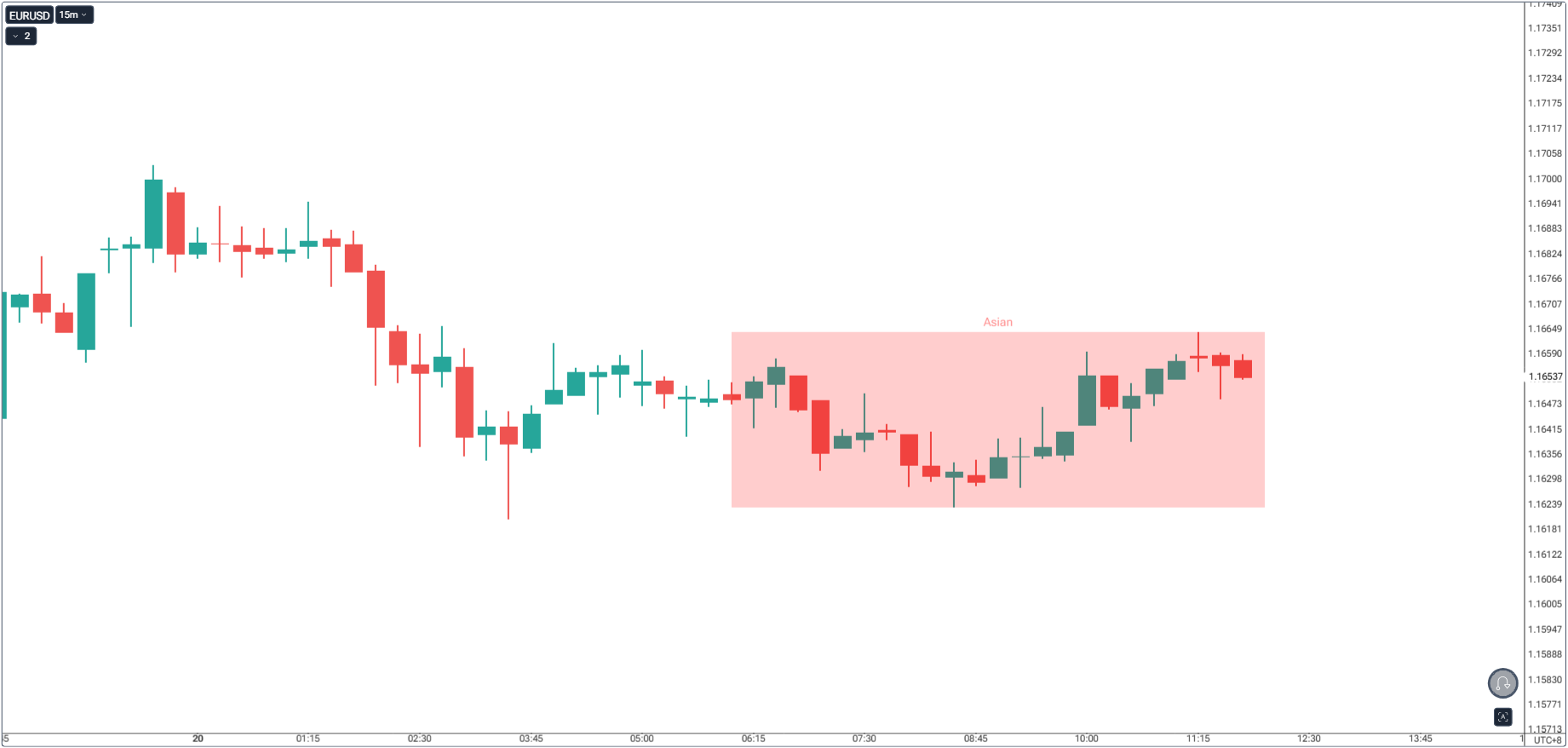

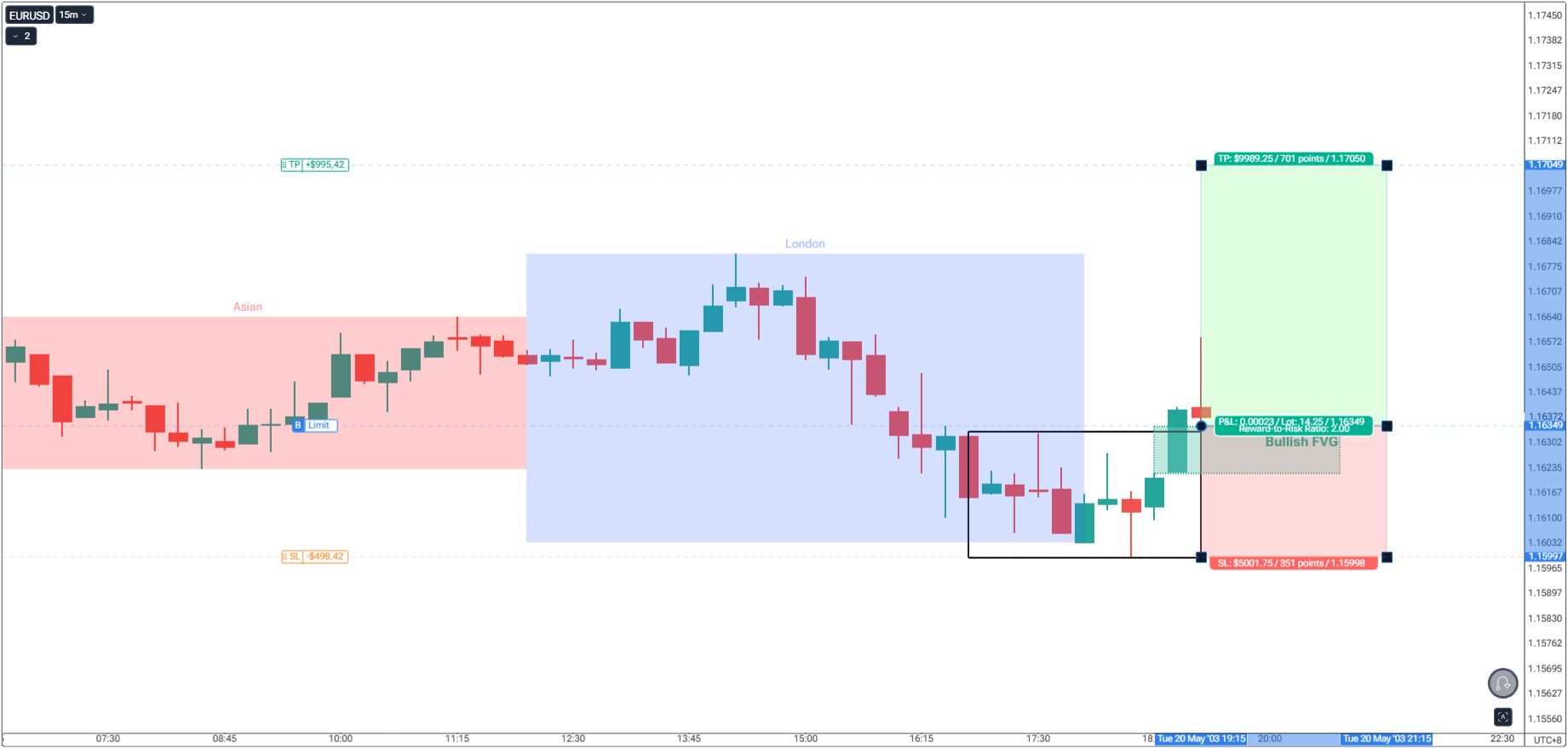

1. Asia = Accumulation

- Price consolidates, creating a tight range of highs and lows.

- Liquidity builds above and below these levels as retail traders place stops.

2. London = Manipulation (High/Low of Day Formation)

- London sweeps one side of the Asian range to grab liquidity.

- This sweep often becomes the day’s high (in a bearish day) or low (in a bullish day).

- A false breakout traps traders in the wrong direction, while institutions load positions for the real move.

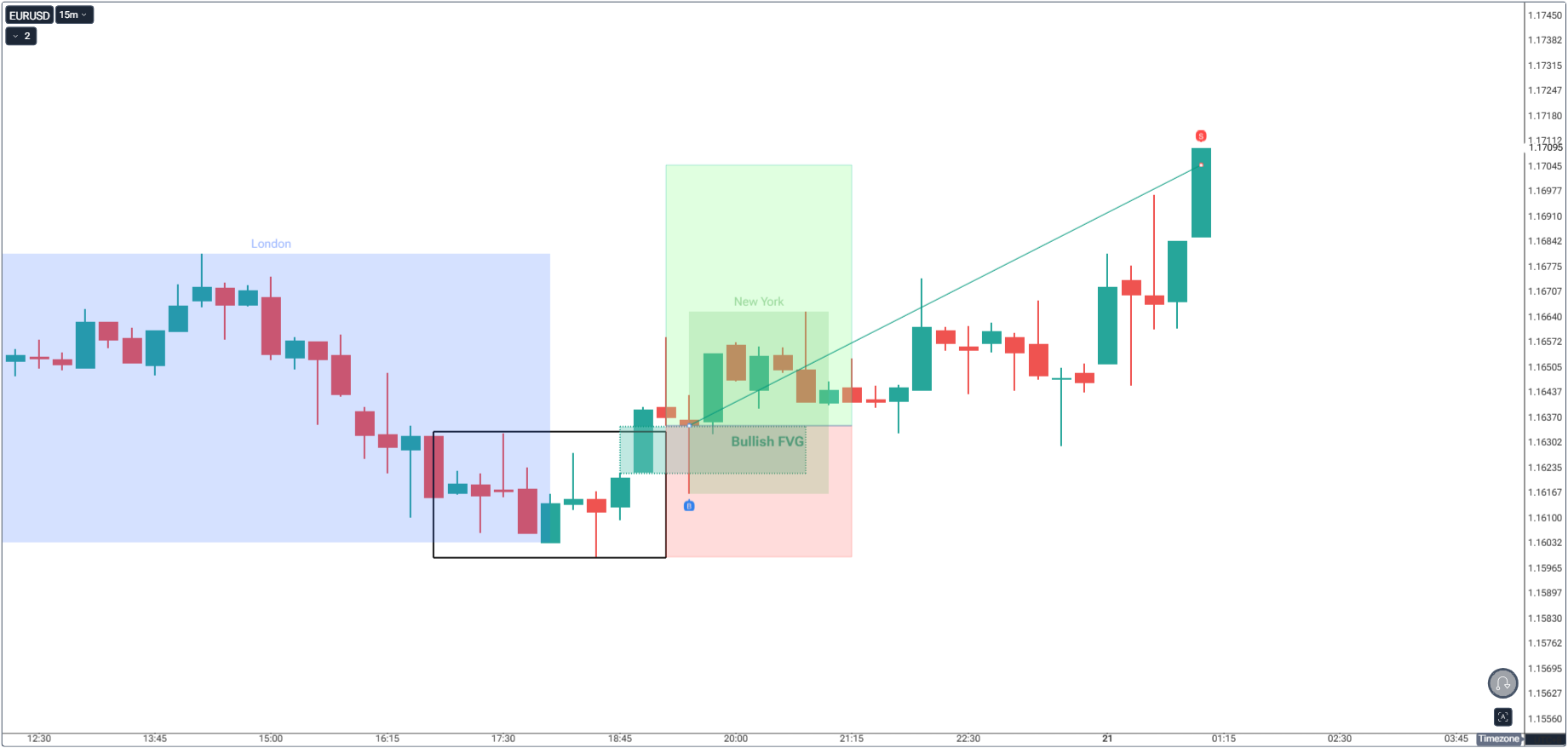

3. New York = Distribution (The True Move)

- With liquidity collected in London, New York pushes price toward the opposite end of the range.

- This move can be aggressive, often with clean displacement and FVG setups for entries.

Pro-Tip: This is best analyzed in a lower timeframe like the 15-minute timeframe.

Key Time Windows for Spotting the Day’s High or Low

- 2:00–3:00 AM London Time: Liquidity sweep and trap move - this is often where the day’s high or low is formed.

- 3:00–5:00 AM London Time: Main expansion confirms whether the sweep was the high or low.

- 5:00–7:00 AM London Time: Pause or pullback before New York continuation.

How to Trade London’s High/Low of the Day Setup

1. Identify Bias: Higher timeframe trend direction = your clue on whether London will set the high or the low.

2. Mark the Asian Range before London opens.

3. Wait for the Sweep: Do not enter until London runs one side of the range. Since our overall price action on a higher timeframe is bullish, we look for a sweep of low then a reversal to the upside.

4. Look for Entry Models: Range Breakout + FVG Entry

5. Target Opposite Side of the Range: Ride the move in the true direction with the high or low locked in with minimum 2R multiple.

Best Pairs to Trade During the London Session

Not all pairs respond to London liquidity patterns with the same consistency. To maximize probability, focus on pairs with high European and cross-session participation:

- EUR/USD – The world’s most traded pair, with deep liquidity and strong reaction to both Eurozone and US data.

- GBP/USD – Known for sharp London moves due to heavy UK market participation and frequent GBP news releases.

- EUR/GBP – Strong session reaction driven by European interbank flows.

- GBP/JPY – Highly volatile; London moves are often explosive due to GBP and JPY liquidity shifts.

- EUR/JPY – Reacts well to European market opens and carry trade flows.

Why these pairs?

- They are directly impacted by London market opening flows.

- Many have tight spreads during this session, making them favorable for intraday execution.

- They align perfectly with the “London sets the high/low” playbook because they’re influenced by both European and Asian liquidity flows.

The Stage Illusion

Think of London as a magician’s misdirection.

They draw your attention to one hand (the sweep), while the real trick is happening in the other hand (the true move). Once you know where to look, the trick stops working on you.

Common Mistakes Traders Make

- Entering during the sweep instead of waiting for confirmation.

- Trading against higher timeframe bias.

- Assuming every day’s high or low is set in London - on high-volatility news days, New York can override.

Final Thoughts

The high or low of the day is not a random event - it’s a deliberate part of the daily cycle.

While London won’t claim this title every single day, when it does, the resulting move is often one of the cleanest and fastest you’ll see.

Once you learn to recognize the setup, the rest of the day becomes a calculated chess match instead of a guessing game.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading – A Complete Compilation for 2026

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next